Key takeaways

What is financial wellness?

The U.S. Consumer Financial Protection Bureau defines financial wellness as the ability to:

Types of employee financial wellness programs

With inflation at a 40-year high in the U.S., more companies are offering financial wellness benefits to help employees manage financial stress and develop good money habits. Employee financial wellness programs include financial literacy, financial goal management, debt management, retirement planning, emergency relief, and expense reimbursement.

Financial literacy

Financial literacy is a set of skills necessary for achieving financial wellness. It entails knowledge and practices for making informed decisions about current and future financial goals.

Financial literacy helps people:

You can support employees’ financial literacy by hosting regular workshops or seminars. Alternatively, you can provide access to online financial education courses and resources so employees can learn at their own pace. Another method is to include financial literacy tips in company newsletters and training materials.

For providing this type of financial wellness benefit, you can try LearnLux, a learning management system focused on financial literacy and well-being. It provides lessons and tools to help employees learn about retirement planning, homeownership, the effects of credit card debt, and many other topics.

Financial goal management

Businesses can organize workshops focusing primarily on financial goals and outline the steps to achieve these goals. Additionally, you can encourage peer sharing and create a platform where employees can share their financial goals and success stories to promote accountability.

You can also provide access to financial planning tools and resources. These can help employees track spending, savings, and progress toward their goals.

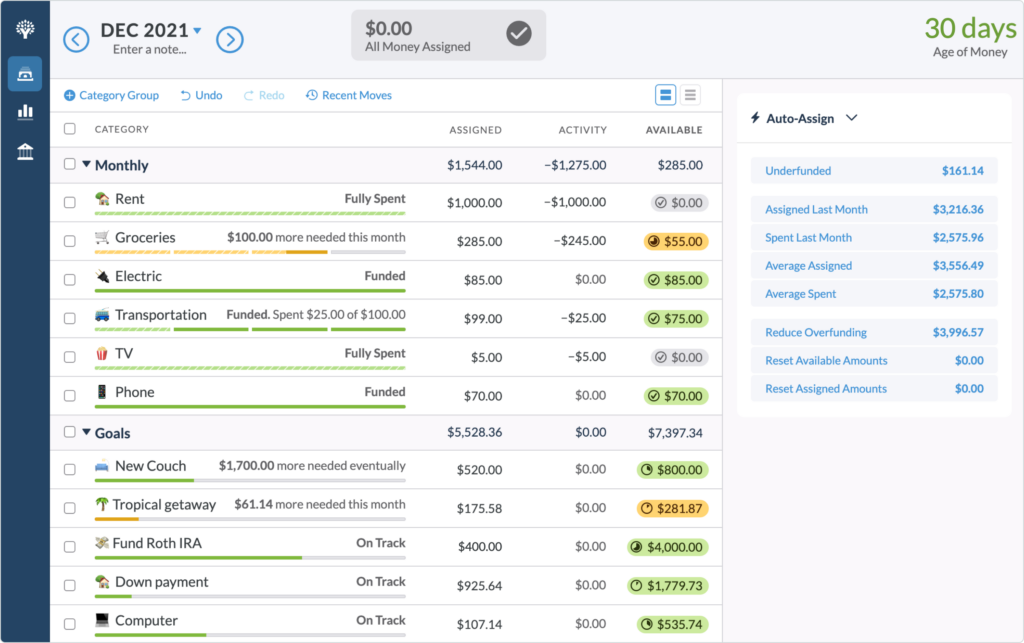

YNAB (You Need A Budget) is a user-friendly tool that can be highly effective for goal tracking. It provides visual indicators in the form of a progress bar, giving users a clear idea of how close they are to achieving their goals. YNAB also sends alerts when users are falling behind on goal contributions or when a target is approaching, making it a valuable tool for financial management.

Debt management

Employers can help employees manage debt in multiple ways. A good start is to help employees check their credit reports. Employers can guide employees on how to access annual credit reports from major credit bureaus. Knowing where an employee’s credit status stands is an excellent way to start strategizing how to manage the debt.

Credello can create a plan tailored to the user’s financial situation and goals regarding debt management. It can create a personalized dashboard that will organize all debts in one place. This visualization will help the user see the bigger picture of their financial situation.

Retirement planning

Companies can connect employees with a retirement expert to provide personalized advice on retirement planning.

These experts should help employees strategize a detailed plan of action for their retirement while considering the cost of living and other factors. Employees must return, review, and revise their pension plans regularly to make sure all information is current and reflects their future goals.

Employers can also help employees access retirement income, whether through lump-sum payments, annuities, or income funds. Features like that of BrightPlan can help employees set retirement goals and plan for estate distribution.

Emergency relief

Employers can provide emergency relief funds to help employees get through unexpected situations.

For example, employees affected by natural disasters such as hurricanes, typhoons, earthquakes, floods, and wildfires can receive relief funds to help them recover and rebuild. Aside from natural disasters, other emergencies to consider are accidents, surgeries, or serious illnesses not fully covered by insurance.

When setting up a relief fund, it is important to clearly outline the emergencies covered by the fund and communicate this with the employees. Explain the eligibility criteria, how to contribute, and the application process. It is also vital to consult with legal advisors to guarantee that the fund complies with tax laws and regulations.

