What is payroll software?

Payroll software helps businesses to manage, organize, and automate the employee payment and tax filing processes. It eliminates time-consuming, payroll-related tasks for human resources (HR), reduces pay errors, and guarantees that employees receive payment on time.

Most payroll software solutions deliver direct deposit, expense management, employee self-service, time tracking, and reporting features. They can also calculate wages, deduct tax withholdings, pay government employment taxes, and even alert employers when it’s time to file tax forms.

For this guide, I reviewed seven market-leading payroll software solutions and narrowed the list to my top five recommendations. The best payroll software for small businesses are:

- Gusto is the best payroll software overall.

- OnPay is best for ease of use.

- QuickBooks Payroll is best for its accounting integration.

- Paycor is best for growing businesses.

- Patriot Payroll is the best budget-friendly payroll software.

- Honorable mention:

- Rippling is best for payroll automation.

Need Help? Talk to an HR Software Advisor

Best payroll software

Overall score

Best for

Starting price

Contractor-only Payroll

Learn more

QuickBooks Payroll

4.08

Accounting integration

$50/mo. + $6/employee/mo.

$15/mo. for up to 20 contractors + $2/additional worker

Paycor

3.77

Growing businesses

$99/mo. + $6/employee/mo.*

Included in payroll plan

Patriot Payroll

3.67

Affordability

$37/mo. + $5/employee/mo.**

Included in payroll plan

Rippling

3.68

Payroll automation

Call for a quote

Included in payroll plan

*Pricing is based on a quote I received.

**This is for Patriot Payroll’s Full Service plan, which includes tax filing services. If you prefer to file tax forms yourself, Patriot offers a Basic Payroll package that costs $17 per month + $4 per employee monthly.

- Mar. 12, 2025: Robie Ann Ferrer verified pricing for each vendor and made minor edits to the copy to remove QuickBooks Payroll’s 30-day free trial as this is no longer available.

- Jan. 29, 2025: Robie Ann Ferrer used a new scoring rubric with criteria and software options best suited for small business pay processing. As a result, RUN Powered by ADP was added to the rubric, while ADP Workforce Now, Paychex, APS Payroll, and Deel were removed. Then, she evaluated the newly added platforms and updated the scores of others on the list. Given the revised rubric, Gusto replaced Rippling as the best overall software for payroll, while Rippling moved to the honorable mentions list. Finally, Robie made revisions throughout the article to reflect rubric score adjustments, changed “best for” recommendations, and added up-to-date product information for all vendors.

- Oct. 11, 2024: Robie Ann Ferrer verified pricing for each vendor and updated the list of countries where Gusto’s EOR services are available. She also added the Best For descriptions of the software in our Honorable Mentions list and updated the formatting for that section.

- Sep. 18, 2024: We refined the page layout by adding new design elements to improve the visual flow of information.

- Sep. 13, 2024: Robie Ann Ferrer verified pricing for each vendor, checked the availability of new features, and updated the copy to improve the page’s readability.

- Sep. 12, 2024: We updated all mentions from Rippling Unity to Rippling Platform to reflect its rebranding.

- Aug. 14, 2024: We added a note to highlight QuickBooks Payroll pricing changes.

- Mar. 19, 2024: Irene Casucian verified pricing for each vendor, checked the availability of new features, and updated the copy to improve the page’s readability.

- Jan. 18, 2024: Jessica Dennis reevaluated our top choices for 2024 using an objective scoring rubric. As a result, Rippling was added to the list as best overall, and Patriot was removed from the list. She also rewrote most of the article and updated product information, prices, and key features.

To evaluate the best payroll software for small businesses, I collaborated with Irene Casucian, one of our expert research analysts, where we used a 52-point rubric to review and compare seven online payroll platforms. Our options included:

- Gusto.

- Rippling.

- Patriot Payroll.

- OnPay.

- QuickBooks Payroll.

- Paycor.

- RUN Powered by ADP.

We looked for functionalities that streamline wage and tax calculations and automate payroll tax filings and payments. In addition to checking online user reviews, we researched the customization features, compliance tools, reporting, third-party software integrations, and customer support options offered. If available, we leveraged free trials and demos to assess each software’s functionality and ease of use.

I also added my expert rating to each criterion, where I considered the effectiveness of that area or feature. Then, I narrowed down the list to my top five recommendations.

Below is the breakdown of the evaluation criteria.

Payroll features: 25%

Payroll is the most weighted criterion in our roundup, at 25%. For this criterion, we considered critical payroll software features like direct deposit timelines, automatic federal, state, and local payroll tax filings, contractor pay runs, garnishment payments, support for various employee pay options, and compliance safeguards. The best vendors automate most employee payment processes while providing payroll services across all US states.

Pricing: 20%

Pricing accounts for 20% of the weighted score. Software with transparent pricing, affordable plans, unlimited pay runs, and free trials received the highest scores. We also considered each platform’s “value for money,” which determines whether the number of features in each price tier or module is competitive with other vendors in the space.

HRIS features: 15%

The human resources information system (HRIS) category assesses the strength of the software’s underlying employee information data repository. Software with robust recordkeeping features, onboarding and offboarding capabilities, new hire reporting features, and employee self-service portals earned the top marks. We also checked whether it provides access to benefits plans available in all US states. HRIS comprises 15% of the solution’s total score.

Platform and interface: 15%

How easy is the platform to use? Will it be able to grow with the company? Will employees’ data be safe? This category, which represents 20% of the platform’s total score, covers the solution’s intrinsic features and how well it will integrate with your current tech stack.

Customer support: 10%

This criterion comprises 10% of each platform’s overall score. Here, we looked at the customer support hours and whether phone, email and/or support tickets, and live chat are available. We also checked if the provider has an online knowledge base or community forum and if it offers online payroll services or bookkeeping assistance.

Reporting and analytics: 10%

Because payroll processing is highly regulated, solutions with in-depth payroll reporting and analytics that address compliance needs performed the best in this category. We looked for payroll report templates and data export options. We also evaluated each platform’s capability to create custom reports and schedule automatic payroll report releases to stakeholders. Reporting and analytics account for 15% of the software’s score.

User reviews: 5%

User reviews from third-party software platforms like Capterra, G2, and TrustRadius accounted for 5% of the software’s overall score. We focused on software that received at least 3.5 out of 5 stars on these sites. Because users have real-world experience with each platform, they played a significant role in narrowing down the list of top products to compare.

My recommendations for the best payroll software for small companies are based on more than five years of experience writing about and evaluating payroll systems for small to mid-sized businesses (SMBs). I also have 10 years of expertise handling different facets of human resources, including managing HRIS, time tracking, and pay processing software. These allowed me to provide insights to help business owners determine which payroll platform best fits their needs.

1. Gusto

Best overall payroll software for small business

Overall Score

4.27/5

User reviews

4.64/5

Pricing

4.06/5

Customer support

4/5

Platform and interface

4.23/5

HRIS features

4.63/5

Reporting and analytics

4.56/5

Payroll features

4.15/5

Pros

- International contractor payroll in more than 120 countries.

- Gusto-brokered health insurance that integrates with payroll on all plans.

- Customer service is available by phone, email, or chat.

- Native employee financial wellness tools through Gusto Wallet app and Gusto debit card.

Cons

- No dedicated account manager (unless with a Premium subscription).

- Check delivery is currently in beta and costs $1.50 per check.

- The lowest price plan is only for single-state payroll.

- Employer of Record (EOR) services to hire and pay global workers are limited to 12 countries.

Why I chose Gusto

Gusto’s simple but modern user interface (UI) helps you quickly establish basic payroll flows and maintain compliance requirements. It offers a wide range of payroll tools and services, such as its AutoPilot feature, which automatically approves pay runs, saving you time from manually doing payroll yourself. You also don’t have to worry about payroll tax filings and remittances, Gusto will handle these for you.

With a 4.27 out of 5 score, Gusto’s rating reflects its capability to offer accessible tools to both payroll newbies and experts while supporting their needs. In addition to full-service payroll, Gusto’s project tracking allows you to pay your contractors the right amount while providing you with data to make more accurate, competitive project bids to your clients. And if you decide to grow into an international business, Gusto can compliantly pay your global contractors and employees. It can even help you hire international employees with its EOR service—Gusto Global.

For HR features, Gusto provides basic versions of several HR processes, like performance reviews, but it’s not the best choice if you need a full-scale human capital management (HCM) system. Paycor or Rippling are better options in this scenario. Both have feature-rich HR platforms that can handle simple to complex HR processes.

