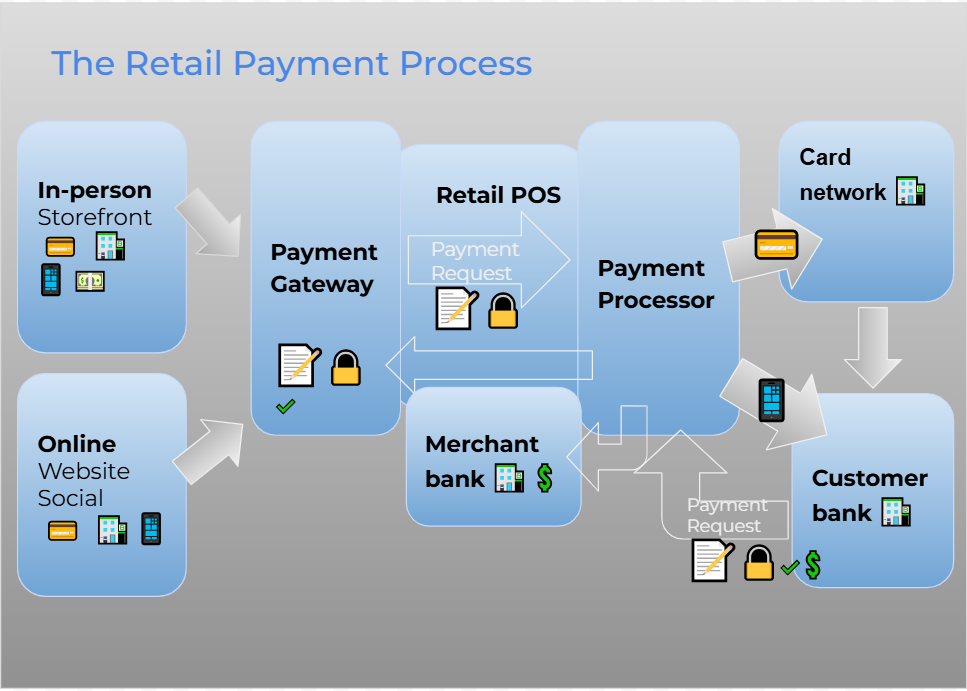

A credit card payment app is mobile software that provides businesses with the tools to accept credit card payments on a tablet or smartphone. These are often free to download and with the added mobility in accepting payments, businesses are given more opportunities for sale.

In my years of evaluating payment software, I have found that the best credit card payment apps are ones that are easy to use, compatible with multiple payment processors, and offer a variety of payment methods. It should also provide the most value for money based on your business needs. But with many providers in the market today, choosing the right app can become challenging.

To help get you started, here are my recommendations for the best credit card payment apps of 2025:

In evaluating the best credit card payment app, I focused on finding providers with the most flexibility and the right resources to scale with growing and established businesses. I also looked at the cost-effectiveness of payment apps and narrowed down our list to the following:

- Square

- Stripe

- Helcim

- Clover

- SumUp

- Shopify

- Nomod

- Stax

- CDGcommerce

- Payanywhere

- Adyen

- SwipeSimple

- iProcess

- Paysley

- Paysimple

- PayPal

- Venmo

I then hand-picked seven providers based on the following criteria:

Pricing 20%

The fee structure should allow users to maximize their savings through volume discounts. The card reader should be affordable, and the payment app should be free.

Mobile App Features 30%

The credit card payment app should provide the widest range of payment methods and features that expand the user’s ability to process payments, such as inventory and customer relationship management. The app should also have customization tools to scale with growing businesses.

Support & Reliability 20%

The app should be reliable and secure, with features to avoid business downtime. It should provide high-level customer support, with live assistance available 24/7. A detailed knowledge base and well-documented developer tools should be accessible.

User Experience 15%

This category takes into account the credit card payment app provider’s overall ease of use and scalability. It also evaluates the user’s application and onboarding experience as well as the flexibility of contract terms.

User scores 15%

This computes the average review scores provided by real-life users on the App Store and the Google Play Store.

Please note that while I work to create a detailed evaluation of each provider, my scores are based on the currently available features and information. This list and scores will be regularly updated based on the latest technology and user demands to ensure that I provide you with the best information.

Feb 10, 2025: Anna Lynn Dizon added two new providers and re-evaluated all the credit card payment apps for consideration. She updated the comparison table and rewrote the “best for” designations as well as the product sections based on her latest findings.

My recommendations for credit card payment apps are based on more than seven years of evaluating payments software and hardware across different industries and business types. To score each one, I reviewed software and hardware specifications, tested the payment app when possible, and gathered feedback from real-life users. I also considered available integrations to gauge the scalability of each provider.

