Key takeaways

If your payroll audit tells you it’s time to upgrade your software, use our Payroll Software Guide to find the tool that’s right for you.

What is a payroll audit?

A payroll audit is a thorough examination of your payroll processes to ensure accuracy, compliance, and efficiency. During an audit, you will review employee rosters, payroll reports, and reconcile against employee hours, payments, and company accounts. If you’re doing payroll yourself, you might even find some errors from manual calculation that need to be corrected. Using payroll software—even free payroll software—and a checklist can expedite processing payroll, ensuring you don’t miss any steps while identifying areas for improvement.

Software Spotlight: Paycom

There’s a better chance that your payroll audit will go smoothly if you’re using software that’s designed with compliance in mind. Payroll systems like Paycom keep track of employee compensation changes, handle multiple pay schedules, and even run garnishments on your behalf. As a result, there’s less room for payroll errors, speeding up your annual audits and giving you more peace of mind throughout the year.

Visit PaycomBenefits of conducting a payroll audit

Payroll audits help you realize when your process is slightly off, where there might be gaps, and what’s going well. Here are a few key benefits.

Improves payroll accuracy

Payroll accuracy is crucial and here’s why: A 2017 survey found that 49% of employees will start looking for a new job after just two payroll errors. While understandable, the risk to employee retention and satisfaction places extra pressure on you to ensure absolute accuracy. Ultimately, these audits help you preserve your employees’ trust in the payroll process by ensuring they’re paid accurately and on time and, if necessary, rectifying errors before they have an impact.

Ensures compliance

Payroll audits also help verify your compliance with federal, state, and local labor and employment laws. This can reduce the risk of costly legal disputes and penalties. Failing to make a timely tax deposit, for example, can result in a fine of up to 15% of the total tax due. For many small businesses, this penalty is debilitating.

Uncovers inefficiencies and fraud

What’s more, payroll audits can uncover inefficiencies and fraud, allowing you to streamline payroll processes and improve overall operational efficiency.

Mark Wilkinson, Co-Founder and Financial Officer at Yabby, notes the value of preventative action: “If you’re doing [audits] often, you’re making sure that you won’t have to put in a huge chunk of time in the future.” Just like doing laundry each week means you won’t run out of socks at the end of the month, getting over the initial payroll audit hurdle will help your team avoid a significant administrative burden down the road.

What should a payroll audit include?

Successful payroll audits analyze the following information in your company’s payroll processes:

- Employee rosters.

- Employee pay, including overtime, variable, and atypical payments.

- Time clock data, such as hours worked and days off.

- Taxes and deductions, including benefit deductions.

- Number of payrolls, including any atypical payrolls.

- General ledger and bank account reconciliations.

When reviewing the data in the payroll audit, you should double-check that your processes adhere to updated federal, state, or local laws and make adjustments or issue corrections as necessary. For example, many states update their minimum wage laws at the beginning of the year. You should make sure all affected employees’ pay rates are updated appropriately.

Pay attention to errors in the records. Some errors could be as simple as a typo — such as transposing two numbers — while others could point to fraud, embezzlement, wage theft, or time theft. Thus, payroll audits benefit both employees and employers; employees’ pay records are double-checked for accuracy while employers’ accounts are protected from significant financial loss.

Free payroll audit checklist template

Is the thought of conducting your own payroll audit daunting? Start with this payroll audit checklist to make the process easier.

Download our payroll audit checklist for free:

How do you audit payroll records?

To implement an effective payroll audit, first determine the parameters of your payroll audit, collect necessary employee pay data, and reconcile them with time records, tax payments, and financial ledgers. At the end of the audit, you can then take measures to improve your payroll processes to mitigate future errors.

1. Determine the payroll audit timeframe and stakeholders

The first step in a payroll audit is understanding when the payroll audit should take place and who is involved. To do that, ask yourself the following questions:

2. Generate reports and examine the data

Gather employee rosters, payroll registers, and other payroll reports covering the lookback period. These reports should cover employee start and termination dates, job titles, pay rates, deductions, taxes, and other pertinent employment details.

3. Confirm payments match hours worked

Pull time clock data and make sure all employees are being paid appropriately for their actual time worked during each pay period. For example, if an employee works 47 hours in a pay period when they normally work 35, investigate to understand why.