Gusto started as an employee and contractor payments company but now supports various HR functions like benefits administration, performance management, recruitment, and global payroll. As a full-service payroll company, it offers automatic deductions, remittances, and filings of federal, state, and local taxes. It can even handle minimum wage adjustments for tip credits and child support payments in 49 states (all but South Carolina). In contrast, many standalone payroll solutions for small businesses require you to process garnishments and local taxes manually.

Gusto also supports global businesses with contractor payments in more than 120 countries. For its Gusto Global product, it partnered with Remote to offer EOR services for employers needing to hire and pay workers in the following countries:

- Australia

- Brazil

- Canada

- Germany

- India

- Ireland

- Mexico

- Spain

- Netherlands

- Philippines

- Portugal

- United Kingdom

While the coverage may be limited as of this writing, Gusto plans to expand its EOR services to other countries soon.

Gusto limitations

Even if it has started offering global hiring and payroll services, Gusto is not the most scalable solution in the market. Enterprise businesses, for example, will have difficulty finding crucial pay data insights, such as pay disparities and compensation benchmarks. This is because Gusto has limited report customization capabilities and completely lacks data visualization. Instead, you’ll need to export the reports to a spreadsheet program to create customized charts and gain data insights.

Gusto also becomes tedious to use once you have more than 50 employees. Unless you upgrade to a higher tier, it still requires some manual data inputs for things like time tracking and new hire onboarding.

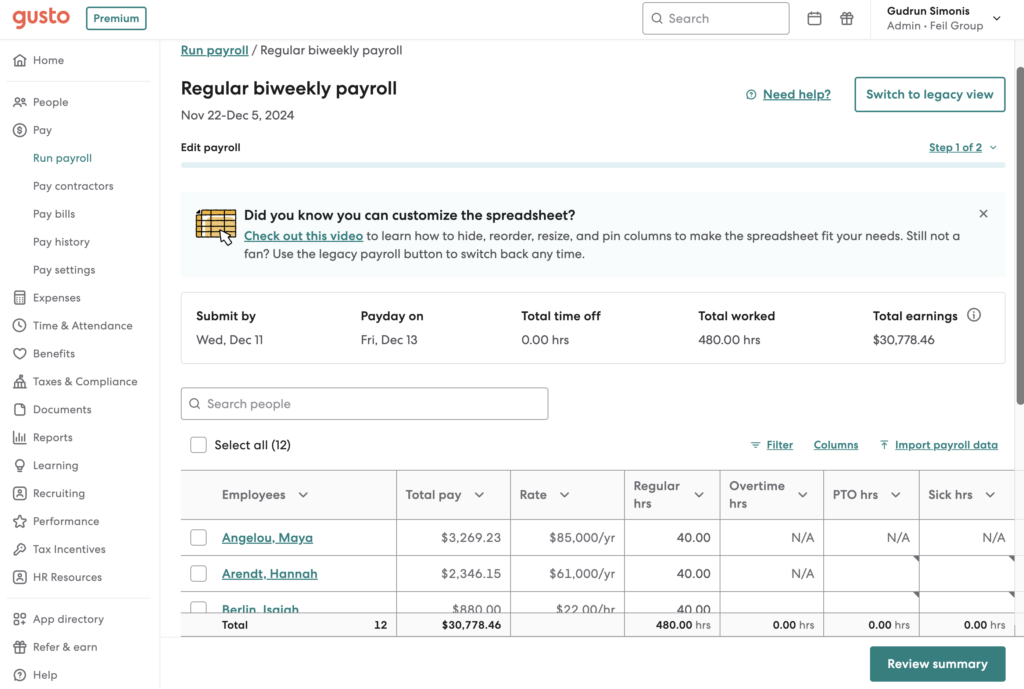

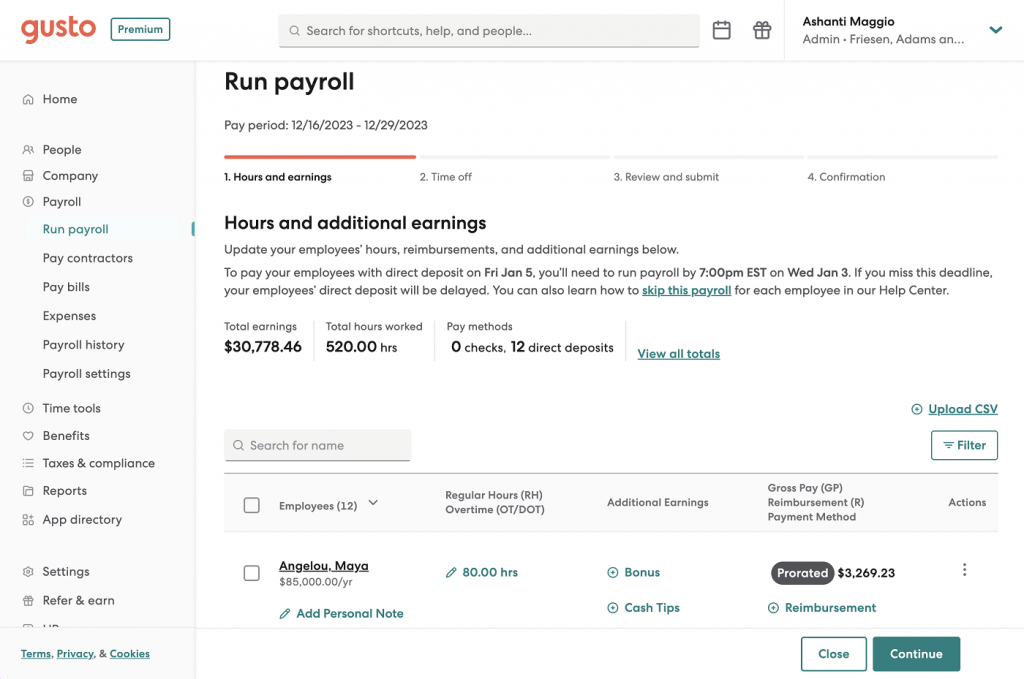

Simple payroll interface

Gusto’s payroll module features a progress bar with steps and instructions at the top so you stay on track and remember what information you need for payroll finalization. If you don’t enable Gusto’s AutoPilot function, running payroll takes only three steps: enter employee earnings and actual work hours, input time off details, and review and submit.

If you don’t have a native or integrated time-tracking module, Gusto makes the process somewhat less tedious than Rippling, which previously held the top spot in this list. This is because Gusto includes fields to adjust employees’ hours, earnings, deductions, and reimbursements on the same page. You only have to open the section to adjust the fields that apply to each employee.

This is unlike Rippling, which separates hourly and salaried employees into different steps and puts each employee’s earnings and deductions in tabs. You will need to switch tabs and do long, horizontal scrolls to find and adjust the pay codes that apply to each employee. As a result, Rippling requires significantly more clicks to finish payroll than Gusto.

Payroll add-ons

Gusto offers several add-on features that benefit small businesses. It can help you save money with R&D tax credits or start a pay-as-you-go workers’ compensation policy through its partner, NEXT Insurance. If you sign up for its state tax registration add-on, Gusto will file and monitor all the paperwork needed to expand your business into new states.

