Key takeaways

What is a payroll schedule?

A payroll schedule is the timetable your business follows to pay its employees. It determines how often they’re paid and specifies the dates when payments are disbursed. The most common payroll schedules are:

- Weekly.

- Biweekly.

- Semi-monthly.

- Monthly.

- On-demand.

Choosing the right payroll schedule is crucial for maintaining cash flow, reducing administrative burden, and ensuring legal compliance. Irregular pay schedules can lead to fines and erode employee trust, causing dissatisfaction and turnover. Timely, predictable paychecks build trust while helping you avoid costly noncompliance issues.

According to the U.S. Bureau of Labor Statistics, biweekly pay periods are the most common among private employers, followed by weekly, semi-monthly, and monthly schedules:

Data: U.S. Bureau of Labor Statistics, Current Employment Statistics survey, February 2023. Graphic: TechnologyAdvice.

No one schedule is best for all businesses. In some cases, companies operate with two payroll schedules to accommodate differing employee classifications.

For example, having both a weekly and semi-monthly payroll makes sense for companies with hourly and salaried employees, as the former helps with overtime calculations and the latter with tax deductions. International companies can also benefit from multiple payroll schedules due to differing legal and cultural expectations.

The best payroll schedule for your business balances your finances, administrative workloads, workforce demographics, and industry payroll expectations to make your payday a smooth and painless process.

Ensure your payroll process is accurate and compliant. Discover how in this article: What Are the Best Methods for Paying Employees?

Weekly

Employers pay employees every week in weekly payroll schedules, with 52 paydays per year. Pay periods are seven days long, often between Sunday to Saturday or Monday to Sunday. Paydays are on a particular day of the week following the end of the pay period. Occasionally, employers may need to pay employees a day earlier or later if a national or bank holiday falls on their typical payday.

Pros

- Paydays are consistent.

- There is little wait time for employees to access their wages.

- It’s easier to prevent wage and hour violations with simplified overtime calculations.

- Weekly schedules align more closely with government regulations, which is helpful during government or company payroll audits.

Cons

- There is more payroll administrative work for HR and accounting departments.

- Payroll costs are higher compared to biweekly, semi-monthly, or monthly payroll schedules.

- Ensuring funds are available every week requires meticulous financial planning, potentially limiting your financial flexibility.

When to choose a weekly payroll schedule

If you have a primarily hourly workforce: A weekly schedule makes it easier to track and pay workers who are subject to overtime, typically those paid at an hourly rate.

Biweekly

A biweekly payroll schedule means businesses pay employees every two weeks for a total of 26 paydays per year. Pay periods are 14 days long, and, similar to weekly payroll schedules, paydays occur after the end of the pay period on the same day every week unless it occurs on a bank or national holiday. Biweekly payroll schedules are also the most common payroll frequency in the U.S.

Pros

- Paydays are consistent.

- There is a lower administrative burden on employers.

- Helps manage cash flow more effectively while still providing regular paychecks.

Cons

- Businesses need to budget accordingly for the two months per year with three payroll runs.

- It can be difficult for accounting departments to compare and reconcile expenses for those two months.

When to choose a biweekly payroll schedule

If you have full-time and part-time employees: A biweekly schedule is ideal for businesses with diverse employee types as it accommodates overtime calculations for non-exempt employees, maintains consistency for exempt employees, and makes it easy to manage payroll for both full- and part-time employees.

Semi-monthly

Semi-monthly payroll schedules mean employers pay employees twice every month, typically on the 15th and the first or last day of the month. Pay periods run between the first and 15th of the month and then the 16th and final day of the month.

Unlike biweekly payroll schedules, there are only 24 paydays per year. Paydays are also based on the day of the month, not a particular day of the week. As a result, the number of days in each pay period varies slightly.

Pros

- Salaried employee payments are easy to track and manage.

- It’s easy to calculate tax and benefit withholdings.

- There is less administrative work for accounting departments.

Cons

- The overtime calculations for hourly employees are complicated.

- Paydays are less frequent.

- Paydays might change if the first, 15th, or last day of the month falls on a weekend or holiday.

