I reviewed 10 market-leading payroll software solutions and narrowed my list of recommendations to the best of the best:

- Rippling is the best payroll solution overall.

- Gusto is best for businesses new to payroll.

- OnPay is best for small businesses.

- QuickBooks Payroll is best for its accounting integration.

- Paycor is best for midsize businesses.

- Honorable mentions:

- ADP Workforce Now is best for complex payroll needs.

- Deel is best for international payroll.

- Paychex Flex is best for business and payroll services.

Need Help? Talk to an HR Software Advisor

Our picks for the best payroll software

Rippling: Best overall payroll software

Overall score

4.29/5

User reviews

4.67/5

Pricing

2.88/5

Platform and interface

4.34/5

HRIS

5.00/5

Payroll

4.44/5

Reporting and analytics

5.00/5

Pros

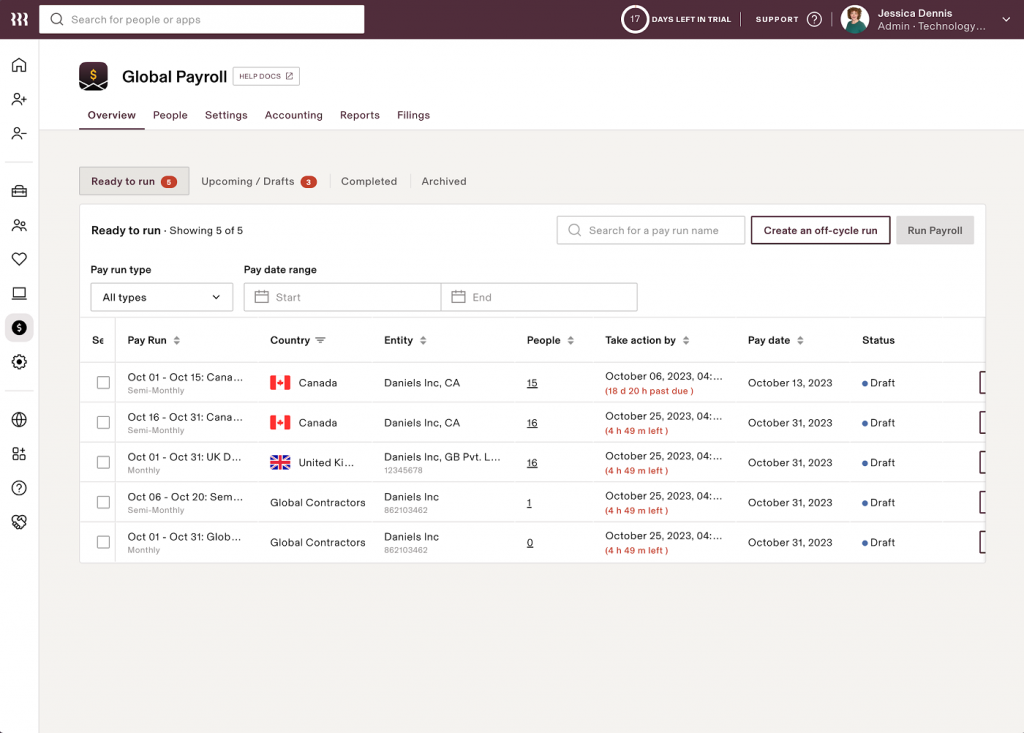

- Supports payroll for hourly and salary workforces in 50 countries.

- Available PEO and EOR services to outsource your payroll needs.

- Automated garnishment deductions and payouts on your behalf.

- Job costing by location, client, and task for insights into labor costs and proper contractor billing.

- Customizable payroll reports that can connect data from over three different sources.

Cons

- Payroll is an add-on module to its core Rippling Platform.

- Only available to companies headquartered in the U.S. and UK.

- You must purchase its HR Help Desk module for support by phone.

- Occasionally slow and glitchy when moving between modules.