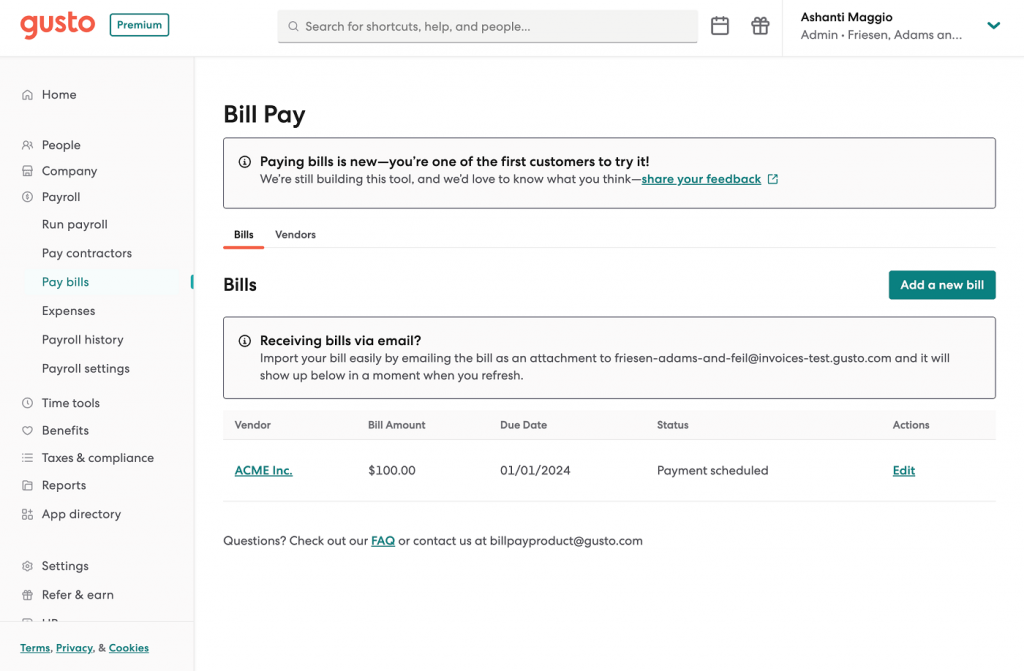

Further, Gusto has a free bill pay module. It allows you to create an electronic roster of all your vendors, upload bills from suppliers and subcontractors, and schedule payments. However, its features aren’t extensive—you can’t attribute codes, like utilities, to payments for accounting purposes or send transactions to stakeholders for approval. You also can’t filter or export bill payment data to your accounting application. Nevertheless, if you’re switching to Gusto after doing accounting and payroll processes yourself, it is a step up from manually maintaining billing and vendor profiles.

Gusto’s pricing starts at $49 monthly plus $6 per employee, per month (PEPM). You can choose between three tiers: Simple, Plus, and Premium. Similar to QuickBooks Payroll, Gusto also offers a contractor-only payroll plan for $35 per month plus $6 per contractor per month*. However, it isn’t as affordable as QuickBooks Payroll, which only costs $15 monthly for up to 20 workers plus $2 for each additional contractor.

Gusto plans

Simple

Plus

Premium

$49/mo. + $6 PEPM

$80/mo. + $12 PEPM

$180/mo. + $22 PEPM

Includes:

- Unlimited single-state full-service payroll.

- Auto-run payroll.

- Two- and four-day direct deposits.

- Basic support.

- Employee self-service.

- Gusto-brokered health insurance.

- Basic hiring and onboarding.

- Basic paid time off (PTO) policies.

- Custom admin permissions.

- Reports for payroll and time off.

- Accounting, time tracking, and expense management integrations.

Includes everything in Simple, plus:

- Unlimited multi-state full-service payroll.

- Next-day direct deposits.

- Advanced hiring and onboarding.

- PTO management.

- Time tracking and project tracking.

- Time kiosk.

- Scheduling.

- Reimbursement and expense claim management.

- Workforce costing and custom reports.

- Employee directory and printable org charts.

Includes everything in Plus, with:

- Dedicated customer success manager.

- HR templates for handbooks, job descriptions, and policies.

- Proactive federal and state labor law compliance alerts.

- Access to certified HR experts.

- Full-service payroll migration and account setup.

- Health insurance broker integration.

- R&D tax credit discount.

- Priority support.

Gusto contractor-only plan

- Monthly fee: $35 plus $6 per contractor.

- Includes unlimited US contractor payments, four-day direct deposits, 1099-NECs at the end of the year, and new hire reporting, if required in your state.

Add-ons

- International contractor payments: Price varies by foreign exchange rate.

- State tax registration: Prices vary by state.

- R&D tax credits: Pay 15% of identified tax credits.

- Gusto Global: $699 PEPM.

- Health insurance broker integration: $6 per month per eligible employee.

- 401(k) retirement savings: Price varies by 401(k) integration.

- Health Savings Accounts (HSAs): $2.50 per month per participant.**

- Flexible Spending Accounts (FSAs): $4 per month per participant, with a $20 per month minimum.**

- Dependent care FSAs: $4 per month per participant, with a $20 per month minimum.**

- Commuter benefits: $4 per month per participant, with a $20 per month minimum.**

- Workers’ compensation: Price of premiums only.

- Life and disability insurance: Price of premiums only.

- Next-day direct deposit: $15/mo. + $3 PEPM.***

- Time tracking: $6 PEPM.***

- Performance reviews: $3 PEPM.***

- HR resources: $50/mo. + $5 PEPM (includes compliance alerts and access to HR experts and HR templates).***

- Priority support and HR resources: $8 PEPM; only available with the Plus plan.

- Annually updated labor law posters: $8.99/mo. (onsite posters); $10/mo. for up to five employees, plus $1/mo. for each additional employee (ePoster service for remote employees).

*For new clients, Gusto waives the $35 monthly base fee for the first six months. This could change anytime, so please explore its website for the latest deals.

**Annual $200 service charge covers HSAs, FSAs, dependent care FSAs, and commuter benefits.

***Add-on only for the Simple plan; included for free with the Plus and Premium tiers.

2. OnPay

Best for ease of use

Overall Score

4.11/5

User reviews

4.07/5

Pricing

4.5/5

Customer support

3.75/5

Platform and interface

3.46/5

HRIS features

4.63/5

Reporting and analytics

4.06/5

Payroll features

4.05/5

Pros

- Free setup and data migration.

- Specialized payroll services for particular industries like agriculture, churches, and nonprofits.

- Employee rosters, organizational charts, leave management, and customizable onboarding included.

Cons

- Does not offer native time-tracking and accounting modules.

- Limited third-party integrations.

- Not suitable for fast-growing companies.

- No mobile app.

Why I chose OnPay

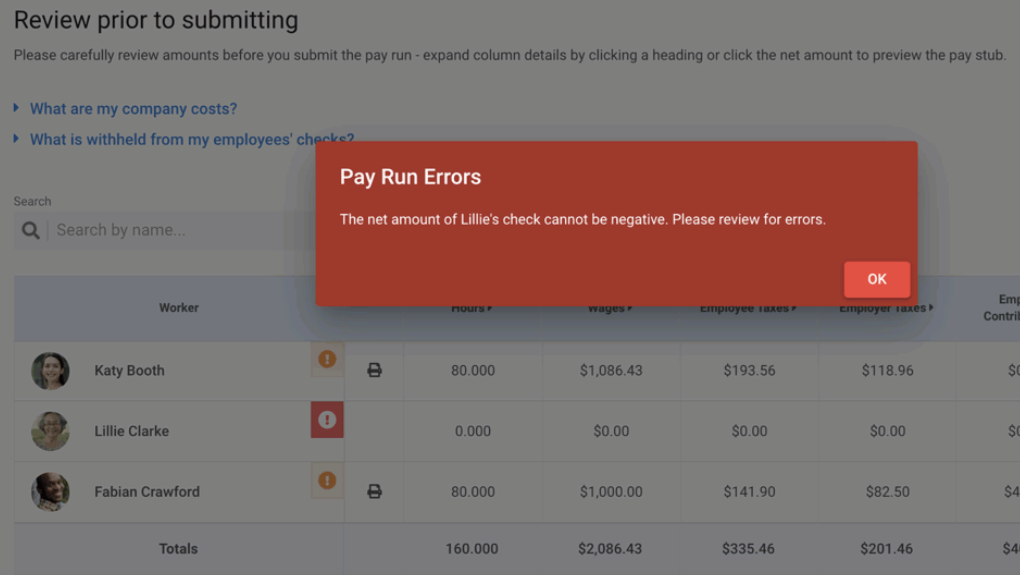

OnPay has an intuitive interface and uncomplicated payroll workflows that can accommodate multiple payroll schedules, worker types, and pay methods. Coming in with a score of 4.11 out of 5, OnPay makes running payroll easy with its simple-to-use features and automatic alerts that highlight payroll errors and discrepancies. It also comes with a suite of HR tools to meet minimum compliance requirements by state and industry, including PTO policy management, compliance audits, and an HR resource library.

OnPay’s flat-rate pricing structure makes planning for and controlling long-term business costs much easier. However, this also makes OnPay less likely to innovate and offer more modern features at the same rate as competitors. Its one-price-fits-all feature means that adding more capabilities will result in profit loss for the company unless they raise prices or offer add-on modules for additional fees. If you want a small business payroll product that improves and adapts constantly, go with Gusto instead. Over the years, the company has added more functionalities to its platform, the latest include global payroll and EOR services.

