Key takeaways

- Retail payment processing allows your business to accept a wide variety of payment methods in-store, on mobile, and online.

- The right payment processing solution will increase your sales, provide customer convenience, and build loyalty by enabling a personalized buying experience.

- Choosing the best payment processing company depends on matching your current business needs and future business plans to a provider’s pricing and features.

What is retail payment processing?

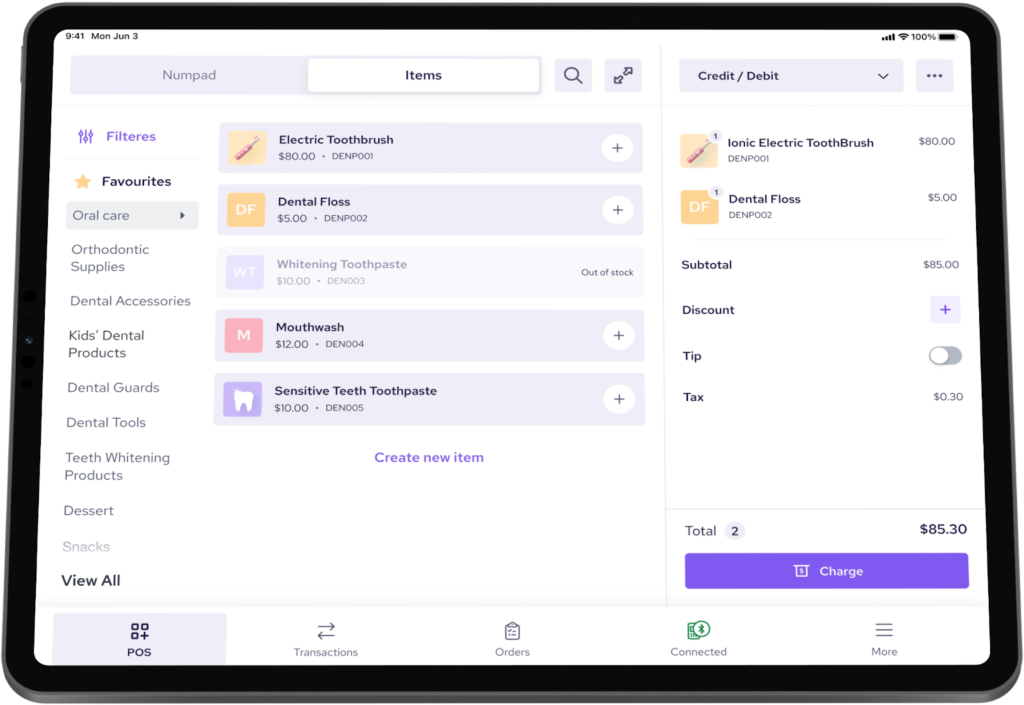

Retail payment processing is a system of hardware and technology that allows retailers to accept cash and non-cash payments from direct customers in order to complete a transaction. Modern retail point-of-sale (POS) systems can integrate with payment processors, which means that every transaction is automatically reconciled with your sales and inventory records — whether customers use cash or cards to pay for their purchases.

Why is retail payment processing important?

There are many benefits to using a retail-specific payment processing service:

- It increases sales by supporting multiple payment methods: Retail payment processors support a long list of payment methods popularly used in retail sales — including digital wallet payments, Pay Later integrations, EBT/Snap, and gift cards, in addition to credit cards.

- It provides omnichannel sales management: Retailers often sell on multiple channels to maximize sales. Retail payment processors offer omnichannel tools so businesses can record and monitor in-person, online, and mobile sales from a single platform.

- It improves customer convenience: Retail payment processors allow customers to pay with their preferred payment method. It also provides customers with a seamless buyer experience. For example, customers can start their purchase in-store and make payment via mobile or online and vice versa.

- It supports business integration tools: A retail payment processor is designed to integrate with most retail business management tools, such as payment gateways, customer relationship management, accounting, and POS software.

- It ensures payment processing security: Retail payment processors comply with industry security standards and are built to efficiently handle frequent daily transactions both in-person and online.

If you’re just starting out and on a budget, the most cost-effective solution is an all-in-one retail POS and payment system.

Square offers a feature-rich free plan that comes complete with payment processing, e-commerce website builder, and invoicing built into a retail-specific POS software. Sign-up is instant, so you can get your business up and running in minutes — no application or approval required. Create your free Square account today.

How does retail payment processing work?