Why I chose Rippling

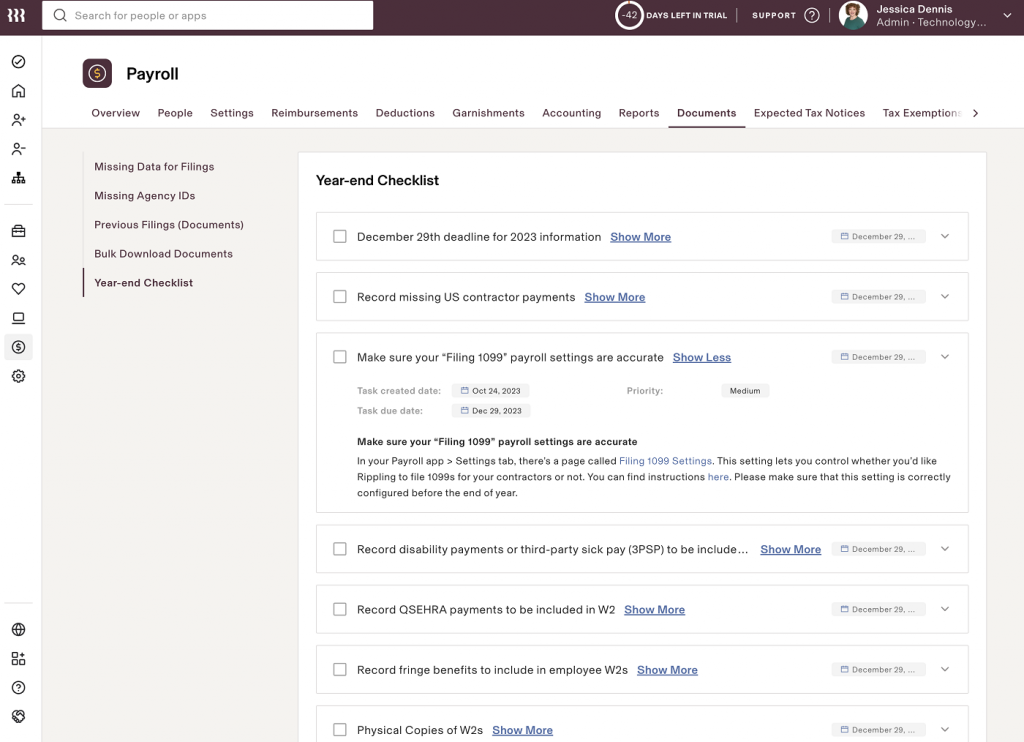

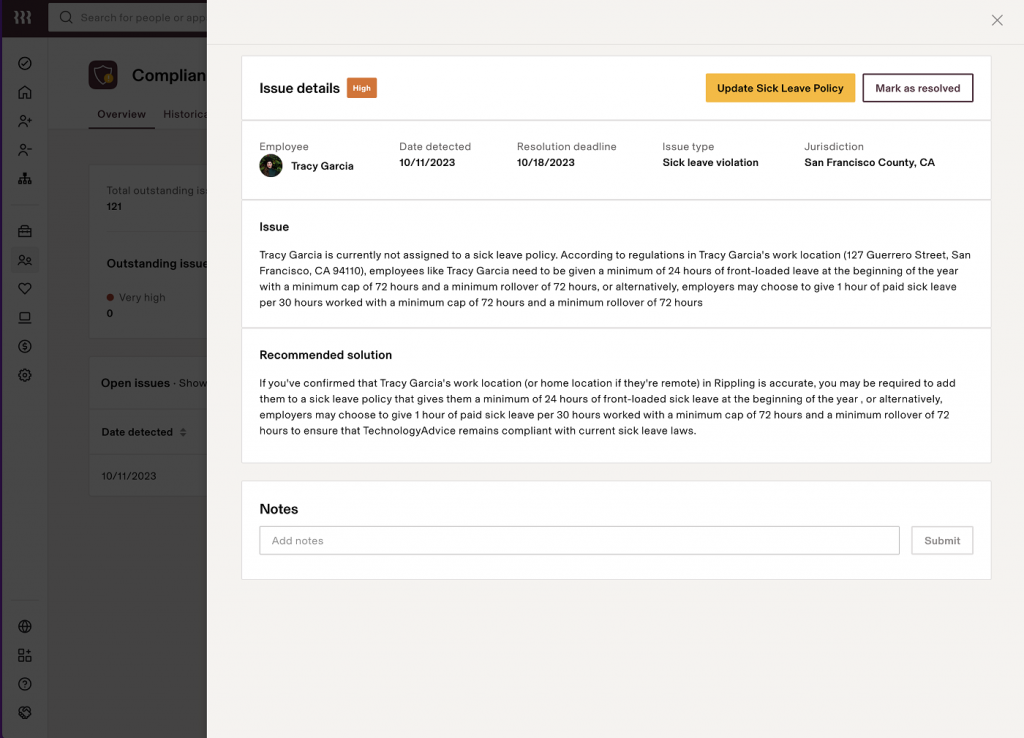

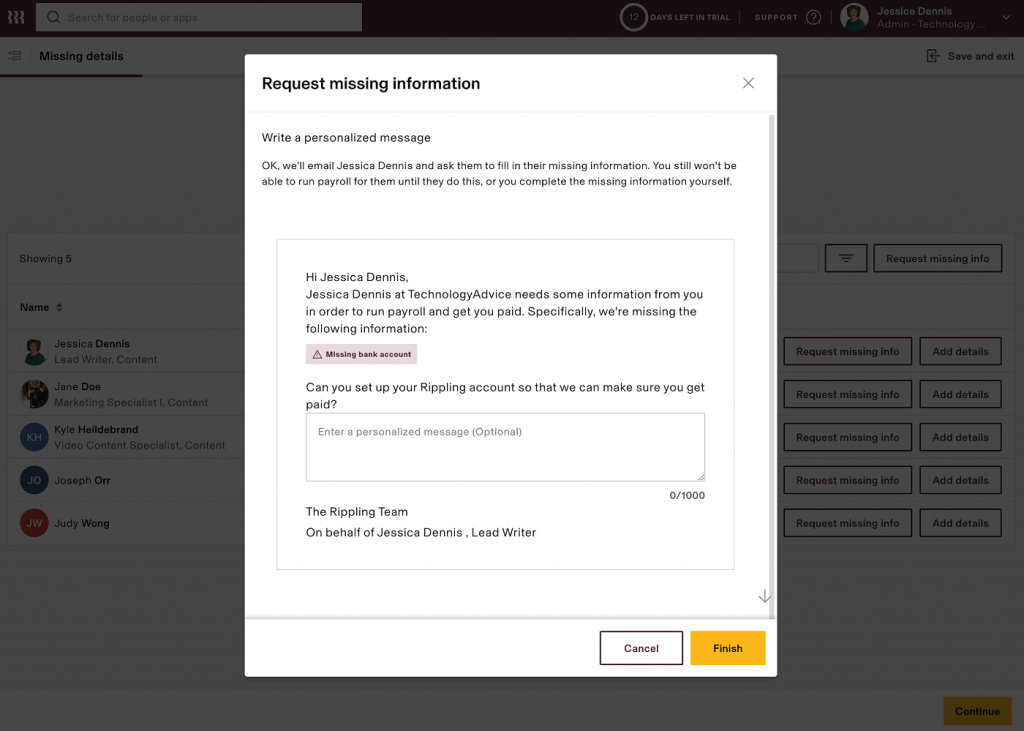

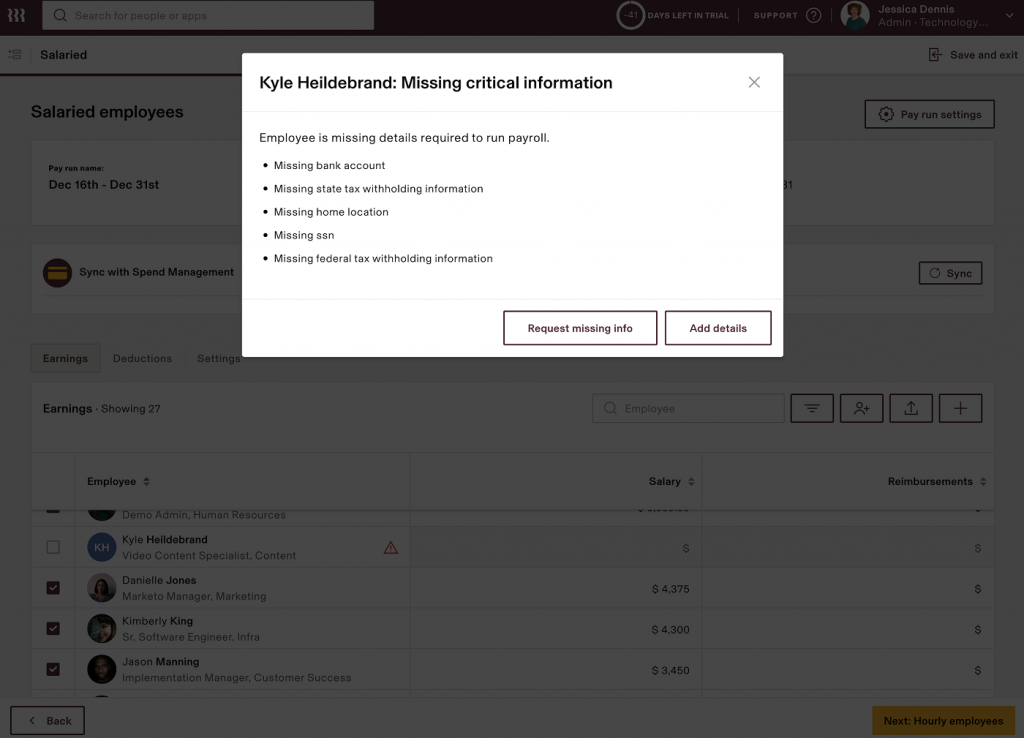

Rippling is the best payroll choice overall for its ability to accommodate complex payrolls, plus its scalable features and services. In particular, its customizable workflow automations impressed me. Besides auto-approving payrolls, you can get as granular as you need with your payroll runs by creating workflows to notify necessary stakeholders of payroll changes, automate sending reports, and pay multiple employee types in the same payroll run.

Rippling earned an overall score of 4.29 out of 5, losing points only for pricing, lack of native accounting features, and minimal customer support options. Rippling is also better suited for companies paying salary-exempt, distributed workers since its time-tracking features are unwieldy. For example, it takes no less than three clicks to clock in for a shift using Rippling’s desktop application.

Rippling also does not monitor regulations regarding youth employment, which affect working hours and wages for employees under 18 years old in the U.S. This can be a huge drawback if you’re in an industry like food or retail, where minors can make up a significant portion of your workforce.

Despite this, Rippling checks all of the major boxes for payroll. So, if you need a strong payroll solution and a people management system, I recommend starting with Rippling rather than connecting disparate applications.

Gusto: Best for businesses new to payroll

Overall score

4.03/5

User reviews

4.34/5

Pricing

4.00/5

Platform and interface

3.89/5

HRIS

3.88/5

Payroll

4.23/5

Reporting and analytics

4.00/5

Pros

- International contractor payroll in more than 120 countries.

- Gusto-brokered health insurance that integrates with payroll on all plans.

- Customer service is available by phone, email, or chat.

- Native employee financial wellness tools through Gusto Wallet app and Gusto debit card.

Cons

- No dedicated account manager (unless with a Premium subscription).

- Check delivery is currently in beta and costs $1.50 per check.

- EOR services are limited to over 10 countries only.

- The lowest price plan is only for single-state payroll.