OnPay’s specialty may be payroll, but it has all the features you need to manage small business HR processes, such as time off management, benefits administration, task management, and customizable onboarding workflows. These all come standard with OnPay, unlike the other providers on my list that require you to purchase a higher subscription to get some of these features.

OnPay may not have automatic pay run features, but its interface is straightforward, requiring just as many (or fewer) clicks as Gusto to complete payroll. Like Gusto, OnPay lets you add or adjust earnings and deductions on the same screen, avoiding extra clicks and cumbersome spreadsheets. You can also adjust specific employee pay information in a sidebar window without leaving the workflow.

While it doesn’t offer a contractor-only plan like QuickBooks Payroll and Gusto, OnPay allows you to pay contractors within the same pay cycle as your regular employees. This avoids repeating the payroll process for your different worker classifications at the end of every pay period.

OnPay limitations

OnPay is not the best choice if you expect to need more robust payroll features later. It supports unlimited and multi-state payroll but lacks global payroll functionality. OnPay may flag you of payroll errors as you process employee payments, but lacks in-app compliance checkers, so you’ll have to become familiar with new laws on minimum wages, PTO, and overtime in each state where your employees reside before running payroll.

One of the biggest drawbacks, especially for businesses with mostly non-exempt hourly workers, is OnPay’s lack of native time-tracking or scheduling features. It does integrate with popular options like When I Work and Deputy, but QuickBooks Payroll may be a better choice if you want easy data transfers from time tracking to payroll.

Employee engagement and recordkeeping

OnPay offers basic staff engagement and recordkeeping features that you rarely see in standalone payroll platforms, such as employee profile bios and customizable fun fact questions. Workers can view this information and work contact numbers directly in OnPay. This is useful if you have shift workers who need to reach team members to report emergencies like tardies or other shift changes.

You can use its customizable forms to create documents for tracking business and staff information, such as collecting employee T-shirt sizes for an upcoming work event or tracking company equipment like computers and keys. Its e-signature capabilities also allow you to collect essential documents and obtain legal acknowledgments from employees. For instance, employees can electronically sign uniform deduction agreements to deduct the cost from their next paychecks.

You can even create similar flows for handbook policies, including any that impact payroll processes, such as employee bonuses, reimbursements, and other deductions. Gusto may have similar functionalities but reserves it for its higher-paying plans.

Payroll reports builder

OnPay includes a payroll-specific reports dashboard, with links to important reports, like general ledger (GL) summary and payroll register, directly on the main page. Graphs also provide quick views of the number of employees paid each month and paid wages by type to track costs and turnover.

You can save custom reports and views to access the data you need as it changes with each pay run. I was also impressed with OnPay’s report designer, which lets you filter and drag-and-drop report columns to adjust your view in real time without downloading data to a spreadsheet program of choice. This saves you time from downloading reports repeatedly. In contrast, Gusto only lets you choose the columns or data fields you want. You can’t rearrange the order without running the report and selecting the columns again. If you want an easier way of viewing and filtering data fields for your reports, use OnPay.

OnPay has the simplest pricing of all the vendors on my list. For $40 per month plus $6 PEPM, you get access to OnPay’s entire platform, including payroll and basic HR features. These include:

- Multi-state payroll.

- Customized employee onboarding and task checklists.

- Personnel file storage.

- PTO management.

- OnPay-brokered health insurance benefits.

- Company directory and organizational charts.

- HR resource library.

- Customer support by phone, chat, and email.

OnPay’s feature is comparable to Gusto’s least expensive Simple plan, but OnPay has a slightly lower monthly base software fee ($40 vs $49) and surpasses Gusto Simple’s capabilities. It includes multi-state payroll—a feature that Gusto offers in its Plus and Premium tiers. OnPay’s tax filing service is also a bit better than QuickBooks Payroll because it covers federal, state, and local taxes; whereas QuickBooks Payroll will require you to upgrade to either its Premium and Elite plans if you want it to file local tax forms for you. With its competitive one-price-fits-all model, it’s a better choice for small establishments without major growth goals. However, if you have plans to grow, consider Paycor—its all-in-one platform can handle basic to advanced payroll and HR processes.

3. QuickBooks Payroll

Best for its accounting integration

Overall Score

4.08/5

User reviews

3.99/5

Pricing

4.13/5

Customer support

4.13/5

Platform and interface

3.88/5

HRIS features

4.25/5

Reporting and analytics

4.56/5

Payroll features

3.86/5

Pros

- Online chat support available 24/7.

- Tax penalty protection for any reason on its Elite subscription tier.

- Next-day or same-day direct deposits (depending on subscription tier).

- Direct integration with QuickBooks Time and other Intuit products.

- Personal HR advisor at Elite subscription tier.

Cons

- Local tax filings are only available in Premium and Elite plans.

- Additional fees for tax filings in multiple states, unless on Elite plan.

- QuickBooks time and attendance features open in a separate application.

- Service capped at 150 employees.

Why I chose QuickBooks Payroll

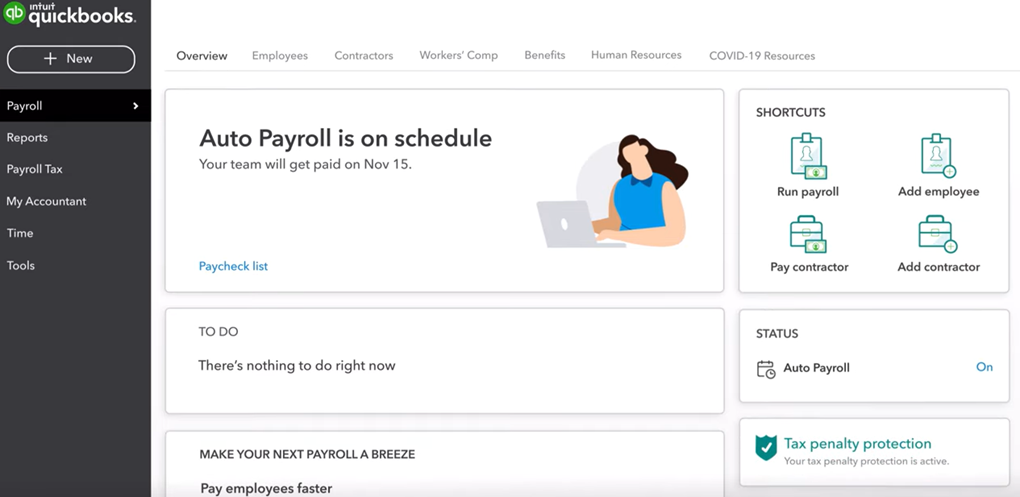

QuickBooks Payroll is one of the top providers for small business payroll, with an interface, pricing, and features very similar to those of competitors like Gusto and OnPay. It earned 4.08 out of 5 and stands out for its accounting functions—even within its payroll product—and easy integration with Intuit QuickBooks products. It automatically syncs payroll data to your chart of accounts and offers data analysis tools, provided you have a QuickBooks Online subscription. You can even customize how it enters this data into your accounts to meet your business needs.

While QuickBooks Payroll is an excellent choice if you want to save money by joining your payroll and accounting processes together, it lost points for its minimal HR and employee management features. For example, it relies on partnerships with Allstate Health Solutions and Mineral for benefits offerings and HR advisory services. It also doesn’t have Gusto’s hiring and performance management tools, OnPay’s detailed employee profiles, and Paycor’s feature-rich HR platform.

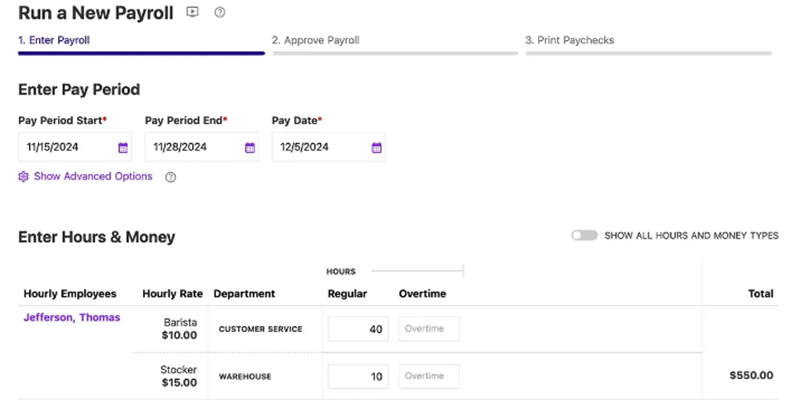

As a small-business accounting giant, Intuit’s QuickBooks is highly likely one of the first software products you purchase alongside a payroll solution. If you get both QuickBooks Online and QuickBooks Payroll, you can manage accounting and payroll data from the same app so you can see a single view of your business’s cash flow. Running payroll in QuickBooks is also relatively easy. It automatically populates earnings for your salaried employees, but you’ll have to manually enter regular and overtime hours for your non-exempt hourly staff. However, upgrading to its higher subscription tiers grants you access to its native time and scheduling capabilities.