Best credit card payment apps compared

Company

Our Score (out of 5)

Monthly Account Fee

Card Reader Options

Payment Processor

Square

4.33

$0-$165 (w/ POS)

Square magstripe and contactless $0-$59

Exclusive to Square

Stripe

4.3

$0

Stripe Reader M2 3-in-1 $59

Native & third-party providers

PayPal

4.24

$0

PayPal Zettle 2-in-1 card reader $29-$79

Exclusive to PayPal

Helcim

4.24

$0

Helcim 2-in-1 card reader $99

Exclusive to Helcim

Venmo

4.23

$0

Not required

Exclusive to Venmo

Shopify

4.23

$5+

Shopify 2-in1 card reader $49

Exclusive to Shopify

Stax

4.2

$99-$199

SwipeSimple 3-in-1 card reader

Exclusive to Stax

All of my recommended providers above support both iOS and Android devices. But if you’re looking for more specific options, check out our sections for:

Square: Best overall credit card payment app

Overall Score

4.33/5

Pricing

4.06/5

Mobile app features

4.25/5

Support & reliability

4.38/5

User experience

4.38/5

Average user review scores

4.75/5

Pros

- All-in-one POS and payment system

- Highly rated mobile pos app

- Waived chargeback fees

- Large-business solutions

Cons

- Limited customer support hours

- Reports of frozen funds

- Account stability issues

Why I chose Square

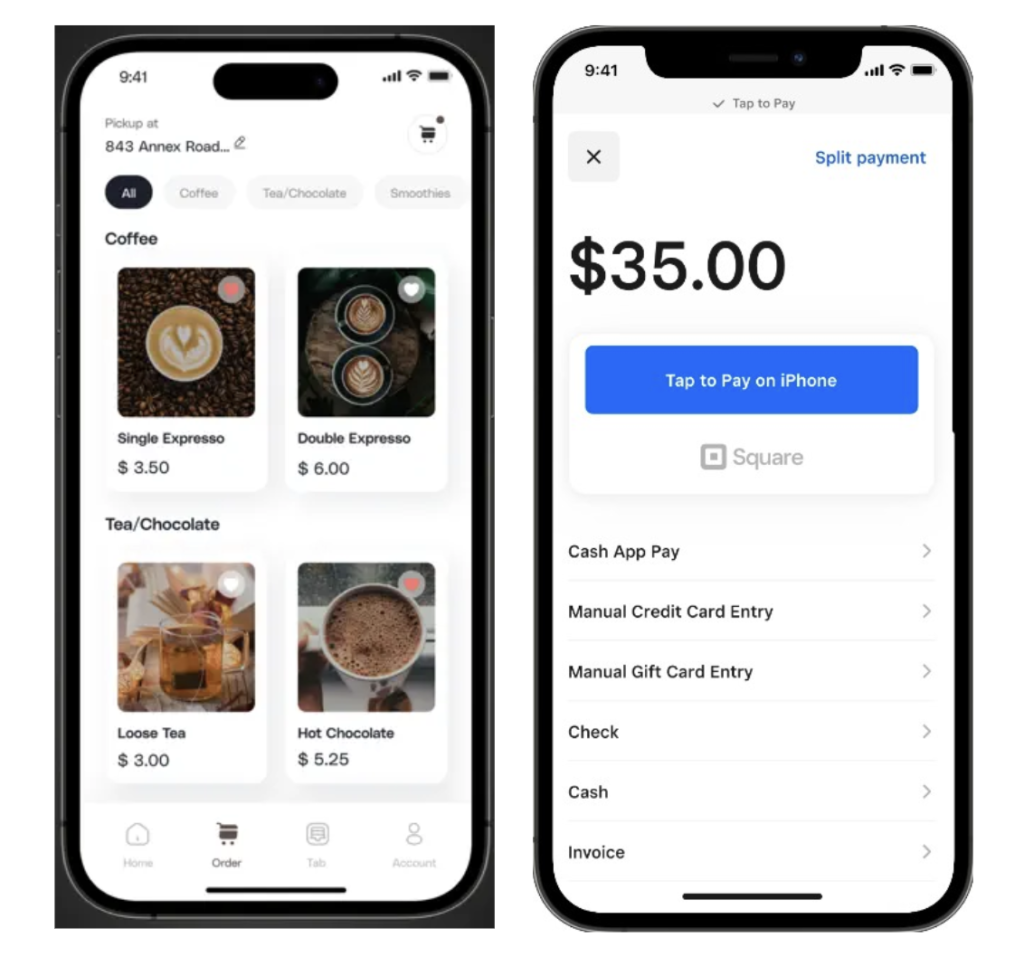

Square is an all-in-one POS system with a built-in payment processing service. It also provides a free mobile POS app that’s integrated with Square’s ecommerce and in-store POS platforms. Square does not require merchants to apply for a merchant account. Its pricing structure is ideal for new and small businesses, but it also offers solutions for larger companies.

Of all the providers on this list, Square, to me, is the most small business-friendly. Its feature-rich forever-free plan includes both basic and industry-specific mobile POS apps and is designed so that any budget-restrained business can start selling and accepting payments with very little (even zero) upfront cost.

I like how it’s easy to sign up for a Square account, and the guided setup took only minutes to complete. However, note that the app is exclusively for Square’s platform, so you won’t be able to use the software with other POS and payment processors.

