Stripe is a popular online payment processor because of its ability to accept a wide range of payment methods, top-notch security features, and customizability. However, online businesses looking to grow multichannel sales may look for Stripe alternatives that are easy to use, competitively priced, and offer seamless in-person payment processing.

For this guide, I compiled a list of the top Stripe alternatives for ecommerce businesses and examined pricing, features, ease of integration, security, and customer support quality.

Here are my top six picks:

- Square: Best overall Stripe alternative

- Shopify Payments: Best for Shopify websites

- Helcim: Best for interchange pricing

- PayPal: Best for easy integration

- PaymentCloud: Best for high-risk merchants

- CardX: Best for zero credit card processing fees

Top alternatives to Stripe in 2025

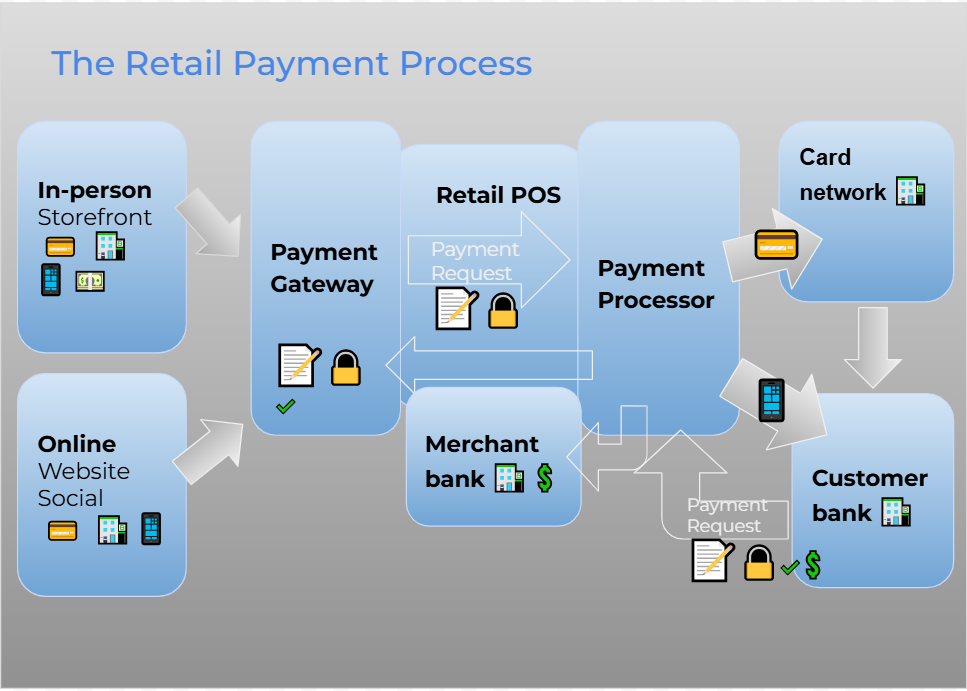

Although Stripe is an excellent payment processor for online businesses, it may not be the best option for those needing a “plug-and-play” option or an easy-to-use multichannel point-of-sale (POS) system. Below is a quick comparison of my recommended Stripe alternatives:

Provider

Starting Price per Month

Online Transaction Fee

Platform Compatibility

Multichannel Sales Tools

Ease of Set Up and Use

Square

$0

2.9% + 30 cents

Exclusive

- Storefront

- Mobile

- Ecommerce

- Payment links

- Virtual terminal

- Invoicing

Excellent

Shopify Payments

$5

2.9% + 30 cents

Exclusive

- Storefront

- Mobile

- Shopify Ecommerce

- Payment links

- Invoicing

Excellent

Helcim

$0

Interchange plus 0.15% + 15 cents to 0.50% + 25 cents

Limited

- Storefront

- Mobile

- Ecommerce

- Payment links

- Virtual terminal

- Invoicing

Good

PayPal

$0

2.99% + 49 cents

Excellent

- Storefront

- Mobile

- Ecommerce

- Payment Checkout

- Virtual terminal

- Invoicing

Excellent

Payment Cloud

$10

2% to 4.3%

Excellent

- Storefront

- Mobile

- Ecommerce

- Payment links

- Virtual terminal

- Invoicing

Good

CardX

$29

Credit card: 0%

Debit card: Starts at 2.91%

Good

- Storefront

- Ecommerce

- Virtual terminal

- Invoicing

Good

Square: Best overall Stripe alternative

Overall Score

4.28/5

Pricing

4.25/5

Hardware

4.5/5

Features

4.17/5

Support and reliability

3.75/5

User experience

4.38/5

User scores

4.67/5

Pros

- No monthly fees

- Omnichannel payment processing tools

- Easy to set up

Cons

- Payments exclusive to Square POS

- Limited support for cross-border sales

- Developer-based solutions only for enterprise accounts

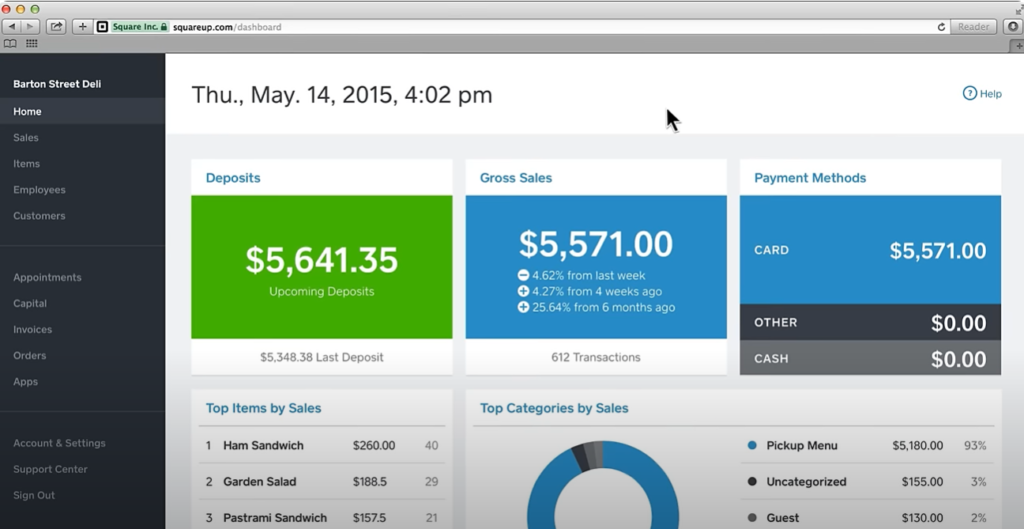

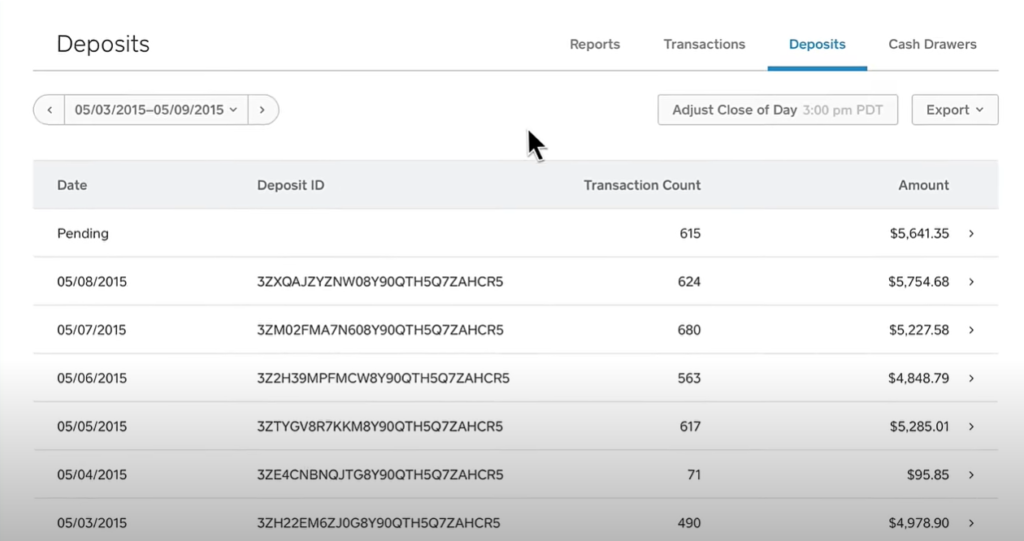

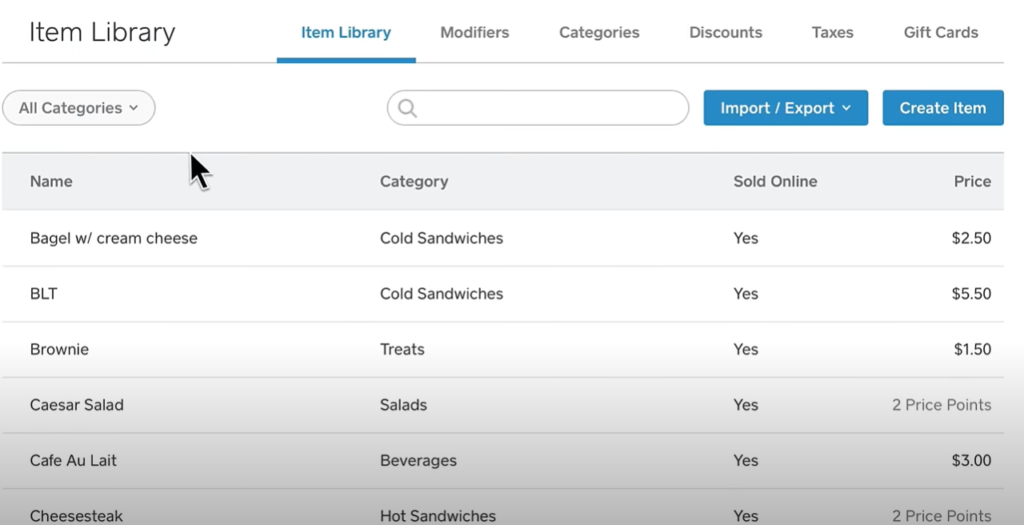

Why I chose Square

Square is an all-in-one POS platform that enables businesses to accept various forms of payments through several channels — in-person, online, and mobile. It provides hardware like card readers and terminals as well as payment gateway for POS systems and online payment processing. Square’s zero initial cost makes it a viable and attractive option even for startups, and it also offers easy integration with many popular ecommerce platforms for larger online businesses.