When to choose a semi-monthly payroll schedule

If most of your employees are exempt: It can be challenging to calculate overtime with a semi-monthly schedule, making it an ideal option if most of your workforce is exempt from overtime pay.

Monthly

With a monthly payroll schedule, employers pay workers once every month. Each pay period encompasses the entire month.

Employees can expect 12 paydays per year with a monthly payroll schedule, and employers typically schedule paydays toward the end or the beginning of the month. Monthly payroll schedules are the rarest pay frequencies in the U.S.

Pros

- Monthly tax and benefit deduction reporting is easier than with other payroll schedules.

- The cost to run only 12 payrolls per year is relatively low.

- Businesses can schedule their monthly paydays around when they expect their cash infusions.

Cons

- Certain state laws prohibit or regulate monthly payrolls.

- Irregular pay periods can make it difficult to calculate overtime hours.

- It is typically unpopular among employees.

- New hires may have to wait a month to receive their first paycheck.

When to choose a monthly payroll schedule

If you have a limited payroll staff: A monthly payroll schedule reduces your administrative burden and costs while simplifying your financial planning.

On-demand

On-demand pay, also known as earned wage access (EWA), allows employees to access a portion of their earned wages before the standard payday. Instead of waiting for a set pay period, employees can request and receive their earnings as they accrue throughout the pay cycle.

This innovative payroll option is gaining popularity as businesses seek to offer more flexible payment solutions to meet the evolving needs of their workforce.

Although businesses can manually administer on-demand payroll schedules, many payroll software vendors offer EWA management services as part of their features. Wisely by ADP, for example, gives employees access to their wages after they’ve earned it through their mobile app at no additional cost to employers.

Pros

- Employees can access wages as soon as they’ve earned them.

- Helps employees when they have financial emergencies and need a safety net until their next payday.

- It’s an attractive employee perk in industries with high turnover.

Cons

- There is a greater chance of paycheck errors, such as tax deductions, missing sick pay, or incorrect hours.

- Additional fees may be associated with more frequent payroll runs or on-demand payroll management services.

- There are legal risks to employers who pass on-demand service costs to employees.

- Some employees may become overreliant on EWA.

- Employees may also be subject to additional fees for accessing their wages early.

When to choose an on-demand payroll schedule

If you prioritize employee satisfaction and retention: On-demand payroll schedules give employees financial flexibility for emergencies and unanticipated expenses.

Best practices for managing payroll schedules

If your business employs various types of employees, such as non-exempt employees, contractors, and seasonal workers, paying everyone on the same schedule may not be possible. However, managing more than one pay frequency can introduce a layer of complexity.

Whether you’re dealing with different pay schedules or transitioning to a new one, I know a few best practices that can help you streamline the process.