Related: Square 2025 Overview

Stripe: Best for customizations & integrations

Overall Score

4.3/5

Pricing

3.13/5

Mobile app features

4.5/5

Support & reliability

4.69/5

User experience

4.69/5

Average user review scores

4.55/5

Pros

- Integrates with other payment platforms

- Advanced customization features

- Custom pricing for large businesses

- Industry-leading API and developer documentation

Cons

- Add-on fees for invoicing and recurring billing

- Limited in-person payments for native mobile app

- Requires third-party or custom developer for card-reader payments

Why I chose Stripe

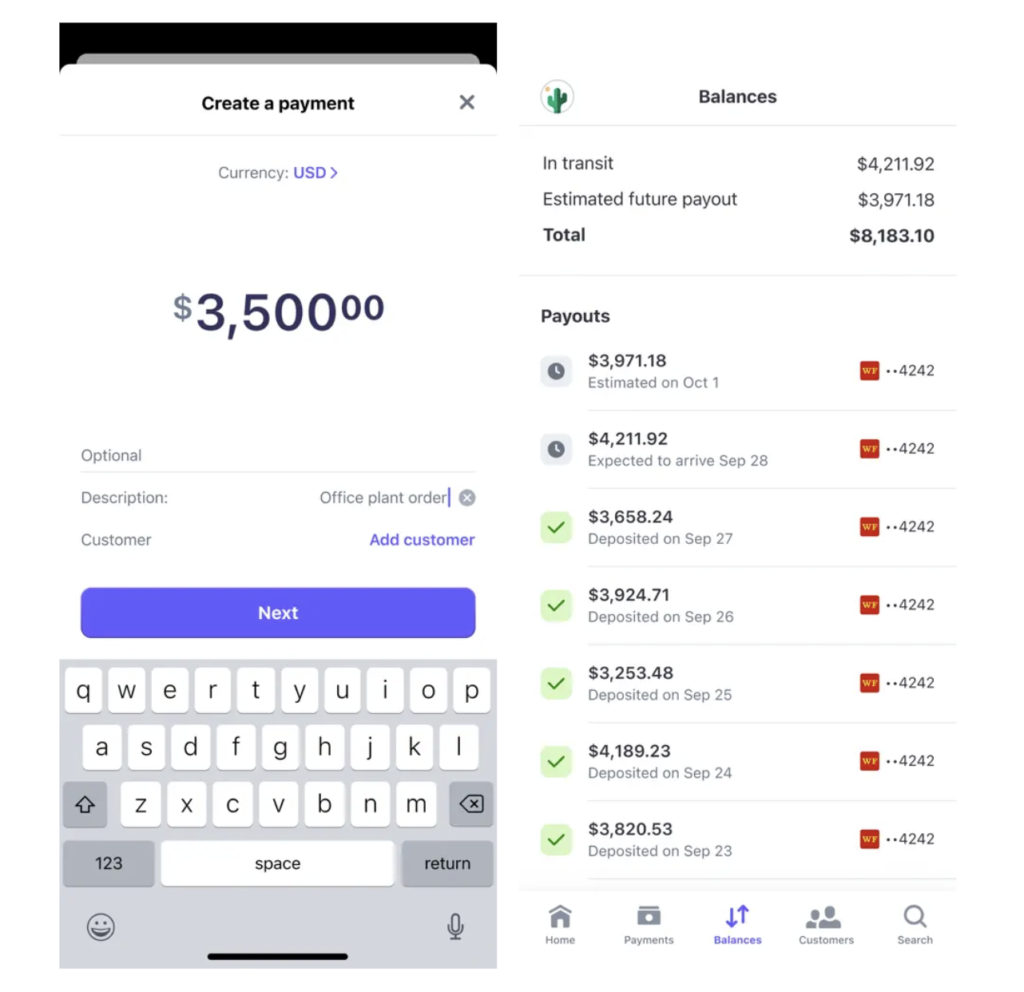

Stripe is a payment services platform that also comes with a merchant account. It is developer-friendly payment software known for its advanced customization features. Stripe’s payment processing service also powers Lightspeed, Shopify, WooCommerce, and other popular business tools.

It wasn’t until recently that Stripe launched its native mobile app, Stripe Dashboard. The app is highly rated by both iOS and Android users, despite its limited in-person payment capabilities. The sign up process is very similar to that of Square and the set up is fast unless you need advanced customization which takes some time to do.

Stripe also offers a wider range of compatible mobile credit card readers than Square. For larger businesses, Stripe offers well-documented APIs and developer tools to create a mobile app customized to their needs.

PayPal: Best for fast & convenient payments

Overall Score

4.24/5

Pricing

4.06/5

Mobile app features

4.25/5

Support & reliability

4.06/5

User experience

4.69/5

Average user review scores

4.25/5

Pros

- Ease sign up and set up

- Free POS

- Instant access to funds via PayPal Balance

- Wide range of payment options

Cons

- Complex pricing

- Can be pricey with add-on tools

- Reports of frozen funds

Why I chose PayPal

This guide won’t be complete without the pioneer of the digital payment platforms, PayPal. As the pioneer in digital payment apps, PayPal is also one of the most popular credit card payment apps in the world. As a trusted brand with over 400 million individual users, businesses that offer the convenience of a PayPal payment method will have an advantage over other merchants. Businesses with low-volume transactions and those that process foreign credit cards such as in tourist spots can benefit from PayPal.

One of the best things about the PayPal business app is its credit card reader. The hardware is very much like Helcim (though at a much lower price point), with a PIN pad for debit card transactions, and is easy to sync with the payment app. And while there are some mixed reviews about the software, the processor is reliable and easy to use. Developers update the app every two weeks for fixing bugs and security updates.

