Key takeaways

Payment technology has evolved in recent years, allowing small and medium-sized businesses access to a wider range of payment methods and automations that eliminate repetitive business management tasks. Stripe and Square are two popular names in the payment industry, as each offers a wide range of payment processing services and integrations for building a customized POS and payments ecosystem.

When comparing Stripe vs Square, businesses should keep an eye on the key differences between the two software systems to decide what will work best for their business.

Stripe and Square are just two of the many POS and payment systems in the industry. Check out our guide to POS software for more options.

For advanced online payment customization, choose Stripe

For the best value all-in-one POS and payment system, choose Square

Stripe: Best for customization and growing e-commerce

Overall Reviewer Score

4.46/5

Pricing

4.25/5

Hardware

4/5

Software Features

4.79/5

Support & Reliability

4.58/5

User Experience

4.69/5

User Scores

4.43/5

Pros

- Zero monthly fees

- Highly customizable

- Supports cross-border payment processing

- Strong machine learning-based fraud protection

- Chargeback management features

Cons

- Relies heavily on integrations for POS tools

- Initial setup takes time

- Requires a developer to make the most out of the platform

Square: Best all-in-one system for startups and small businesses

Overall Reviewer Score

4.43/5

Pricing

4.25/5

Hardware

4.5/5

Software Features

4.17/5

Support & Reliability

3.75/5

User Experience

4.69/5

User Scores

4.67/5

Pros

- All-in-one POS and payment solution

- Forever-free POS available

- Easy, nearly instant setup

- Variety of payment terminals

- Omnichannel payments and selling

- Affordable, elegant hardware

Cons

- Limited scalability

- Customer support limited to business hours

- Does not integrate with other POS software

How are Square and Stripe different?