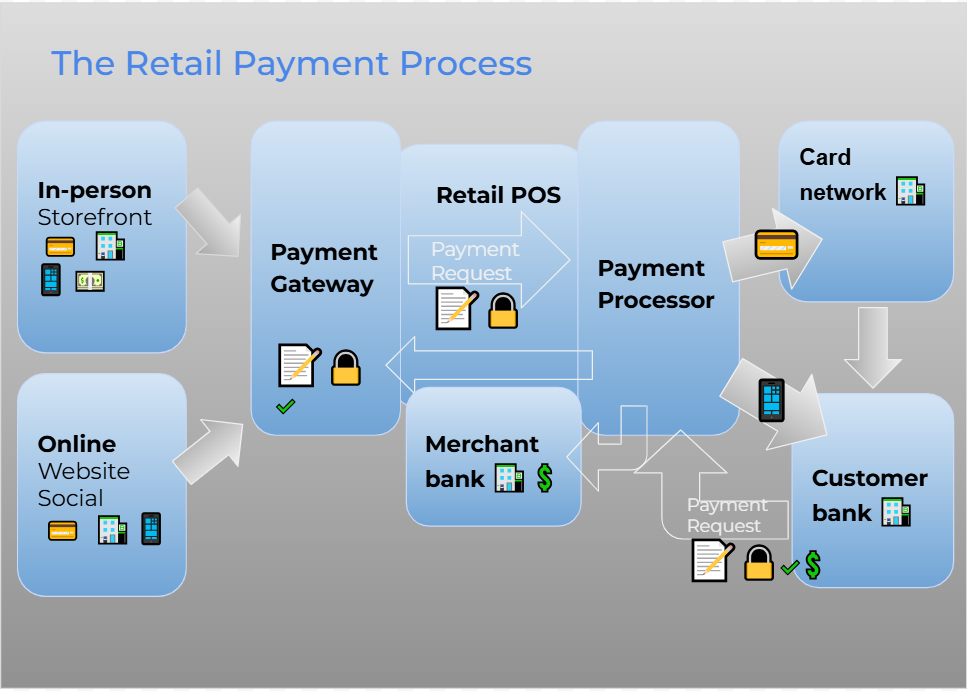

As with all business-to-consumer transactions, retail payment processing deals with primarily one-off payments using cash, card, and contactless methods, such as digital wallets, that have access to both the customer’s credit and bank funds. Customers then complete their purchase either in-person (at a storefront or mobile) or online (on an e-commerce website or social media post).

In the back end, the payment gateway, payment processor, and retail software work together to get the payment approved by the customer’s bank and eventually update the merchant’s POS inventory and sales records.

Below are the steps that take place in retail payment processing:

- Payment information capture. Customers provide their payment details at checkout, and information is captured by the payment gateway.

- Transaction authentication. The payment gateway verifies the authenticity of the payment information with security features such as CCV.

- Payment data encryption. Once the payment information is authenticated, the payment gateway encrypts the data before sending it through to the payment processor.

- Payment authorization request. The payment gateway sends a payment authorization request to the payment processor along with the transaction details and payment information.

- Card network assessment. For card transactions, the request first goes through the card network to verify the account and assess the transaction fees. Non-card transactions, such as bank transfers, go straight to the customer’s bank.

- Transaction validation. The customer’s bank validates the transaction data and checks to make sure that the customer has enough bank or credit balance to fund the payment request.

- Payment authorization response. The customer’s bank sends back either a positive (approval) or negative (rejection) response to the payment processor and forwards the information to the payment gateway.

- Customer notification. The customer’s bank’s response is displayed on the screen to notify if the transaction was successful.

- Transaction settlement. If approved, the transaction amount is debited from the customer’s account, and the payment processor deposits the proceeds of the sale to the merchant account.

Related:How Does Credit Card Processing Work?

Types of retail payment methods

Retail payment processors support a wide variety of payment methods.

Primary payment method options include:

- Cash

- Credit cards

- Debit cards

- ACH/echecks

- Bank or electronic fund transfers (EFTs)

- Gift card/ gift cheques

- EBT/SNAP

Alternative payment methods that are growing in popularity in retail transactions include:

- Digital wallets, including mobile wallets

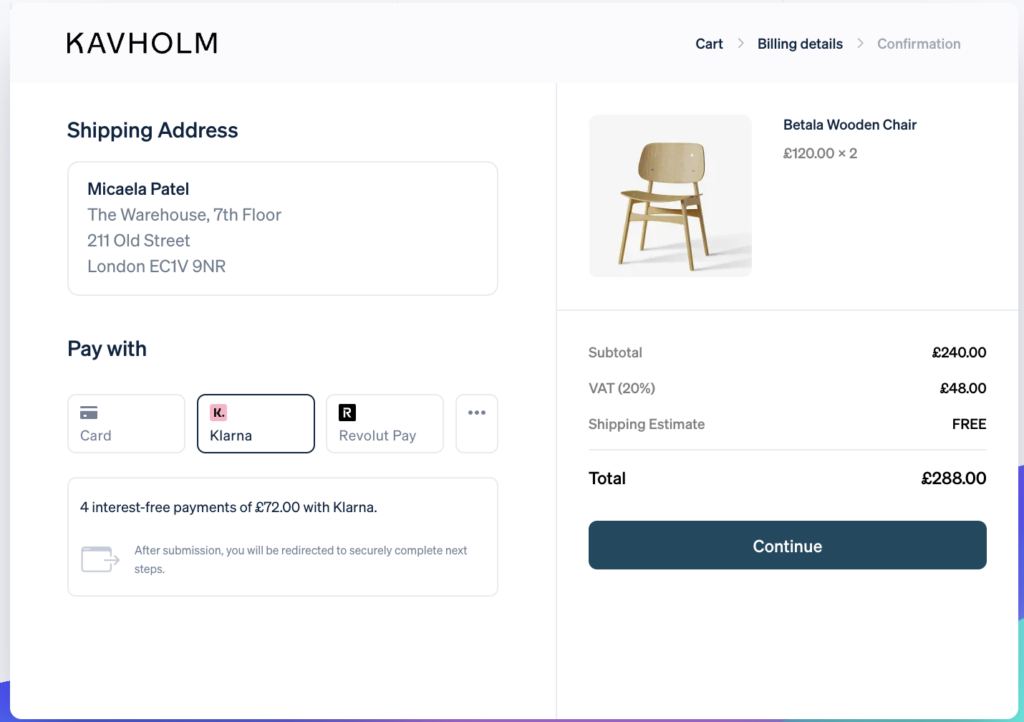

- Short-term financing, such as Pay Later platforms (Klarna, AfterPay, Affirm, etc.)

- Peer-to-peer payment platforms (Venmo, Cash App, Zelle)

There are also less popular alternative payments, such as cryptocurrency with platforms like PayPal.

