What is enterprise risk management software?

Enterprise risk management (ERM) software and risk management information systems (RMIS) help organizations identify risks in information systems and critical technologies, so the organization can plan for potential risks, document responses, and improve upon response processes.

Risk assessments are designed to quantify risk and its potential effect on a project or business’s major goals. The identified risks are classified as acceptable or unacceptable, and the team and managers can implement a plan to mitigate the disruptions or alter the course as needed. Continuous input along a project’s lifecycle will help lower risk levels and equip teams to act faster.

Find your new ERM software

Top ERM software vendors

These best enterprise risk management vendors are chosen based on market share, online reviews, and user feedback. Not all solutions are best for every team, but our Technology Advisors can help you find the right ERM platform for your needs. Request a consultation now via the form on the right-hand side of the page, and our unbiased Technology Advisors will contact you to find a set of solutions that meet your individual needs.

RSA Archer

With a long history in the security and risk management space, RSA has built a strong reputation for providing comprehensive solutions to businesses of all sizes.

One of the key features that make RSA Archer stand out is its flexible and configurable design. The software is built on a scalable and adaptable foundation, allowing users to tailor the solution to his or her unique requirements.

RSA Archer offers an extensive array of out-of-the-box applications and content libraries that facilitate a more efficient implementation approach. These resources cover various aspects of risk management, from policy and compliance management to audit and incident management. The platform’s integration capabilities allow organizations to consolidate data from disparate sources, providing a comprehensive view of the risk landscape.

Oracle Risk Management and Compliance

Oracle Risk Management and Compliance is a subset of the Oracle enterprise resource planning cloud tools. The tools help companies design secure financial and data structures, digitize certification and compliance workflows, and provide continuous monitoring of financial transactions to reduce stress on auditors during compliance checks. The streamlined digital security and access management surfaces exceptions across the entire organization and allows for swift action to maintain compliance and react to risk.

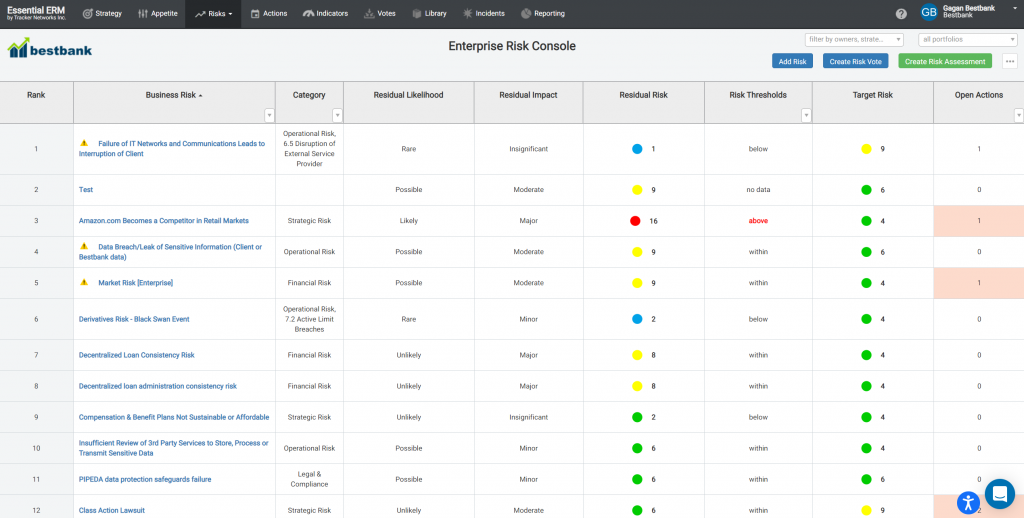

Essential ERM

Essential CRM is a web-based software solution that can launch new ERM programs as well as take existing programs and augment them. Renowned for its commitment to providing user-oriented products, Essential ERM has carved out a niche for itself as a top ERM software provider by continually evolving to meet the needs of a diverse clientele.

The company’s flagship ERM solution, RiskEssentials stands out for uts functionality and intuitive design.

RiskEssentials offers a suite of features tailored to specifically address the unique challenges of risk management. One of the software’s most distinctive offerings is its AI-powered risk analysis capabilities that identify potential threats as well as opportunities.

Additionally, RiskEssentials provides seamless integration with third-party systems, enabling the consolidation of data from various sources for a more holistic view of the risk landscape. The software’s collaborative tools foster a culture of shared responsibility and engagement. Customizable dashboards are available so users can create visually appealing dashboards that highlight key risk indicators, enabling informed decision making.

