Key takeaways

Managing a business requires tools that automate repetitive tasks like payment processing, inventory tracking, customer relationship management, and tracking sales. And as a company grows, the same business tools should be versatile enough to scale along with increasing demands. Square is one such provider that offers an entire ecosystem of business management software that is affordable and user-friendly for small businesses but can also grow with your business.

What is Square?

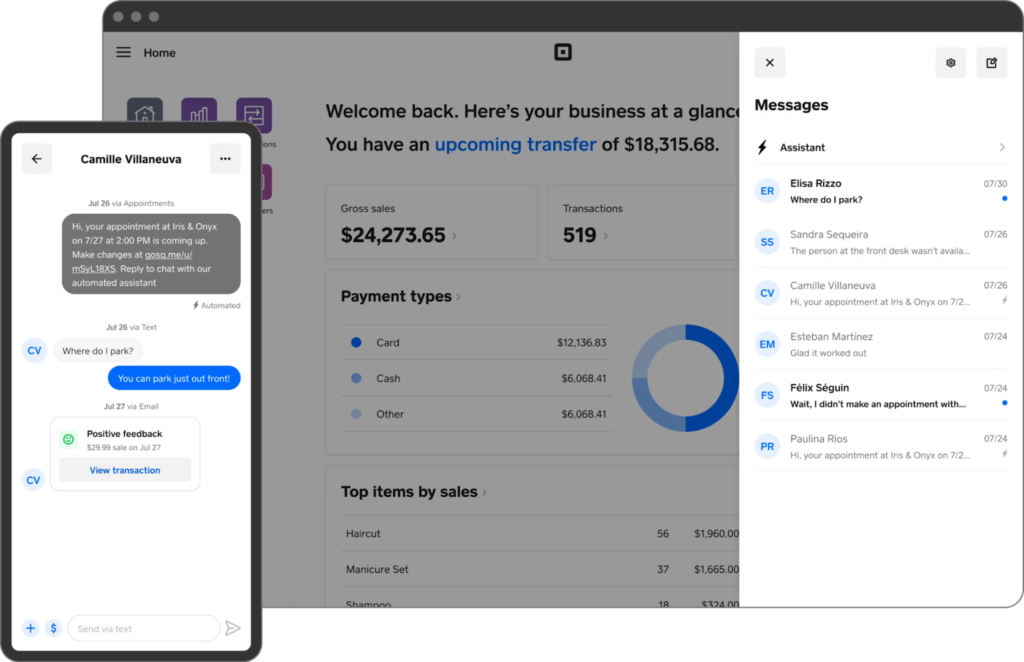

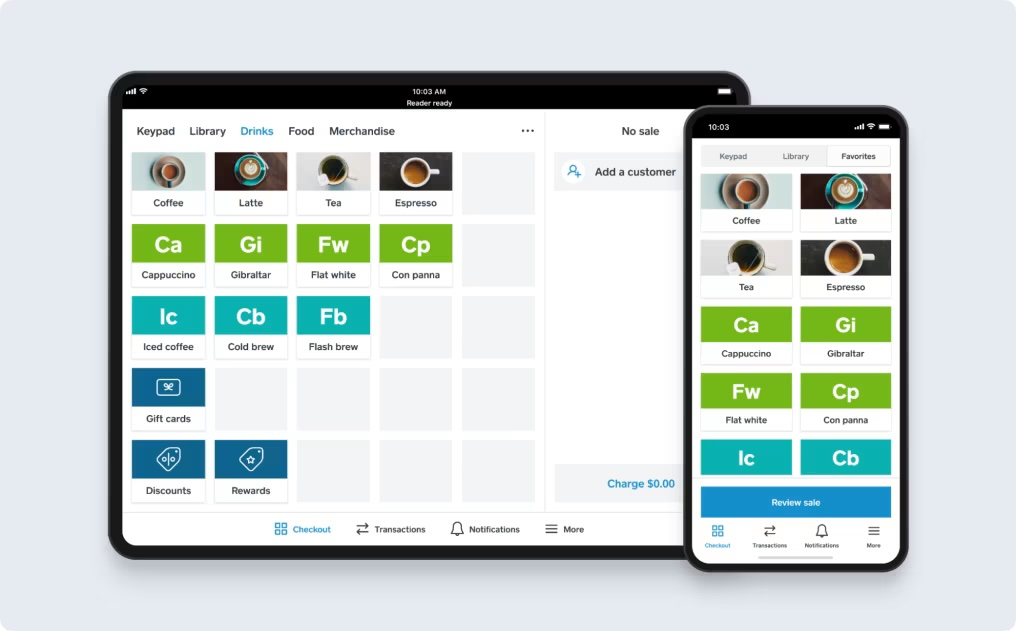

Square is an all-in-one point of sale (POS) solution with a built-in payment processing service, ecommerce platform, marketing tools, and a long list of native business management tools. The software is app-based, so users can start selling by simply creating an account and downloading the free POS software on any mobile device. It offers a unified platform for selling in-person and online.

Many small and new businesses love Square for its feature-rich free plan. However, it also provides custom POS solutions, making it possible to power businesses of any size with Square. To date, the Square POS software has over 10 million downloads on iOS and Android devices and has hundreds of thousands of high ratings from real-life users.