Related: How to Accept Payments Online

Retail payment processing cost

Merchants typically pay an average of 2.7% per credit card transaction. This covers interchange, assessment, and payment processor markups. ACH payments cost less at around 0.5% to 1%, capped at $5 to $10 per transaction.

Credit card processing fees will vary depending on your payment service provider’s pricing model and your business’s annual sales volume. In general, the larger your credit card sales volume, the lower your transaction rate.

Learn more: Credit Card Processing Fees: Complete Guide

How to choose the best retail payment processor for your business

The best retail payment processor is unique to each business, but the steps towards determining the right fit are generally the same.

Step 1: Evaluate your business profile

To determine the best retail payment processing solution for your business, the first step is evaluating your business profile.

Consider your:

- Retail business type: A small mom-and-pop shop might not need as many payment methods as a grocery store.

- Current sales volume and growth rate: This tells you which payment processor pricing model will best fit your business.

- How your customers like to pay: Spend your budget only on payment services that you actually need.

- Integration requirements: Match with payment processors that are compatible with business software you currently use.

- Hardware requirements: Compare with provider hardware options to find the best value.

Step 2: Curate a list of potential providers

Once you have a clear understanding of your payment processing needs, you can start researching potential retail payment processors. Begin with a Google search of the most popular providers, then create a checklist of key features and business-specific features based on your evaluation in step 1.

Step 3: Compare each provider for value-for-money

A provider is not the best option just because it offers free services or the lowest rates. The best approach is to compare providers based on what features you get in each pricing plan. For example:

- Create columns for free, basic, standard, and advanced plans on your checklist of features.

- Check off which features are available for each provider and compare

- Rank your provider list based on which payment processor offers the most features with the lowest fees.

Step 4: Evaluate for scalability

Next, compare each payment processor based on how its more advanced capabilities align with your business plan. Do you see your business needing these tools to grow? Are there add-on features, such as multilocation management and customizations (like developer APIs), relevant to your growing business needs? Does the payment processor offer discounted rates as your sales volume increases?

Step 5: Get expert and real-life user feedback

This time, search the internet for at least three expert reviews for each provider. Make sure to focus on the latest feedback since software is regularly updated. Look at comparison tables as well as expert insights that tell you what to expect from the provider, such as in contract terms and support.

Visit third-party review sites and read the latest feedback from real-life users describing their experience using the software. If the payment processor runs on a mobile app, check out user feedback from Google Play and App Store.

Step 6: Narrow down your list and speak to a sales representative for each provider

By now, you should notice some providers standing out for you more than others. At the same time, you’ve likely discovered more questions relevant to your business needs you’d like answers for.

Pick three to five of the best payment processors and contact a sales representative. Ask your questions, see if you can negotiate for better rates, terms, or fees — maybe even custom pricing.

Don’t forget to also ask about payment security:

- Is it included in the current pricing?

- Can you customize the acceptable risk level from the platform?

- Does it include a chargeback and dispute management feature?

- Will the payment processor assist you with your PCI compliance?

Doing this will give you more helpful information and help you arrive at your decision.

Related: What is Payment Security?

Best retail payment processing companies

Still unsure? I evaluated the most popular retail payment processors in the industry today to help you get started.

The best retail payment processing companies for 2025 are:

Our Score (out of 5)