Related: Best Mobile Credit Card Processing Solutions for 2025

Helcim: Best for scalability

Overall Score

4.24/5

Pricing

4.69/5

Mobile app features

4.5/5

Support & reliability

3.75/5

User experience

4.38/5

Average user review scores

3.65/5

Pros

- Automated volume discounts

- No additional approval for surcharging

- Interchange-plus rates

Cons

- Low mobile app rating for Android users

- Additional cost for Amex transactions

- Expensive mobile card reader

Why I chose Helcim

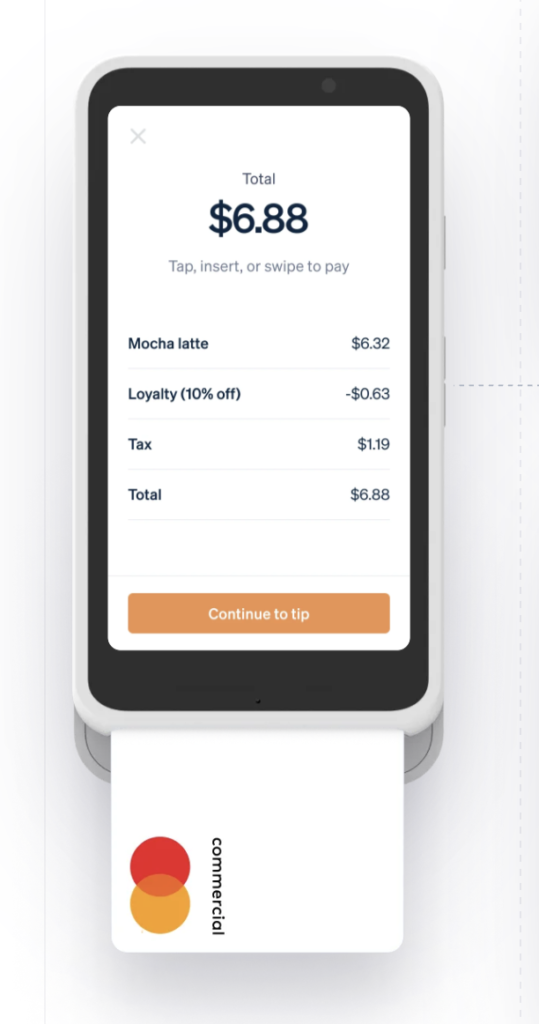

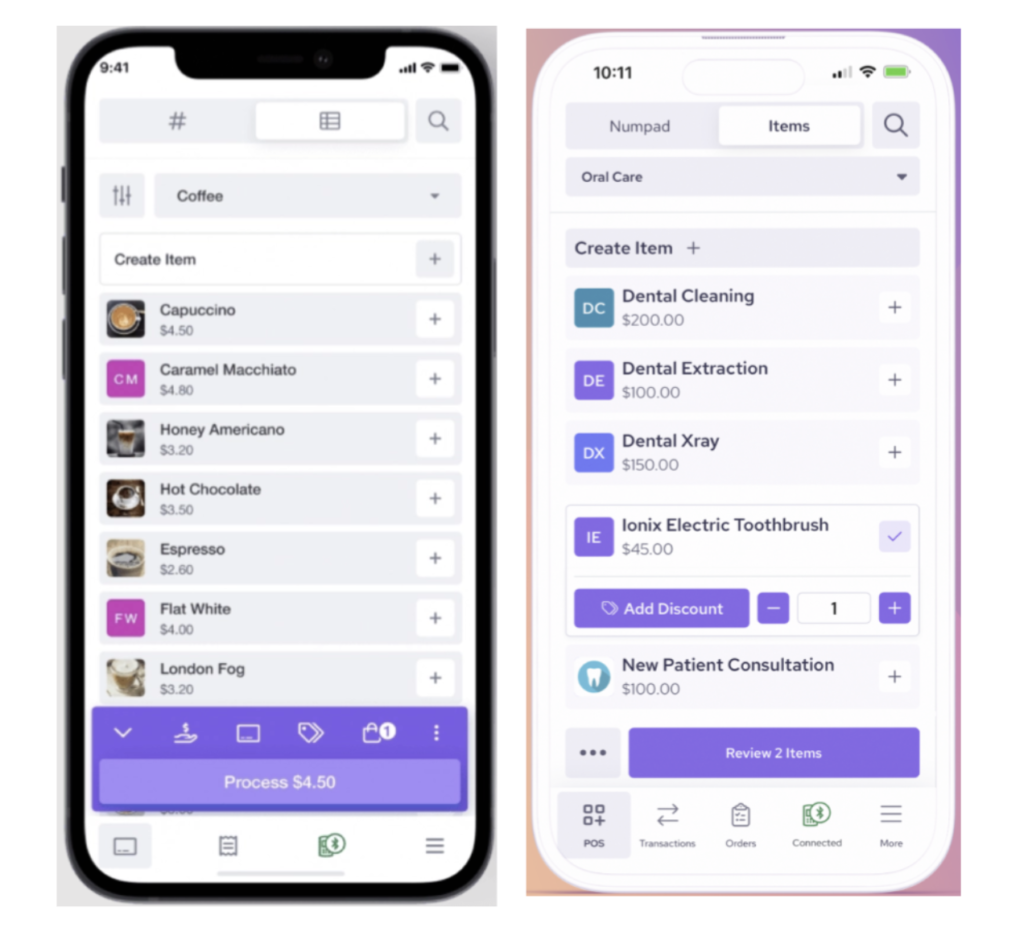

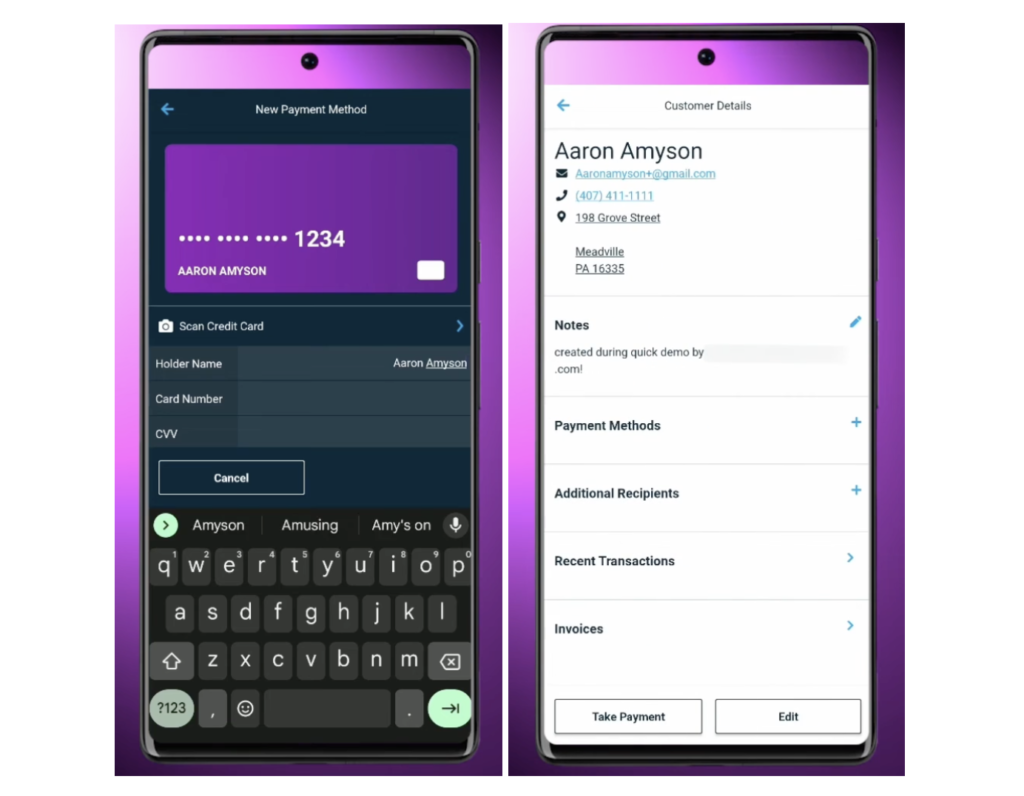

Helcim is a traditional merchant account services provider that comes with its own payment software. It uses a volume-based pricing model with no monthly fees and complete access to all of its payment processing features at no extra cost. Helcim’s mobile POS app is seamlessly integrated with the merchant account’s inventory catalog, CRM, and secure card vault. It also offers free native ecommerce, mobile app, and POS platforms.

Note that, unlike Square and Stripe, applying for a Helcim account takes longer and the requirements are stricter. However, I like how you can still explore the app while waiting to be approved. Businesses that do get approved for a merchant account will like Helcim’s automation features. It offers automated volume discounts that eliminate the hassle of applying for better rates for businesses with fast-growing sales. Surcharging is also automatically available for users who also process ACH payments.