Square’s Products At-a-glance

Every free Square account comes with:

- Standard POS software

- Payments processing

- Payment gateway

- Waived chargeback fees

- Mobile POS app

- Basic website builder and online store

- Online ordering

- Basic invoicing

- Virtual terminal

- CRM

- Starter team management plan

- First magstripe mobile card reader

Additionally, Square offers other products and add-ons like:

- Advanced card readers, POS terminals, and registers

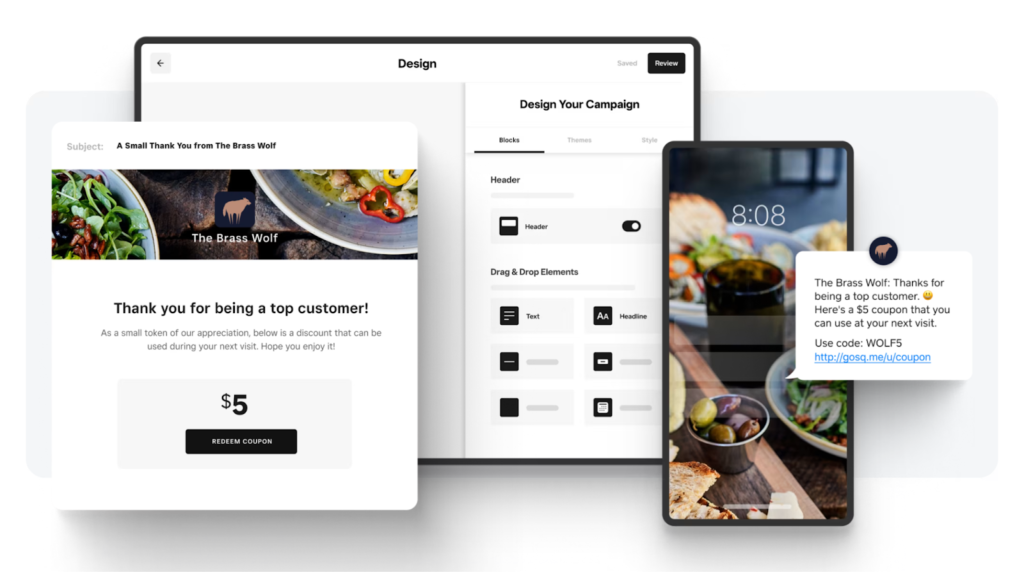

- SMS and email marketing

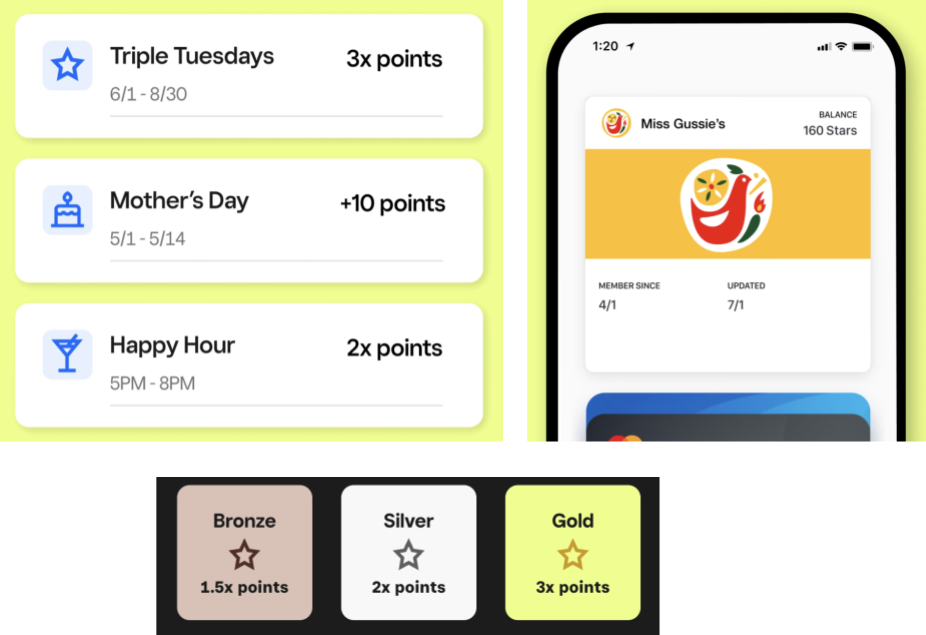

- Customer loyalty programs

- Customer contract creating and management

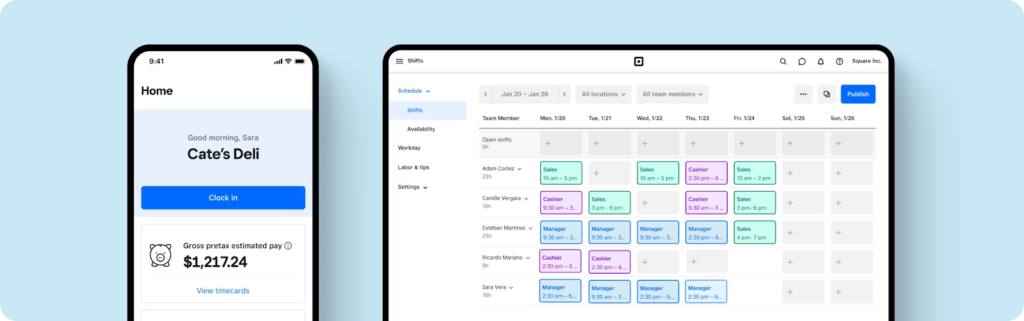

- Employee shift scheduling

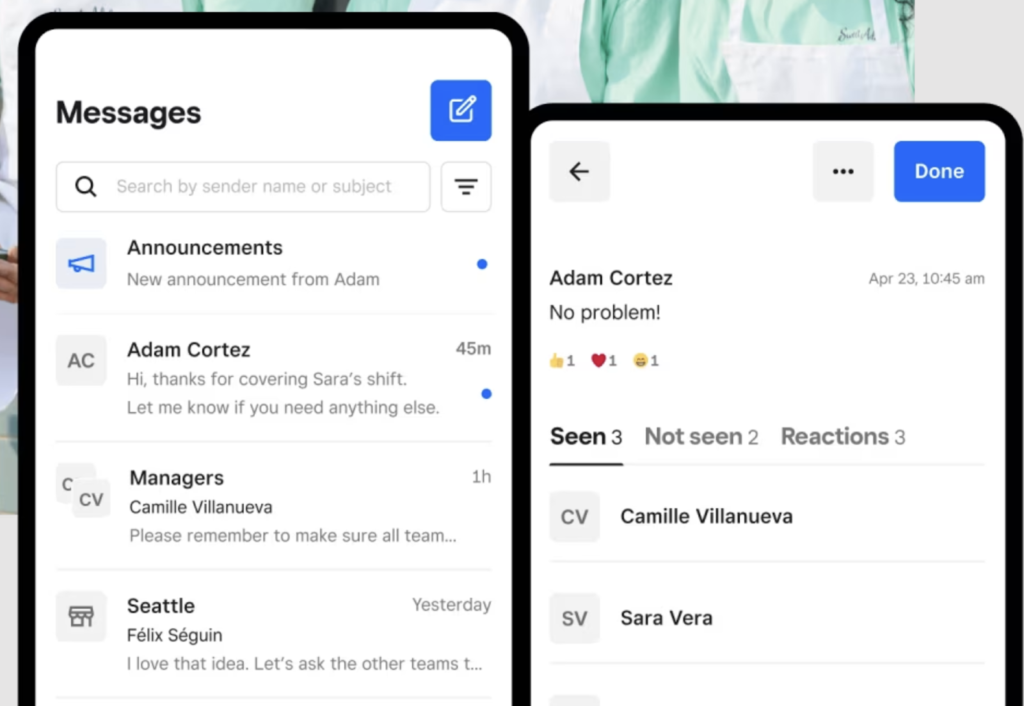