Pricing Structure

Payment Terminal Options

POS and Ecommerce Compatibility

Chargeback Management

Reporting Features

4.38

$0-$29+/month Flat rate

Excellent

Exclusive to Square

Excellent

Good

4.25

$0-$30/month

Flat-rate

interchange-plus

Good

Excellent

Good

Good

4.15

$0/month

Custom interchange-plus

Great

Excellent

Great

Excellent

4.08

$0-$10/month

Flat rate

Custom interchange-plus

Good

Excellent

Excellent

Excellent

4.05

$0/month

Interchange-plu

Good

POS Exclusive to Helcim

Ecommerce flexible

Great

Good

Square: Best all-in-one retail payments processor

Overall Score

4.38/5

Pricing & contract

4.5//5

Payment processing

4.6/5

Account features

4.25/5

Expert score

4.25/5

Pros

- Free all-in-one retail business system

- Wide range of payment terminal options

- No merchant account application

- Free ecommerce and website builder

Cons

- Exclusive to Square’s POS and ecommerce

- Not the cheapest transaction rates

- Some limitations to reporting and analytics

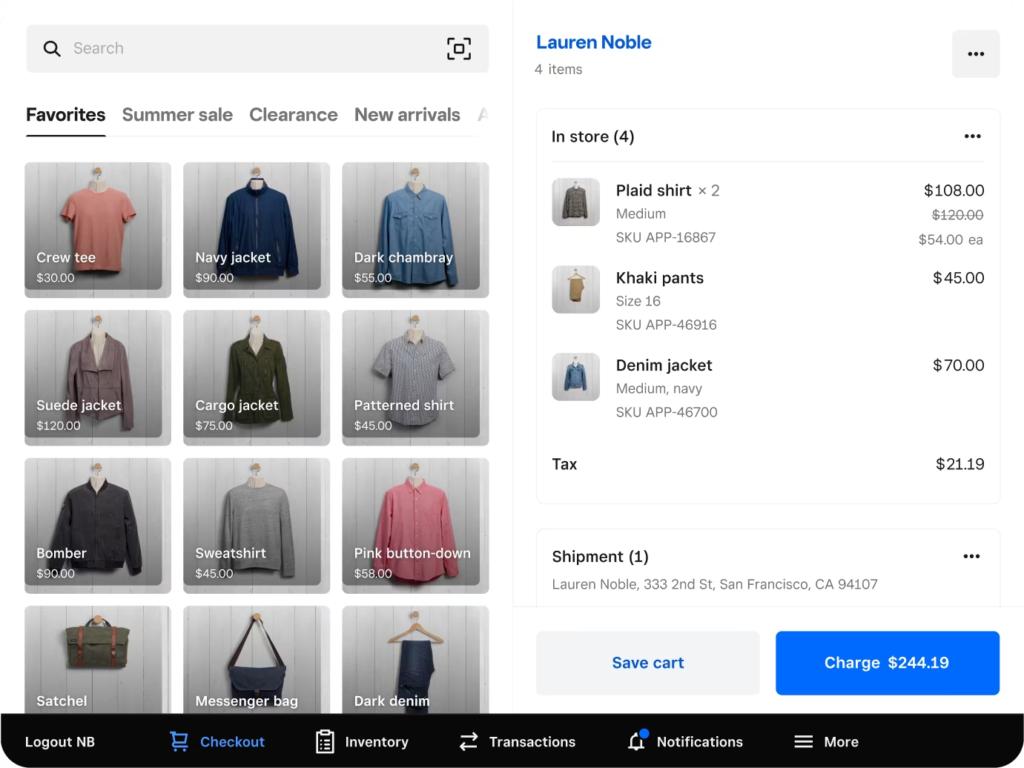

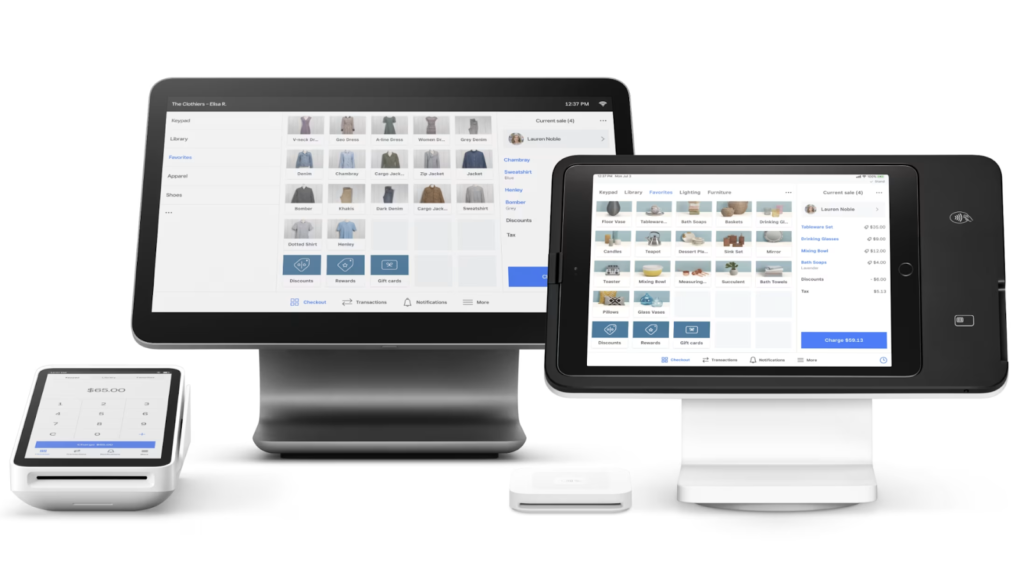

Square is an all-in-one POS system that includes a built-in payment processing feature. I like how the system supports a POS solution with retail-specific software, checkout features, and an e-commerce website builder for completely integrated multichannel sales. Best of all, the entire service starts with a free account, which means you can build all this with very little to zero upfront cost. There are no monthly fees (unless you need to upgrade your POS tools) or long-term contracts.

This level of scalability and small-business friendliness makes Square stand out from other providers on this list. It also offers a wide range of mobile and countertop payment hardware options. Square does not require a merchant application process and even waives chargeback fees of up to $250 per month. That said, using Square’s payment feature will lock you into Square’s POS and e-commerce platform. If you need a more flexible solution, consider PayPal or Payment Depot instead.

Transactions

- Monthly account fee: $0-$29+ including POS software

- Card-present fee: 2.6% + 15 cents per transaction

- Card-not-present fee: 2.9% + 30, or 3.3% + 30 cents (payment links) per transaction

- Pay later: AfterPay 6% + 30 cents per transaction

- Tap-to-pay: iOS and Android 2.6% + 15 cents per transaction

- Manual entry: 3.15% + 30 cents per transaction

- Chargeback fee: Waived up to $250 per month

- Same-day funding: +1.75%

Payment hardware

- Mobile: $0-$59

- Smart terminals: $299 or $27 per month x 12 months

- Countertop: $149-$799 (financing available)

- Payment methods: Square card readers can process swipe, dip, and tap payments (digital wallets, QR). It also integrates with AfterPay for Pay Later payments and supports Android and iOS tap to pay and EBT/SNAP. Online checkouts can process manual entry card payments and digital wallet options. Square’s POS software supports cash tracking features.

- Payment terminal options: Square’s range of hardware includes mobile card readers, smart terminals, tablet stands, and integrated countertop registers with built-in magstripe, EMV chip, and contactless readers.

- POS compatibility: Square Payments is exclusive to Square’s POS and mobile app software.

- E-commerce compatibility: Square’s payment service is only compatible with a Square-hosted e-commerce platform. However, Square’s payment links can be embedded in any email, real-time messaging, and social media platform.

- Chargeback management: Includes real-time notification and dispute management tools. It also waves up to $250 worth of chargeback claims per month.

- Fraud prevention: The Square merchant account includes an interactive fraud prevention platform that provides fraud monitoring, customizable acceptable risk management, and reporting tools.