Stripe

Square

Software type

Payments

All-in-one POS

Payment services

Primarily for online

In-person and online

Compatibility

Open-source; can be paired with most other software and websites

With other Square applications and APIs

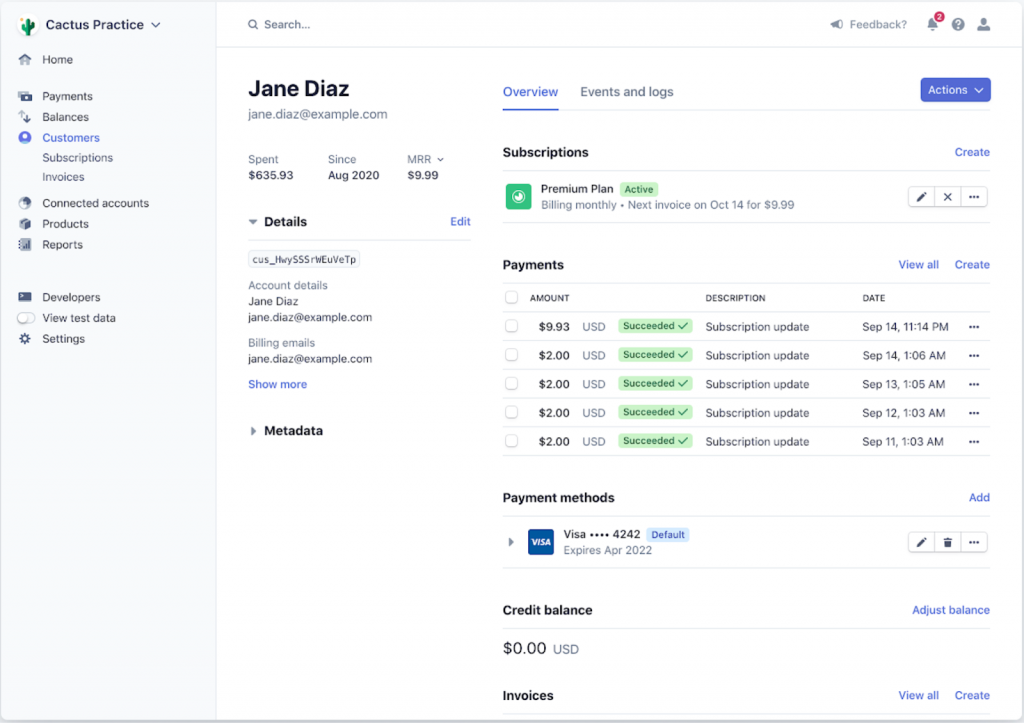

Square and Stripe are both excellent payment processors for small and growing businesses. Both providers have also expanded their services, but there are key differences that make them better suited for certain business types.

Primary use

The key difference between Stripe and Square is the nature of each software. Stripe is primarily a payment processing service originally designed to support online sales, while Square is a POS system meant to support in-person sales.

Compatibility

Stripe is compatible with most online platforms, such as e-commerce websites, CRMs, and project management software. It can be integrated as a simple payment processor or use advanced tools to add more functionality to your website.

Meanwhile, the downside of Square is that its business tools, such as Square Payments, can only work within Square’s ecosystem. Businesses that decide to migrate to a different POS or payment services provider won’t be able to continue using any of Square’s features.

Ease of use

Square is more versatile when it comes to payment services. The system is designed for easy payment processing setup for e-commerce websites, and its POS and payment terminals are ready to use out of the box.

Stripe, on the other hand, is well known for creating highly customized online payment checkouts. And while it can also support in-person sales, Stripe will require some configuration and coding before it accepts payments.

Scalability

Stripe offers no-code customizations and more advanced upgrades through software. Merchants using Stripe can choose from hundreds of third-party integrations and huge resources of developer tools. Stripe has also recently launched interchange-plus pricing structure for businesses with large-volume card transactions.

Meanwhile, Square offers a long list of pre-built business management tools that users can add to their basic Square POS. Square also offers developer-based upgrades but is only available for B2B and enterprise-level businesses that use the platform.

