Key takeaways

A point-of-sale (POS) transaction is the process by which a customer pays a business for goods or services, from the initial payment prompt to the final fund transfers. Put simply, POS transactions are business-to-consumer (B2C) payments.

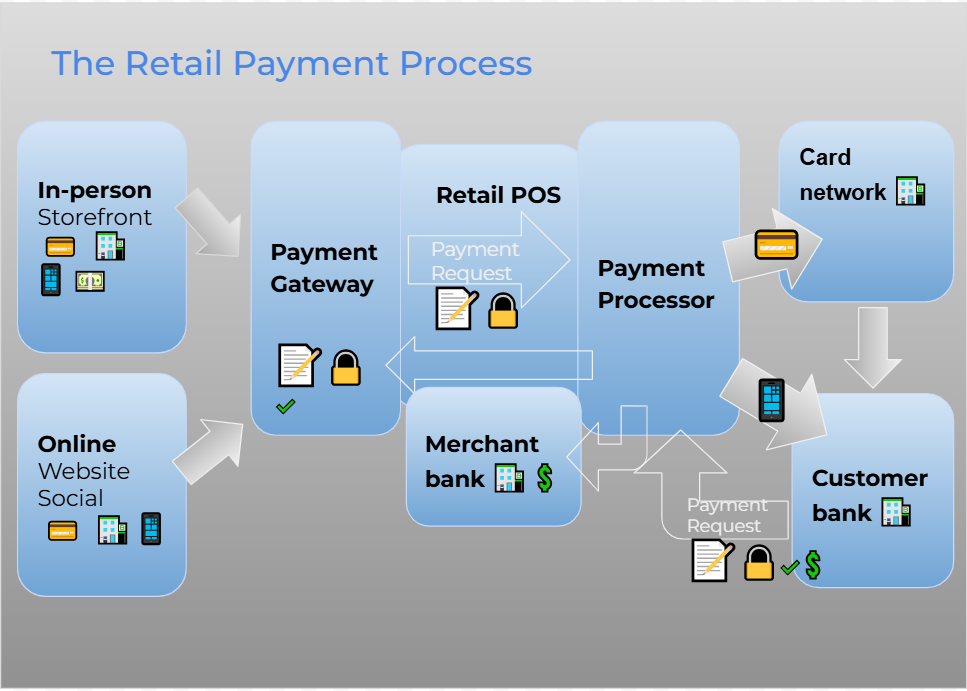

POS transactions can take place in person through a card reader or POS system or online through a payment gateway.

Learn more: What Is a POS System?

Types of POS transactions

There are three different types of POS transactions, each requiring a different setup:

- In-person (card-present transactions): Customers pay using a physical credit card, debit card, or smart device. You’ll need a card reader or POS terminal.

- Online (card-not-present transactions): Customers pay via your website or online portal. You’ll need a payment gateway.

- Returns and refunds: These transactions reverse the original in-person or online transaction and typically use the same tech that was used for the initial sale.

Key elements of a POS transaction

A successful POS transaction depends on both hardware and software components:

POS Hardware

The hardware for in-person POS transactions typically includes:

- Card readers

- Cash registers

- Receipt printers

- Barcode scanners

- Mobile devices (for mPOS) to accept payments on the go

Online transactions don’t typically require hardware.

POS Software

You’ll need at least a basic point-of-sale system or virtual terminal to enter payments for in-store and in-person sales.

For online transactions, businesses rely on e-commerce platforms, website builders, and payment gateways.

You’ll also need:

- A payment processor that can accept multiple payment methods

- The customer’s source of funds used to purchase the products

How a point of sale transaction works

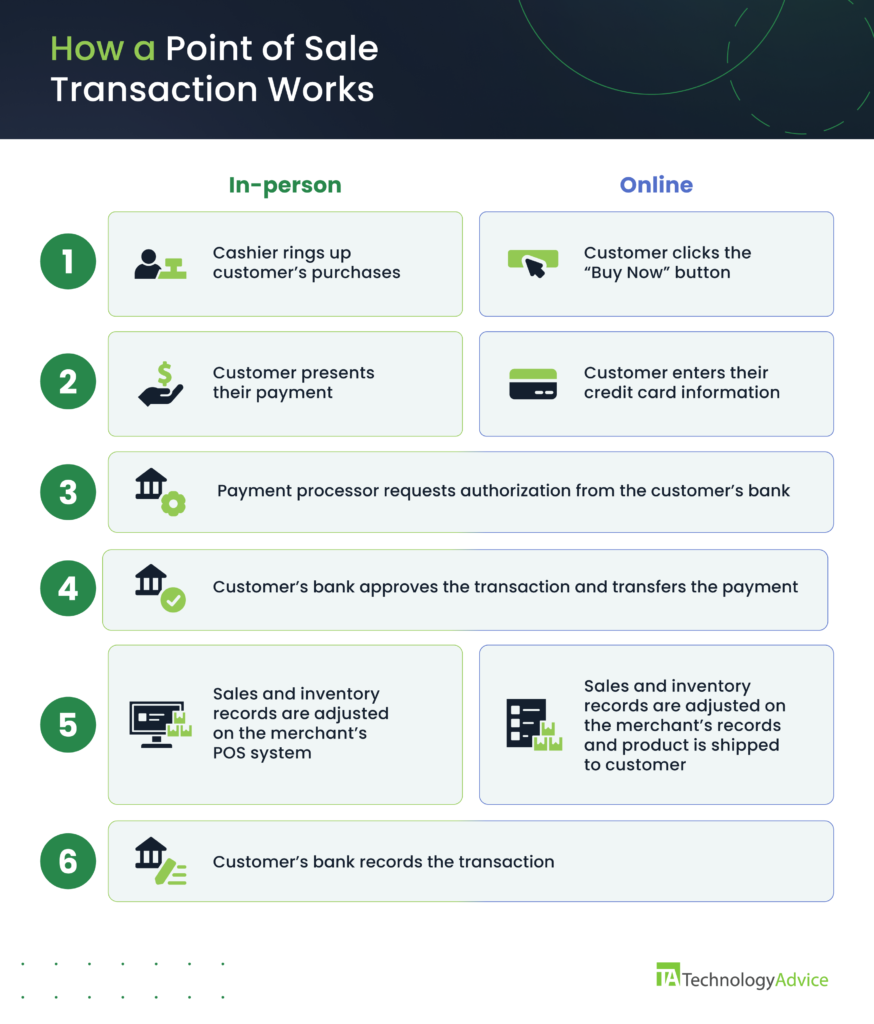

A POS transaction begins when a customer checks out items they intend to purchase and ends when the sale is finalized.

Here’s how it works:

- Customer selects products/services: The transaction starts when a customer clicks the “buy” button online or presents their items to the cashier for checkout.

- Customer enters payment information: For in-store transactions, customers swipe, dip, or tap a card, smartphone, or smartwatch. For online sales, the customer enters payment details using a digital wallet like Apple Pay or by manually entering the information. For online transactions, the payment gateway also encrypts the customer’s payment details for added security.

- POS system or payment gateway processes the payment: The POS system (if in-store) or payment gateway (if online) communicates with your payment processor to verify and approve the transaction.

- Transaction completion: Once the payment is approved, the POS system finalizes the sale, updates inventory, and adjusts the sales records.

Related: What is Payment Authorization?

Reconciling POS transactions

Updating records to reflect changes in sales, inventory, and revenue is a key part of any POS transaction. These records are usually housed in a POS, payment processing, accounting, or inventory system.

Particularly, POS software typically reconcile:

- Inventory: Decreasing on-hand stock counts based on the transaction

- Sales records: Updating register or sales reports to reflect the transactions

- Expense reports: Logging any cost of goods sold (COGS), taxes, and other fees

For the easiest and most accurate POS transaction reconciliation, integrate your accounting software with your POS system.

Accounting best practices for reconciling POS transactions

To further ensure accuracy and efficiency when managing POS transactions, keep the following accounting best practices in mind:

- Establish a cash handling policy

- Create a regular schedule for reconciling POS records

- Consider the payment method used for the transactions

- Conduct inventory counts

Learn more: How to Use a POS System

Modern POS transaction methods

Just a few years ago, cashiers would simply ask, “Cash or card?” Nowadays, modern POS systems support a range of payment methods designed for customer convenience and security.

- Contactless payments (NFC): Near-field communication (NFC) enables customers to tap their chip-enabled card, phone, or smartwatch to complete the payment. NFC payments are quick and extremely secure.

- Digital wallets: Popular digital wallets like Apple Pay and Google Pay allow customers to make purchases using their smartphones or smartwatches.

- EMV chip cards: Chip cards offer enhanced security by generating unique transaction codes for each sale.

These options are highly secure (more so than swipe payments) and are popular with today’s consumers.

Learn more: How to Accept Payments Online

POS transaction challenges & solutions

Businesses have been using POS systems and processing POS transactions for decades, and their benefits have long been established. However, even as technology advances, there are still challenges to using the system.

Compliance

- Legality: This includes managing POS transactions where certain products are heavily regulated. It also refers to certain payment methods that involve additional compliance requirements such as surcharging.

- Security: Merchants are expected to maintain Payment Card Industry (PCI) compliance to protect customers’ personal, financial, and sensitive information (such as PIN codes).

- Taxes: Local government expects merchants to file accurate tax returns on their POS transactions on time.

The solution: Work with a payment processing service that can assist you with PCI compliance. Integrate your account software with your POS to improve record keeping and report-generating automations and minimize human error.

Related: What Is Payment Security?

Accuracy

- Manual errors: POS transactions are repetitive and susceptible to human error. This can come anywhere from reconciling daily transactions to adjusting sales and inventory.

- Timeliness: The sheer volume of transactions that businesses need to record and manage can take time. Some records may not be updated, especially if you sell on multiple channels or locations.

The solution: Use POS software that maximizes automation for record keeping. You should also use a cloud-based system that can update business records in real time.

Cost

- Upfront investment: Some POS systems can require a significant investment in software, hardware, and payment processing. Physical setups for a POS system can also be costly.

- Ongoing cost: As your business grows, you will need software and hardware upgrades for your POS system, which can stack up and become expensive. This includes additional monthly fees for upgraded software and payment processing, as well as maintenance fees for your hardware.

The solution: Start your business with an all-in-one POS system that offers a free plan. You should be able to find feature-rich, even industry providers developed on a mobile-based platform such as iOS and Android that can cost significantly less. Also, look for providers that offer hardware payment plans or subscriptions that bundle hardware and or payment processing to get the most out of your upfront investment.

Finally, look for a provider that scales their plans so you have the option to pay only for features you currently need while also having add-ons available that seamlessly integrate with your basic setup as your business grows.

Learn more: POS System Costs

Transaction fees and costs

POS transaction costs can vary based on the type of payment processed. Here’s a quick overview:

- In-person transaction fees: Merchants pay a small fee for each in-person transaction, typically a percentage of the sale, between 2% and 3%.

- Online transaction fees: Online POS transaction fees are higher than in-person ones and typically range from 2.5% to 4%.

Learn more: Complete Guide to Credit Card Processing Fees