PayPal: Best add-on payment processor

Overall Score

4.25/5

Pricing & contract

4.25/5

Payment processing

4.5/5

Account features

3.75/5

Expert score

4.63/5

Pros

- Customer trust that boosts conversion

- Can be added to any POS and -ecommerce checkout payment processor

- Supports multi-currency and cryptocurrency payments

- No merchant account application

Cons

- Add-on fees for billing management virtual terminal

- Complaints of frozen funds

- Complex pricing model

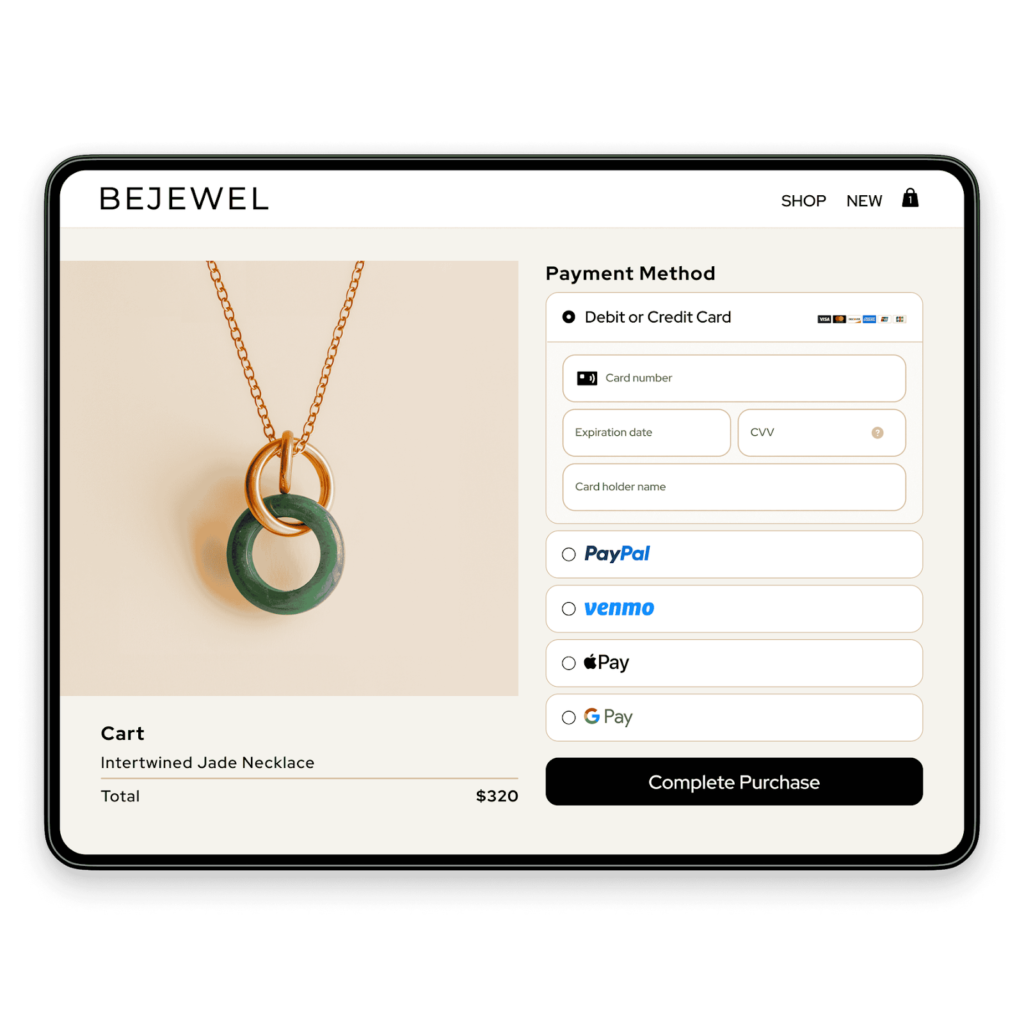

PayPal is a pioneer in digital wallet payment solutions. Eventually, it created business accounts that allowed retailers to accept payments. Like Square, small businesses love PayPal because it’s easy to set up without any merchant account application requirements. But unlike Square, PayPal checkout can be added to storefront POS and e-commerce platforms that already have a payment processor.

In January of this year, PayPal made “interchange plus pricing with gross settlement” available for merchants who complete onboarding and set up Advanced Checkout which involves developer-based customization. However, this requires a short evaluation to determine if your business needs advanced checkout. PayPal also charges additional monthly fees for manual entry (virtual terminal), add-on payment gateway, and subscription management (billing).

Transactions

- Monthly account fee: $0-$30/month

- Card-present fee: 2.29% + 9 cents

- Card-not-present fee: 2.99% + 49 cents (Standard card and digital payments), 3.49% + 49 cents (Venmo, PayPal checkout/guest checkout)

- Pay later: PayPal Pay Later 4.99% + 49 cents

- Tap-to-pay: iOS and Android 2.29% + 9 cents

- Manual entry: 3.49% + 9 cents

- International payments: +1.5% for foreign credit card transactions

- Payment gateway: $0 (payment links), $25 (add-on to any payment processors on e-commerce platforms)

- Chargeback fee: $20

- Same-day funding: +1.5%

- For qualified merchants: Interchange + 49 cents per transaction

Payment hardware

- Mobile: $29 for the first reader, $79 for each additional

- Smart terminals: $239-269

- Countertop: N/A

- Payment methods: PayPal accepts in-person and online payments. It can process a complete range of retail payment methods for both guests and customers with a PayPal account. PayPal also supports manual payment entry, iOS and Android tap-to-pay, cryptocurrency payments, as well as its own Pay Later platform.

- Payment terminal options: PayPal’s payment terminal is limited to one type of mobile card reader and smart terminal, but both are well reviewed and offer great value for money.

- POS compatibility: PayPal offers its own POS software but can be integrated with other payment processors already embedded in a POS platform.