- Team communication

- Payroll

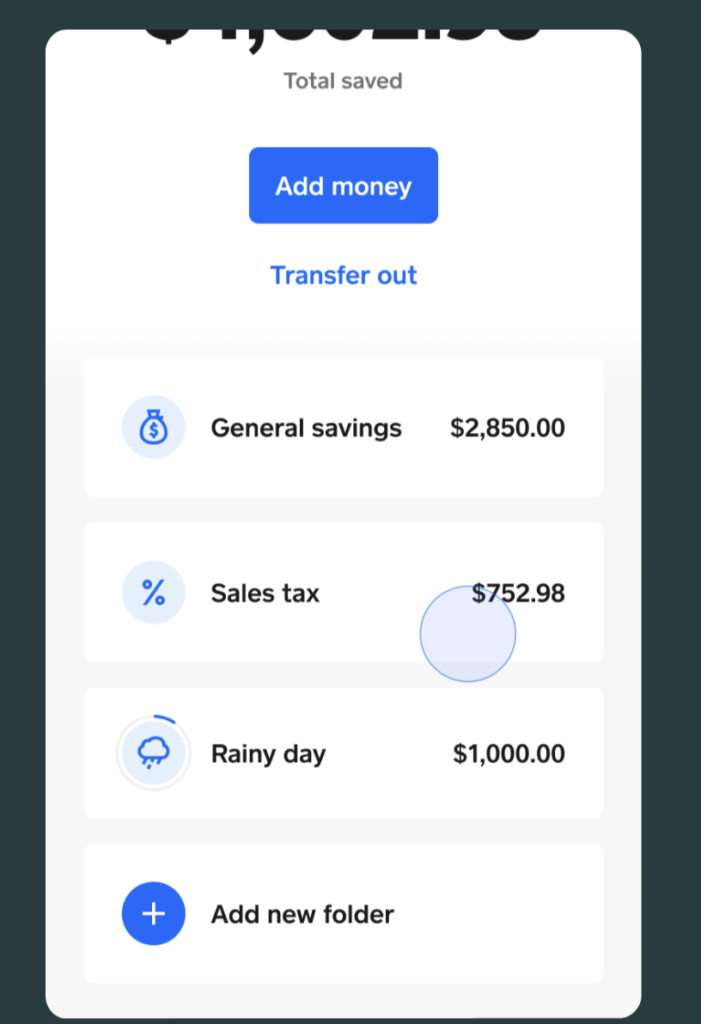

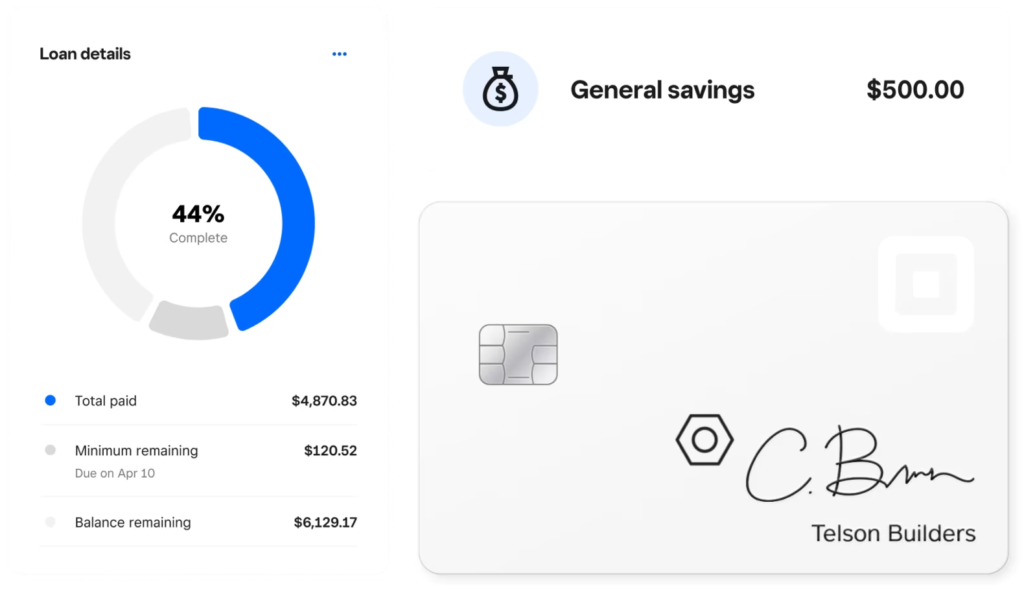

- Checking and savings accounts

- Small business loans

- And more

Square payment processing

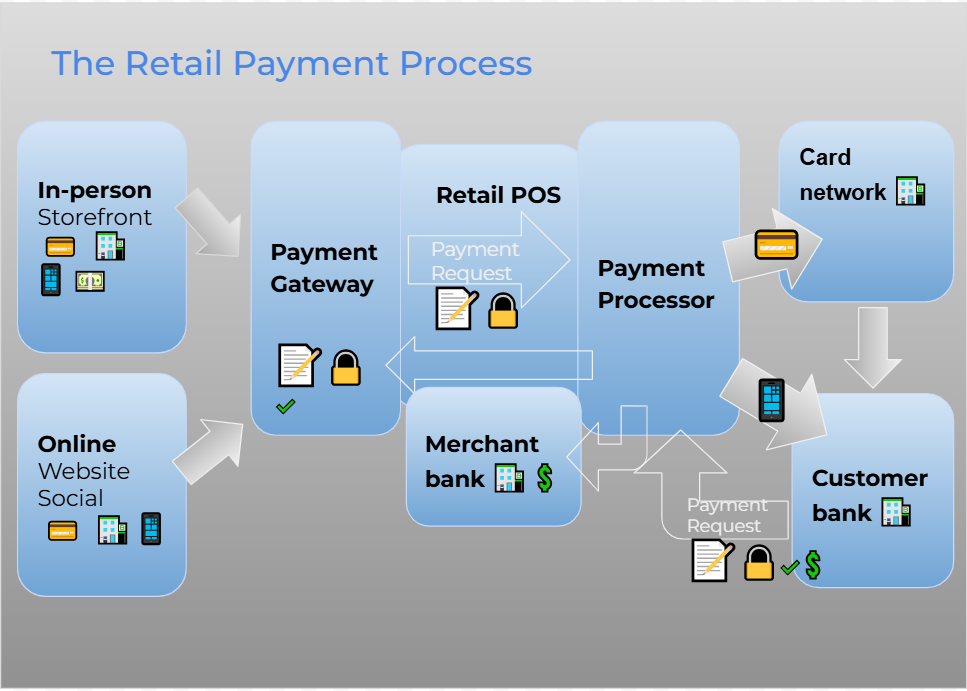

Square is a fintech company whose payment processing services are at the core of its offerings.

Square Payments operates as a payment facilitator. It enters into agreements with acquiring banks to create a central merchant account. Every business owner who opens a Square account receives a sub or aggregate merchant account.

As a payment facilitator, Square holds, receives, and disburses funds on your behalf. Square’s merchant account connects to various payment networks such as card networks, banks for credit and debit card payments, and the ACH network for ACH payments. This allows Square to process transactions and transfer funds for its business customers.

With Square, new businesses can avoid the hassle of long and complicated approvals. They can immediately accept different payment methods with competitive terms, zero monthly fees, and no long-term contracts.

Available payment methods

Accepted payment methods:

- Cash, check, vouchers, and other tenders

- Credit & debit card payments (Visa, Mastercard, American Express, Discover)

- Digital wallets

- HSA and FSA debit cards

- ACH

- Gift cards

- Buy Now, Pay Later (BNPL) with Afterpay

- Peer-to-peer payments with CashApp

Supported payment services:

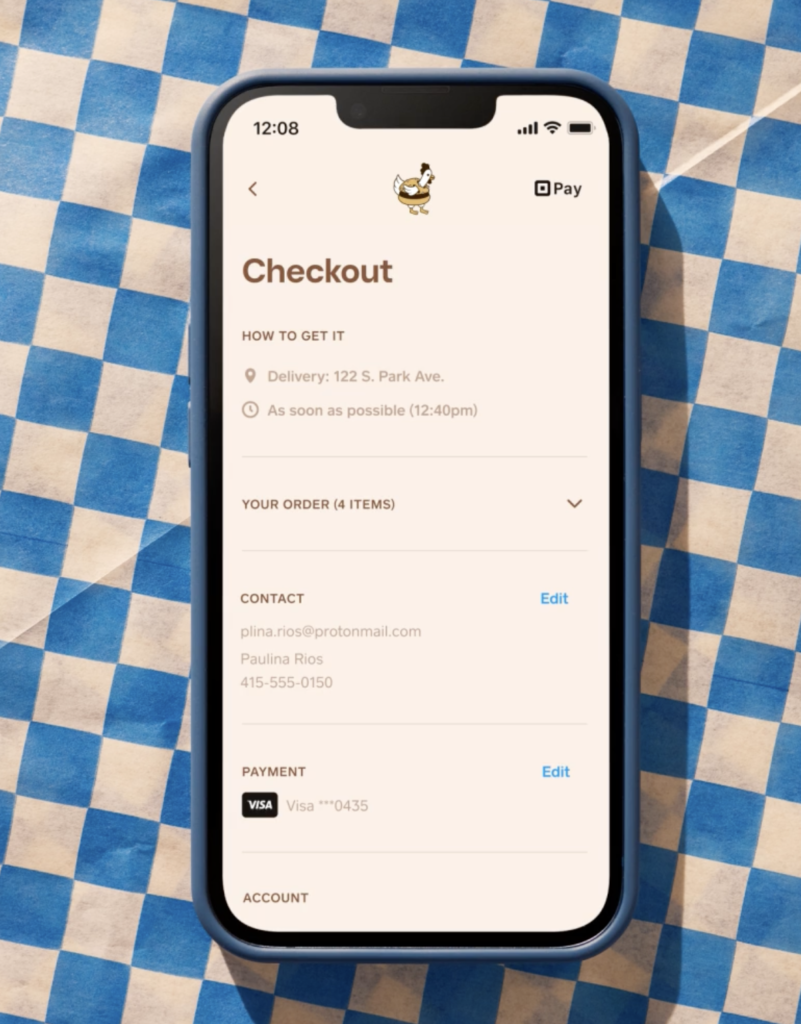

- Mobile POS

- In-store POS

- Online payment gateway

- Invoicing

- Subscription management

- Virtual terminal

- CBD program

Payment processing fees

Like most payment facilitators, Square offers flat rate pricing, which may not be the lowest terms but are easiest to manage for small and new businesses. Businesses that process more than $250,000 annually must work with Square to negotiate custom rates, which typically involve volume discounts and likely better pricing models such as interchange plus or subscriptions.

Below are Square’s standard payment processing fees:

- Monthly payment processing account fee: $0

- Cash, cheque, vouchers, and other tenders: $0

- Credit cards:

- In-person transaction: 2.6% + 10 cents

- Online: 2.9% + 30 cents per transaction

- Keyed-in & card-on-file transactions: 3.5% + 15 cents per transaction

- Chargeback fee: Waived up to $250/month

- Invoicing: 3.30% + 15 cents to 3.5% + 10 cents per transaction

- ACH Payments: 1%, minimum $1

- Afterpay: 6% + 30 cents per transaction

- CBD program transactions: From 3.5% + 10 cents per transaction

- Same-day funding: + 1.5%

- Volume discounts: With a paid POS plan, or more than $250,000 in annual sales volume and over $15 in average ticket size

All Square payments processing comes with free dispute management, active fraud prevention, end-to-end encrypted payments, live phone support, and PCI compliance.

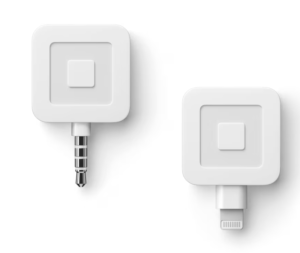

Hardware

While Square’s software is app-based, it does provide its own range of proprietary hardware, which is designed for scalability.

It starts with mobile credit card readers, where users get a separate magstripe and contactless device. Next is a versatile iPad stand with a built-in card terminal that can be set up as a countertop or kiosk. Lastly, Square provides mobile and countertop versions of a stand-alone checkout terminal, complete with a built-in touch screen, customer display, and swipe, chip, and contactless card readers.

Square Magstripe Reader

Square Contactless Reader

Square Stand

Square Terminal

Square Register

Square point-of-sale

Square offers basic and industry-specific POS software. Every software version comes with inventory, ordering, sales, customer management, and reporting tools.

The basic free POS software includes the following features:

- Inventory management

- Cash, mobile, debit, credit, and gift card payments processing

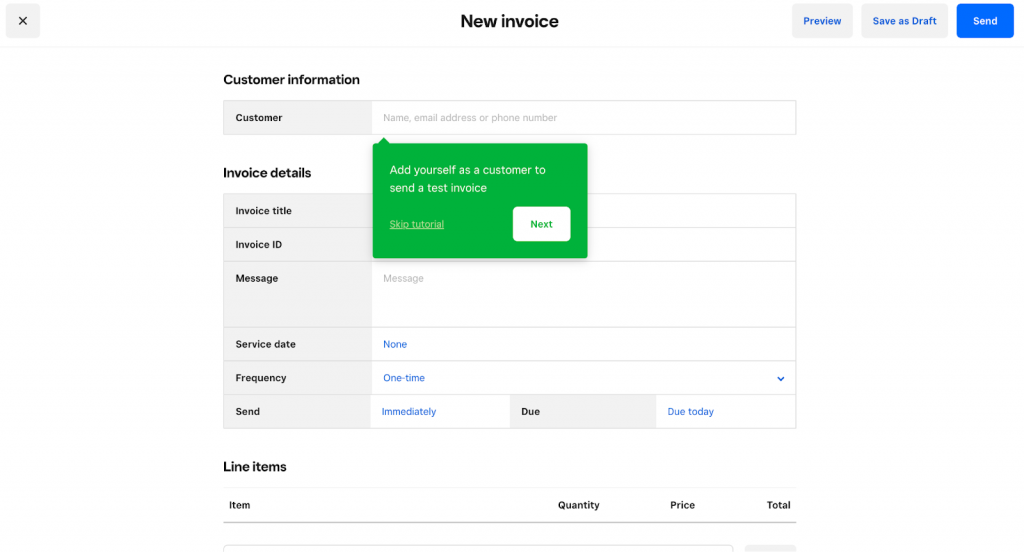

- Invoicing

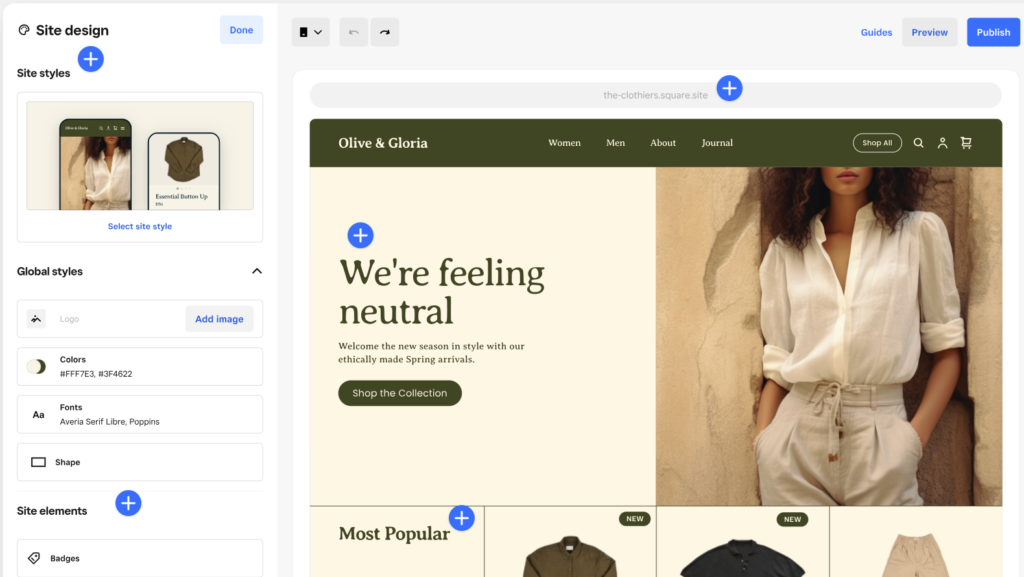

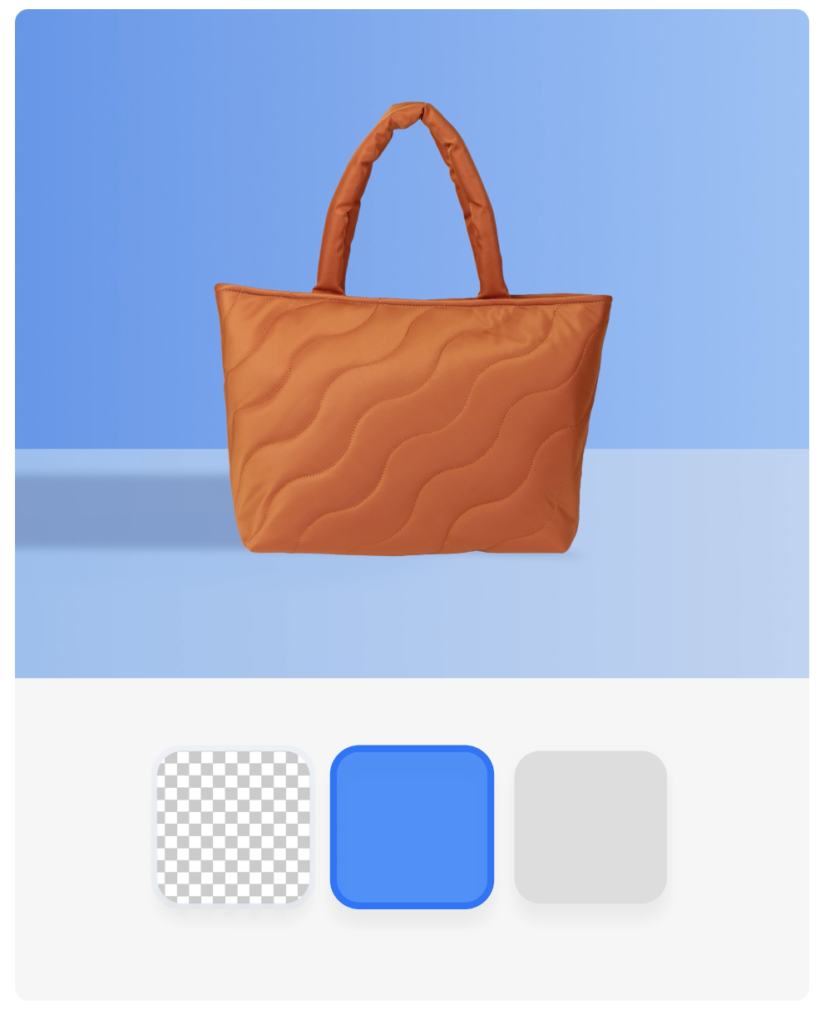

- Website builder

- Virtual terminal

- CRM

- Offline credit card payment processing

- Returns and refunds processing

- Tip management

- Digital and printed receipts

Industry-specific POS software

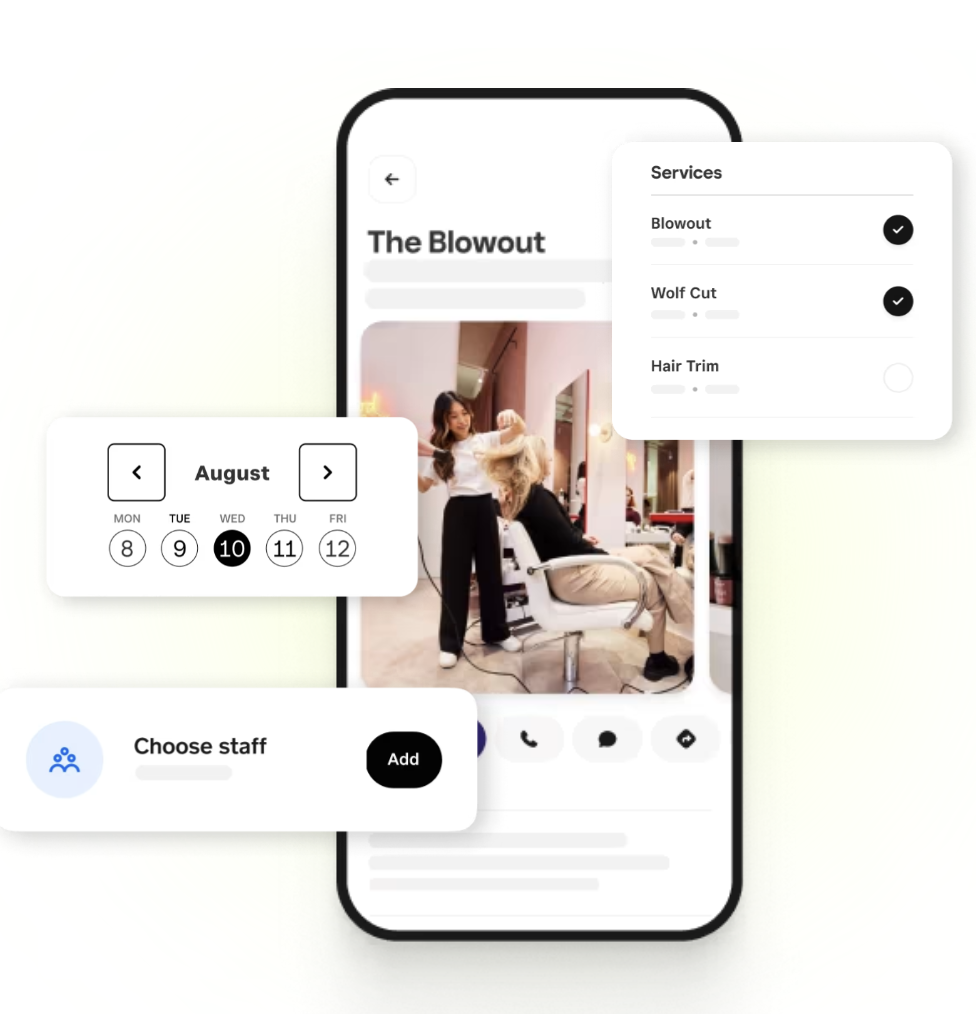

Square offers industry-specific POS software for retail, restaurants, and professional services. These alternatives come with their own set of free and paid plans. Unique features in industry-specific POS include advanced inventory management for retailers, seat management and a kitchen display system for restaurant owners, and scheduling for professional service providers. Square also offers discounted transaction rates for those who upgrade to a paid POS plan.

Additional features and products

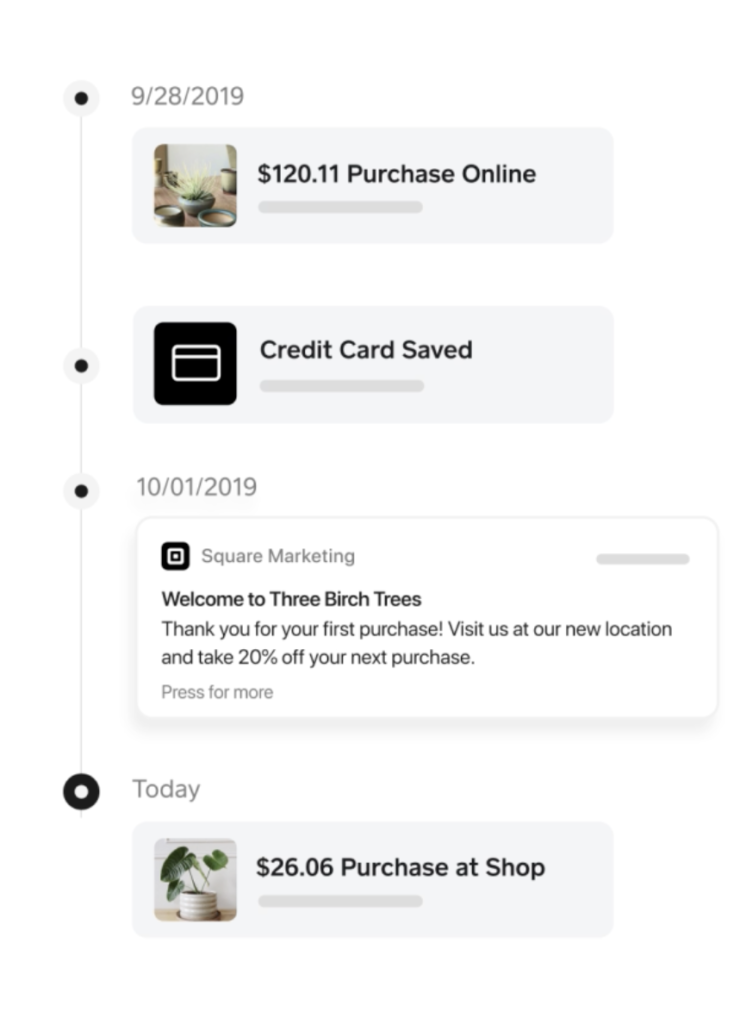

Square offers a full ecosystem of business tools across four main categories: commerce tools like payment processing and point of sale, customer management tools like marketing and CRM, employee management tools like shift scheduling and payroll processing, and banking tools like business checking accounts.

Here’s a full breakdown:

Square commerce products

Square customer management products

Square staff products

Square banking products

Benefits of using Square

All-in-one business solution

Square offers a complete business ecosystem to support its POS software. A payment processing solution and an ecommerce platform are built into the POS system, while a range of proprietary hardware is available for mobile and brick-and-mortar sales. Square also offers industry-specific software for retailers, restaurants, and professional services.

Native business integration tools such as team management, payroll, and marketing are also available as add-ons. Square also works with a long list of third-party integrations for everything from accounting to delivery apps for users who prefer to keep their current business software tools.

Feature-rich free plan

One of the reasons why Square is popular among small and new businesses is because it offers a feature-rich free plan. This allows merchants to launch their business with Square with zero upfront cost.