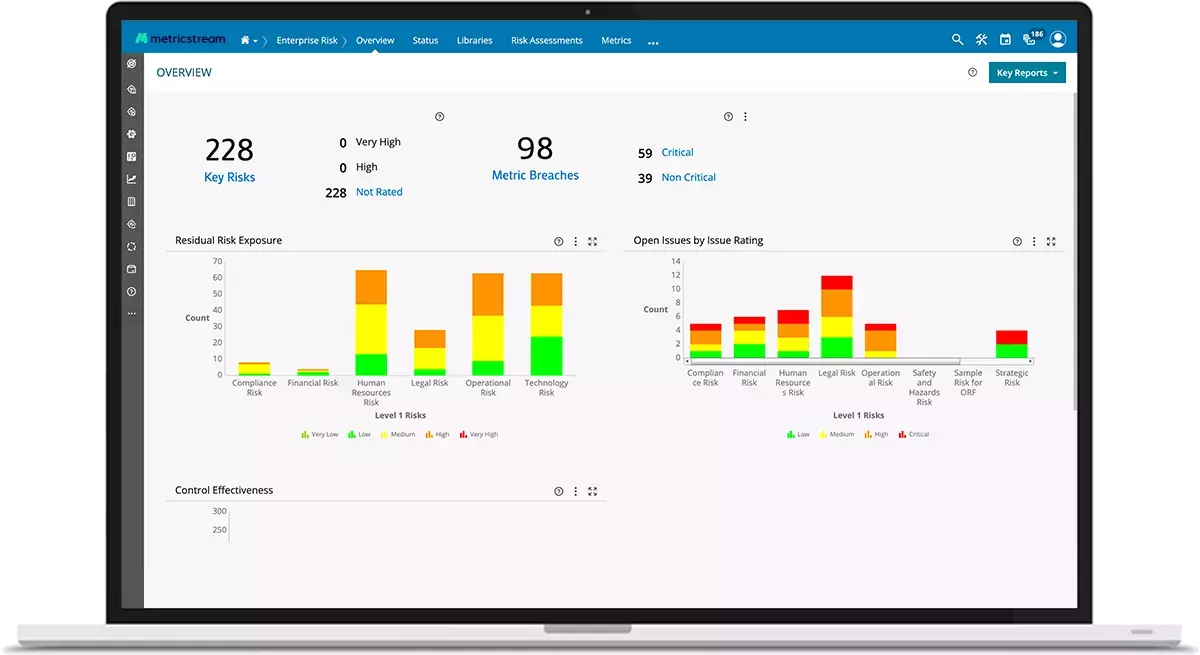

MetricStream

MetricStream’s ConnectedGRC is a governance, risk, and compliance platform for enterprise companies looking to increase their resilience after an incident. The tools combine traditional risk, compliance, and audit tools with cybersecurity and third-party controls to ensure a full-spectrum view of the enterprise’s risk profile. The collaborative platform increases transparency between otherwise-siloed departments, which contributes to higher agility in the face of risk.

Riskonnect

Riskonnect’s risk management platform integrates insurable and non-insurable risks for an actionable 360 view of the company’s risk profile. The workflow tool lets companies quickly assign actions and priorities to mitigate risk as it happens, while risk heatmaps give stakeholders a quick understanding of the most vulnerable parts of the business. Then use Riskonnect’s prebuilt and customizable reporting templates to communicate progress and increase awareness across the organization.