Read more: Guide to B2B payment processing

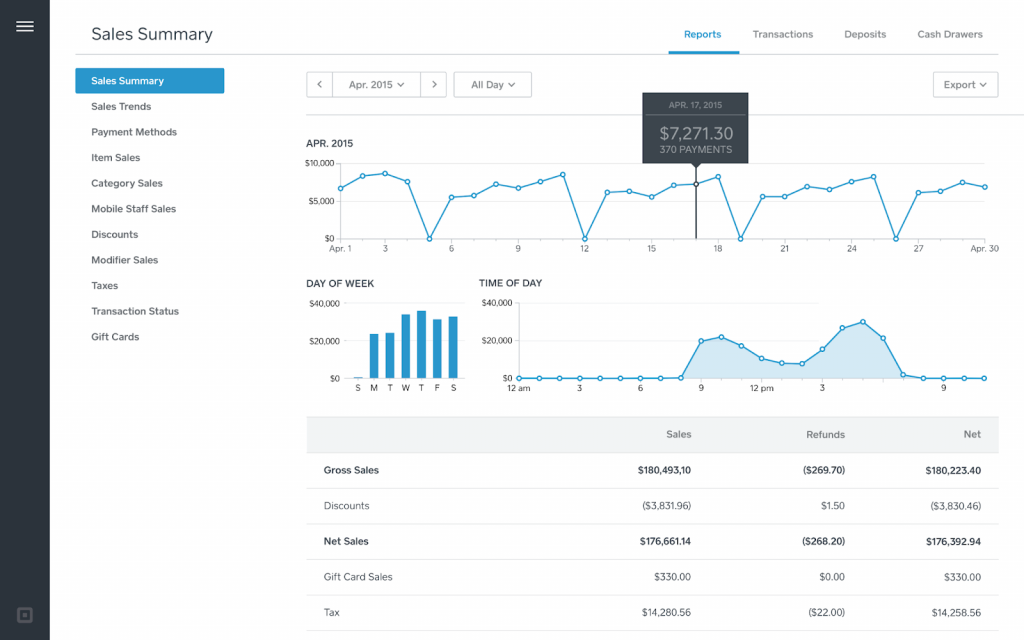

Stripe vs Square: Fees

Stripe

Square

Monthly account fee

$0–$10

$0–$60

Transaction fee

From 2.7% + 5 cents

From 2.6% + 10 cents

Large-volume business

Custom interchange plus rates

Discount if processing over $250,000 annually

Hardware cost

$59–$349

$0–$799

Forever free plan

✓

✓

Available upgrades

✓

✓

Chargeback cost

$15

Waived up to $250/month

When comparing Square vs Stripe in terms of pricing, the key is to remember that Square’s monthly fees include the use of its POS software, while Stripe’s quotes are purely for payment processing features. Both Stripe and Square do not charge businesses a monthly fee to access their payment processing services and quote a flat-rate fee for transactions. There are no long-term contracts and cancellation fees for Square and Stripe, so businesses using either provider can cancel any time.

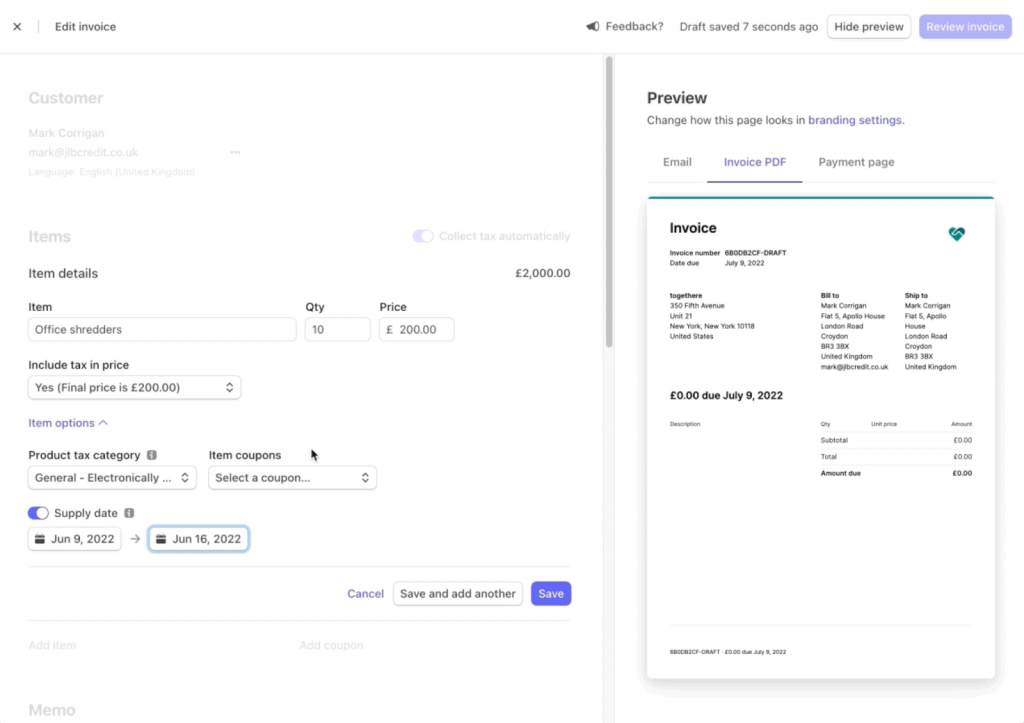

When to choose Stripe

Use Stripe if you’re only looking for a payment processing service. Stripe only charges a monthly fee if the business upgrades to access custom checkout pages. Stripe is also cheaper than Square for businesses that accept digital invoice, keyed-in, and ACH payments. Only Stripe can process international payments; it charges a small 1% for cross-border fees. Stripe also provides custom interchange-plus rates for large-volume businesses.