Businesses should choose Square as a Stripe alternative if quick setup, budget, and ease of use are top of mind. Both platforms let businesses accept payments easily and securely, with transparent pricing structures and straightforward setup processes. However, Square offers omnichannel payments without needing developer-based integration, making it a more user-friendly platform overall than Stripe. Square’s intuitive interface also makes it accessible to businesses with limited technical expertise. Businesses can easily adopt Square’s payment solutions and begin accepting payments.

Square is designed to adapt and grow alongside businesses, providing scalability and flexibility to accommodate changing demands. However, you will be limited to using Square’s POS and add-ons. It also does not have Stripe’s well-documented, open-source developer tools for creating tailored business solutions. You will need to upgrade to an enterprise account to access similar developer tools with Square.

Read more: Stripe vs Square

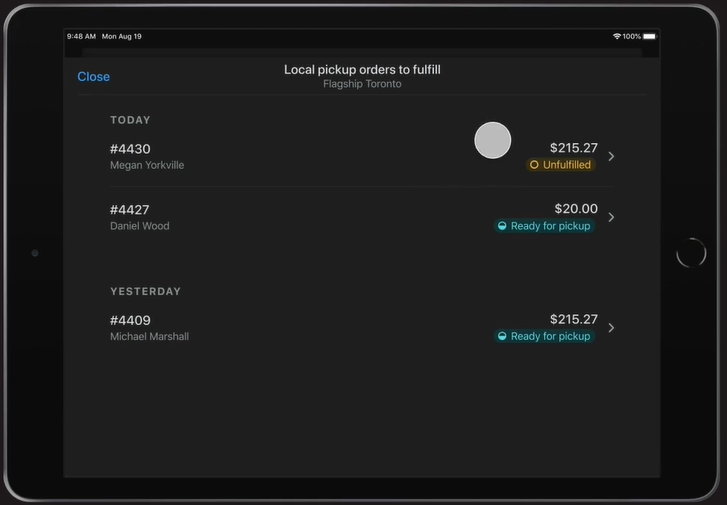

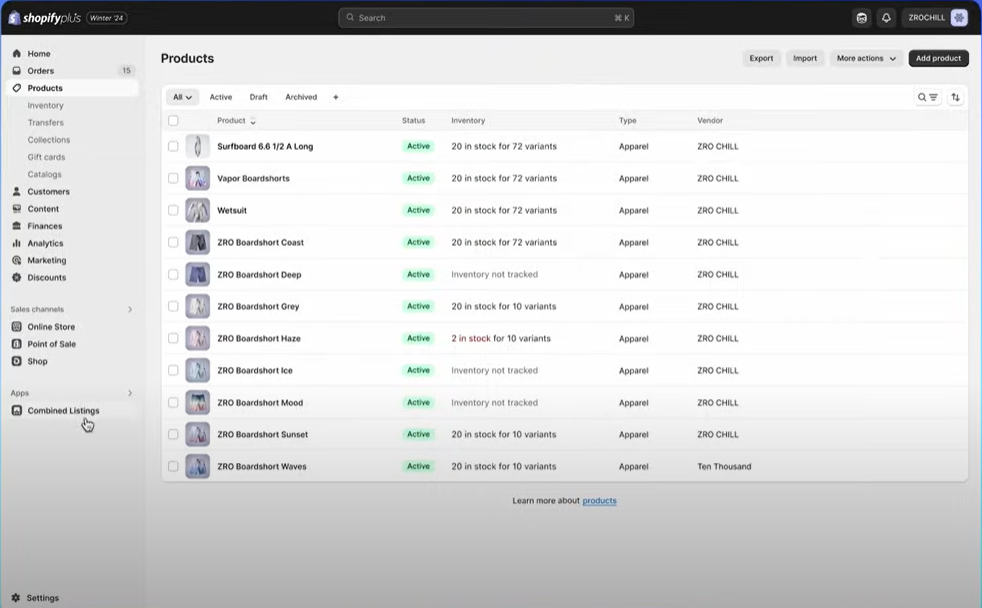

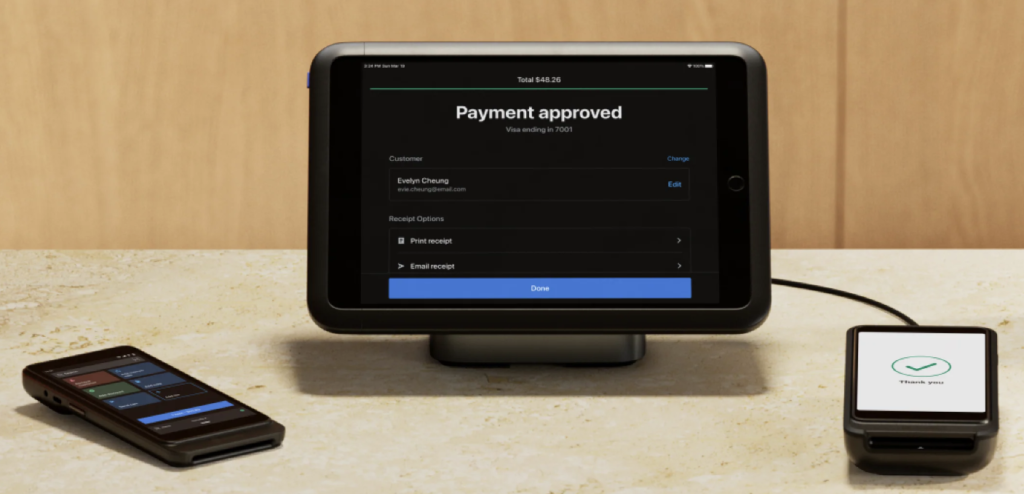

Shopify Payments: Best Stripe alternative for Shopify websites

Overall Score

4.16/5

Pricing

3.5/5

Hardware

4.25/5

Features

4.17/5

Support and reliability

4.17/5

User experience

4.38/5

User scores

4.5/5

Pros

- Full integration with Shopify platform