Venmo: Best for businesses selling on social media

Overall Score

4.23/5

Pricing

4.06/5

Mobile app features

4.25/5

Support & reliability

4.06/5

User experience

4.69/5

Average user review scores

4.2/5

Pros

- Social media integrations

- Native marketing tools

- Tap to pay for non-Venmo customers

- Easy business account sign up

Cons

- Limited payment options

- No volume discounts

- Limited seller protection

Why I chose Venmo

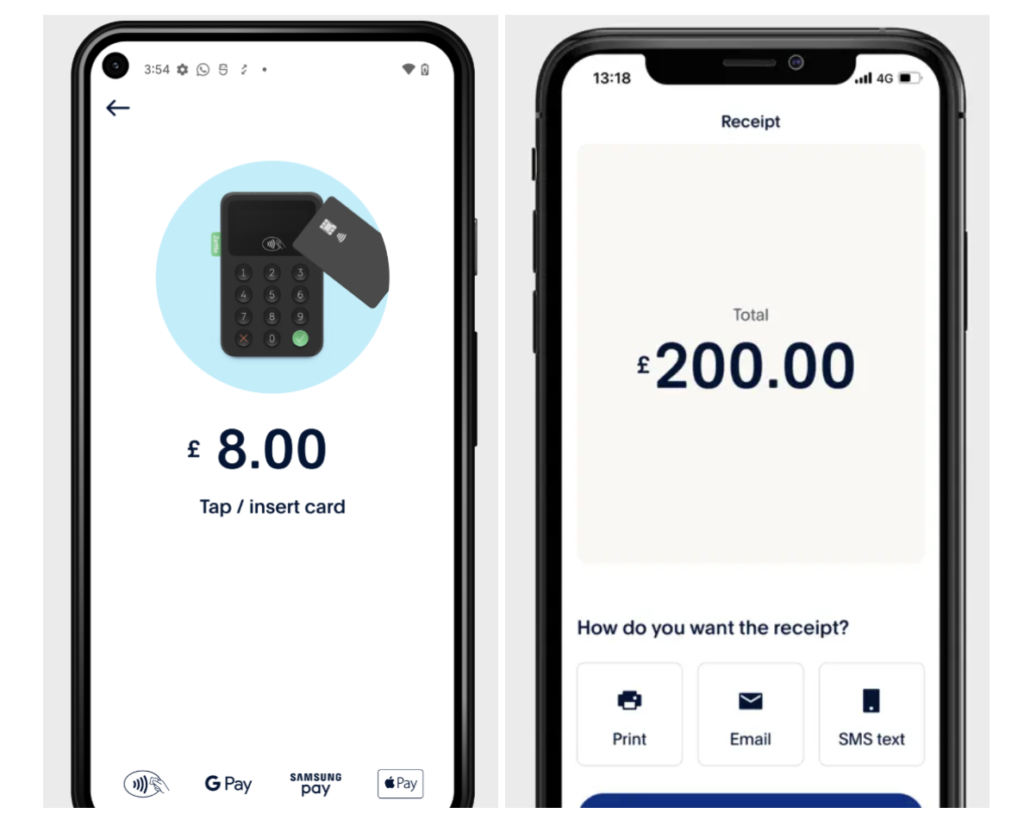

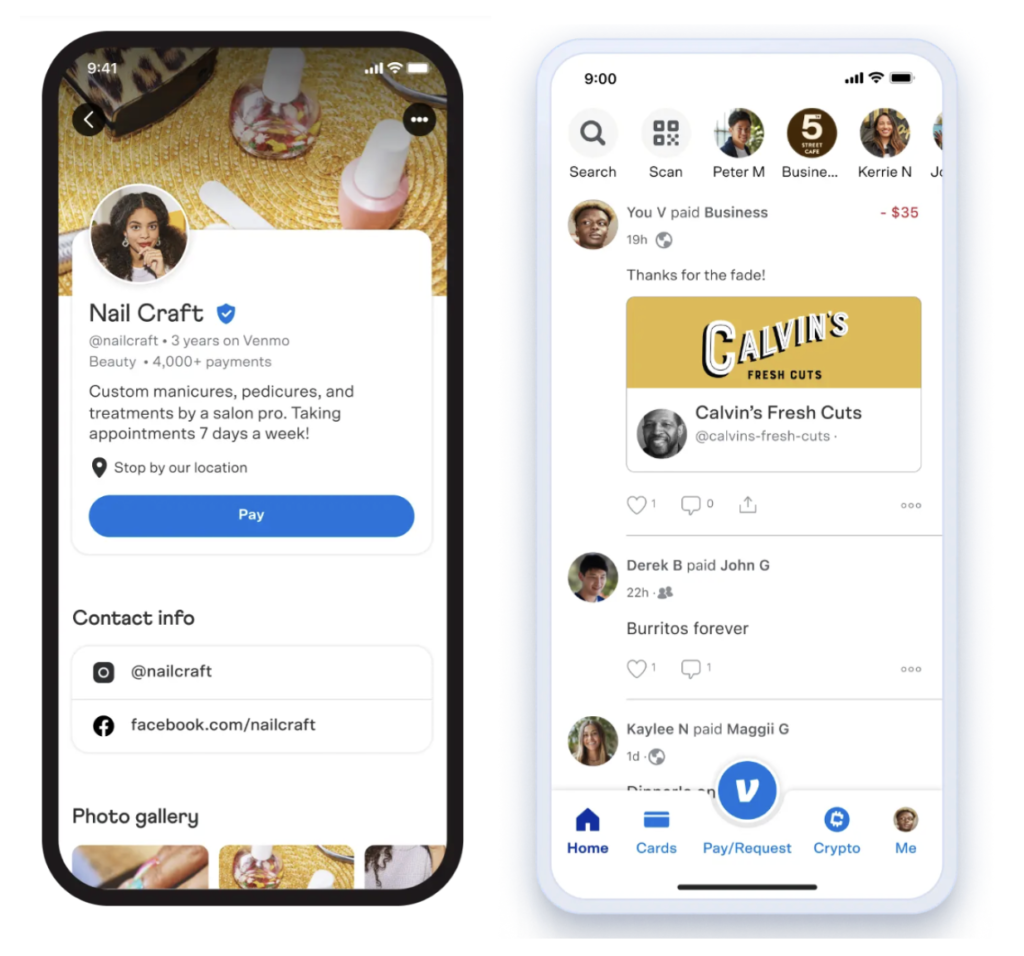

Venmo is a peer-to-peer payment app popular for its social media integration. It recently launched a business profile feature that allows individuals to create a separate account for processing business transactions.

As it is owned by PayPal, Venmo supports direct PayPal integration so customers can use their PayPal account to pay for their products and services via Venmo. There are no monthly fees for using the service, and Venmo-to-Venmo transaction rates are considerably lower than those of other in-app payments, including PayPal.

Unlike other providers in this list, Venmo is not compatible with mobile credit card readers, so Venmo merchants can only accept payments from Venmo individual users. However, with the latest addition of the tap-to-pay function, it’s now possible to accept contactless payments from credit cards and other mobile wallets. This makes it possible to actually perform in-person transactions via Venmo with one of the lowest flat transaction rates in the market.