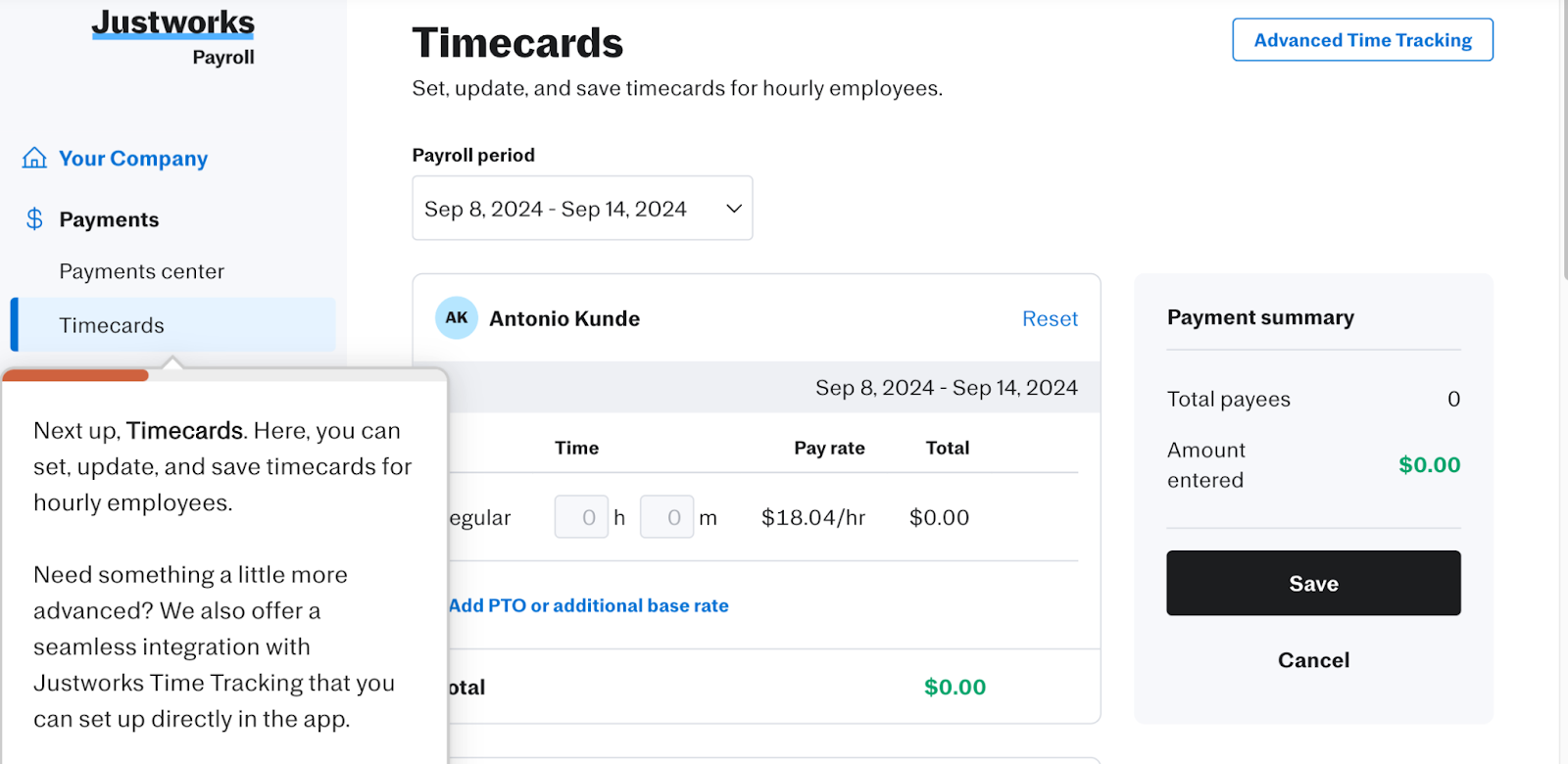

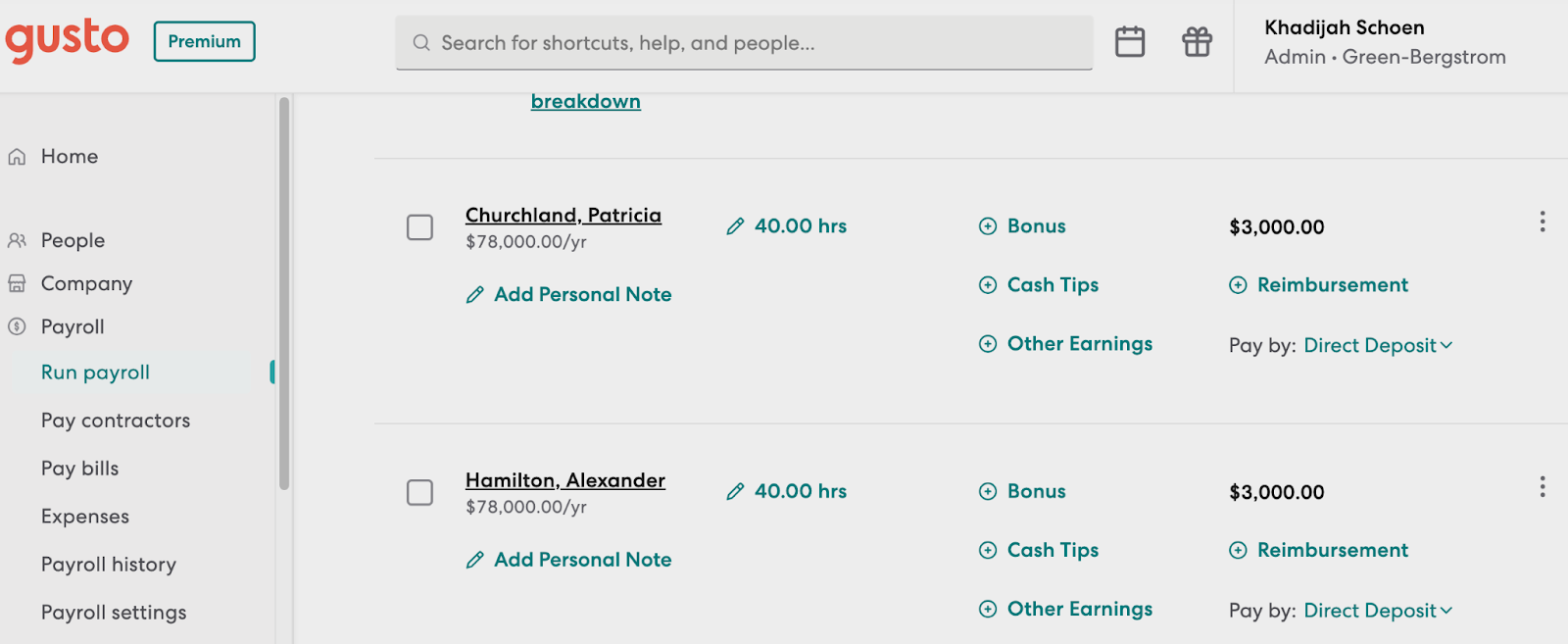

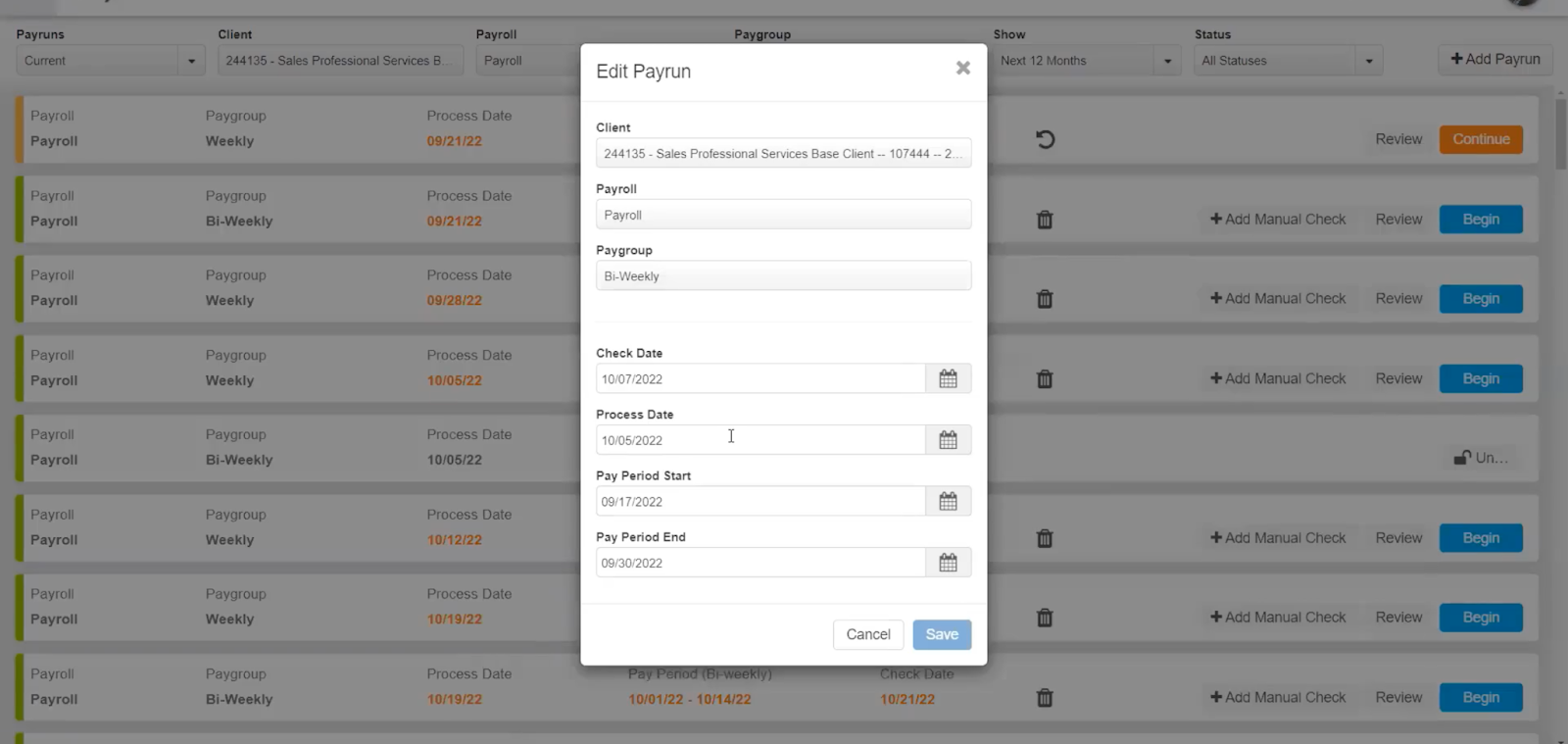

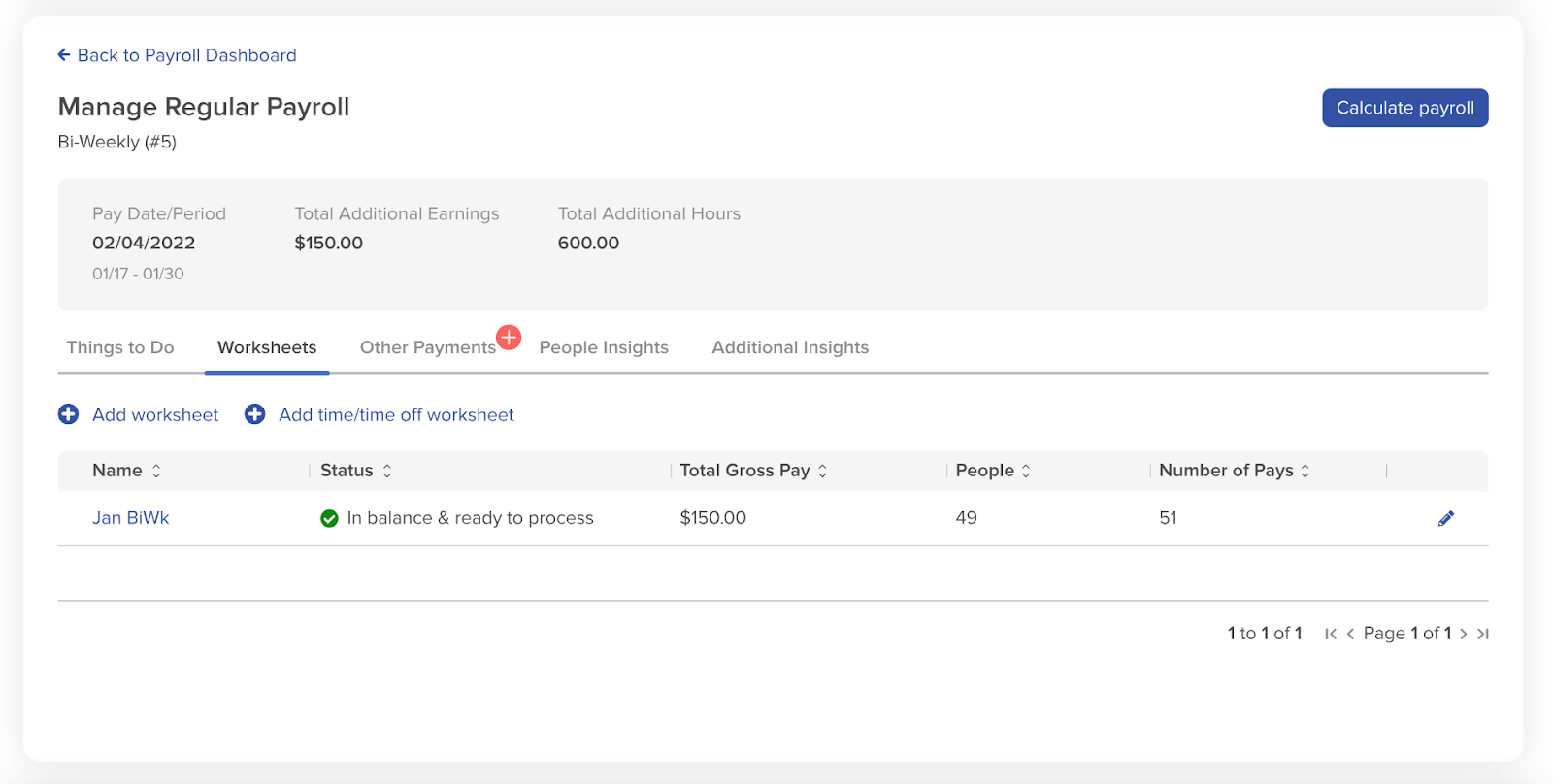

Utilize payroll software

Payroll software simplifies managing multiple payroll schedules by automating calculations, tracking pay periods, and ensuring timely, accurate payments. However, some software is better suited to specific schedules, so it’s essential to choose one that fits your business needs.

Check out some of my recommendations:

Standardize your processes

Standardizing your payroll process ensures uniformity and reduces complexity. Even if employees are paid on different frequencies, the underlying procedures should remain consistent.

Start by creating a manual that outlines your preferred steps, from gathering time cards to calculating taxes and processing payments. Pair this with a calendar that includes deadlines for payroll submissions, approvals, and tax due dates.

Standardized processes allow for the management of multiple pay schedules without confusion while reducing errors and discrepancies. This approach also makes training easier by empowering new employees to learn and follow the same protocols quickly.