- No Shopify Payments transaction fee for higher Shopify plans (card transaction fee still applies)

- More mobile payment options compared to Stripe

Cons

- Only available on Shopify

- Requires at least a Shopify Basic e-commerce plan for waived transaction fee

- Limited virtual terminal functionality

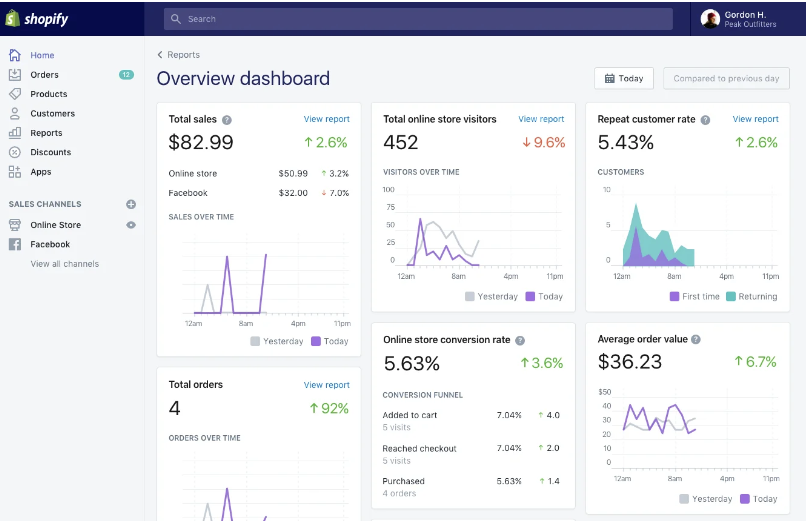

Why I chose Shopify Payments

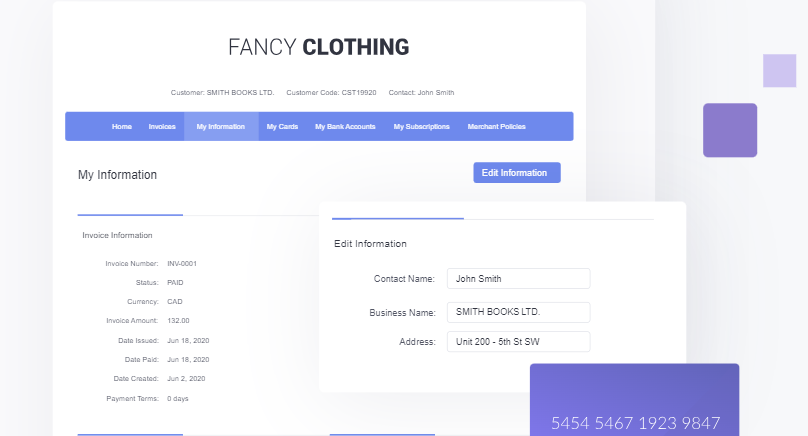

Shopify Payments is an integrated payment processing solution offered by the e-commerce platform Shopify. Businesses can accept credit card payments directly through their Shopify stores without needing to set up a separate payment gateway. With Shopify Payments, sellers can manage their entire online business, from product listings to order management and payment processing, all within the Shopify dashboard.

I chose Shopify Payments as a Stripe alternative for businesses with a Shopify website for its seamless integration with the platform and cost-effectiveness. Its full integration simplifies operations, eliminating the need for third-party processors and ensuring compatibility with other Shopify tools. And with no additional transaction fees for most Shopify plans and the elimination of Shopify’s add-on fees, businesses can save on processing costs while benefiting from Stripe’s reliable infrastructure. The availability of 24/7 customer support makes it even more suitable as a Stripe alternative for Shopify websites.