Next, double check overtime hours are being paid correctly. Generally, non-exempt employees must be paid at their time-and-a-half (overtime) rate for any hours worked over 40 hours in a week according to the Fair Labor Standards Act. However, this could differ depending on international, state, or local laws, collective bargaining agreements, or contracts.

For example, in California non-exempt employees must be paid at their overtime rate for any hours worked over 8 in a day and at their double time rate for any hours worked over 12 in a day. Employers should pay employees any owed overtime retro pay as soon as it is discovered.

What if you notice discrepancies with an employee’s hours?

Before assuming an employee acted maliciously, you should do some due diligence to rule out other issues like technical glitches and clerical errors. False accusations can destroy employee trust and team morale, so if you can’t find evidence of an employee’s wrongdoing, it’s worth having an open dialogue to get a better understanding of what may have happened.

If the investigation reveals someone else clearly clocking in on someone else’s behalf, however, this could be grounds for disciplinary action against both employees for time theft. To proactively avoid situations like this, consider modifying your policies and procedures or adopting time clock software with features that make buddy punching more difficult.

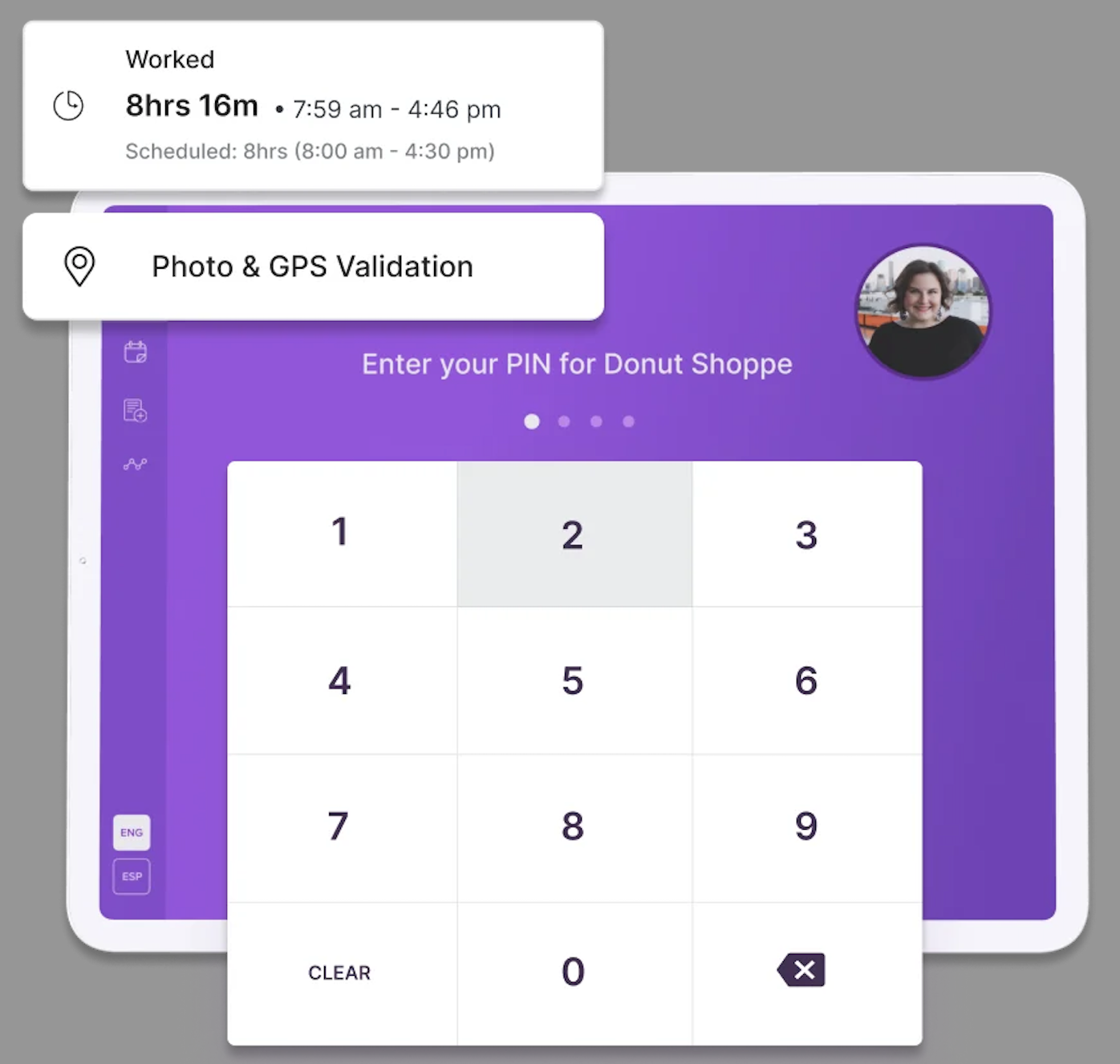

For example, Homebase reduces the likelihood of buddy punching by taking a picture of employees and requiring them to input a unique pin code when they clock in. You can also use the software’s geo-fencing features to restrict off-site clock-ins.

4. Double-check that variable and atypical payments are correct

Variable payments are payments based on an employee or company’s overall performance and include factors like bonuses, commissions, shift differentials, or tips. Check that there is documentation in place to support these variable pay structures, such as a handbook policy or employment contract.

Each variable payment should be labeled differently for tracking purposes. Differentiating variable payments from regular or overtime rates demonstrates employers are adhering to tip laws since they differ across U.S. jurisdictions.

Paid time off (PTO) payments should also be labeled and paid correctly. This includes distinguishing payments like vacation, sick, holiday, bereavement, personal time, or jury duty according to company policies.

Label these payments separately from regular rates to promote accurate paid leave tracking and to effectively diagnose policy procedures in need of improvement. Say, for example, you discover the payroll department paid an employee for two weeks of vacation when they had only accrued one. One way you could prevent this from happening again is to update your vacation policy to require signed employee and manager authorization before payment.