Why I chose Gusto

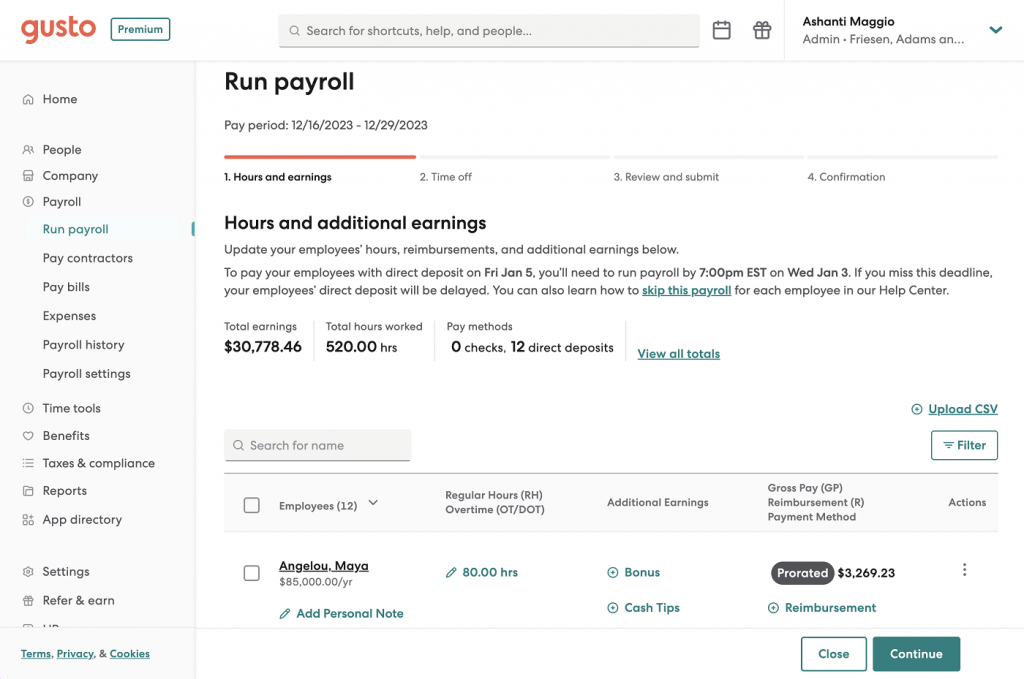

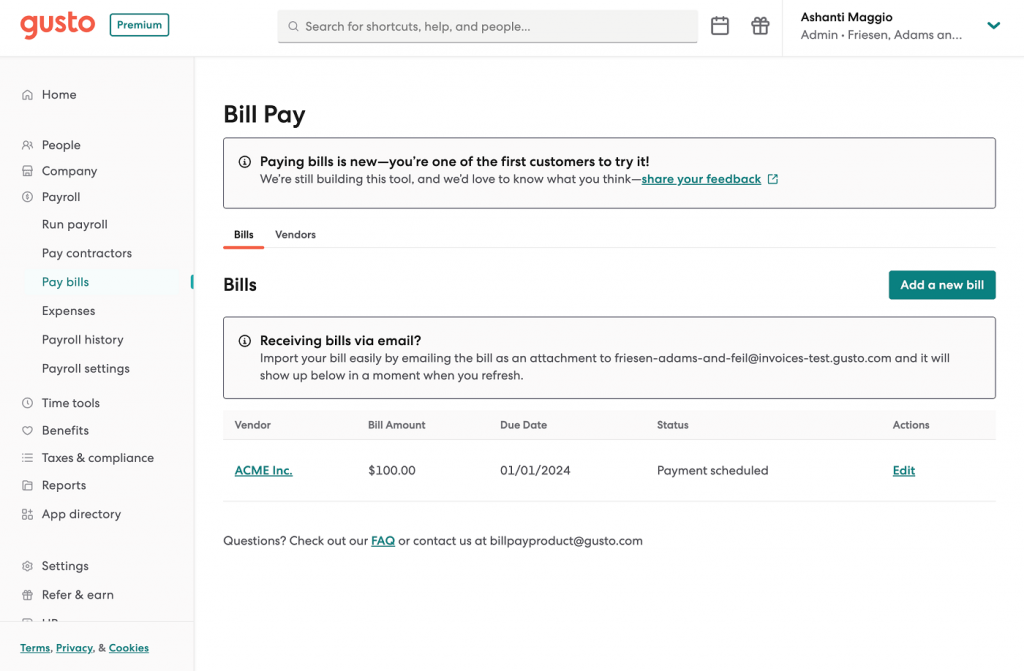

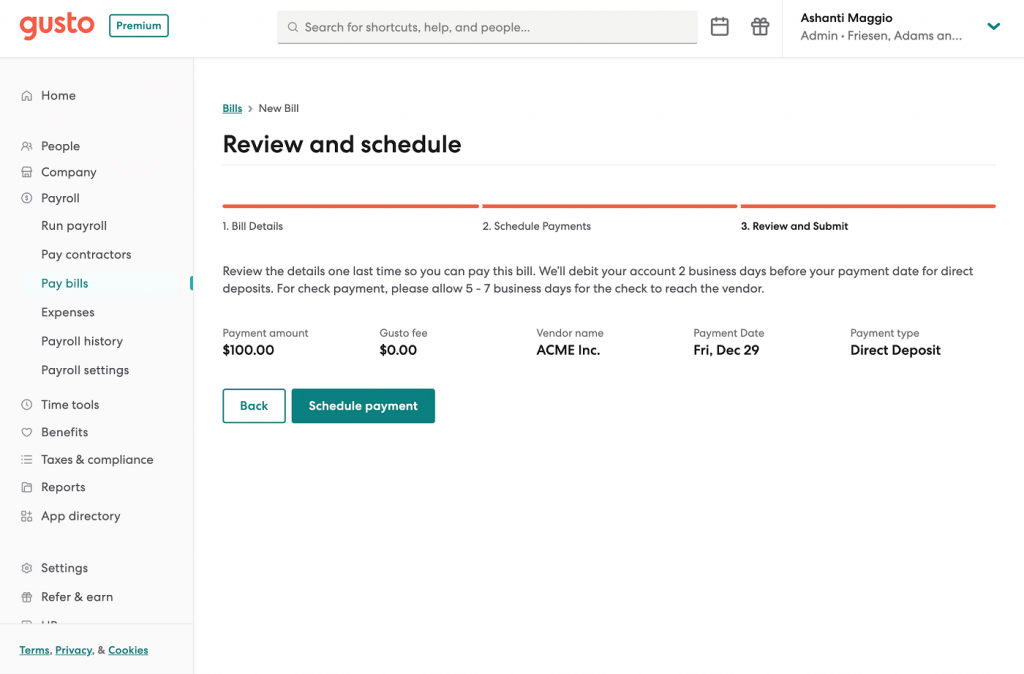

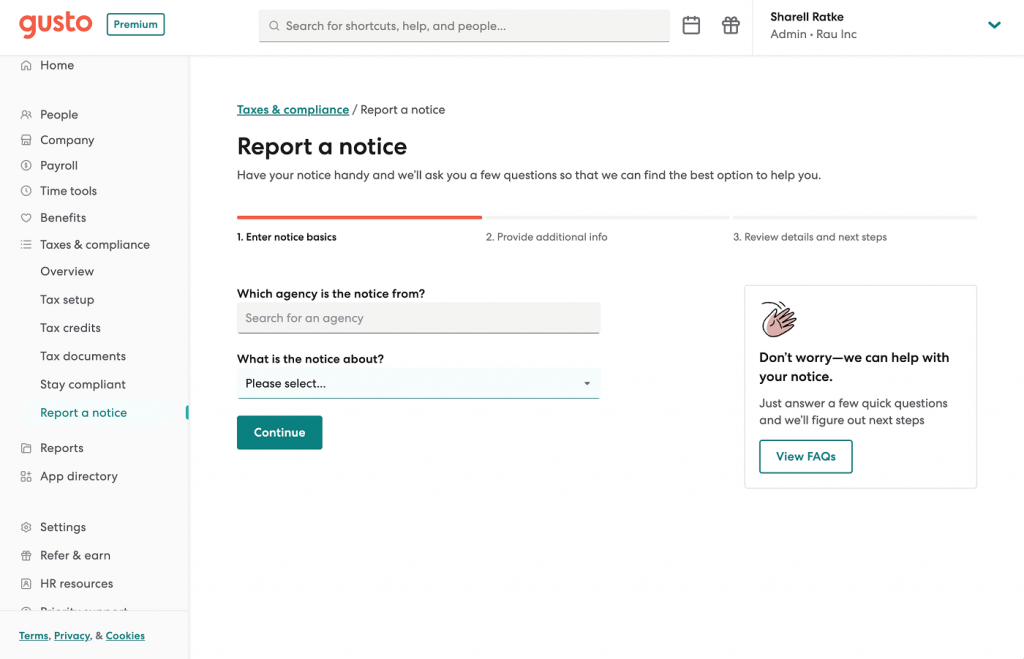

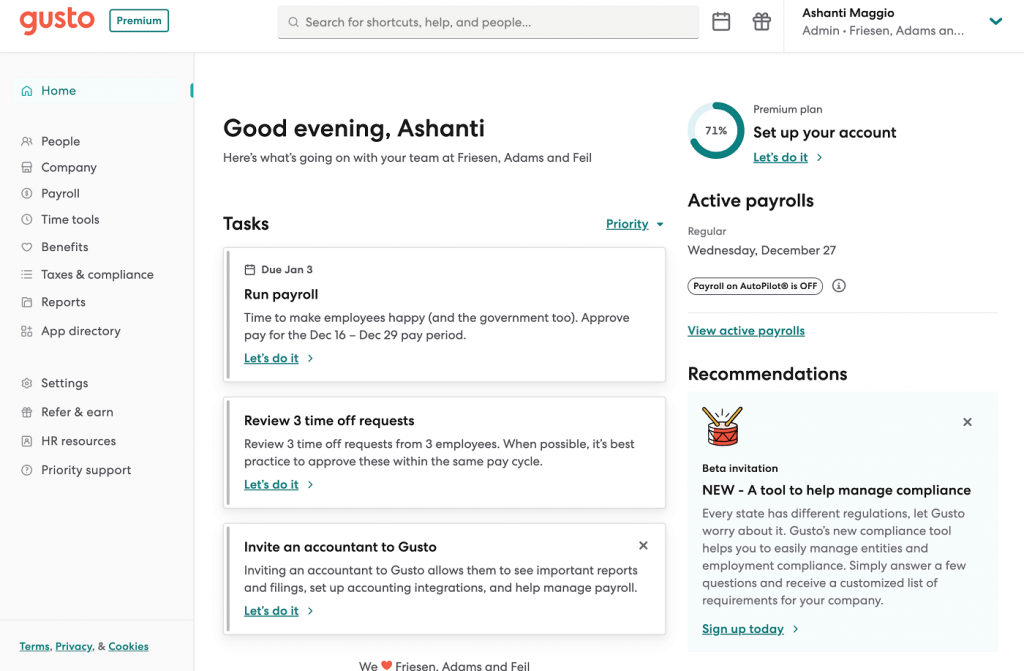

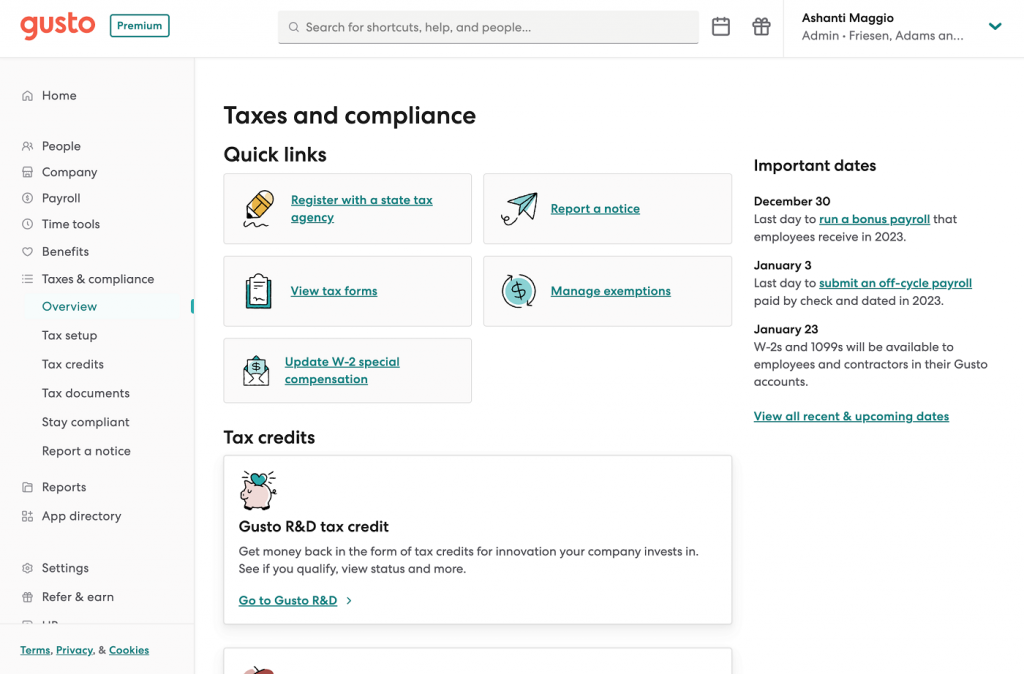

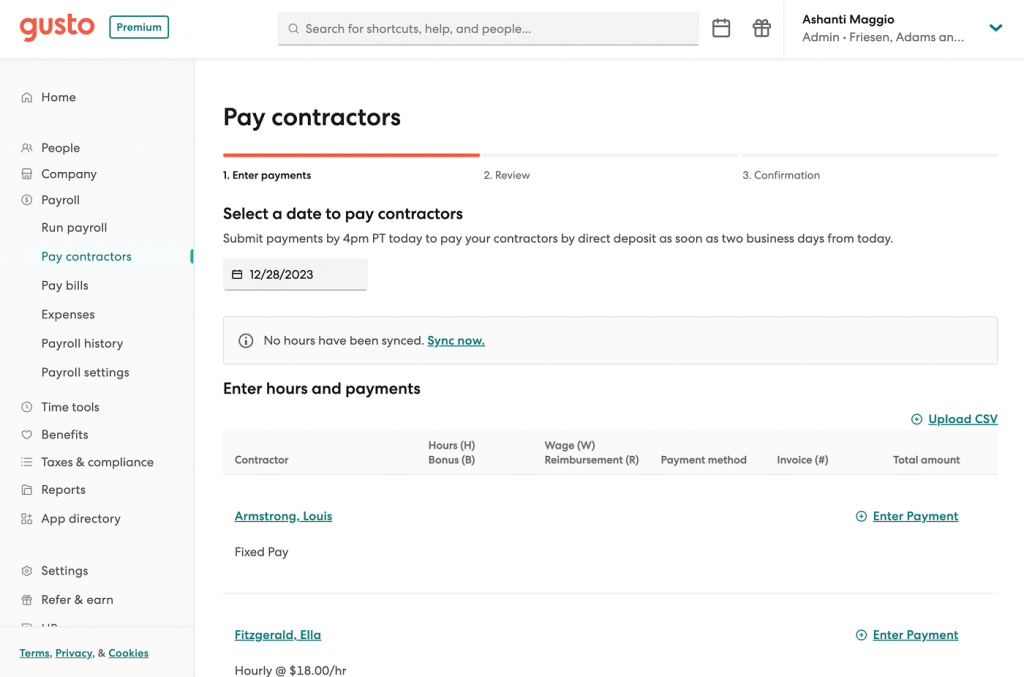

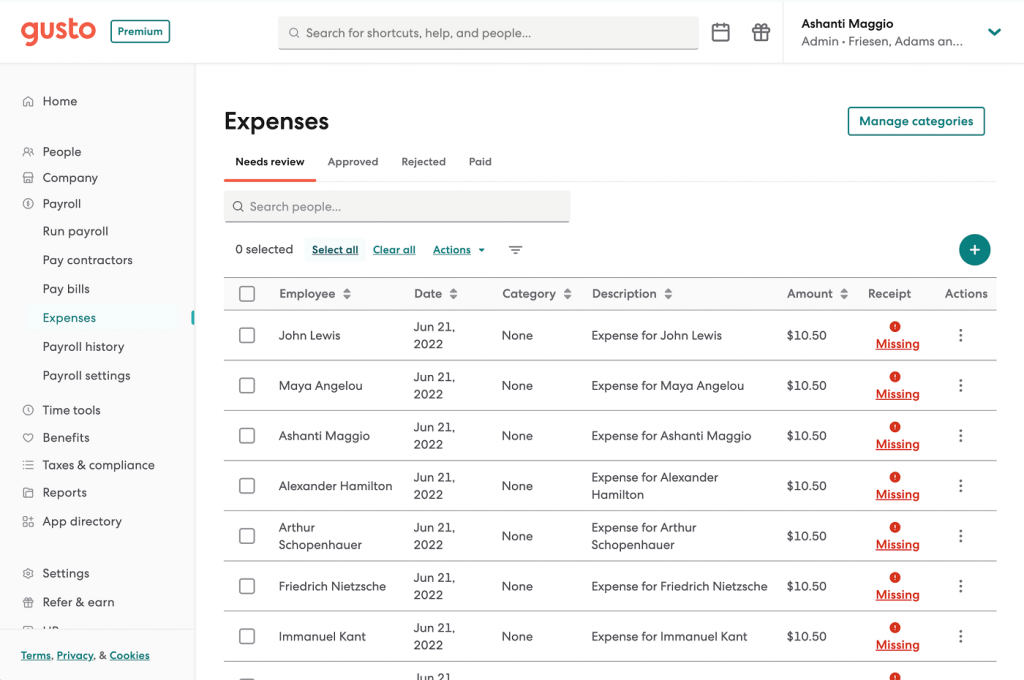

Gusto stands out for its accessible features that make it easy for companies to get familiar with payroll processing for the first time. Besides offering competitive workers’ compensation and health insurance benefits, it can also walk you through registering your business in new states. This support is crucial, especially if learning and adhering to labor law regulations in new states is a major obstacle to expanding your small business.