Overall, Shopify Payments presents a robust and user-friendly alternative to Stripe for merchants operating within the Shopify ecosystem. However, like Square, this limits the user’s ability to work on a different e-commerce platform, which can result in business downtime to accommodate migration to Shopify.

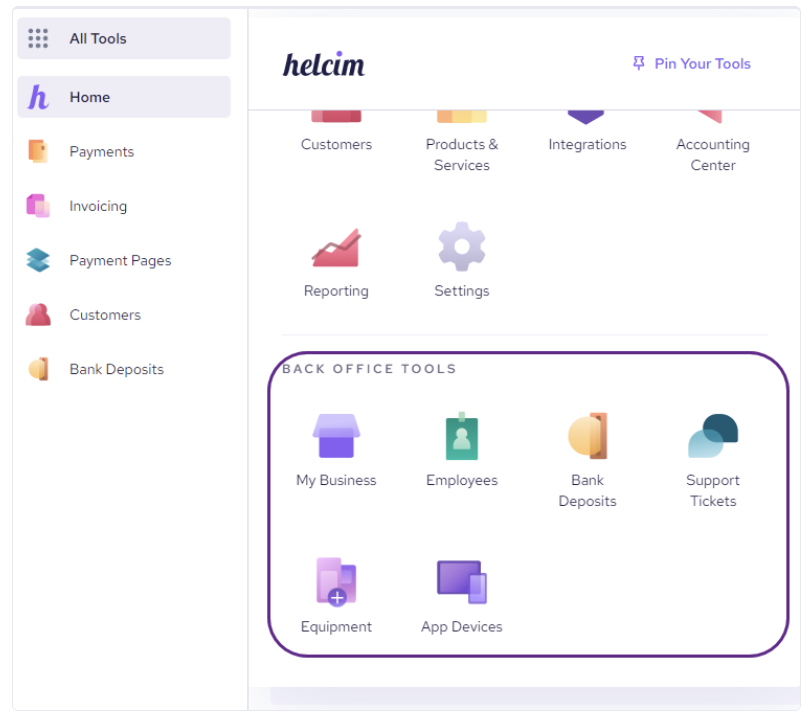

Helcim: Best Stripe alternative for minimizing transaction fees

Overall Score

4.13/5

Pricing

4.75/5

Hardware

4/5

Features

3.75/5

Support and reliability

3.75/5

User experience

4.38/5

User scores

4.17/5

Pros

- Interchange-plus pricing

- Automatic volume discount

- Free access to all payment tools

Cons

- Limited integrations

- Add on transaction fee for AMEX cards

- Requires merchant account approval

Why I chose Helcim

Helcim is a traditional merchant account service provider that also offers robust payment processing solutions. It provides transparent pricing with interchange-plus pricing models and automatic volume discounts, along with a range of features including payment gateways, virtual terminals, and POS solutions.

I chose Helcim as a Stripe alternative for its cost management features. Compared to Stripe, Helcim offers similar functionalities but with a focus on a more competitive pricing structure. While merchants can apply for interchange plus rates with Stripe, Helcim already provides straightforward payment solutions with lower processing fees. Its interchange-plus pricing model ensures that Helcim’s markup stays the same and merchants benefit from any savings on lower interchange rates, while automatic volume discounts further optimize costs as businesses grow. Additionally, Helcim’s Fee Saver provides surcharging, as well as level 2 and 3 data optimization programs (to qualify for low B2B interchange rates) at no extra cost.

Overall, Helcim is a solid Stripe alternative for businesses prioritizing cost-effectiveness and transparency. However, it significantly falls short of Stripe in terms of integration options, for which Helcim is very limited. And while Helcim’s traditional merchant account is more stable compared to Stripe’s, it will require an application process that new and even some small merchants may struggle with.