In addition to attendance monitoring and staff scheduling, you get geolocation, geofencing, and mobile time clock tools. This is helpful if you employ mostly field workers without a central base of operations. Plus, as you progress subscription tiers, you access additional project tracking features. By comparison, Paycor and Gusto are the only alternatives on my list that offers equivalent time tracking and scheduling support—although Paycor’s are add-on modules while Gusto’s scheduling tools are limited.

QuickBooks Payroll limitations

QuickBooks Payroll is ideal to use if you’re a QuickBooks user or only need a standalone payroll option for your small business. It doesn’t support third-party integration options for strategic HR functions, such as recruitment and performance management. It also lacks an organizational chart and customized onboarding workflows.

Heads up!

Intuit will discontinue QuickBooks Desktop 2022 on May 31, 2025. As a result, all modules and services that integrate with this core platform, including QuickBooks Desktop Payroll, will also be discontinued. If you are a current user, learn more about moving to QuickBooks Online or subscribing to QuickBooks Desktop Plus or Enterprise. You can also read on for a quick look at the cloud-based QuickBooks Payroll.

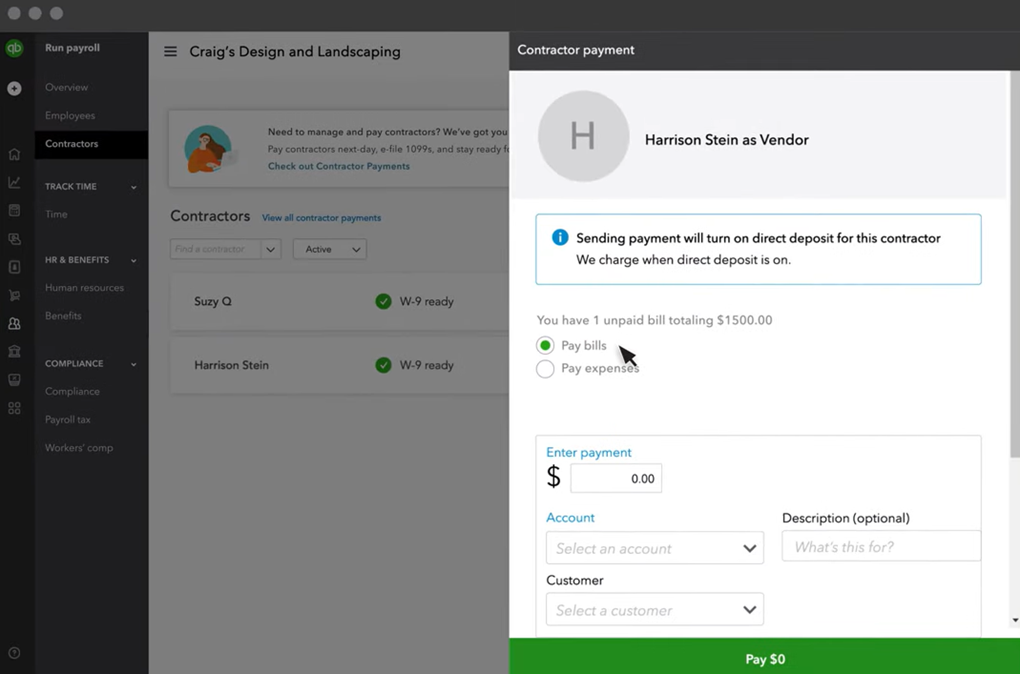

Contractor and vendor billing

If you bundle your QuickBooks Payroll subscription with QuickBooks Online, you can run payroll and vendor bill payments from the same system. QuickBooks’ is significantly more advanced than Gusto’s bill pay option. In addition to creating a list of vendors and paying them directly from the platform, it lets you set up multi-conditional approval workflows and log bills by categories to assist with expense management. This is great if you’re managing bills from multiple work locations and need certain employees to confirm bill accuracy, such as when bills exceed a certain dollar threshold.

If you don’t have employees, QuickBooks offers a contractor payments option with accounting features. Besides being more affordable than Gusto’s contractor-only plan, it doesn’t restrict you from following typical employee payroll schedules. Instead, you can pay contractors per any pay agreement you make or alongside your regular billing cadences. This provides you more control over your company costs, allowing you to schedule payments during periods of higher revenue.

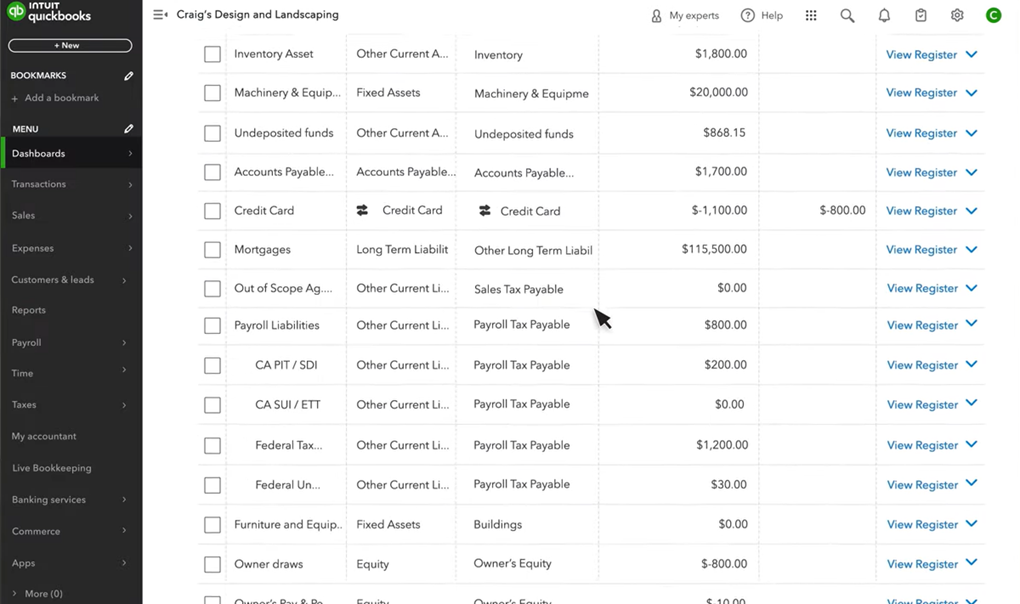

General ledger integration

Exporting payroll ledgers to your accounting program of choice can be tedious, especially if your payroll platform doesn’t integrate with your accounting program. However, when you use QuickBooks Payroll and QuickBooks Online together, the system automatically records applicable pay data in your chart of accounts once you finalize payroll. While it automatically assigns default accounts to map your payroll based on wages, expenses, and liabilities, you can modify these settings to your liking.

For example, you may use a particular account to monitor your contribution to payroll taxes outside of a general expense account. Besides helping you understand your tax liabilities, you can also use it to determine some of the costs associated with hiring a new employee for recruitment and headcount planning purposes.

QuickBooks offers several different pricing plans and bundles, depending on whether you want only payroll features or payroll and accounting. If you want more information on QuickBooks payroll and accounting suites, check out its payroll and bookkeeping bundles. But if you only need small business payroll, its lowest-priced tier starts at $50 per month plus $6 PEPM.

Unlike the other payroll processing software on my list, it offers an affordable contractor-only plan and an option to get 50% off monthly base fees for your first three months* with QuickBooks Payroll. However, it lost points given the barebones HR features of its lowest-priced Core plan. You also need to upgrade to at least its Premium plan if you want automated local tax filings, time tracking tools, and 24/7 product support.

QuickBooks Payroll plans

Core

Premium

Elite

$50/mo. + $6 PEPM

$85/mo. + $9 PEPM

$130/mo. + $11 PEPM

Includes:

- Unlimited full-service payroll.

- Next-day direct deposit.