When to choose Square

Use Square if you are also looking for a POS software. Square only adds a monthly fee and decreases its transaction cost if the business upgrades to a more advanced POS software. Square also offers a slightly better transaction rate for simple card-present and card-not-present transactions. It even waives chargeback costs up to $250 per month. As an all-in-one POS system, Square leads for hardware variety and price range.

Stripe vs Square: Hardware

Square Magstripe Reader

Square Contactless Reader

Square Stand

Square Terminal

Square Register

Square range of hardware

Stripe Reader M2

BBPOS WisePad 3

BBPOS WisePOS E

Stripe Reader S700

Stripe range of hardware

Stripe’s mobile contactless card reader costs $59, similar to Square. Stripe also provides a couple of in-store card readers priced at $249 and $349. These are handheld mobile types similar to Square’s (which cost $299). Square’s mobile credit card readers start at $10 for a magnetic stripe reader (the first one is free), while the contactless card reader costs $59 each. In-store registers range from $149 to $799 (available in installments in some states).

The main difference between Square and Stripe hardware is the setup requirement. A mobile credit card reader needs to be paired with a POS app downloaded to a smart mobile device. Square’s mobile POS app can be downloaded for free but with Stripe, businesses will need to design their own or pay for a third-party app.

When to choose Stripe

Choose Stripe if you want customized software for your payment terminals. For example, Stripe’s in-store credit card readers can be programmed with Lightspeed POS or custom POS software. So, while Stripe’s hardware is similarly priced with Square, these have very limited out-of-the-box features. Businesses will need custom-programmed features to maximize hardware use.

When to use Square

Choose Square if you are looking for hardware that’s ready to use out of the box. Square also offers a wider range of options for both mobile and countertop setups. You only need to download the mobile payment app on your smartphone and connect the mobile card reader to start accepting payments. Credit card readers and Square POS software are built into the Square’s in-store POS hardware.