Shopify: Best for ecommerce

Overall Score

4.23/5

Pricing

3.13/5

Mobile app features

4.75/5

Support & reliability

4.38/5

User experience

4.69/5

Average user review scores

4/5

Pros

- Full-suite ecommerce solution

- Omnichannel features

- Accepts PayPal payments

Cons

- Advanced tools require an ecommerce subscription

- Reports of frozen funds

- Low app ratings from Android users

Why I chose Shopify

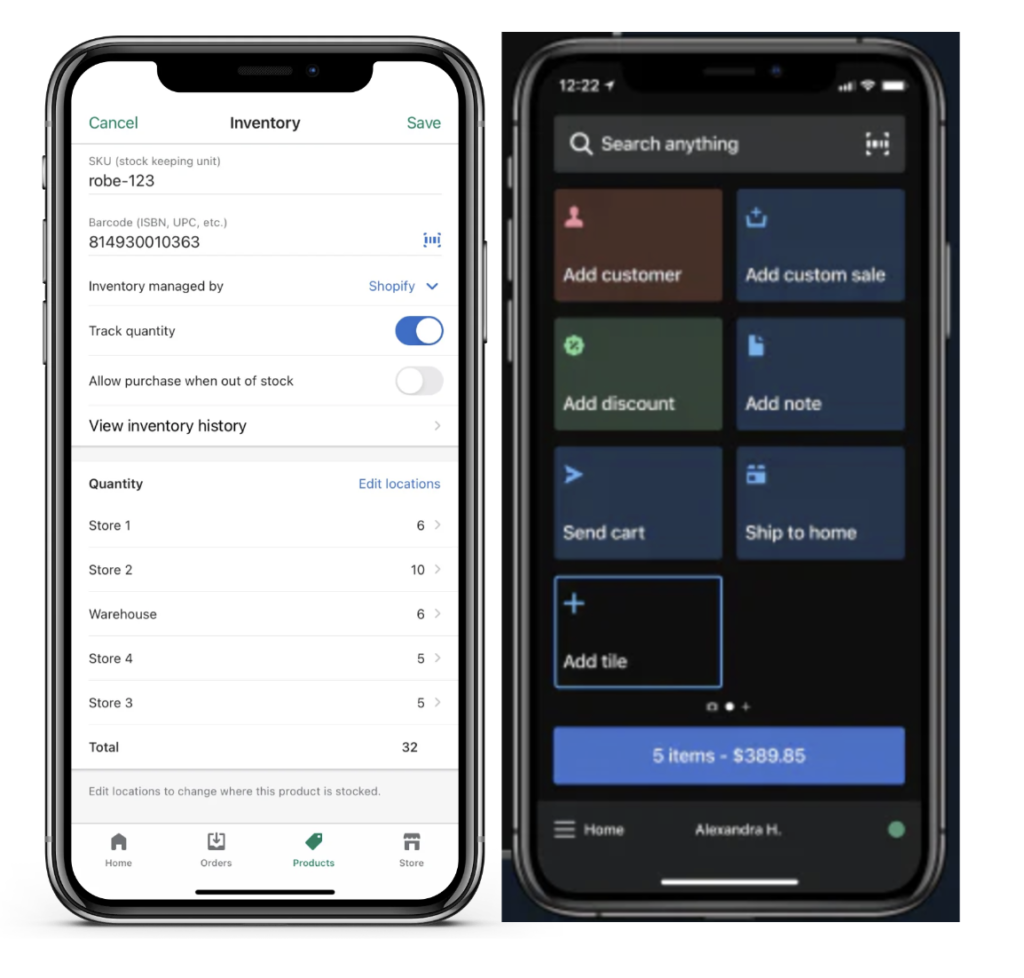

Shopify is the leading ecommerce platform in the industry. It has expanded its features over the years with payment processing and point-of-sale, and even built in-house business tools for marketing and fulfillment.

Its pricing plans are designed to include features for businesses of all sizes, and its POS software is app-based, so it’s compatible with smart devices such as tablets for in-store setup and smartphones for selling on the go. Shopify is the best alternative to Square if you need an all-in-one solution but run primarily an online business.

Related: Best 8 Square Alternatives & Competitors.

Shopify joins our list of best credit card payment apps as the best recommendation for ecommerce businesses expanding into in-person sales. It previously lost points because you can’t use the app without paying for an ecommerce account. However, this is no longer the case although you’ll have to get the ecommerce bundle to access advanced POS features.

Over the years of testing the app, I’ve noticed that Shopify for Android seems more prone to bugs and card reader disconnections, but it seems to crash less now with the recent updates, which is likely why the app review score is slowly improving.