- Auto-run payroll.

- Basic support via phone and chat.

- Employee self-service.

- Access to health benefits and 4019(k) plans.

- Workers’ compensation administration.

- Payroll reports.

Includes everything in Core, plus:

- Same-day direct deposits.

- Scheduling and time tracking with geofencing.

- 24/7 product support.

- Payroll setup review.

- HR support center (via Mineral) with access to forms, customized job descriptions, and HR guides.

Includes everything in Premium, plus:

- Expert payroll setup.

- Project tracking.

- Up to $25,000 tax penalty protection.

- Personal HR advisor (via Mineral).

QuickBooks contractor-only payments plan

- Monthly fee: $15 for 20 contractors plus $2 per additional worker.

- Includes unlimited US contractor payments, next-day direct deposits, contractor self-setup tools, and unlimited electronic filings of 1099-MISC and 1099-NECs.

*Note that these terms can change anytime, so please check their website for the latest new client promotions.

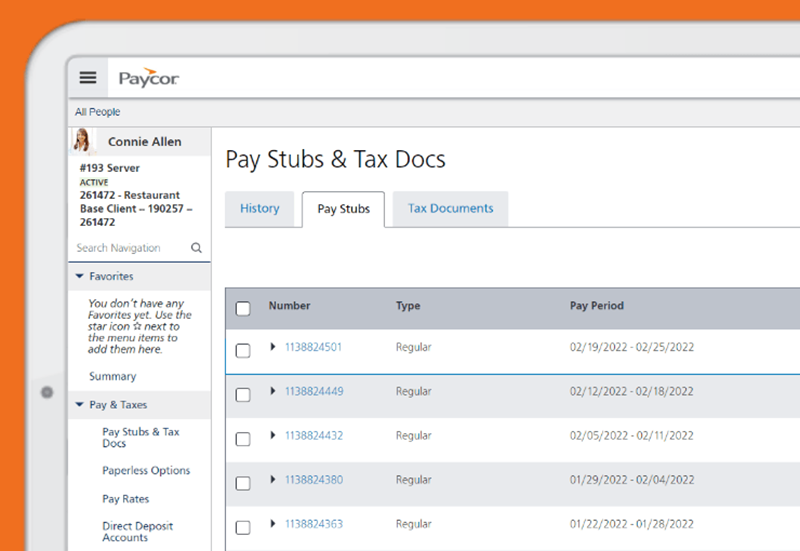

4. Paycor

Best for growing businesses

Overall Score

3.77/5

User reviews

4.29/5

Pricing

1.69/5

Customer support

4.25/5

Platform and interface

4.38/5

HRIS features

4.25/5

Reporting and analytics

4.56/5

Payroll features

4.18/5

Pros

- Multi-state payroll with automated local tax deductions and filings included in all plans.

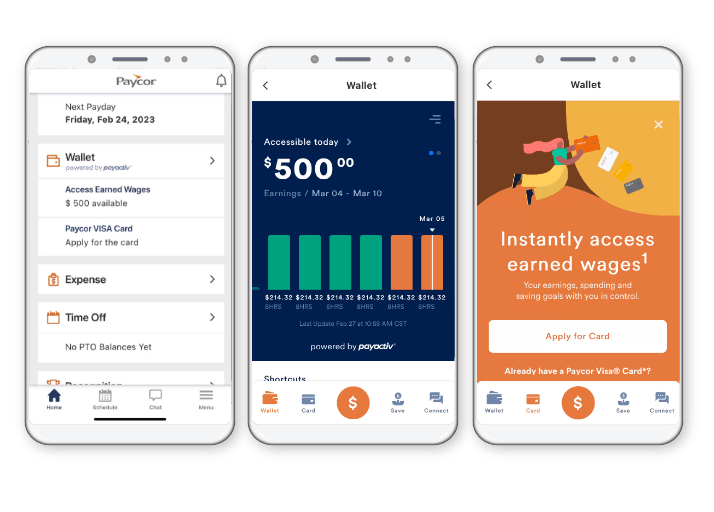

- Robust employee self-service features, including earned wage access, via its mobile app.

- Capability to view multiple pay cycles months in advance for effective status change management.

- Automatic prorated pay for mid-cycle hourly employee pay rate changes (with Paycor’s time tracking add-on).

Cons

- Non-transparent pricing.

- Must purchase Essential plan or higher for onboarding, analytics, and PTO management modules.

- Time tracking, scheduling, and benefits administration are paid add-on modules.

- Difficult to navigate UI.

Why I chose Paycor

Paycor’s advanced analytics, in-app tax compliance alerts, and customizable payroll processes suit growing businesses that need more advanced and versatile pay controls. I was impressed with its pay grid for completing payroll functions, which lets me adjust how I wanted to see and complete payroll. It also allows me to do payroll faster since I don’t have to go through a set series of steps compared to competitors like Rippling and Gusto.

With a total score of 3.77 out of 5, Paycor also stands out for its wide range of HR tools that can support a small business’s growing HR needs. For example, unlike Patriot Payroll and QuickBooks Payroll, Paycor has a full-scale recruiting module that leverages artificial intelligence (AI) HR tools to source top prospects and engage passive candidates. Other features like compensation planning, pulse surveys, and career management support your long-term talent needs and align them with your company’s objectives and costs.

However, its monthly fees aren’t published on its website—you have to call Paycor to request a quote. Plus, it does not include support for businesses with international teams. But if you need a customizable payroll system or more robust modules to complete your increasingly advanced HR needs, then Paycor is a great choice.

Paycor is an all-in-one human resources management system (HRMS) that offers modules for critical HR functions like payroll as well as auxiliary processes like learning and development. This versatility makes Paycor best suited for growing and established companies that need direct control over their payroll processes in a unified HR tech stack.

It lets you add or modify existing payroll schedules as needed, and the system will automatically make the necessary adjustments. It has a customizable pay grid organized by rows of employees, which lets you add and remove columns for information like bonuses and commissions to fit your needs. You can even pay terminated employees without temporarily changing their employment status in the system. This is great if there was an error in the employee’s previous payroll and you need to pay them an adjustment after they’ve separated from the company.

There are also buttons to automatically adjust an employee’s gross pay so the net pay is a specified amount, like in the case of bonus checks. Plus, Paycor has alerts for shortfalls, no pay, earnings, and hours based on your company’s needs.

Paycor limitations

Paycor’s pay grid setup may increase payroll efficiency for large teams, but it can be overwhelming for small businesses and startups that need dedicated support. Without a step-by-step guide, newbies are less likely to remember to add or adjust critical pay items. Gusto, for instance, has a separate step just for keying PTO hours—a crucial data point that’s easy to miss if you’re managing payroll on top of multiple other HR functions.

Paycor also doesn’t support payroll outside of the U.S., so it’s a better option for domestic businesses with seasoned HR or payroll specialists that need flexibility over their pay processes.

Multiple employee payment methods

Paycor lets you pay employees through direct deposits, paycards, or checks. It also offers on-demand pay, allowing employees to access up to 50% of their wages before payday through its mobile app. Free budgeting, financial counseling, and learning resources for employees also compete with the financial wellness resources offered by Gusto.

Another great feature is Paycor’s check-stuffing services to pay your unbanked employees. While most payroll platforms let you print live checks, it adds extra steps to the payroll process like ensuring you have the proper check stock paper and magnetic ink to manually print checks.

Custom reports and analytics

Before finalizing payroll, Paycor populates charts so you can view key information about payroll runs quickly. Doughnut charts allow you to see the breakdown of employer and employee tax liabilities, while a series of quick links lets you download popular reports, like your payroll journal. It even pre-populates employee pay stubs up to three days before paydays, enabling your workers to check their expected payouts and report pay errors.

Paycor also has a report builder to craft customized reports from scratch. You can work off pre-existing reports by adding, renaming, or creating new columns for analysis. Many of the payroll reports also come with visualizations, like total compensation by month and department, to understand changes in labor costs without switching to your accounting software.

Further, Paycor’s analytics module includes an AI digital assistant to ask questions and receive answers about your employee data in natural language. Meanwhile, benchmarking and predictive analytics let you compare pay practices with industry standards and adequately plan for the future.

If you have fewer than 50 employees, Paycor offers four small business plans: Basic, Essential, Core, and Complete. Paycor does not publish pricing on its website, but based on the quote I received, monthly fees start at $99 plus $6 PEPM. If you have 50 or more employees, you must contact Paycor’s sales team for a customized quote for its mid-market tier.