- E-commerce compatibility: As with its storefront POS, PayPal’s online checkout can be used as a primary payment service or as an add-on option for ecommerce platforms that already have its own payment processor. Like Square, its payment links can be embedded into any online social media, email, and instant messaging platform.

- Chargeback management: PayPal assists both retail customers and business owners in processing chargeback claims. You can also get chargeback protection from PayPal for an additional fee per transaction.

- Fraud prevention: PayPal merchant accounts come with machine-learning fraud monitoring tools and analytics for businesses using advanced checkout.

Payment Depot: Best custom payment services for growing businesses

Overall Score

4.15/5

Pricing & contract

4/5

Payment processing

4.25/5

Account features

4/5

Expert score

4.38/5

Pros

- Tailored payment services with custom fees

- Compatible with various POS and e-commerce platforms

- Multiple payment gateway options

- Traditional merchant account

Cons

- Only available for US merchants

- Next-day funding with fee

- Merchant application process

Payment Depot is a traditional merchant account and payment services provider powered by Stax. It allows businesses to choose from Payment Depot’s long list of payment services, so you only need to pay for features that you need. A traditional merchant account also offers better scalability than aggregate accounts like Square’s. However, unlike Stax, Payment Depot’s pricing structure of customer interchange plus is more small-business friendly.

But what makes Payment Depot stand out from Square, and even Helcim, is its compatibility with most POS, e-commerce, and payment gateway platforms — so businesses can keep using Payment Depot even as they upgrade to new POS software and hardware. However, the downside of a traditional merchant account is that businesses undergo a merchant application process, which most new and micro businesses may not qualify for.

Also, Payment Depot’s default funding speed is two or more business days and does not support same-day funding. For flexibility and faster access to your funds, consider PayPal or Stripe.

Transactions

- Monthly account fee: $0

- Card-present fee: Custom interchange-plus

- Card-not-present fee: Custom interchange-plus

- Manual entry: Custom interchange plus

- Pay later: Varies depending on integration

- Chargeback fee: $25

- Same-day funding: N/A

Payment hardware

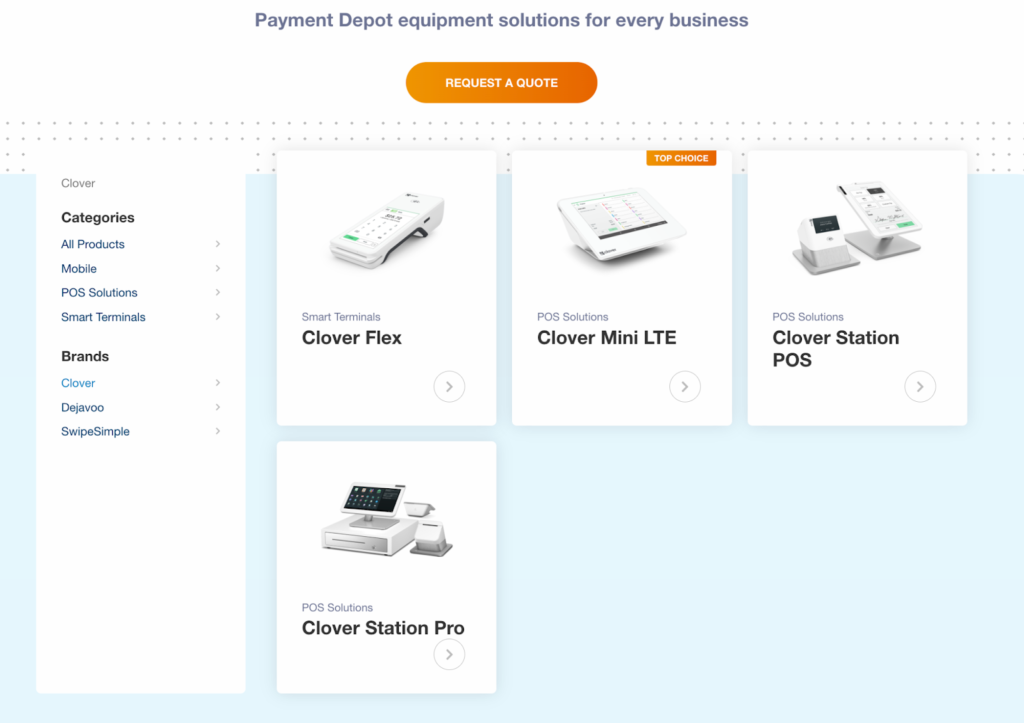

- Mobile: Varies (Clover, Dejavoo, SwipeSimple)

- Smart terminals: Varies (Clover, Dejavoo, SwipeSimple)

- Countertop: Varies (Clover, Dejavoo, SwipeSimple)

- Payment methods: Payment Depot supports all types of payment methods on in-person, online, and mobile platforms. It can process credit and debit cards, digital wallets, ACH, and echecks. Payment Depot can also work with most Pay Later platforms.

- Payment terminal options: One of Payment Depot’s advantages is its compatibility with popular hardware providers, including SwipeSimple, Clover, and Dejavoo.

- POS compatibility: Payment Depot integrates with most POS software, such as Clover and Loyverse.

- E-commerce compatibility: As with POS systems, Payment Depot’s online payment gateway integrates with most e-commerce platforms such as WooCommerce and BigCommerce.

- Chargeback management: Payment Depot’s merchant account platform comes with a dispute management system that notifies and tracks chargeback claims.

- Fraud prevention: Payment Depot also includes a fraud monitoring and reporting system. Like Square, it allows businesses to customize its prevention tools based on your acceptable risk level.