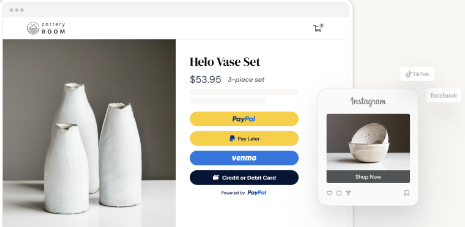

PayPal: Best Stripe alternative for easy ecommerce integration

Overall Score

4.21/5

Pricing

4.25/5

Hardware

4.25/5

Features

4.17/5

Support and reliability

3.33/5

User experience

4.69/5

User scores

4.6/5

Pros

- Widely available and easy online checkout integration

- Well-known and trusted by consumers

- Easy to use

Cons

- Complicated pricing structure

- Extra fee for virtual terminal

- Account holds

Why I chose PayPal

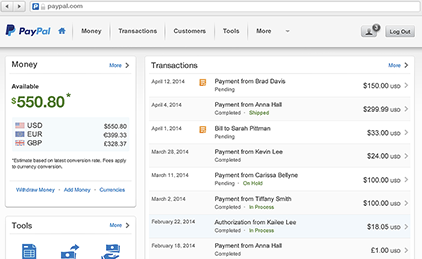

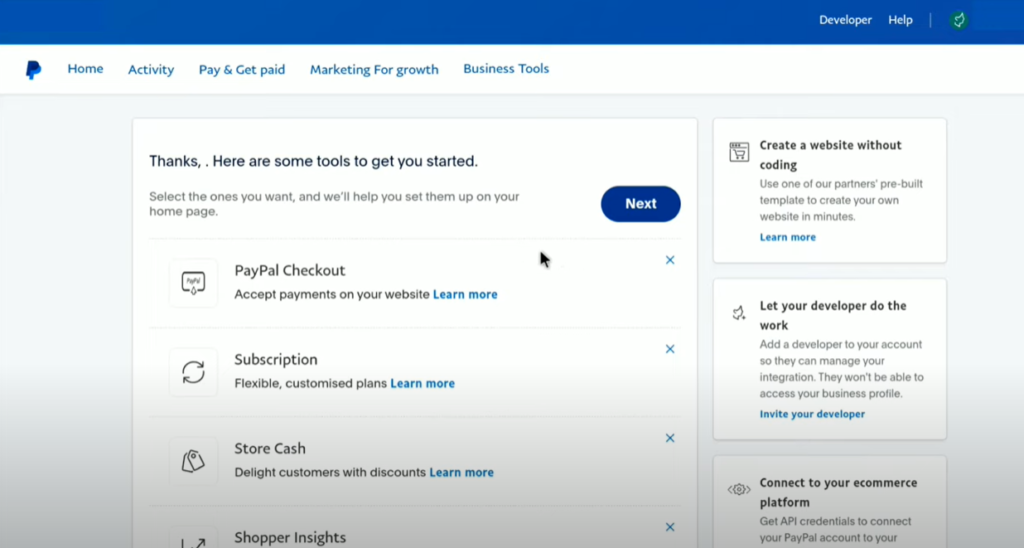

Established in the 1990s, PayPal is THE pioneer digital payment platform, with over 400 million users. It offers a business account that helps merchants manage their finances, accept payments, and facilitate transactions. PayPal offers various features such as invoicing, payment processing, customizable checkout options, and business analytics. With PayPal Business, merchants can accept payments from customers globally through multiple channels, including credit/debit cards, PayPal accounts, and more.

PayPal is my top choice as an alternative to Stripe for its unmatched ease of integration and widespread consumer trust. While both platforms offer easy integration to websites and applications, PayPal’s simple integration process simplifies the online payment setup across various platforms. PayPal is also more widely recognized, instilling confidence in buyers, driving higher conversion rates and increased sales.

Despite its complex pricing structure and additional fees for services like virtual terminals, PayPal offers unique features such as cryptocurrency payment processing and BNPL options, enhancing flexibility for businesses. PayPal’s simplicity, consumer trust, and innovative features make it an excellent choice for businesses seeking a reliable Stripe alternative.