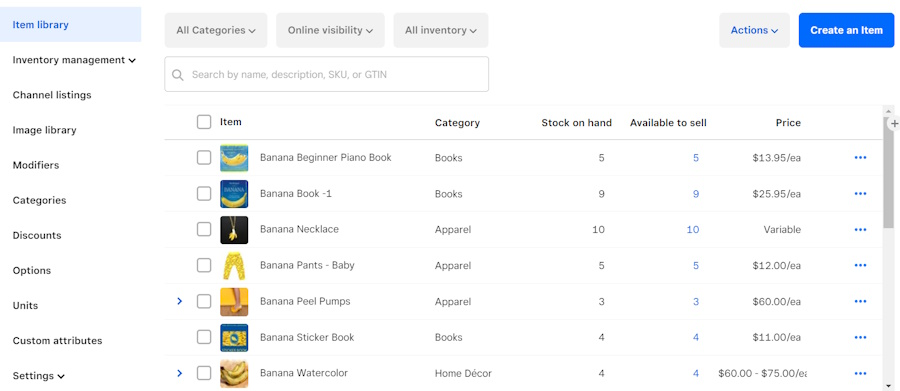

Stripe vs Square: POS System

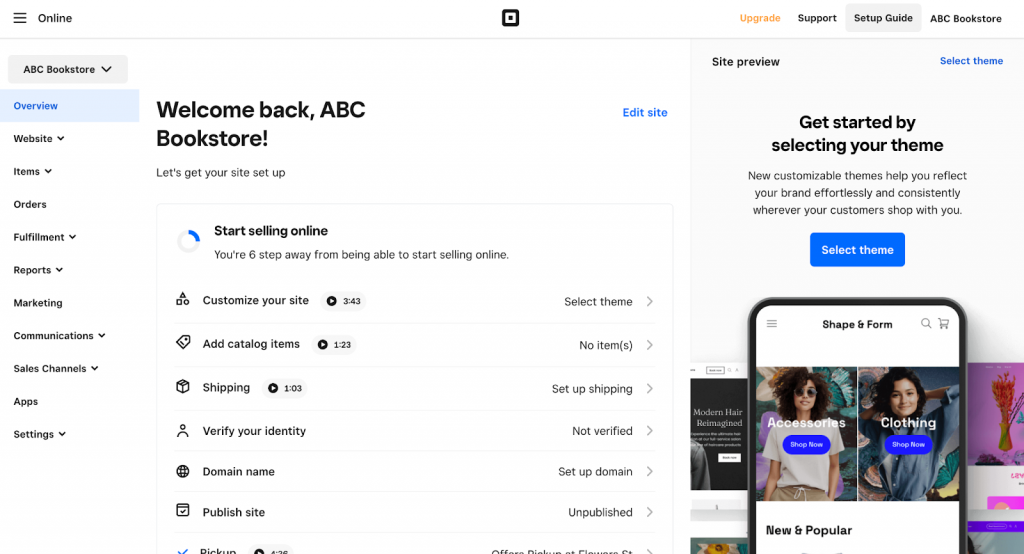

One of the key differences between Stripe and Square is its POS system. Being primarily a POS provider, Square has a clear advantage. Square offers free POS software and different types of POS software for users upgrading to industry-specific solutions.

When to choose Square

Startups and small businesses find Square’s all-in-one POS system the most convenient because it can be set up and ready to manage your omnichannel sales, e-commerce, inventory, fulfillment, CRM, and reporting within a day. Square even offers free and paid industry-specific POS solutions, allowing businesses access to features specific to their needs.

However, mid-size businesses can easily outgrow Square’s features, even with its software upgrades. For example, Square’s inventory management features offer limited flexibility. They won’t be able to handle a complex matrix of raw ingredients, processed items, and special orders that other retail and restaurant POS software could.

When to choose Stripe

Choose Stripe if you need a custom-based solution. Stripe can be integrated with most POS systems, including custom POS software for mid-size and larger businesses. This makes Stripe a better choice if you are looking for scalability.

Stripe vs Square: Payment Services

Payment Types & Methods

Stripe

Square

Credit card

✓

✓

Digital wallets

✓

✓

ACH/e-check

ACH

ACH

Buy now, pay later (BNPL)

Integration

✓

Invoicing/Recurring billing

✓

✓

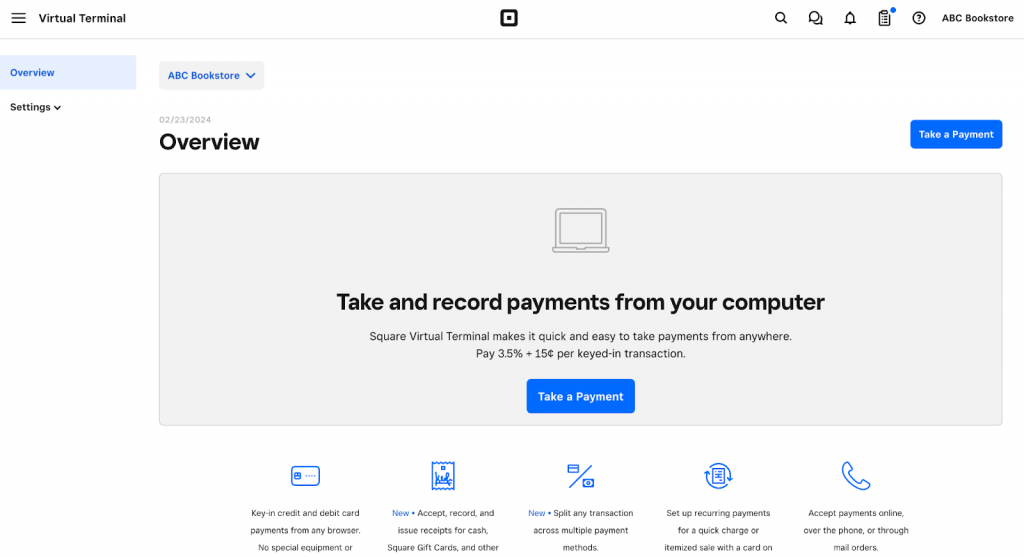

Virtual terminal

Limited

✓

International

✓

✗

CBD

✗

✓

Healthcare services

✗

✓

Social media selling

✓

✓

Choosing between Stripe and Square for payment services boils down to the type of payment methods and checkout solutions you are looking for.