Stripe: Best for custom online retail processing

Overall Score

4.08/5

Pricing & contract

3.75/5

Payment processing

4.5/5

Account features

3.5/5

Expert score

4.63/5

Pros

- Fast set-up and no monthly fees

- Flat-rate or custom interchange-plus fees

- Flexible POS and ecommerce platforms

- Highly customizable checkouts

Cons

- Some basic payment services require customization

- Limited virtual terminal capabilities

- Mobile payment app requires custom development

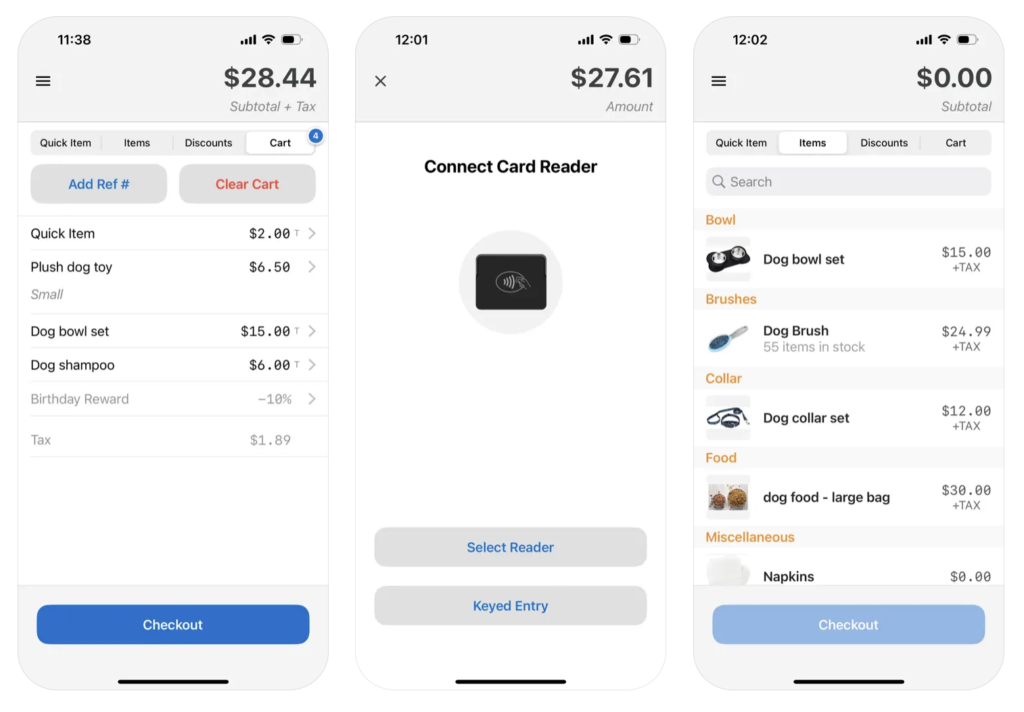

Stripe is a leading online payment services provider. Like Square, it has no monthly fees (unless you need a custom domain) and does not require a merchant application process. But what I like most about Stripe is that it now allows businesses to opt for a customer interchange-plus instead of flat-rate pricing. This new feature complements Stripe’s customization capabilities, making it a truly scalable payment platform.

I docked points for ease of use after testing the system because even though Stripe offers fast sign-up, it’s impossible to maximize Stripe’s basic tools without some code-based configuration. That said, Stripe remains the most versatile option among all the providers on this list. And businesses with access to software developer resources will get the most out of Stripe’s customization features. However, if you need a more beginner-friendly alternative, consider PayPal or Square instead.

Transactions

- Monthly account fee: $0

- Card-present fee: 2.7% + 5 cents or custom interchange plus rate

- Card-not-present fee: 2.9% + 30 cents or custom interchange plus rate

- Pay later: AfterPay, Klarna, Affirm, Zip; from 5.99% + 30 cents

- Tap-to-pay: +5 cents per transaction

- Manual entry: +0.5% per transaction

- Custom domain for online payments: $10 per month

- International payments: +1.5% per transaction

- Chargeback fee: $15 (refundable)

- Same-day funding: +1.5% per transfer

Payment hardware

- Mobile: $59

- Smart terminals: $249-$349

- Payment methods: Stripe supports mobile and online payment methods. It accepts swiped, chip, contactless, tap-to-pay, and manual entry payments through compatible mobile card readers and smart terminals. Stripe also accepts a long list of local payment methods, including a variety of Pay Later options, in 47 countries.

- Payment terminal options: Stripe’s range of compatible payment terminals is limited to mobile and smart terminal options. Note that the hardware requires configuration to integrate custom or third-party Stripe mobile payment apps.

- POS compatibility: Stripe is compatible with most POS software but will need some developer-based configuration.

- E-commerce compatibility: Stripe is also a popular payment processor choice for e-commerce platforms, including Shopify.

- Chargeback management: Stripe charges 5 cents if you want to screen a transaction for potential fraud. It also offers chargeback protection for a fee of 0.4% per transaction and also waves any successful chargeback claims.

- Fraud prevention: Stripe’s machine learning fraud prevention capabilities are best in class. It offers a more fine-tuned calibration of fraud monitoring tools than Square, allowing you to minimize missed transactions. Stripe also provides reporting and analytics of all flagged and rejected transactions.

Related: Best Online Payment Processors

Helcim: Best for optimizing fees for growing businesses

Overall Score

4.05/5

Pricing & contract

4.25/5

Payment processing

4.5/5

Account features

3.75/5

Expert score

3.63/5

Pros

- Interchange-plus pricing with automated volume discounts

- Free invoicing and subscription billing management tools

- Instant access to surcharging features

- Fee optimization tools, including level 2 and 3 data processing

Cons

- Expensive mobile card reader

- Exclusive to Helcim’s POS

- Limited third-party integrations

Helcim is a traditional merchant account services provider that also offers payment processing services directly to businesses. It provides proprietary payment hardware and free POS software which, though not as robust as Square’s, can efficiently handle unlimited inventory and customer data. Helcim also offers a native e-commerce website builder, customer management, invoicing and billing management, and virtual terminal tools at no extra cost.