With a 4.03 out of 5, Gusto’s score reflects its ability to offer accessible tools to payroll newbies while supporting their needs. For example, Gusto’s project tracking allows you to pay your contractors accurately while also providing you with data to make more accurate, competitive project bids to your clients.

Plus, its employee self-service features are easy to use, reducing the need for employees to reach out to your time-strapped HR department for things like W-2s or paystubs. Moreover, employees keep their Gusto profiles for life, even after termination. This is unlike platforms that typically lock employee accounts following separation or delete their accounts if their employers switch payroll platforms.

While Gusto provides basic versions of several HR processes, like learning and development, it’s not the best choice if you need a full-scale human capital management (HCM) system. In this scenario, I’d look to Rippling or ADP with HR modules that rival standalone equivalents. But as a new business, Gusto is a step up from free payroll solutions, ensuring you adhere to tax law and minimize errors.

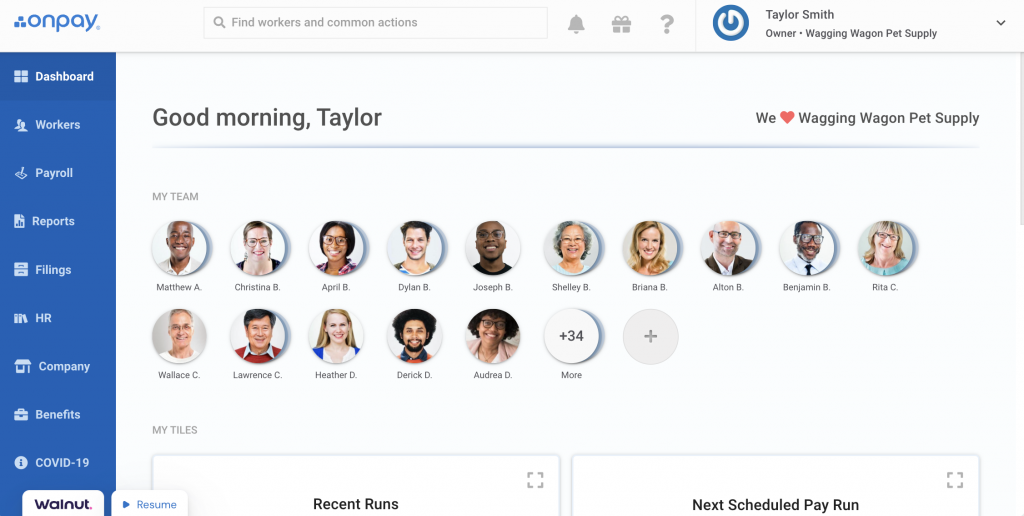

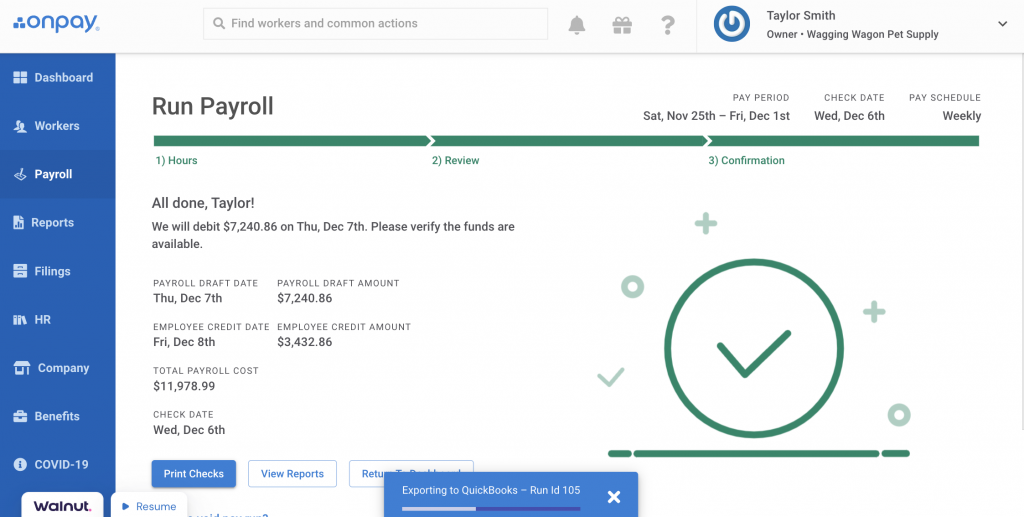

OnPay: Best for small businesses

Overall score

3.61/5

User reviews

4.35/5

Pricing

3.00/5

Platform and interface

2.76/5

HRIS

4.63/5

Payroll

3.39/5

Reporting and analytics

4.69/5

Pros

- Free setup and data migration.

- Only pay for employees you actively pay in a month.

- Specialized payroll services for particular industries, like agriculture, churches, and nonprofits.

- Employee rosters, organizational charts, leave management, and customizable onboarding included.

Cons

- Does not offer native time-tracking and accounting modules.

- No mobile app.

- Limited third-party integrations.

- Not suitable for fast-growing companies.