Read more: Stripe vs PayPal

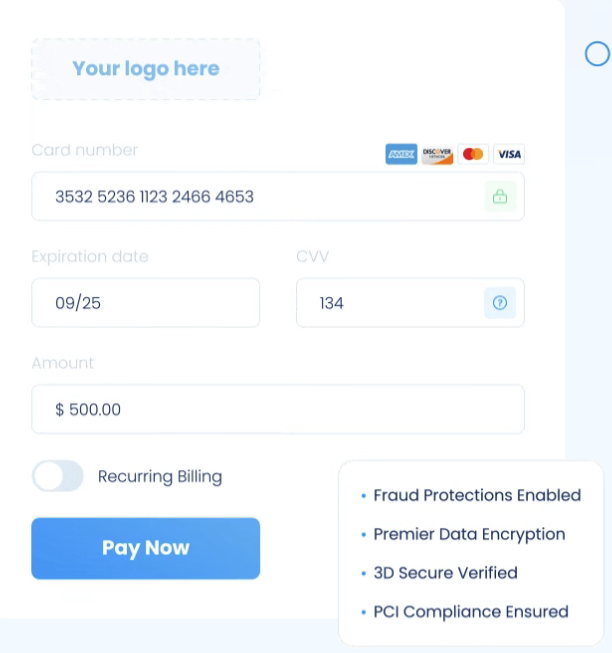

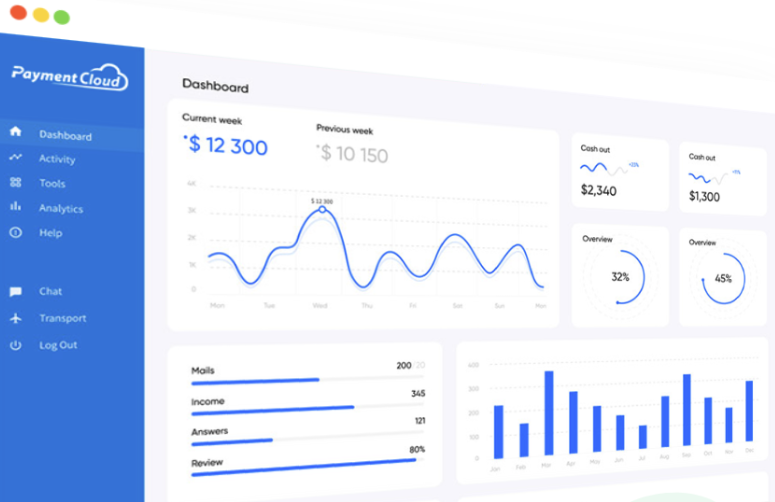

PaymentCloud: Best Stripe alternative for high-risk merchants

Overall Score

3.83/5

Pricing

3.75/5

Hardware

3.5/5

Features

3.54/5

Support and reliability

3.75/5

User experience

3.75/5

User scores

4.7/5

Pros

- Accepts high-risk merchants

- High approval rate

- Offers cryptocurrency payment processing

Cons

- Longer application and approval process

- Extra fee for virtual terminal

- Pricing is not publicly disclosed

Why I chose PaymentCloud

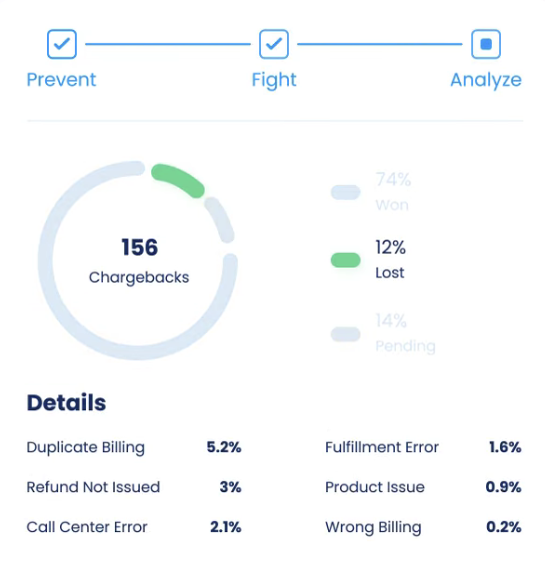

PaymentCloud is a merchant account service provider designed for high-risk businesses, offering services like credit card processing, ACH processing, and e-check processing. It caters to industries such as CBD, vape, adult entertainment, and other businesses typically considered high-risk by traditional payment processors. PaymentCloud provides specialized solutions tailored to the needs of these industries, including fraud prevention tools and chargeback management.

While Stripe is a popular choice for many businesses, it may not be suitable for industries considered high-risk. This is where PaymentCloud fits as the best Stripe alternative. With its high approval rate for businesses in medium- and high-risk industries, PaymentCloud offers a lifeline where other processors, including Stripe, may decline. PaymentCloud provides flexible payment processing with its wide array of payment methods, including its support for cryptocurrency payment processing. PaymentCloud’s commitment to chargeback and fraud protection further solidifies its reliability for high-risk merchants, making it the preferred choice despite a longer application process and undisclosed pricing.

Note that PaymentCloud also supports low- and mid-risk businesses, but small merchants may be better off with a merchant account provider that is more upfront with their fees and offers a simple, quick setup.

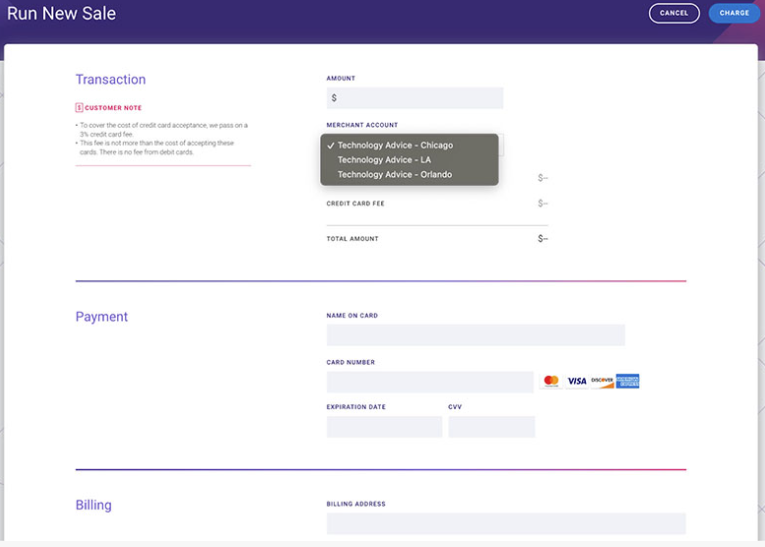

CardX: Best Stripe alternative for zero credit card processing

Overall Score

3.9/5

Pricing

4.25/5

Hardware

3/5

Features

4.17/5

Support and reliability

4.17/5

User experience

4.06/5

User scores

3.75/5

Pros

- Auto surcharging

- Fully compliant credit surcharging

- Auto-detection of debit and credit cards

Cons

- Limited invoicing and POS integrations

- Does not accept cross-border payments

- Underwriting requires at least $5,000 in monthly sales

Why I chose CardX

CardX is a payment processing solution designed to help businesses accept credit card payments and pass on credit card processing fees to customers. This approach aims to help businesses save on processing costs by shifting the burden of fees to the cardholder. Additionally, CardX emphasizes compliance with regulations surrounding credit card surcharging, ensuring that businesses can implement surcharges legally and transparently.