Like Payment Depot, Helcim’s merchant application process is not the best choice if you need fast set-up. But there’s much value in getting access to Helcim’s features, which are built around automation and fee optimization. Automated volume discounts mean businesses with fast-growing sales don’t need to keep negotiating for lower rates. You can toggle surcharging tools on and off per transaction and automatically qualify for level 2 data processing discounts when your customer uses a commercial card.

Note that Helcim’s third-party integrations are limited. However, it provides developer-based API for custom integrations with your current POS system and other business platforms.

Transactions

- Monthly account fee: $0

- Card-present fee: From interchange plus 0.15% + 6 cents

- Card-not-present fee: From interchange plus 0.15% + 15 cents

- American Express transaction fee: 0.10% + 10 cents

- Pay Later: $0 – No integrations but allows you to split transaction payments to different payment methods, including recurring billing at no extra cost.

- Tap-to-pay: +10 cents per transaction

- Manual entry: From interchange plus 0.15% + 15 cents

- Chargeback fee: $25 (refundable)

- Same-day funding: N/A (Next business day)

Payment hardware

- Mobile: $99

- Smart terminals: $329 or $30 x 12 months

- Payment methods: Helcim supports both online and in-person payments with payment methods such as credit cards, ACH, split payments, and tap-to-pay. You automatically qualify for the online and in-person supercharging feature if you accept ACH and use Helcim’s smart terminal.

- Payment terminal options: Helcim’s payment terminal is limited to one mobile card reader and one smart POS terminal. The mobile credit card reader lets you accept chip and contactless payments and PIN-based debit card transactions, while the smart POS terminal includes a built-in magstripe reader.

- POS compatibility: Like Square, Helcim’s payment services are exclusive to its proprietary POS system. However, developer-based API allows you to custom-integrate Helcim with your POS software.

- E-commerce compatibility: Third-party e-commerce integration is limited to WooCommerce and Foxy.io for a more customized shopping cart. However, Helcim also offers a native e-commerce website builder to integrate its checkout solutions.

- Chargeback management: Helcim comes with a built-in chargeback management platform that allows you to monitor and respond to dispute claims within your merchant account.

- Fraud prevention: Activating Helcim’s Fraud Defender risk assessment feature allows you to customize your acceptable risk settings and record and monitor each transaction. You can opt for automatic void and approval or place potentially fraudulent payments on hold.

Methodology: How I evaluated retail payment processors

In evaluating the retail payment processors, I curated a list of popular payment processing providers in the industry. Each offers a wide range of payment methods and payment services with different pricing plans, which I then tested for scalability, value for money, and ease of use. This narrowed down my list to the following:

- Square

- PayPal

- Payment Depot

- Helcim

- Chase Payment Solutions

- CDGCommerce

- Clover Payments (Fiserv)

- Payline

- National Processing

- Dharma Merchant Services

- Stripe

- Stax

- QuickBooks

- Adyen

- PaymentCloud

- Shopify

- Lightspeed Payments

I then hand-picked five providers based on the following criteria:

- Pricing & contract (20%): Compares each provider’s pricing model, hardware cost, and contract terms, including incidental fees and chargebacks.

- Payment processing features (30%): Evaluates each provider’s range of payment methods and payment services such as invoicing, billing, stored payments, virtual terminal, and multicurrency.

- Account features (30%): Considers the provider’s support features, such as compatibility, native business management tools, funding speed, reporting functionality, offline capabilities, and customer support quality.

- Expert score (20%): This category takes into account each provider’s cost-effectiveness, popularity, ease of use, user feedback, and my personal experience with the platform.

Please note that provider scores are based on the currently available features and information, trends, and user demands to ensure that I provide you with the best information.

Related: 7 Best POS Systems for Small Business in 2025

The future of retail payment processing

Payment processing is an integral part of the retail business and continues to evolve as industry leaders continue to upgrade business software based on customer demands. If you are a retail business owner, consider the following:

Personalized customer experience will continue to drive retail innovation. Customers prefer to shop at stores that offer personalized service, whether in-store or online. To satisfy this, you’ll need the ability to provide payment methods that benefit your customer the most.

What you can do: Unless adding a payment method does not incur additional cost, it’s better to take a closer look at your payment strategy. Your online store can also use a dynamic checkout system that displays payment method options based on the customer’s geo location and profile.

Transaction data, including payment data, is your first-hand source of customer preferences. Customer information will continue to be the best source of information for planning a business strategy. This makes the ability to collect accurate data a significant advantage.

What you can do: Review your system’s reporting and analytics tools. Make sure that your customer profiles include transaction history records that can analyze your customers’ payment preferences. You should be able to generate an analysis of payment methods based on different demographics.

AI’s role in retail sales is growing. AI’s benefits in retail sales are growing beyond marketing and fraud protection. It can now automate payment approvals and optimize the checkout experience.

What you can do: You don’t need to interact directly with an AI platform to improve your retail business. Shop for POS systems and payment processors that have already integrated AI into their checkout and payment processes. Consider the cost and benefits of replacing or upgrading your current system.

Digital payment and Pay Later preferences are rising. As Gen Zs slowly fill the role of adults with the most spending power, demand for their payment method preference should be a major consideration for retailers.

What you can do: Check your current system’s compatibility with digital wallets and Pay Later platforms. Consider integrating options based on your customer profiles.