Easy to use

Square has a reputation for being incredibly easy to use. Real-life first time users can attest that it will only take minutes to sign up for a Square account. And once you get access to a merchant dashboard, users get a guided tour and set up instructions to upload inventory, create payment options, design invoice templates, and even launch a website.

Multichannel and omnichannel sales platform

Square provides its users with multiple sales channels regardless of plan type. The software is ready to conduct sales and accept payments from a mobile device, in storefronts, and online. Each Square account comes with a built-in ecommerce platform that allows users to set up and manage their ecommerce website. Square’s payment gateway service is accessible from the merchant account dashboard, where users can create payment links and QR codes to embed on invoices and social media posts and send them via email and messaging apps to collect payment.

Seamless ecosystem

All of Square’s business management tools are fully integrated. So, inventory records are always updated in real-time, regardless of whether businesses receive sales online, in-store, or on-the-go. The built-in omnichannel functionality allows users to receive timely low-stock alerts and avoid selling out-of-stock products. It also helps provide a better customer experience by making customer profiles available on every platform.

Read more: Square reviews

Square competitors and alternatives

Square’s main competitors and alternatives are PayPal, Stripe, and Helcim. All three of these companies also offer free accounts with different payment processing tools.

| Square | PayPal | Stripe | Helcim | |

|---|---|---|---|---|

| Best for | Small business | Seasonal, occasional sellers | Online sales | Fast growing businesses & B2Bs |

| Merchant account type | Aggregate | Aggregate | Aggregate | Traditional/dedicated |

| Fee structure | Flat rate | Flat rate | Flat rate | Interchange plus |

| Monthly software fee | $0-$89 (POS+payments) | $0-$30 (virtual terminal) | $0-$10 (Custom domain) | $0 |

| Chargeback fee | Waived up to $250/mo | $20 | $15 | $15 refundable |

| Volume discounts | Sales volume > $250,000/year | Upgrade to Braintree for interchange plus rates | Custom interchange plus rates quote for large-volume sales | Built-in volume-based discounts |

| Scalability | Integrations, Square large business solutions | PayPal for Enterprise + upgrade to Braintree | Coding-based customizations | Developer tools and APIs |

Read more: Check out our recommended best alternatives to Square.

PayPal vs Square

PayPal is a pioneer in online payment processing and a trusted brand known for improving online conversion rates. It supports mobile payments via a mobile POS app and proprietary mobile card reader. PayPal offers a wide range of payment solutions and is particularly unique for its proprietary payment methods that make it easy to sell to customers with a personal PayPal account.

Though both PayPal and Square are easy to set up (both are payment facilitators) and essentially mobile-based, PayPal is a better option for occasional sellers because it doesn’t require its users to create a complete POS platform to start selling. And PayPal payment methods can be easily added to any e-commerce website. Square Payments is exclusive to websites created on the Square platform.

Read more: How Square stacks up against Paypal.

| Square | PayPal | |

|---|---|---|

| Best for | Small business | Occasional sellers and ecommerce businesses |

| Merchant account type | Aggregate | Aggregate |

| Fee structure | Flat rate | Flat rate |

| Monthly software fee | $0-$89 (POS+payments) | $0-$30 (virtual terminal) |

| Chargeback fee | Waived up to $250/mo | $20 |

| Volume discounts | Sales volume > $250,000/year | Upgrade to Braintree for interchange plus rates |

| Scalability | Integrations, Square large business solutions | PayPal for Enterprise + upgrade to Braintree |

Stripe vs Square

Stripe is a popular online payment processor that also serves as a payment facilitator, offering a free merchant account similar to Square. It is a developer-first platform that allows for nearly unlimited customization options via APIs and SDKs. That said, Stripe also offers payment processing services that don’t require coding, such as basic checkout, invoicing, and recurring billing tools.

Stripe’s clear difference from Square is that it has no native POS software (PayPal has Zettle). It requires custom integration to use the system with a business platform but offers huge customization potential. To put it in perspective, Stripe powers Shopify’s payment processing service, Shopify Payments. Stripe also requires users to design a mobile POS app to work with their credit card readers.

Read more: Our detailed comparison of Square vs Stripe.

| Square | Stripe | |

|---|---|---|

| Best for | In-person sales | Online sales |

| Merchant account type | Aggregate | Aggregate |

| Fee structure | Flat rate | Flat rate |

| Monthly software fee | $0-$89 (POS+payments) | $0-$10 (Custom domain) |

| Chargeback fee | Waived up to $250/mo | $15 |

| Volume discounts | Sales volume > $250,000/year | Custom interchange plus rates quote for large-volume sales |

| Scalability | Integrations, Square large business solutions | Coding-based customizations |

Helcim vs Square

Helcim is a merchant account provider that offers a variety of payment methods and services. Like Square, Helcim also offers free point-of-sale, invoicing, and ecommerce software. Unlike Square, Helcim supports a number of additional cost-saving features, such as built-in volume discounts, free credit card processing, and level 2 and 3 data processing for B2Bs—all automated so savings are always optimized.

Also, unlike Square, Helcim offers a traditional merchant account. So, while it’s less prone to holds or frozen funds, it requires an approval process, for which most small businesses may not be suitable. The fee structure is also set to maximize savings compared to Square’s.

| Square | Helcim | |

|---|---|---|

| Best for | Small and new businesses | Fast growing businesses & B2Bs |

| Merchant account type | Aggregate | Traditional/dedicated |

| Fee structure | Flat rate | Interchange plus |

| Monthly software fee | $0-$89 (POS+payments) | $0 |

| Chargeback fee | Waived up to $250/mo | $15 refundable |

| Volume discounts | Sales volume > $250,000/year | Built-in volume-based discounts |

| Scalability | Integrations, Square large business solutions | Developer tools and APIs |