Why I chose OnPay

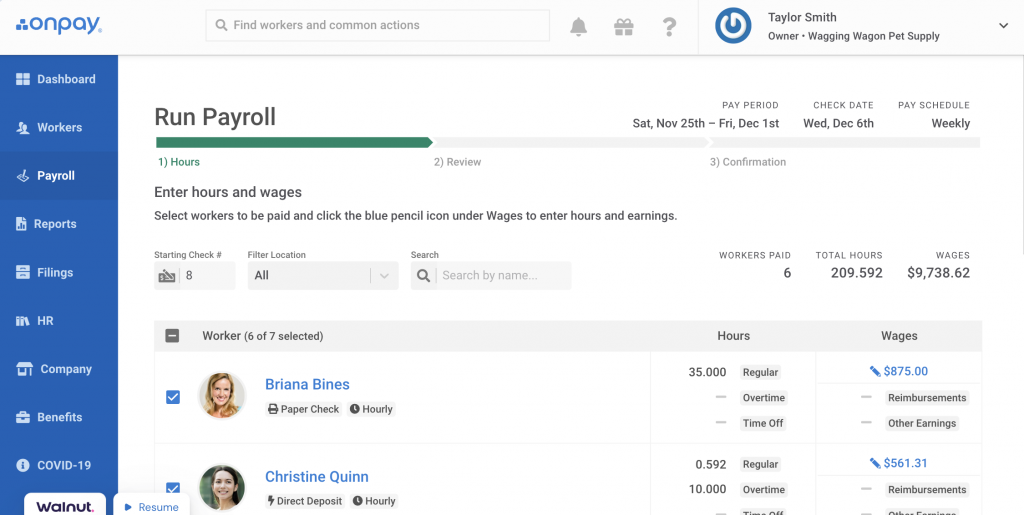

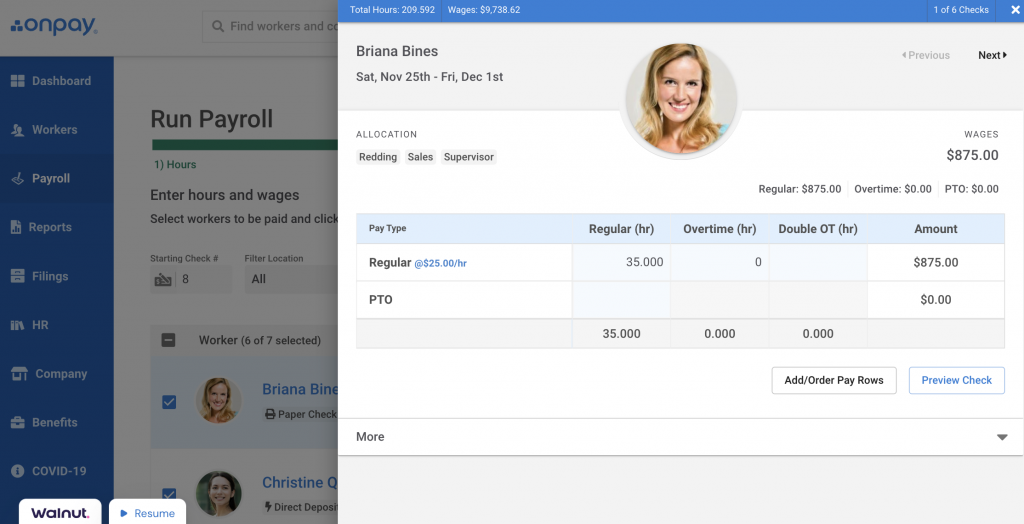

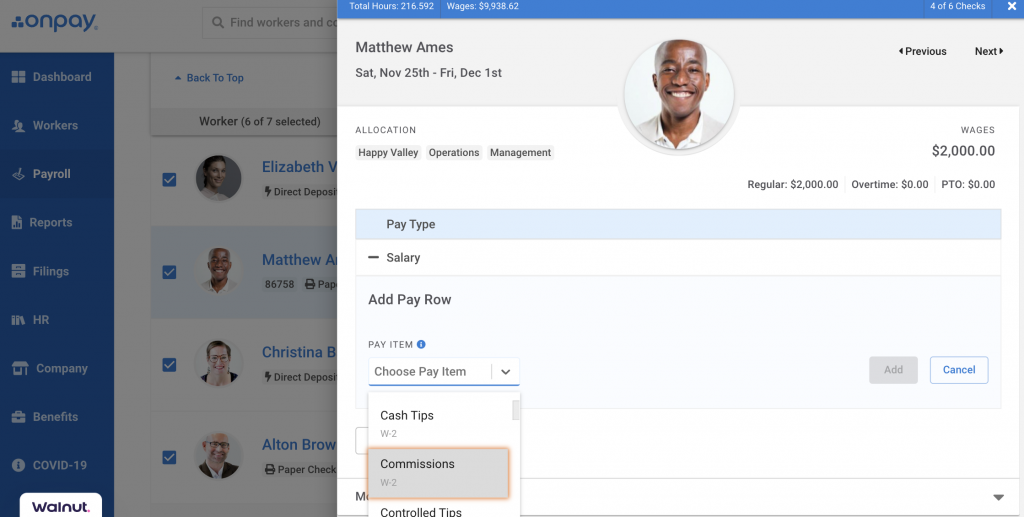

If you’re looking for basic payroll and HR support for your employees at an affordable price, OnPay is your best bet. Coming in with a score of 3.61 out of 5, OnPay supports small businesses through uncomplicated payroll workflows that accommodate multiple payroll schedules, worker types, and pay methods. It also comes with a suite of HR tools to meet minimum compliance requirements by state and industry, including PTO policy management, compliance audits, and an HR resource library.

OnPay’s consistent pricing structure makes planning for and controlling long-term business costs much easier. This benefits small businesses that have to account for high overhead costs or whose profits change from season to season.

However, this also makes OnPay less likely to innovate and offer more modern features at the same rate as competitors. Its one-price-fits-all feature means that adding more capabilities will result in profit loss for the company unless they raise prices or offer add-on modules for additional fees. If you want a product that improves and adapts constantly, go with Rippling instead.

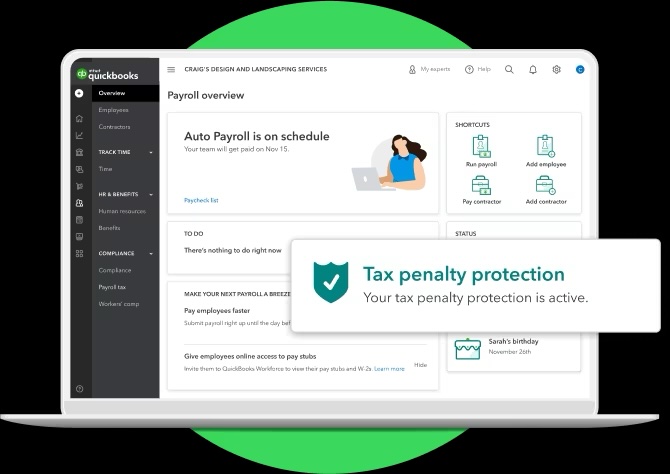

QuickBooks Payroll: Best for its accounting integration

Overall score

3.56/5

User reviews

4.08/5

Pricing

3.63/5

Platform and interface

3.33/5

HRIS

3.38/5

Payroll

3.63/5

Reporting and analytics

3.69/5

Pros

- Online chat support available 24/7.

- Tax penalty protection for any reason on its Elite subscription tier.

- Next-day or same-day direct deposits (depending on subscription tier).

- Mobile app time and mileage tracking.

- Personal HR advisor at Elite subscription tier.

Cons

- Local tax filings are only available in Premium and Elite plans.

- Additional fees for tax filings in multiple states, unless on Elite plan.

- QuickBooks time and attendance features open in a separate application.

- Service capped at 150 employees.

Why I chose QuickBooks Payroll

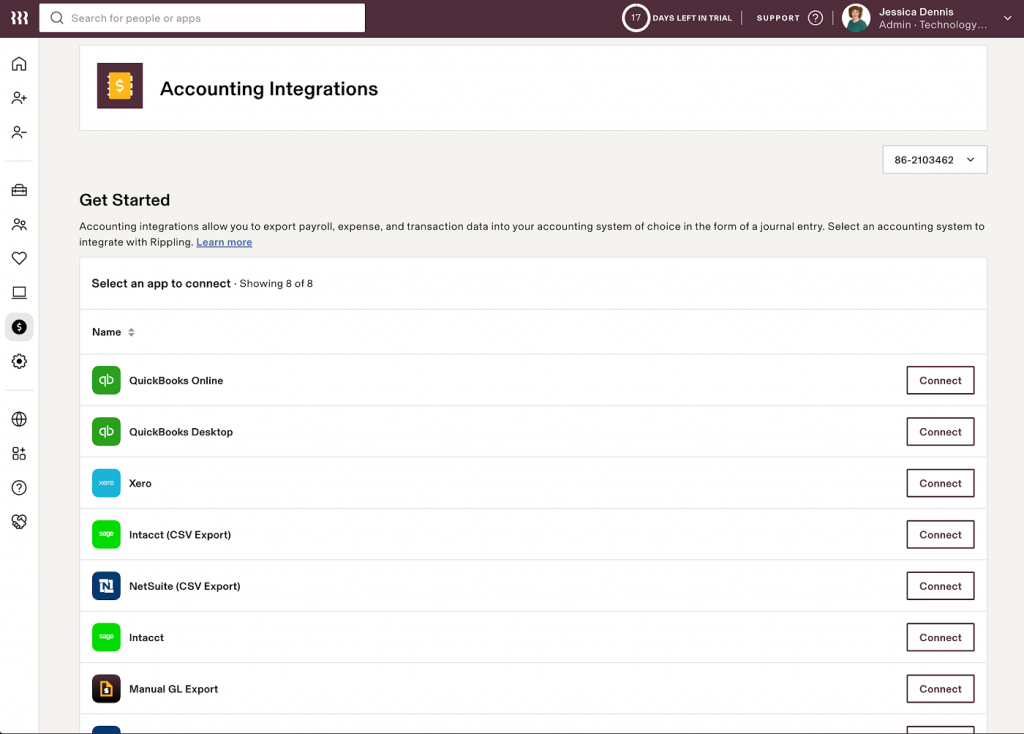

QuickBooks Payroll is one of the top providers for small business payroll, with an interface, pricing, and features very similar to those of competitors like Gusto, OnPay, and Deel. It earned 3.56 out of 5 and stands out for its emphasis on accounting functions, even within its payroll product.