Paycor plans

Basic

Essential

Core

Complete

Starts at $99/mo. + $6 PEPM*

Call for a quote

Call for a quote

Call for a quote

Includes:

- Unlimited full-service payroll.

- Auto-run payroll.

- Client-managed garnishments.

- Check stuffing.

- On-demand pay.

- New hire filing.

- Basic reporting.

- Work Opportunity Tax Credit (WOTC).

Includes everything in Basic, plus:

- Onboarding and time off management.

- Paycor-supported basic wage garnishments.

- Job costing.

- Labor law posters.

- 401(k) integrations and EDI processing.

- General ledger report and electronic GL.

- E-Verify service.

- Paycor’s recruiting and hire module.

- Report builder.

- Basic analytics.

Includes everything in Essential, plus:

- Expense management tools.

- Paycor’s HR, engage, and COR leadership modules.

Includes everything in Core, plus:

- Compensation planning.

- Career management.

- Talent development.

*Pricing is based on a quote I received.

5. Patriot Payroll

Best budget-friendly payroll software

Overall Score

3.67/5

User reviews

4.46/5

Pricing

4.56/5

Customer support

4/5

Platform and interface

2.88/5

HRIS features

1.88/5

Reporting and analytics

4.13/5

Payroll features

4.05/5

Pros

- Simple yet intuitive payroll platform.

- Free payroll setup assistance.

- Time tracking, basic HRIS, and accounting tools are available as paid add-ons.

- Has an affordable full-service payroll plan and do-it-yourself (DIY) tax filing option.

Cons

- Only integrates with QuickBooks Desktop or QuickBooks Online.

- Doesn’t file new hire reports (but can generate them).

- Multi-state payroll costs extra.

Why I chose Patriot Payroll

Patriot’s payroll module made my list of the best payroll software for small businesses mainly because of its affordability. For a monthly fee of $37 plus $5 PEPM, you get unlimited pay runs with tax payment and filing services. This is the lowest full-service payroll plan that I reviewed and comes with all of the essential tools you need to pay employees and contractors. If you have a limited budget and prefer to handle tax filings yourself, its basic plan only costs $17 per month plus $4 PEPM. It has all the features included in the full-service option but without tax filing services.

It can handle multiple pay rates—max of five—and you can add a description to each rate. This makes it easy to track and differentiate pay rates for hourly employees who may be assigned to different roles with various pay rates. I also like that it lets you change employee hourly rates while running payroll without canceling or closing the pay run page. Other online payroll services will require you to update the employee’s pay rate in the system’s HRIS module before you can process payroll.

Patriot Payroll earned an overall score of 3.67 out of 5, losing points for its limited HRIS features and third-party software integrations. It also only generates new hire reports, but you have to file these yourself. While it has over a dozen payroll report types, you need to get its HR add-on if you want employee-related reports like staff demographics and retirement plan contribution reports.

Similar to QuickBooks, Patriot offers software for payroll and accounting. Its platform has a simple but intuitive interface that helps streamline processes, making it easy for small businesses to learn and use its various features. With its payroll module, you get unlimited pay runs with automatic federal, state, and local tax deductions and filings—provided you sign up for its full-service plan. It offers several essential payroll features, such as multiple pay schedules and customizable money and deduction types, enabling you to create your own employee deductions and company-paid contributions and payments, such as special bonuses.

If you have a multi-location business, you can assign employees to a primary work location in the system, which also includes a work-from-home option. Patriot Payroll will then calculate the applicable payroll taxes based on the employee’s work location. Plus, you don’t need to manually search for workers assigned to specific business sites when running payroll. Patriot Patriot has a filter option that lets you choose the work location, allowing you to process and review payroll only for specific teams.

Patriot Payroll limitations

Patriot Payroll may support unlimited pay runs for US-based workers, but it lacks Gusto’s global payment tools. Its contractor-only package also does not compete well with QuickBooks Payroll, which only costs $15 monthly for up to 20 workers; whereas Patriot charges $17 per month plus $4 PEPM if you’re on its basic plan. Plus, Patriot collects add-on fees for time tracking and multi-state payroll tax filings. And even if you get the HRIS add on, the features are very limited. This is unlike Gusto and OnPay, which include basic hiring tools and automated onboarding flows in their starter tiers.

While you can get two-day direct deposits with Patriot Payroll, it only offers this to qualified customers. If you don’t meet Patriot’s requirements, you will only be entitled to a four-day option. This is unlike the other providers in this guide that don’t have qualifying assessments for two-day direct deposits. However, if you require fast payouts to expedite payroll processing times and don’t need a wide range of HR tools, consider QuickBooks Payroll as it offers a next-day option in its basic plan.

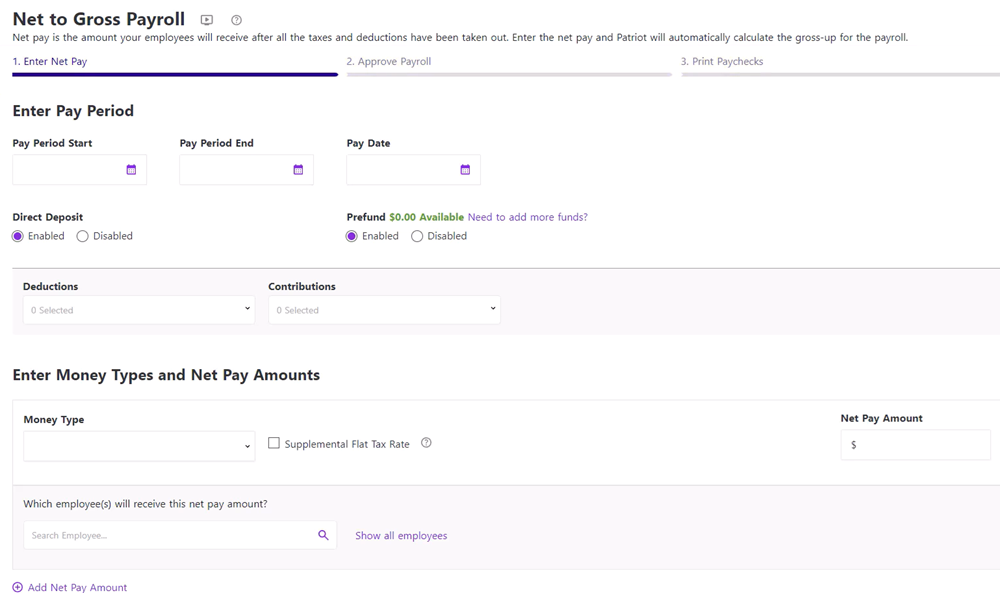

Net to gross payroll tool

While it may be easy to notify employees that they are eligible for a specific bonus, you have to constantly remind them that the amount they see may be subject to tax. Typically, workers find it difficult to determine the applicable payroll tax deductions—intead, they prefer knowing the take-home bonus amount they stand to get. With Patriot’s net to gross payroll tool, you don’t need to do manual calculations to figure this out. You simply input the bonus amount you want employees to receive and the system will automatically gross it up for taxes. This helps you save time and ensures payroll compliance.

Flexible payroll services

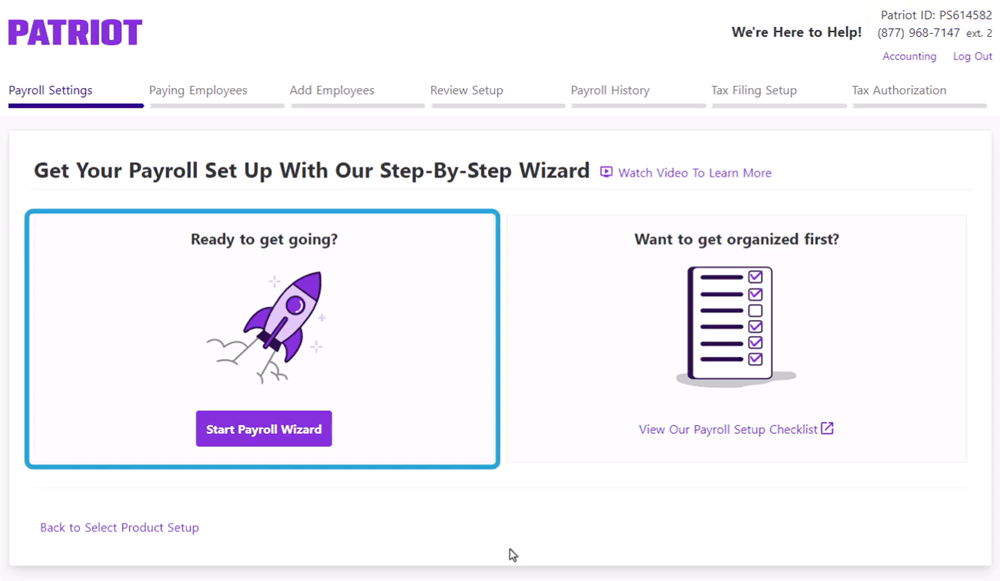

What I like about Patriot is that it provides full-service and DIY payroll options. If you have a very small team—let’s say, up to 10 employees—and are comfortable handling tax payments and filings, you can start with Patriot Payroll’s Basic plan. Once you exceed 10 workers, you can switch to its Full-service package, where Patriot will handle tax remittances and filings for you.