When to choose Stripe

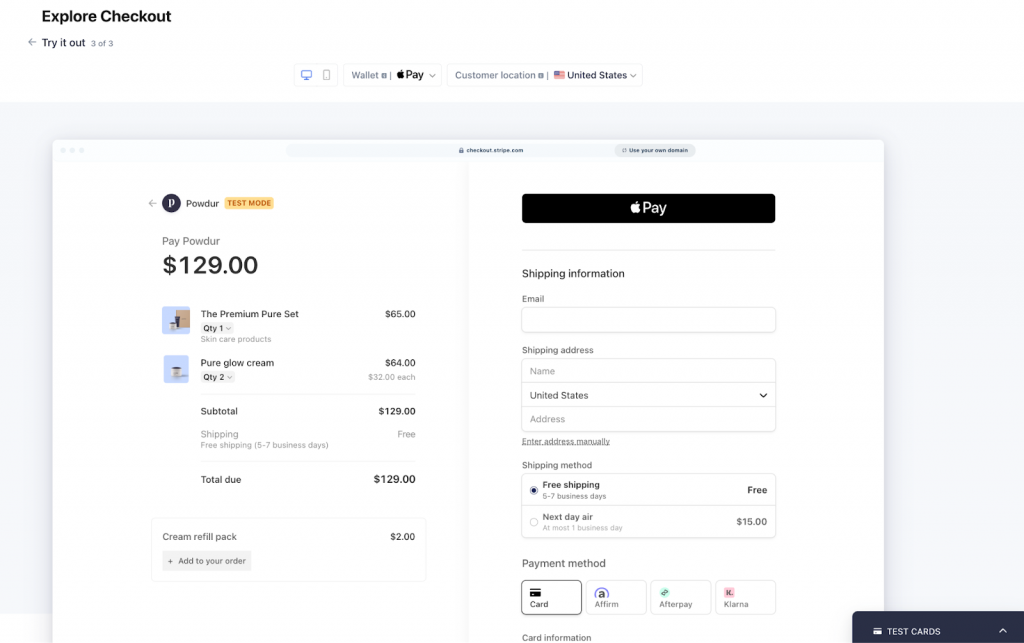

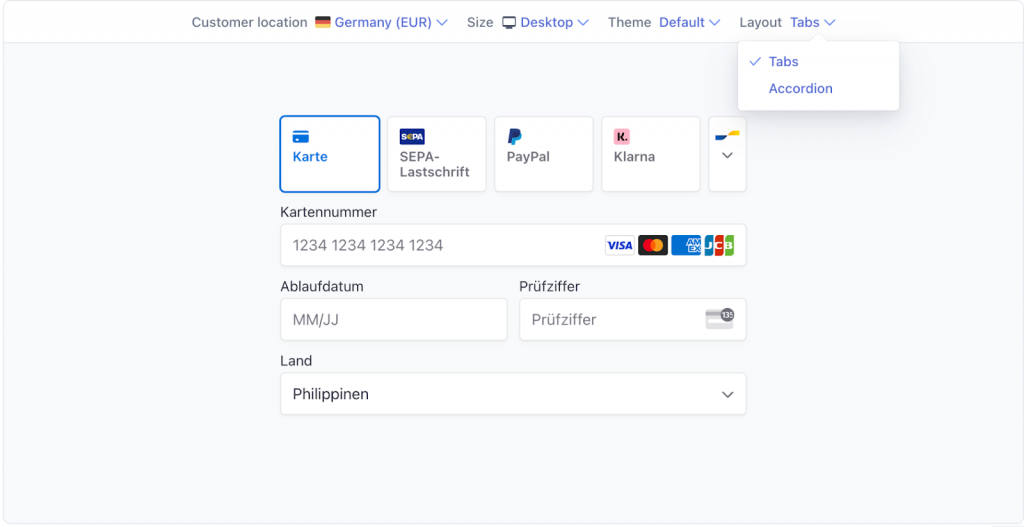

Stripe is regarded as one of the most outstanding online payment providers, particularly for its ability to process international payments and customize language and currency at checkout based on the customer’s location. Stripe’s customization tools also allow businesses to fine-tune their customer’s checkout experience and efficiently filter suspicious transactions.

When to choose Square

Choose Square if you primarily accept in-person payments. Square is also a fully HIPAA-compliant POS and payment service ideal for healthcare POS solutions. It also provides its own CBD program for businesses that want to use Square to sell some form of CBD products. Square is also the better choice for users looking for a virtual terminal and BNPL payment service.