LogicManager

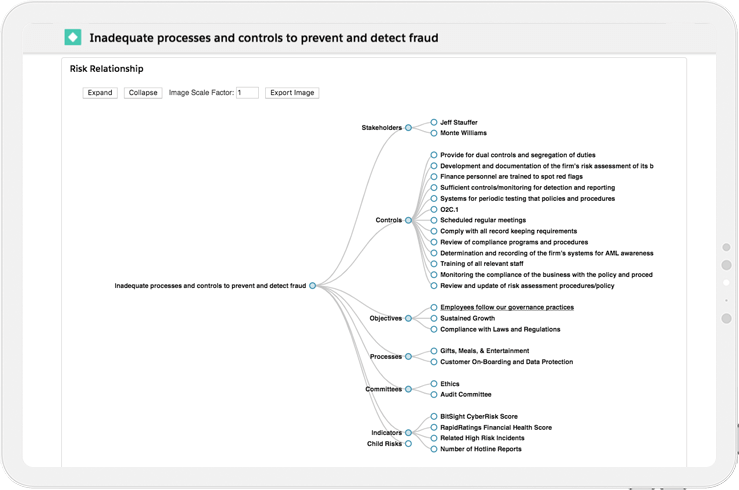

LogicManager uses a risk taxonomy structure to help companies categorize their risk across departments and business units to surface the most urgent vulnerabilities across an organization’s information silos. The taxonomy structure also allows risk and compliance teams to better allocate resources without duplication, providing the company with a faster, more organized response to risk environments.

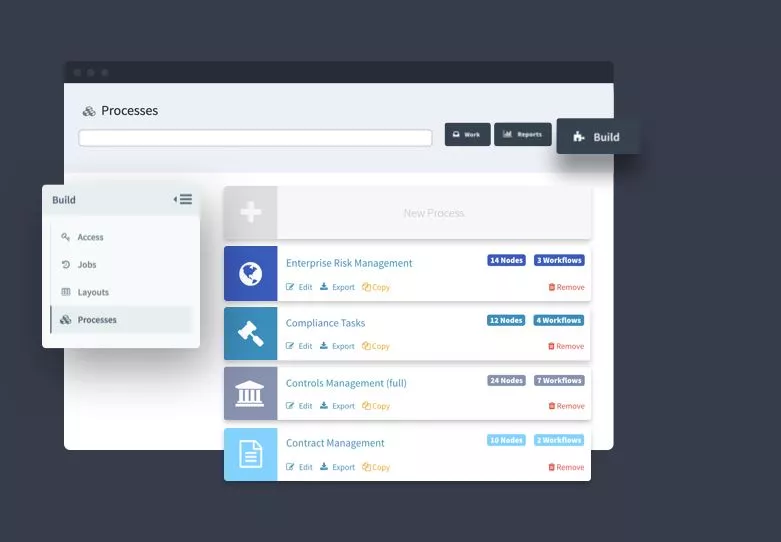

LogicGate

LogicGate offers a full platform of modular no-code enterprise risk management solutions that companies can choose from to improve risk management as the company grows, including ERM, third-party, IT, compliance, and incident management solutions that work together in a single interface. Companies can use the pre-built workflows and drag-and-drop form builder to customize identification, notification, and response protocols.