Stax: Best for large-volume businesses

Overall Score

4.2/5

Pricing

4.38/5

Mobile app features

4.75/5

Support & reliability

4.38/5

User experience

4.38/5

Average user review scores

2.45/5

Pros

- Wholesale payment processing rates

- Wide range of enterprise-level customizations

- Robust reporting and analytics

Cons

- Poor mobile app user ratings

- Limited mobile card reader options

- Reports of crashes and connectivity problems

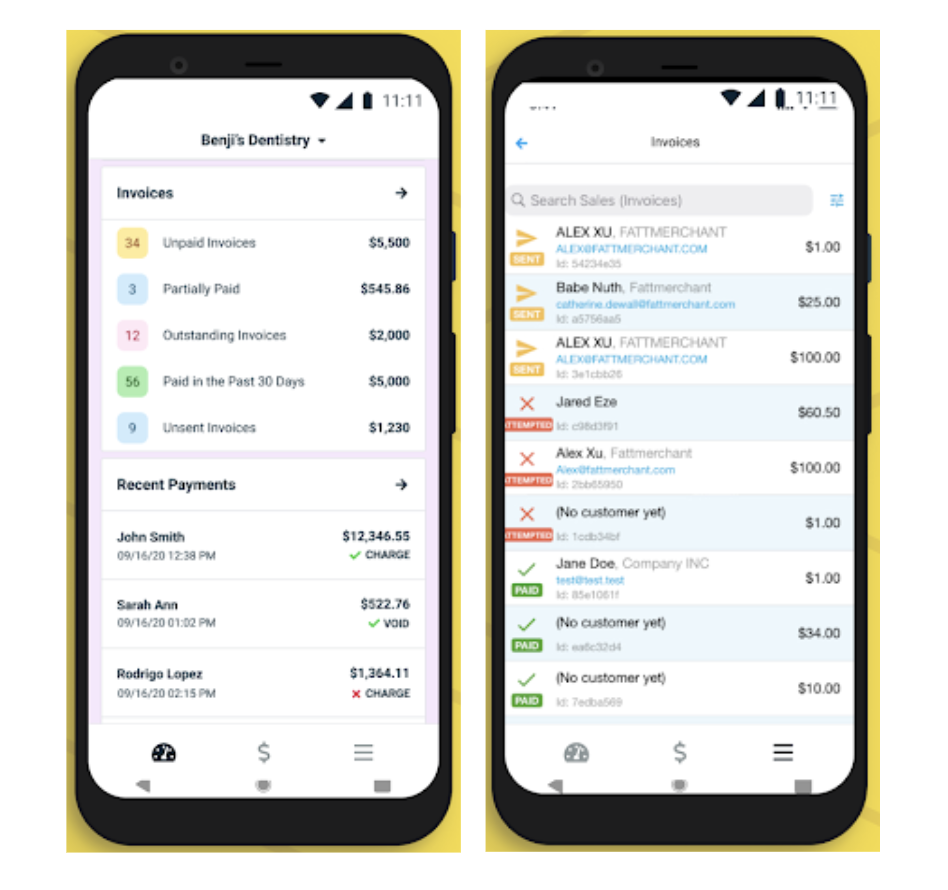

Why I chose Stax

Stax is a traditional merchant account that offers wholesale subscription-based pricing. Like Helcim, applying for a merchant account with Stax takes a while, and the strict process is better suited for mid-sized and established businesses. That said, Stax offers a wide range of payment processing features, including a mobile app version of Stax Pay through advanced SwipeSimple customization. Stax Pay comes with a guided setup feature and an intuitive interface.

What I like most about Stax is the system’s ability to scale its features along with any business. This means it can provide simple payment processing solutions, but as a business grows, users can upgrade to any of Stax’s more advanced products such as high-level subscription management with Stax Bill and white label customizations with Stax Processing. The functionalities within the Stax mobile app will also be upgraded along with the business needs.

How to select the right credit card payment app for your business

To get the most out of a credit card processing app, businesses need to consider the cost-effectiveness of each option. This helps ensure that users choose a provider that can maximize savings while also providing features they need and with room to grow. Below are some key features to look for in a credit card payment app.

Flexible pricing structure

As businesses grow, the priority in pricing shifts from minimal upfront costs to volume discounts. The ideal credit card payment app should support flexible pricing that will allow businesses to upgrade their services without interrupting business operations.

Related: Credit Card Processing Fees: Complete Guide

Variety of payment methods

The best credit card payment app should provide a full suite of in-person payment methods. This means it should be able to work with a card reader that supports swipe, EMV, and contactless payments. Hardware-free payment methods should also be available for businesses that prefer not to invest in a credit card reader for one reason or another.

Level of customization

Credit card payment apps should be equipped with a variety of customization options. This includes additional payment processing services such as invoicing, payment links, card vaults, and surcharging tools. It should also provide customizations that support business growth, such as developer tools to create industry-specific features and various integrations with business systems.

Security measures

Every payment processing service should be level 1 PCI DSS compliant. Users should also look for available tokenization and encryption tools. Ideally, payment processors should also offer chargeback management and customizable fraud protection features.

App & card reader reliability

It’s important that a credit card payment app and a card reader are reliable. The best option should not disrupt business operations with bugs resulting from app updates or card readers that often get disconnected. It’s also ideal for the app to be able to process credit card payments even without an internet connection. Users should also check real-life user reviews for any complaints about frozen funds or failed transactions.

Expert Tip

Note that some apps work with multiple payment processors, while others only work with their namesake processors. If you’re just starting out, choosing an all-in-one solution is easiest. However, if you already have a merchant account or are having trouble getting approved for one, a payment app that works with multiple processors offers more flexibility.

Related: 7 Best Best Credit Card Processing Companies

How apps for credit card payments help your business

The primary benefit of credit card apps is mobility. Being able to accept payments anywhere and anytime gives businesses more opportunities to create a sale. Other benefits of credit card payment apps include:

- Lower transaction fees: Accepting payments in person is cheaper than remote transactions.

- Affordable investment cost: Most payment apps are free and you only need to invest in a mobile credit card reader ($30 to $100) to start accepting payments.

- Multichannel functionality: A mobile credit card payment terminal can be programmed as an additional sales channel for store-based POS.

- Compatibility with multiple payment processors: Businesses will be able to continue using the same payment app so there is no operational downtime.

- Ability to scale: Most credit card payment apps can be easily programmed with custom features to match a growing business’ needs.

- Additional layer of security from smartphones: Smart devices are equipped with native authentication tools, including biometrics, that help in securing payments.

FAQs

Yes, most payment processors provide a free mobile POS or payment app. These payment apps are compatible with tablets and smartphones and can be connected to a mobile credit card reader that can process swipe, chip, and tap payments.

Most credit card payment apps are free to use unless they come from a third-party app developer. The only monthly fees involved are the costs to process transactions.

The best credit card payment app is one that provides payment methods and features that match your business needs. Also, consider your business sales volume and choose a payment processor with a free payment app that can offer you the most savings.