Finally, atypical payments include retro-pay, backpay, expense reimbursements, signing bonuses, relocation, and contractor payments. Investigate why an employee suddenly makes more or less than they typically make in a pay period. For example, if an employee typically receives $1,000 every paycheck but suddenly starts receiving $2,000, check if the payment is from a pay rate increase, variable, or atypical payment. If not, this could be a case of payroll fraud.

5. Check the accuracy of tax withholdings and other deductions

6. Compare payroll records with the General Ledger and bank accounts

Pull the General Ledger (GL) from the lookback period and reconcile it with payroll records from the same time. Each payroll expense in the GL should match your findings from the payroll audit. If they do not, investigate further. For instance, if you notice an employee’s paycheck listed twice in the GL, it could either be a clerical error or an indication an employee was accidentally double paid.

To know for sure, repeat the same process as above, this time by comparing the payroll transactions in the GL with their payroll bank accounts. Does the bank account confirm the employee was actually paid twice? Are there any other transactions that were missed? What about uncashed payroll checks? Use this time to correct internal documentation, void and reissue any stale checks, and update procedures to prevent double payments or fraudulent activity.

7. Take advantage of payroll software

You can speed up the payroll audit process by leveraging payroll software. Instead of compiling reports for the payroll audit lookback period by hand, payroll software can instantly assemble:

- Employee rosters.

- Payroll ledgers.

- Tax reports.

- Deduction reports.

- Employee pay stubs.

Moreover, payroll software automatically calculates complicated employee pay rates, from overtime rates for shift differentials to fluctuating workweeks. Many of these solutions also include code to prevent errors, reducing the risk that a payroll audit will uncover glaring issues.

ADP, for example, has safeguards in place to notify employers of critical issues, such as missing employee data, duplicate Social Security numbers, or unbalanced transactions. Employers can then fix these errors before they finalize payroll.

Meanwhile, companies looking to save time inputting or transferring payroll information into their accounting programs can benefit from an integrated solution. QuickBooks, for instance, allows you to easily reconcile payroll reports with transactions in the GL with your combined account and payroll software.