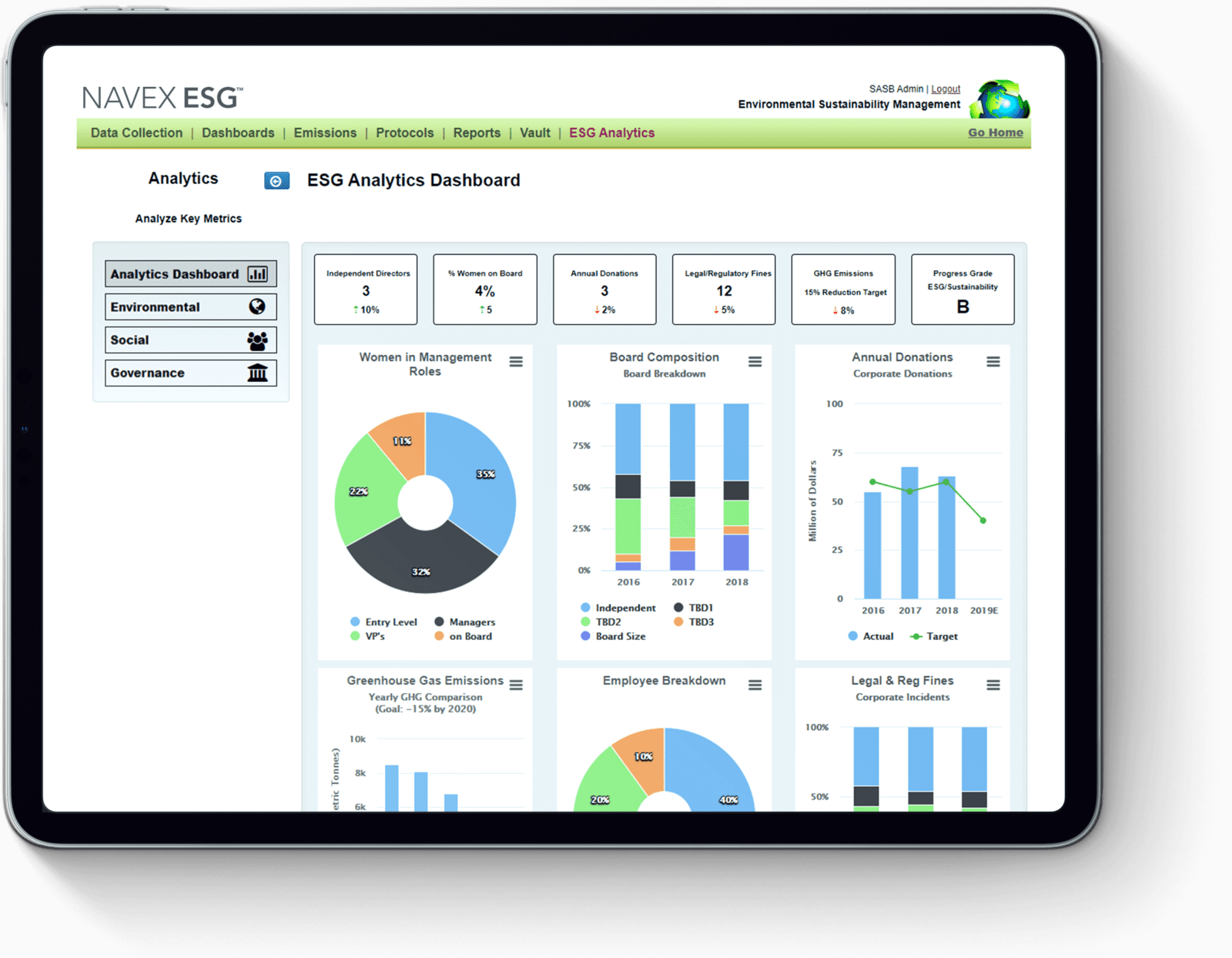

NAVEX Global

The NAVEX One Platform is a combination of the NAVEX ethics and compliance (E&C), integrated risk management (IRM), and environmental social governance (ESG) tools, which can be purchased individually, as well. These tools help enterprise corporations manage their risk across all business sectors, including IT, finance, HR, and regulatory compliance. The tools are especially useful for multinational organizations that must ensure simultaneous compliance across multiple business regions.

Navex takes a holistic approach to risk management, offering a single, unified interface. The platform integrates multiple risk management functions, including policy management, risk assessment, incident management, and third-party risk management.

Another unique aspect of Navex IRM is its focus on automation and streamlined workflows. The platform is designed to reduce manual processes and increase efficiency, allowing users to focus on strategic decision-making rather than administrative tasks.

Who needs ERM software?

Enterprise risk management is critical for businesses that must abide by federal and international regulations, especially those in financial services, insurance, and healthcare industries. ERM software is often used by financial analysts to identify monetary distractions in relation to projects and business objectives, but it’s also a popular tool for project managers, software engineers, and legal specialists.

According to a 2023 AAG IT Services report, ransomware attacks declined 23% in 2022 compared to the previous year. Effective ERM software and strategies can be attributed to this decline. The top 5 industries who were attacked in these technology breaches were:

- Manufacturing

- Financial services

- Transportation

- Technology

- Legal and human resources

The ongoing attacks on industries outside of financial services — attacks that disrupt the supply chain and can create chaos for essential industries that keep the larger economy running, have shown that every company needs to plan for disruptions to be able to act quickly.

All companies increasingly rely on technology to manage day-to-day operations, and enterprise risk management software holds a critical position in IT infrastructure. Managing risk requires strong internal controls, and ERM software often includes features that help businesses plan for ransomware breaches and DDoS attacks. The best risk management platforms also use risk data to identify and assess dependency risks that could derail a planned project or essential business functions.

What are some common ERM software features?

Enterprise risk management software options will help companies build processes that identify and mitigate risks. Workflow tools, document management systems, and notifications and alerts provide the foundation of these tools, as they can help companies build systems to pinpoint possible risks and manage the response to risk. The features we list here may augment these basic tools for many organizations, although not all of these features are available from all vendors.

Threat and vulnerability analysis

Threat and vulnerability analysis tools monitor systems and projects, analyze the potential for business risk inherent in those projects, and alert administrators. Many of these tools will also rank risks, to give administrators a prioritized list of tasks.