Read more: Best retail POS systems

Stripe vs Square: Customization

Square and Stripe’s customization tools are quite different from each other, with pros and cons on both sides.

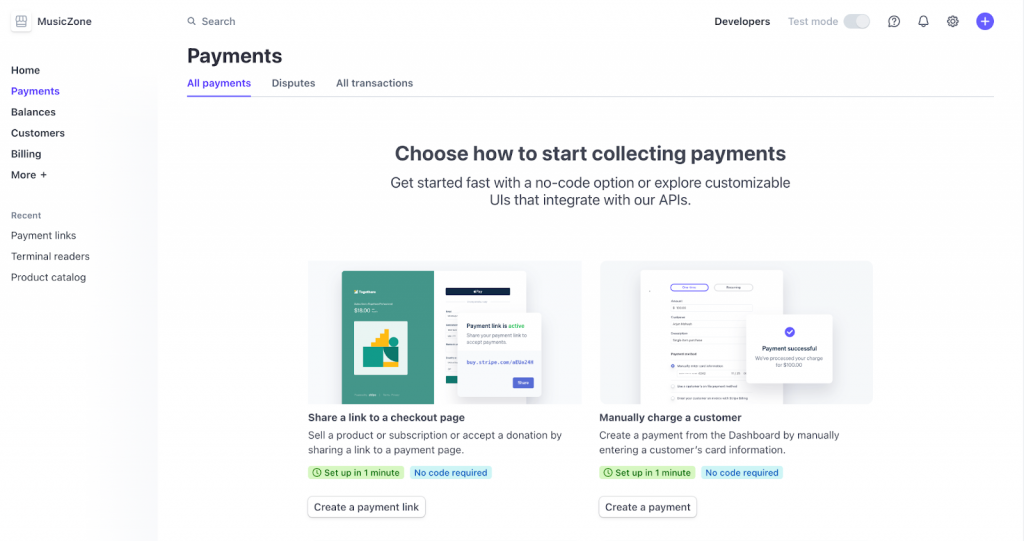

When to choose Stripe

Choose Stripe if you are tech-savvy. Stripe’s versatility comes from all the possible customizations it provides through developer-based tools. Everything from how a checkout page looks and feels to the actual design of POS software can be created with the help of Stripe’s trove of SDK and API documentation. Stripe is also compatible with over 600 third-party applications and offers a long list of accredited developers to help get your custom POS system started.