Additionally, payroll software assists you with labor law compliance, reducing the risk of uncovering major payroll law violations during a payroll audit. For instance, Paycor automatically updates federal, state, and local tax rates and withholding limits whenever they are enacted. Because you no longer have to research and make the new calculations yourself, you can increase efficiency while ensuring employees’ tax withholdings remain accurate.

8. Address payroll processes in need of optimization

In addition to uncovering errors in need of correction, payroll audits can give you concrete action items that will help improve your processes, such as:

- Requiring managers to review timecards for accuracy.

- Adding extra steps to the payroll approval process.

- Implementing measures to flag uncashed checks.

- Limiting payroll data access to mitigate the risk of fraud.

- Evaluating if the payroll software needs to be switched or upgraded.

Failing to address and update payroll processes following the insights of a payroll audit will guarantee you continue to make the same mistakes over and over again, costing you future time and money.

9. Put a process in place for future payroll audits

Make sure systems are in place for future audits and write a policy outlining a regular payroll audit timeline. Consider the following questions when outlining their policy:

- What worked and what didn’t during the payroll audit?

- How long did the payroll audit take? Were there areas that required more time and why?

- Did everyone involved in the audit need to be involved, or were more people necessary?

- Was every area of the payroll audit addressed in a timely manner?

- Should the scope of future payroll audits expand or shrink?

In addition to addressing the questions above, prepare a payroll audit checklist to improve the efficiency of future audits.

Payroll audit best practices

To ensure your payroll audit is effective and comprehensive, consider the following best practices:

Develop a detailed audit plan

Start by outlining your objectives, scope, and timeline. If your goal is to verify tax withholdings, specify the records to check and the timeframe for completion. A checklist like the one we’ve provided above will guide you through the necessary steps, like verifying employee classification and reviewing tax filings, ensuring consistency across audits conducted by different team members.

Update policies and train your staff

Updating your payroll policies help ensure compliance and efficiency in your everyday payroll process. When you update your policies because of audit outcomes, be sure to train your staff. This training is essential to ensuring your audits have a meaningful impact.

Conduct spot checks

Conducting random spot checks on payroll data helps identify inconsistencies or errors that might not be apparent during routine audits. For example, you could randomly select a few pay periods to review in detail, checking for correct tax withholdings and accurate overtime calculations. Spot checks act as a proactive measure to catch and rectify issues promptly, enhancing the overall accuracy of your payroll process.

Involve multiple departments

Engaging relevant internal departments, like HR, accounting, and finance, ensures a comprehensive review from multiple business perspectives. To make this process as smooth as possible, establish clear communication channels and assign specific roles and responsibilities. For example, HR staff can verify employee classifications while accounting ensures accurate financial records. Setting up regular check-ins and using project management tools can help track progress and ensure timely data provision.

Schedule regular audits

Establish a routine schedule for payroll audits, whether annually, semi-annually, or quarterly, to identify issues promptly, preventing small errors from becoming significant problems. Regular audits provide ongoing oversight and ensure continuous compliance. Conducting quarterly audits might reveal discrepancies early, allowing for timely corrective action.

If necessary, seek external expertise

If your organization lacks the internal resources or expertise for a thorough audit, consider seeking external expertise and support. External auditors, accountants, HR consultants, and law firms can provide an unbiased perspective and valuable insight for improving your payroll processes. Start by consulting with your payroll provider or PEO for recommendations. Industry-specific consultants and specialized law firms can offer tailored advice and support, helping you navigate complex compliance requirements effectively.

Why you need payroll audit procedures

Payroll is one of the core functions of any business, so inefficient or inaccurate payroll processes can lead to costly mistakes. However, companies that implement a regular payroll audit process can take proactive measures to address inefficiencies and compliance risks before they become serious problems.

Not only do payroll audits prevent the likelihood of future payroll mistakes or compliance issues, but they also ensure the integrity of payroll. Even companies with no computational or transactional errors in their payroll audits can utilize payroll audit data to correct any employee miscategorizations, unfair or discriminatory pay practices, or poor record-keeping procedures.

Even without the looming threat of labor law violations, failing to conduct regular payroll audits will still cost you in the long run, as you miss out on valuable insights to improve archaic payroll procedures.

If you’re ready to search for payroll software that will support a successful audit, check out our Payroll Software Guide for solutions.