For example, it has a specialized interface just for your accountant, automatic data syncing to your chart of accounts, and data analysis tools, like budgeting, if you have a QuickBooks Online subscription. QuickBooks also has default settings for tracking payroll financial data within your business accounts. Alternatively, you can customize how it enters this data into your accounts to meet your business needs.

While QuickBooks Payroll is an excellent choice if you want to save money by joining your payroll and accounting processes together, it lost points for its minimal HR and employee management features. For example, it relies on partnerships with Allstate Health Solutions and Mineral for benefits offerings and HR advisory services.

However, this might be a minor issue if you only have a few employees and operate your business in one state. Using QuickBooks Payroll minimizes the need for multiple software to run your business operations, so you save time from repeated data entry and uploads.

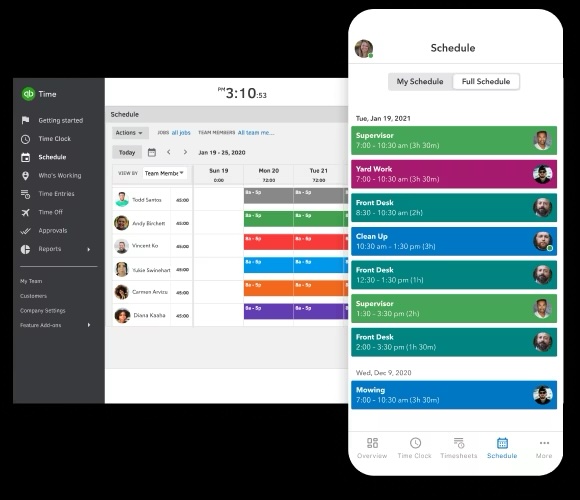

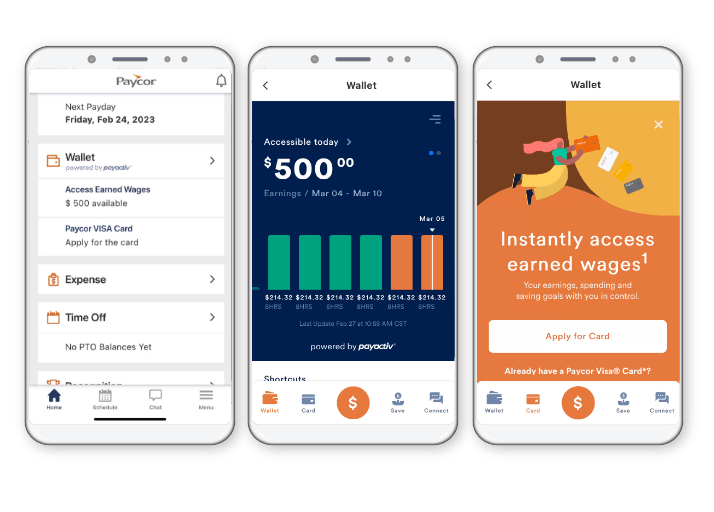

Paycor: Best for midsize businesses

Overall score

3.59/5

User reviews

4.02/5

Pricing

1.94/5

Platform and interface

3.84/5

HRIS

3.38/5

Payroll

4.31/5

Reporting and analytics

4.31/5

Pros

- All plans include multi-state payroll support and automated local tax deductions and filings.

- Robust employee self-service features, including earned wage access, via its mobile app.

- Ability to view multiple pay cycles months in advance for effective status change management.

- Automatic prorated pay for mid-cycle hourly employee pay rate changes (with Paycor’s time tracking add-on).

- Garnishment services included in Essential plan and up.

Cons

- Expensive choice for small businesses.

- Must purchase Essential plan or higher for onboarding, analytics, and PTO management modules.

- Time tracking, scheduling, and benefits administration are paid add-on modules.

- Difficult to navigate UI.