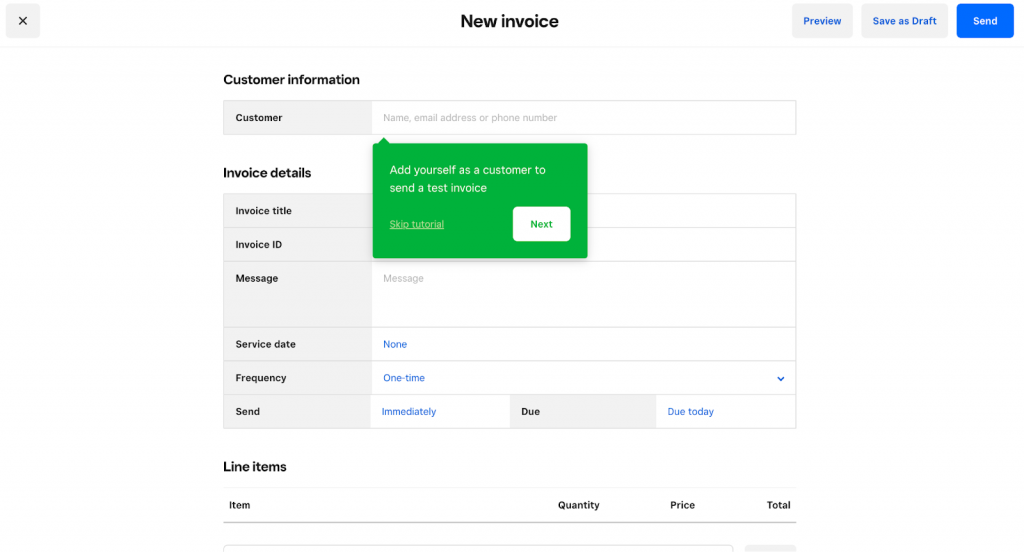

When to choose Square

Choose Square if you prefer pre-built and easy-to-set-up customizations. Square lets you customize your payments and POS software with other Square products. For instance, Square’s invoicing solution can be upgraded to include tools such as multiple package estimates. Square Payroll, Square Marketing, and Square Loyalty are optional add-ons that can help tailor your POS software to your business needs. There’s also a Square App Marketplace for third-party business management integrations. Note that Square also supports developer-based customization for enterprise-level businesses.

Stripe vs Square: Fraud Prevention

Fraud prevention is a significant factor to consider when choosing a payment and POS system. Both Square and Stripe use machine-learning technology and are certified PCI Level 1 service providers using 3D Secure and 256-bit encryption. Both also have a merchant platform to manage fraud detection settings and chargeback claims.

When to choose Stripe

Stripe edges Square out with more customization and fine-tuning fraud detection options to adjust according to a merchant’s acceptable risk level. On top of that, Stripe also supports additional tools for identity verification through SSN, address, IP, and biometrics (facial and fingerprint). Stripe can also recognize and verify local IDs in more than 30 countries.

When to choose Square

With Square, businesses can also set custom rules and alerts for fraud prevention. Although it does not provide the same level of customization as Stripe, Square’s Risk Manager service ensures that every payment sent for processing is screened and assessed for potential risk. Square’s chargeback management tool also makes it easy to dispute and respond to claims by having the functionality to submit proof of transactions from the platform instead of sending via email.

Which is best?

Square stands out as an ideal solution for small businesses—with its all-in-one solution, easy setup, affordable and ready-to-use hardware, and forever-free plan. As a one-stop-shop for all things startup, Square is a popular choice for businesses needing a quick and convenient way to get their business off the ground with minimal investment.

Stripe is also popular among small businesses. Though not as convenient as Square, Stripe is also preferred by new online businesses using e-commerce platforms such as WooCommerce and even Shopify. Stripe users have an advantage because it can work with most business platforms, which means your POS system can grow, and Stripe’s features can scale along with it.

Making your choice

The choice between Stripe vs Square for small business comes down to your goals and available resources—not just in terms of budget but also your access to software development skills. Square is definitely the most cost-effective solution, especially if you are building from the ground up. Setting up quickly at a low cost means minimum business downtime and more sales.

On the other hand, if your goal is to quickly grow your business with product volume, partnerships, integrations, and international sales, then Stripe may be your best fit.

Read more: Stripe vs PayPal