Patriot also offers flexible payroll setup options for new clients. If you’re familiar with using pay processing tools, you can follow its online wizard to create your Patriot Payroll account and complete setup requirements. If you need help, it also offers free payroll setup assistance. You only need to provide the necessary company and employee information and Patriot will handle the setup process for you. Plus, it provides extended weekday support. If you have questions about its features, you can contact the software support team via phone, email, or chat from Monday to Friday, 9 AM to 7 PM Eastern Time (ET).

You can get Patriot Payroll as a standalone solution or enhance its platform by selecting paid add-ons for time tracking and an HR software, a module that contains basic HR reporting and HRIS functionalities. There are two plans: Basic Payroll and Full Service Payroll. Both have similar features, except for the payroll tax filing services and tax filing guarantee included in the Full Service plan.

Patriot Payroll plans

Basic

Full Service

$17/mo. + $4 PEPM

$37/mo. + $5 PEPM

Includes:

- Unlimited payroll.

- Automatic tax calculations.

- Employee and contractor payments.

- Multiple locations, pay rates, and pay schedules.

- Time off accruals.

- Free two-day direct deposits for qualified clients.

- Net to gross payroll tool.

- Integration with QuickBooks Accounting.

- Payroll reports.

- Online self-service portal for employees and contractors.

- Free payroll setup, workers’ comp and 401(k) integration, and US-based software support.

- HR center with compliance alerts, legal updates, HR documents and templates, and an employee handbook builder.

Includes everything in Basic, plus:

- Federal and local payroll tax payments and filings.

- State payroll tax payments and filings for one state. Additional states cost extra.*

- Year-end payroll tax filings.

- Tax filing reliability guarantee.

Add-ons

- Time and attendance: $6 monthly plus $2 PEPM.

- Includes employee time cards, custom overtime rules, multiple job roles tracking, manager permissions, time tracking reports, and online clock ins/outs via the employee online portal or the My Patriot employee mobile app.

- HR software: $6 monthly plus $2 PEPM.

- Includes document management, HR reports, HR manager permissions, and basic employee information management tools.

- Multi-state tax payments and filings*: $12 monthly for each additional state

- Accounting Basic plan: $20 per month.

- Includes automatic bank imports, income and expense tracking, account reconciliation, credit card payments, financial reports, and unlimited customers, invoices, contractors, vendors, and payments.

- Accounting Premium plan: $30 per month.

- Everything in Basic, plus recurring invoices, receipt management, send invoice payment reminders, user-based permissions, and the capability to create and send estimates.

- Bookkeeping service: Starts at $100 per month plus a one-time onboarding fee (call for a quote); only available as an add-on to the Accounting Premium plan.

*This only applies to Full Service plan holders.

Honorable mention

One platform that didn’t make my top five is Rippling. It may have features that might be a better fit for your needs. To learn more, check the below section.

Rippling: Best for payroll automation

Overall score: 3.66/5

When to choose Rippling

Rippling is the best payroll software if you’re looking for strong automation tools. I was impressed with its customizable workflow automations that help you save time and simplify processes. It even works across Rippling’s HR modules, like benefits administration and time and attendance. For example, Rippling automatically updates payroll settings whenever an employee’s information changes, so you don’t have to remember to manually update things like pay rates and banking information when it’s time to run payroll.

This all-in-one HR software can also support the entire employee lifecycle. It has various HR modules, including EOR services and a professional employer organization (PEO) option that allow you to share or completely outsource payroll functions like handling multiple pay schedules and pay types, correctly classifying employees, and maintaining business entities in multiple countries.

Did You Know? There are pros and cons to outsourcing payroll. To learn more, read our in-house vs outsourced payroll guide.

Why it didn’t make the list

Rippling may have a feature-rich HR software but it can get pricey, depending on the number of modules you get. And before you can purchase its modules, you are required to get the core Rippling Platform, which contain its workflows, integrations, compliance, system permissions, reporting, and automation tools.

Rippling is also a rather advanced software for small businesses. Rippling Platform itself has over 500 integrations and automation tools that you likely won’t need but are required to purchase to access its payroll module. These are better suited for mid-sized companies.

Find your new payroll software

Payroll software FAQs

Payroll software simplifies pay processing tasks, such as calculating paychecks, adding employees to the company payroll, maintaining payroll records, and ensuring compliance. The way it works may vary depending on how software providers design their systems, but the standard process includes inputting employee information, pay rates, and attendance or hours worked. The system takes this data to compute, deduct withholdings, support direct deposits, and enable the entire payroll process.

You can also link modern payroll software to bank accounts for automatic salary disbursement. Payroll solutions also generate pay slips to show pay information and create relevant payroll and tax reports.

Payroll software can be a great asset to any business, big or small. It streamlines payroll processes, decreases payroll and accounting staff labor, drives efficiency, and saves your HR team from doing repetitive administrative work. More importantly, it ensures accurate and timely wage payments, which is critical for employee satisfaction. Correct compensation is fundamental to the employee-employer relationship.

Payroll systems also help you avoid or minimize compliance issues. Most payroll software providers offers compliance alerts, automatic updates, and payroll trends to ensure that you’re up-to-date with labor laws, tax rules, and regulatory changes.

Aside from ensuring that it has the pay processing features that your business needs, you should consider the following factors:

- Customer support: If you can’t ask questions, you can’t get answers. You’re going to trust this company with your payroll, the money you’ve set aside for your employees. If you don’t feel welcome, walk away. You can also check user reviews from reliable review sites, such as G2 and Capterra, for feedback about the provider’s customer service quality.

- Transparent pricing: Having immediate access to software fees makes it easy for you to determine whether or not it fits your budget. Ensure that you understand the provider’s pricing scheme as most small business payroll companies charge a base fee every month or every time you run payroll, combined with a fixed rate per employee. There may also be other fees for offcycle pay runs, tax filing services, and access to other features, such as time tracking. For an exact amount, speak with the provider’s sales rep to get an estimate.

- Free trial: A free trial is a nice must-have for small business payroll software to test it out, but don’t be surprised if they are hard to find. If you do get a free trial, sign up for it so you check the features and test if the software is right for you. If you don’t see this, I suggest reaching out to the provider’s sales team to inquire about it or ask if you can participate in an interactive demo.

- Flexibility: One size does not fit all, especially if you’re a small business. Make sure you feel like your payroll provider understands your needs and is willing to meet them. Try to find a provider that doesn’t require an annual contract, in case your situation changes or something goes wrong.

While this can vary depending on your business requirements, I recommend looking for a payroll system that offers unlimited pay runs, automatic tax calculations, and tax payment/filing services. These features help save you time and money, while ensuring compliance with payroll tax regulations. It should also support multiple pay types and pay schedules, including direct deposit payouts so you can conveniently and securely send payments directly into your employees’ bank accounts. Finally, for easy employee data updates, it should have HRIS functionalities with onboarding and offboarding tools and an employee self-service portal where your team can access their pay stubs, tax forms, and other documents.

For a small business payroll software, monthly fees typically range from $40 to more than $60 for one employee. Note that this usually includes per-employee and base software fees. This can cost more, depending on the provider, your headcount, pay runs each month, and the features and services included, such multi-state payrol and tax reporting.

Some of the most commonly used payroll systems are included in this guide, such as Gusto, which topped my list of the best small business software for payroll. QuickBooks Payroll is also a popular option, especially for small businesses that already use its accounting system.