Compliance management

Highly regulated industries struggle to stay compliant with federal, state, local, and industry-wide regulations that may have complicated paperwork and strict deadlines. Compliance management tools help administrators prioritize compliance tasks, ensure timely submission of assets, and provide workflows to keep the team’s tasks organized.

Vendor/third-party risk management

As companies grow, the number of vendors and third parties necessary to conduct timely and efficient business also grows. Risk management information systems with vendor or third party risk management tools allow teams to assess and prepare for the risks associated with delays, shortages, or downtime due to issues with vendors and third party organizations. These tools allow the organization to respond to changing vendor landscapes quickly and efficiently.

Modeling and forecasting

One of the biggest promises of artificial intelligence and machine learning is that of predictive analytics, which can augment legacy data modeling and forecasting tools with speed and greater accuracy. Modeling and forecasting within risk management solutions will help teams prepare for various known and unknown risks and draw up different scenarios to prepare against.

IT governance and security

IT security teams contend with new risks every day from ransomware, hackers, and software bugs. A risk management information system will provide the team with structured workflows, policies, and tools to assess risk across the enterprise. These tools ensure that risk-related knowledge is easily maintained and updated, even during periods of high turnover.

Audit management

Audits of processes and documents benefit greatly from defined workflows and systems that ensure that each audit runs according to regulation and is compliant. These tools help teams perform audits on time and accurately through automation, notifications, and centralized data stores.

Financial reporting

Connection to key financial software and databases that ensures that financial data is centralized means that the financial departments can quickly access all of the important data they need to build reports. Whether teams are building stakeholder reports or forward-facing analyses, financial reporting tools in ERM software give teams a clear view of financials.

Policy management

As companies grow and change, their policies must also adapt to the changing environment. A centralized policy management solution within an ERM gives the entire company a centralized location to store policy, reference existing policies, and use those to build risk mitigation plans. ERM tools that offer operational risk management, like Fusion Risk Management, help businesses create and store policies that lower their organizational risk.

API and native connections to essential software

Finding a risk management solution that integrates with other systems of record is essential — how else will the software gain visibility into your data and processes? This is especially true if you’re looking for a solution that will mitigate risk across the entire enterprise. As you compare products, look for vendors that offer open APIs or native integrations with these software types:

- Cloud and on-premise databases

- ERP software

- CRM software

- Document management systems

- Contract management software

- Supply chain management

- Fleet management

- Accounting software

- Legal applications

- Software development platforms

- Version control software

What Are The 5 Risk Categories?

Before you can manage risk, you have to identify what kind of risk you’re dealing with. Risk identification gives you a better idea of who needs to be involved with the plan, how it affects your business as a whole, and what your initial steps should be. The five types of risks are:

- Strategic risk

- Compliance risk

- Operational risk

- Financial risk

- Reputational risk

Benefits of enterprise risk management software

Enterprise risk management software makes it easier for businesses to identify and account for their risks, helping them make more informed decisions.

Standardized risk assessments

When you have multiple people performing risk assessments, they may not always be doing them the same way. However, ERM tools provide templates for risk assessments, so your organization can decide on one and stick to it. This way, you can ensure your team is including all relevant information in the assessment, and it’ll be easier to see where the risks lie. Performing the same assessment can also help standardize the risk analysis and risk management processes as a whole.

Better compliance coordination

Potential risks can be very scary for a company, but the best way to prepare for them is to communicate effectively. Compliance managers can use their ERM tools to outline potential compliance risks on a project, create an action plan, and assign tasks to avoid them. This way, everyone knows what they’re responsible for, and they can work together to spot and stop emerging risks quickly, improving regulatory compliance.

Business continuity

Most ERM platforms offer business continuity management that helps risk managers outline key risk indicators and how each one should be handled. Risk analytics provide actionable insights on a business’s risk exposure, allowing the risk owners to take action. Additionally, the organization can log each risk mitigation activity into the ERM tool, providing corporate governance and a clear audit trail. By logging risk treatments, businesses can also act faster the next time they encounter a similar risk.

Choosing the right ERM software

Choosing the best ERM solution for your business requires careful planning based on your existing technology and the compliance landscape of your industry. Many businesses will find that a standalone option works, but may not scale with a growing or more mature business. ERP platforms that include risk management features may also be a good solution for larger companies that don’t want to implement and pay for separate systems. When choosing a system, businesses should determine their risk appetite and select software that can help them stick to that level.

Which ERM software is right for your business? Find out now