Expense reimbursement

Another type of financial wellness benefit is through reimbursement or stipend programs. Employers can reimburse employees for any job-related expenses, which may include travel expenses, equipment purchases, or training fees.

Another way is to set up a reimbursement program to cover a portion of health-related expenses. These can be anything from gym memberships to counseling services. To avoid confusion, establish clear guidelines as to what expenses are covered. Also, specify the process for submitting expenses or any limitations.

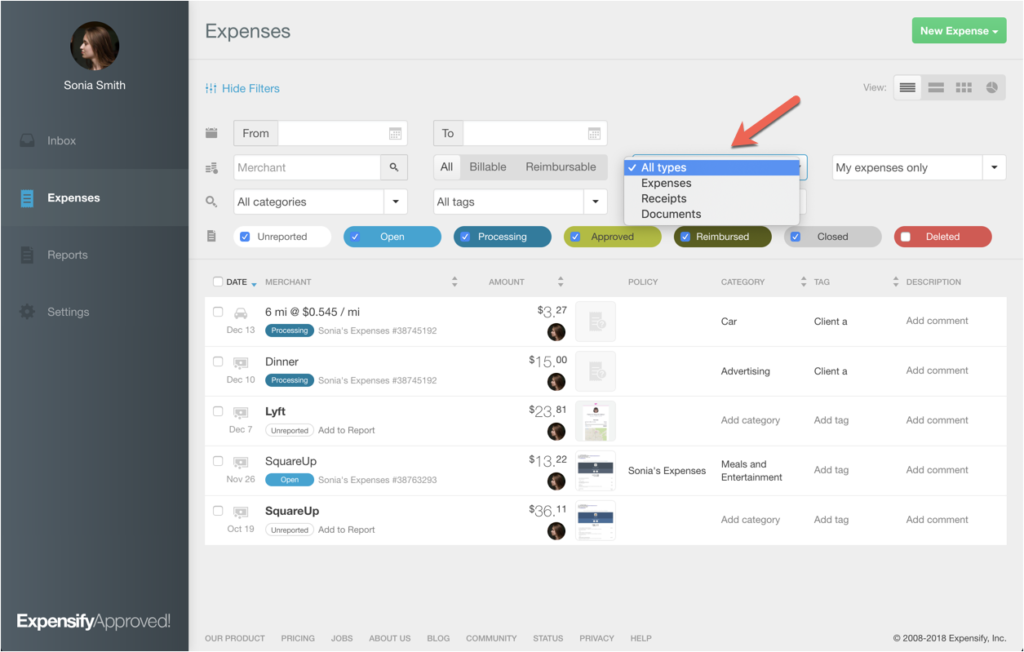

Businesses can use Expensify to streamline this process. Expensify can scan receipts, identify the merchant, and automatically categorize the transaction, helping shorten the processing time.

How to launch a financial wellness program

Your company’s financial wellness program should reflect your company’s values as well as the unique needs of your employees.

1. Evaluate employees’ needs

Use anonymous survey tools to understand your employees’ financial goals and determine what benefits would be most beneficial. Survey questions may include:

The survey findings may reveal the effectiveness of your current benefits, especially if you use the same survey questions before and after launching a financial wellness perk. Survey results may also point to potential gaps in current offerings and persistent, unaddressed employee needs.

2. Obtain leadership buy-in

If company leadership isn’t aware or convinced of employee financial wellness as an issue, present the survey findings from the first step and highlight the productivity and job satisfaction benefits that come with supporting employees’ financial well-being.

By providing data-driven justification, you can present a compelling argument that demonstrates the relation between employee financial wellness and overall company performance. You can also show how competitors who offer financial wellness programs perform when it comes to employee satisfaction rate, talent attraction, and retention.

Additionally, by conducting a cost-benefit analysis, you can demonstrate how reallocating funds from underutilized benefits to financial wellness programs can result in greater employee engagement and reduced financial stress. Another effective way is by showing comparison showing the value employees can get from financial wellness benefits compared to underutilized benefits.

3. Get started immediately with free programs and resources

With a green light from the leadership team, you can offer resources that target a range of financial interests, such as:

Some financial institutions and nonprofits offer free resources, such as workshops, tools, and coaching, which you can use to address your employees’ goals and concerns. Free financial wellness resources include:

Several HR software solutions include financial wellness features that can help streamline this program with other employee benefits. The right constellation of offerings will depend on your workforce’s needs and life stages.

4. Establish metrics for success

After building a program, it’s important to establish metrics for success. A success metric may be the percentage of employees participating in retirement programs or investing in health savings accounts.

Measuring employee stress can be more difficult to capture without prying into employees’ financial decisions. Optional surveys let you check in with employees periodically to see if they are experiencing financial stress without being intrusive.

Depending on the financial wellness benefit you offer; you can measure benefit utilization by measuring the number of employees enrolled in and actively using the financial wellness program. You can also measure engagement by keeping track of attendance at workshops and interactions with online tools.

Benefits of employee financial wellness

Are financial wellness benefits right for your company?

Employee financial wellness is an important part of a holistic approach to employee health. Employers who offer financial wellness programs help reduce employee stress and demonstrate that the company is invested in their health and well-being. In turn, financially secure employees are more satisfied at work, productive, and healthier.

Explore our HR Software Guide to find the best solution for your organization that includes financial wellness.