Compared to Stripe, CardX offers a distinct approach to pricing and fee management. So, if you’re looking to save on credit card processing costs, I recommend CardX with its innovative features and compliance with surcharging regulations. Businesses using CardX may accept payments through a virtual terminal, on their website through a Lightbox integration, or in-store using Dejavoo card readers. Additionally, CardX provides merchant training sessions for smooth implementation.

Despite limited invoicing and POS integrations, CardX’s focus on zero credit card processing and compliance makes it a suitable choice for online businesses looking to save on transaction fees

Why is Stripe so popular?

Stripe was launched in 2011 as a developer-first software for developing secure and seamless online payment processing integration. As of June 2023, Stripe powers payments in over 1.2 million live websites using over 135 currencies in 45+ countries which includes big names like Shopify, Xero, and Amazon.

Businesses of all sizes turn to Stripe for a number of reasons:

- Unlike other payment services, Stripe’s developer-based customization and integration tools are available to anyone. Users will find a well-documented list of APIs, SDKs, and code samples on the provider’s website to create their own custom checkouts, subscriptions, app integrations, and mobile apps.

- Since its launch, Stripe has also developed a long list of business products which includes embedded finance, payment orchestration, and revenue and finance automation.

- Stripe provides small businesses with a free merchant account without the lengthy application process, no long term contract, and simple, transparent pricing.

- Large-volume companies can avail of interchange plus rates to help maximize savings.

Advantages: Why use Stripe

Stripe’s strength lies in its ability to provide nearly unlimited customization possibilities for online payment processing.

Robust online payment customization tools

Use Stripe if your business runs primarily through a website and is looking to customize checkout with useful automations such as identity verification, address autocomplete, and card brand identification.

Supports international payments

Use Stripe if your business accepts international payments through a website. Stripe offers ready integration with numerous local banks and payment methods from 45+ countries.

Strong payment security measures

Use Stripe to ensure payment security and minimize chargebacks. Stripe’s strategic partnership with Visa allowed Stripe to harness Visa’s tokenization tools. Today, Stripe is well known for its fraud detection and management features using machine-learning algorithms to flag suspicious transactions.

Wide range of integrations

Use Stripe if your current business goal is to grow through strategic integrations. Stripe provides 660 third party integrations and 450 platform extensions for everything from payment optimization to finance automation.

Disadvantages: When to use a Stripe alternative

While Stripe has taken strides to provide more ease of use and multichannel support for payment processing, Stripe competitors continue to be a better choice for several reasons:

Limited payment method for pre-built mobile payment app

Use a Stripe alternative if you intend to accept swipe, EMV chip, and other NFC-based payments. I had a chance to try out Stripe’s mobile payment app, Stripe Dashboard, and in-person payment processing limited to Tap-to-pay (which costs an additional 10 cents per authorization) and manual card entry. Stripe’s mobile credit card reader can only be configured to use with paid third-party Stripe apps.

Read more:Best mobile payment processors

Payment terminal requires customization

Use a Stripe alternative if you prefer an out-of-the-box POS terminal. While Stripe Terminal comes with pre-built elements for payment processing, it does not include a complete POS software. You will still need custom integration to add your current POS application and integrate it with the tools included in the Stripe Terminal.

Limited no-code payment processing options

Use a Stripe alternative if you need a quick and painless payment set up. In my experience creating a Stripe merchant account, it’s easy to get lost in the account setup stage, even with the guide. You get no-code payment links and ecommerce website checkout pages, but everything else will require some level of coding skill just to add small customizations, including virtual terminal functions.

How to choose the best Stripe alternatives

When choosing a Stripe alternative, you will need to take your business goals into consideration.

Look at other payment processors like Stripe if your goal is to improve features that you currently get from using Stripe but lack any in-house upgrade option. Some examples are:

- Better rates for accepting international payments (Stripe currently charges 1.5% + 1% for currency conversion

- Free or more affordable use of invoicing and billing management tools (Stripe charges 0.4%-0.5% per paid invoice and 0.7% of the monthly billing volume)

- More established mobile app that can accept more mobile payment methods (Stripe Dashboard only supports tap-to-pay and manual card entry)

Read more: Best online payment processors

Check out other payment processors that differ from Stripe if your goal is fast setup and simple integrations to expand your payment channels. Examples include:

- Ease of use from out-of-the-box payment processing solutions instead of code-based set up and customizations

- Proprietary POS software pre-built into the stand alone payment terminal instead of custom integration or as a mobile app instead of third party Stripe apps

- Provider transaction fee discounts instead of just the standard card network interchange discount for qualified nonprofits.

- Ready integration with surcharging programs/platforms

Once you have narrowed down your available options, you can begin looking into the costs. Start by comparing the estimated monthly fees for each Stripe competitor, then evaluate the overall value-for-money of each provider. If you are going to have to pay for services that you don’t need, then it’s best to look at other options.