Why I chose Paycor

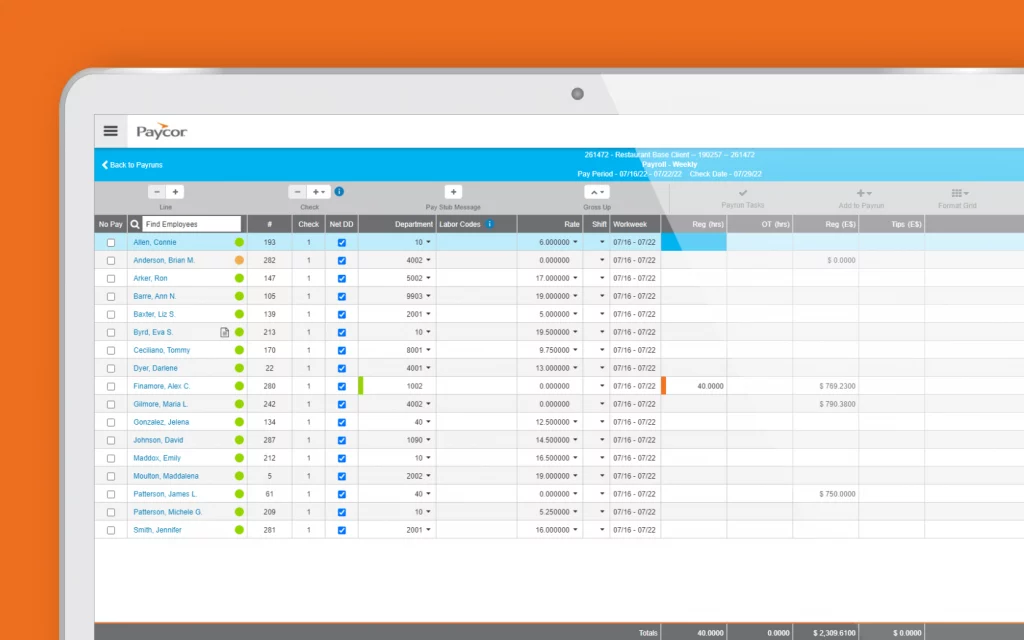

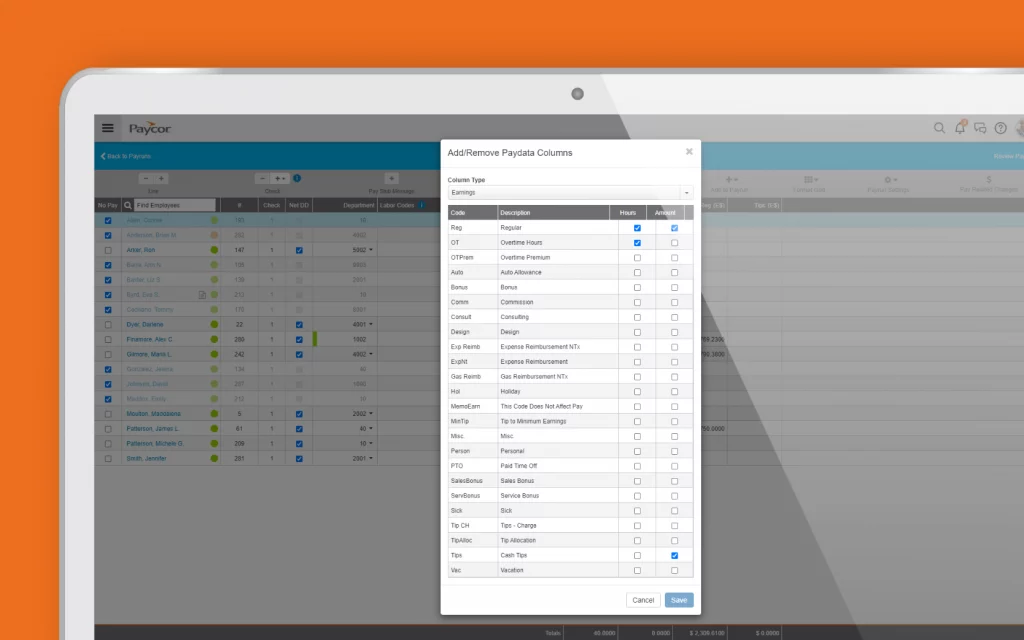

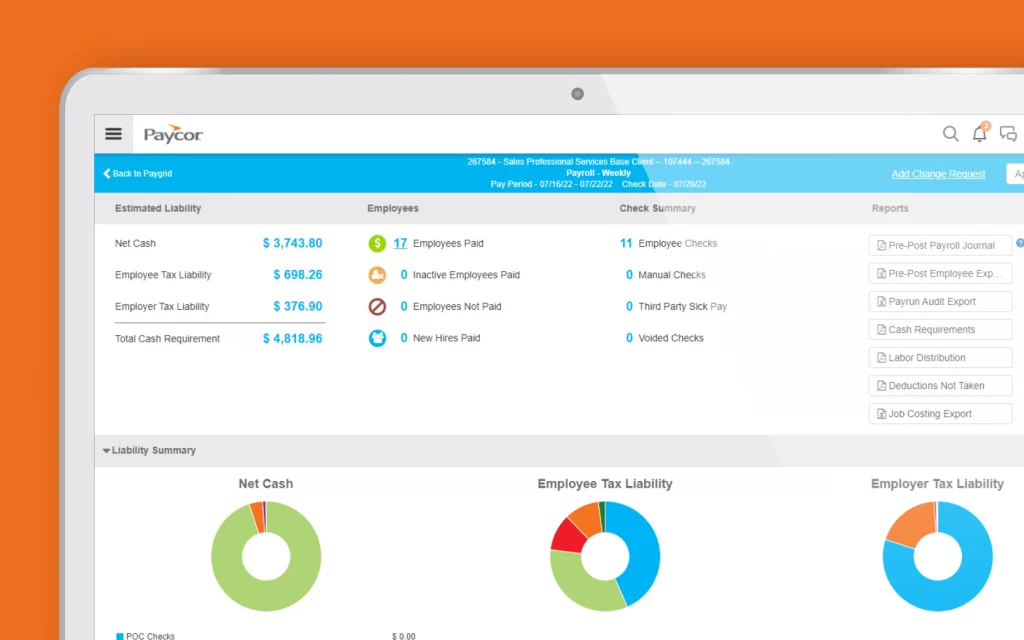

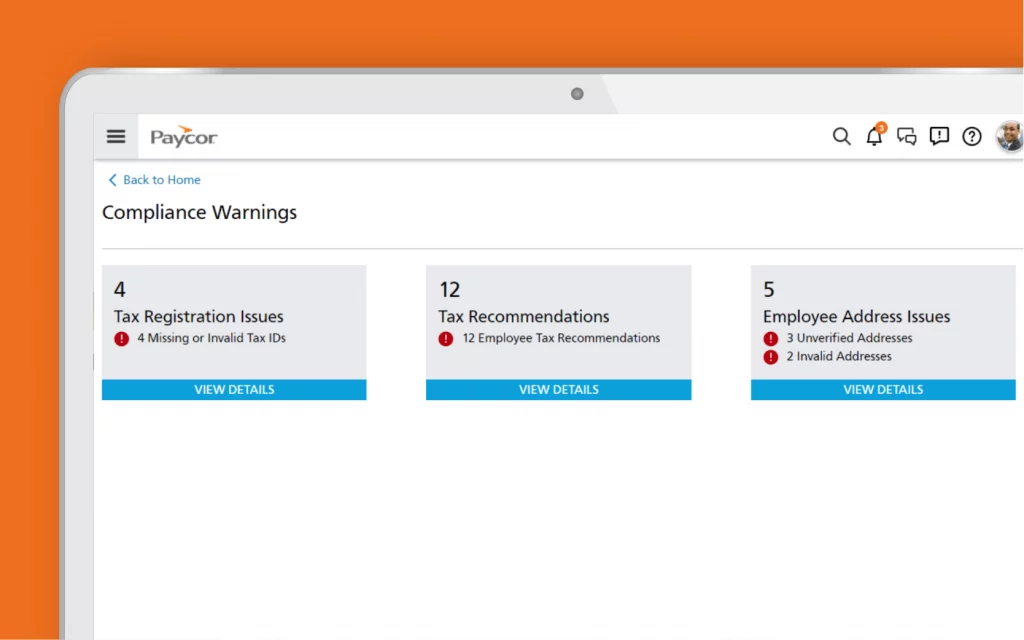

Paycor’s advanced analytics, in-app tax compliance alerts, and customizable payroll processes suit midsize businesses that need more versatile pay controls. I was especially impressed with its pay grid for completing payroll functions, which allowed me to adjust how I wanted to see and complete payroll. It also allows me to complete payroll faster since I don’t have to go through a set series of steps compared to competitors like Rippling and Gusto.

With a total score of 3.59 out of 5, Paycor also stands out for its modules that support midsize company goals. For example, unlike Gusto, Paycor offers a full-scale recruiting module that leverages AI to source top prospects and engage passive candidates. Other features like compensation planning, pulse surveys, and career management support your long-term talent needs and align them with your company’s objectives and costs.

However, Paycor’s pricing scheme makes it an expensive option if you only need payroll. It also does not support businesses with international teams. But if you need a customizable payroll system or more robust modules to complete your increasingly advanced HR needs, then Paycor is a great choice.

Honorable mentions

Several platforms that didn’t make my top five have features that might better fit your needs. Learn more about my runners-up: ADP Workforce Now, Deel, and Paychex.

ADP Workforce Now: Best for complex payroll needs

Alternative for: Rippling

Overall score: 4.03/5

When to choose ADP Workforce Now

ADP Workforce Now is best for SMBs with complex payroll needs since it supports options like certified payroll, on-demand pay through its Wisely app, industry-specific pay cadences (like tip credits), and international payroll. ADP also offers PEO and human resources outsourcing (HRO) services if you’d like to offload most of your payroll processes.

Why it didn’t make the list

Navigating ADP Workforce Now is unintuitive, and processing payroll can take several steps to complete. ADP also does not offer automated payroll runs like Rippling, Gusto, or Paycor. Plus, you pay a processing fee for each payroll you run, making it an expensive option if you have multiple pay schedules.

Currently using ADP but want to switch? Check out Top 6 ADP Vendor Competitors & Alternatives for other options.

Deel: Best for international payroll

Alternative for: Rippling and Gusto

Overall score: 3.48/5

When to choose Deel

Deel offers an EOR service or the ability to pay employees using your local entities in over 100 countries. Deel also offers global-friendly services such as assistance in obtaining U.S. visas, international background checks, and employee misclassification protection.

Why it didn’t make the list

Deel’s platform is minimalistic and does not offer much native support for HR processes outside payroll. For example, you have to integrate with Slack for features like employee communication, surveying, onboarding, and time off management.

Also, Deel only supports biweekly, semi-monthly, and monthly pay schedules for U.S. payroll, while direct deposit turnaround is five days. As a result, you may only want to use Deel for paying international teams and use an alternative for your U.S. payroll and HR management.

Paychex Flex: Best for business and payroll services

Alternative for: Paycor

Overall score: 3.25/5

When to choose Paychex Flex

Paychex Flex, like Paycor, offers payroll plans to support small, midsize, and large companies. Besides a PEO, Paychex provides other services, like hiring, HR consulting, and business insurance, including workers’ compensation, general liability, and employment practices liability insurance (EPLI). Paychex helps you avoid shopping elsewhere for the services you need to support your business and employees.

Why it didn’t make the list

Although its small business Essentials plan starts at $35 per month plus $5 PEPM, many of its features require more manual processing than competitors — unless you sign up for its PEO. For example, the Essentials plan requires you to remember to pay payroll taxes from your account instead of Paychex handling it for you.