Expert Tip

Stay organized, meet deadlines, and simplify your payroll process with our downloadable payroll schedule calendars.

Understand legal requirements

Compliance with labor laws and tax regulations is non-negotiable when it comes to payroll. Different pay frequencies can have varying compliance requirements that must be followed.

For example, California’s payroll laws vary by occupation. Executive, administrative, and professional employees must be paid at least once a month by the 26th, while farm labor workers must be paid weekly.

It’s critical to familiarize yourself with federal, state, and local labor laws related to payroll schedules. To ensure ongoing compliance, conduct regular audits of your payroll processes. It’s a proactive way to identify any potential issues early and helps your business comply with all relevant laws.

Stay compliant with each state’s pay schedule with this guide on State Payday Requirements.

Regularly review and adjust schedules

The business landscape is dynamic, and so is payroll. Regularly reviewing your payroll schedules, processes, and compliance requirements allows you to adapt to changing circumstances and improve efficiency.

Periodically evaluate if your current pay schedule still aligns with your business operations. Gather feedback from employees and payroll staff about any pain points they may have or where you can improve the process.

Labor laws and regulations change frequently, requiring you to stay vigilant at all times. For example, the Department of Labor’s rule on independent contractor classification may necessitate reclassifying your contractors as employees, making them eligible for minimum wage, benefits, and overtime. They’ll also have to be transitioned to the same pay schedule as other employees in their classification.

Outsource payroll

Outsourcing can be a highly effective solution if you don’t have a dedicated payroll department or are handling payroll yourself. Payroll providers specialize in managing all aspects of payroll, from calculating wages and taxes to ensuring compliance, which reduces costly errors that can lead to penalties and fines.

Payroll providers also excel at managing multiple payroll schedules and staying up-to-date with changing regulations. Additionally, a Professional Employer Organization (PEO) can assist by handling complex payroll tasks and providing comprehensive HR services.

Whether through a payroll provider or PEO, outsourcing payroll ensures efficiency and compliance. I recommend Justworks or ADP TotalSource for small business owners and startups.

Both options provide the expertise required to accurately calculate wages, taxes, and deductions. They also provide an employee portal, health benefits, and other core HR functions.

Ready to unload the tedious parts of your payroll? Check out our PEO Services Guide for 2024.

Not sure whether outsourcing is the right call? Keep reading: In-House Payroll vs Outsourcing: Which is Best?

Payroll schedule calendars

Download our sample weekly, biweekly, semi-monthly, and monthly payroll schedules below to easily keep track of the pay periods and paydays for your business.