Mobile point-of-sale (POS) systems are a better fit for businesses that require selling and accepting payments on the go and brick-and-mortar businesses looking for a more flexible POS setup. These systems use handheld hardware and often come with POS software that is compatible with smart devices. However, as there is never a one-size-fits-all solution, business owners considering a mobile POS should look into compatibility, cost-effectiveness, and scalability before signing up.

To help you get started, I curated a list of top mobile POS systems that offer the best solutions for a variety of business needs:

- Square: Best overall (best free all-in-one POS for SMBs)

- Toast: Best for full-service restaurants

- Clover: Best for choosing your own payment processor

- Shopify POS: Best for online businesses expanding into in-person sales

- Loyverse: Best for small, quick-service restaurants

- PayPal Zettle: Best for freelancers and occasional sales

- December 23, 2024: Anna Lynn Dizon updated the rubric criteria to consider hardware cost and built-in tools, and combined the criteria for support, reliability, and ease of use. She re-evaluated all the mobile POS software providers for consideration, added FAQs, and rewrote the product sections based on her latest findings.

Company

Our score (out of 5)

Monthly POS fee

POS hardware options

Payment processing options

User feedback

Square

4.54

$0-$189+

Android, iOS

Built-in

Excellent

Toast

4.25

$0-$69

Proprietary

Built-in

Great

Clover

4.24

$14.95–$185*

Android, iOS

User’s choice

Excellent

Shopify

4.11

$5-$399

Android, iOS

Built-in or 3rd party integration

Great

Loyverse

4.07

$0–$25

Android, iOS

3rd party integration

Excellent

PayPal Zettle

4.02

$0–$30

Android, iOS

Built-in

Good

* Based on Fiserv, fees will vary if you’re purchasing Clover from third-party sellers.

Consider these guide questions as you go through my evaluation of each provider below:

- Is it compatible with your mobile device?

- Does it have the POS software features that your business needs?

- Is the software and hardware pricing reasonable?

- Does it support payment processing fit for your sales volume?

Square: Best overall (Best free all-in-one mobile POS)

Overall Score

4.54/5

Pricing

4.69/5

POS Hardware

4.75/5

POS Software features

4.25/5

Support, reliability, ease of use

4.25/5

User Review Scores

4.75/5

Pros

- Free POS software and merchant account

- Comes with a free mobile card reader

- Easy sign-up and setup

Cons

- Limited inventory feature upgrades

- Account instability

- Must use Square’s built-in payment processing

Why I chose Square

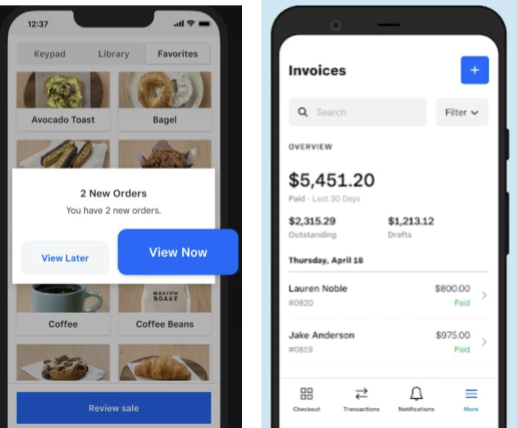

Square is an all-in-one POS system for retail, restaurant, and service-type businesses. It offers a free POS app that can be used with compatible Android and iOS devices, as well as with Square’s standalone handheld smart terminals. Startups and small businesses love Square because of its easy setup and forever-free plan that allows users to start selling and accepting payments in a matter of hours.

I chose Square as my top mobile POS software recommendation because of its affordability, ease of use, and scalable features. As an all-in-one system, I like how each Square account comes with a free POS plan plus a free mobile card reader that makes it easy for new and small businesses on a budget to start selling and accepting payments. Overall, you’ll get the best value in an all-in-one free plan with Square compared to other providers in our list.

Related: Best free POS systems

Note, however, that when you use Square, your payment processing is limited to its proprietary processor, Square Payments. If you already have a payment processing service you’d like to keep, consider Clover instead.

Toast: Best for full-service restaurants

Overall Score

4.25/5

Pricing

4.06/5

POS Hardware

4.5/5

POS Software features

4.25/5

Support, reliability, ease of use

4.25/5

User Review Scores

4.2/5

Pros

- Industry-specific POS features

- Industry-grade proprietary hardware

- Offers starter kit for $0 upfront cost

Cons

- Starter POS software is only ideal for single-location restaurants

- Must use Toast’s built-in payment processor

- Standard 2-year long-term contract

Why I chose Toast

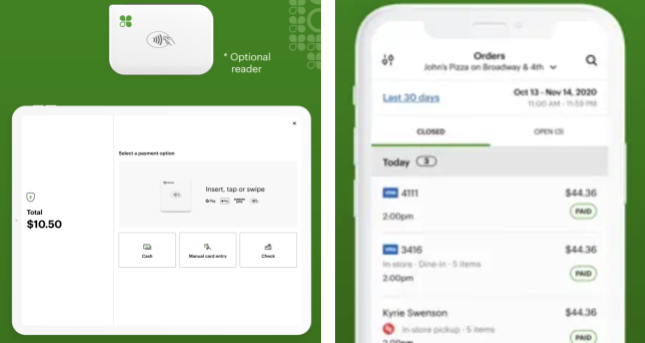

Toast is the leading name among restaurant POS systems. It comes with all the features that any full-service restaurant needs and offers a free starter kit plan. Users can choose between a desktop and a mobile setup with no upfront cost. Like Square, Toast’s mobile POS system includes a built-in payment processing feature; however, Toast’s mobile hardware option is limited to a proprietary standalone handheld POS terminal.

Read more: Best restaurant POS systems

I chose Toast as my most recommended mobile POS for full-service restaurants because of its available features. I particularly like that there is a free plan option for those who prefer a mobile setup. The handheld POS terminal can be used independently, so larger establishments that offer catering for special events or run high-volume food trucks can make use of Toast’s advanced restaurant management tools.

Like Square, Toast has its proprietary payment processor, but unlike Square, there is a 2-year contract when using the software. If you need a more flexible restaurant POS software solution, consider Loyverse instead.

Clover: Best if you have a preferred payment processor

Overall Score

4.24/5

Pricing

3.75/5

POS Hardware

4.5/5

POS Software features

4/5

Support, reliability, ease of use

4.25/5

User Review Scores

4.7/5

Pros

- Affordable software plans

- Option to purchase hardware in installments

- Can process payments offline

Cons

- Little oversight over third-party resellers

- Hardware tied to merchant account

- Contract length depends on the payment processor

Why I chose Clover

Clover is a POS software and hardware service provider owned by Fiserv. Like Square, Clover offers a range of hardware including a mobile card reader that can be paired with smartphones equipped with Clover’s mobile POS software.

But what makes it stand out is Clover’s compatibility with a number of payment service providers which is why I chose this platform for this guide. Users looking to upgrade their hardware but prefer to keep their current payment processor will find Clover the best option.

Existing businesses will eventually need to upgrade their POS software and hardware to keep up with their growing activities. Clover’s POS software and hardware make it possible for you to handle larger sales volumes and more complex inventories while keeping its preferred payment processor’s discounted rates and fees.

That said, please note Clover’s third-party resellers offer different pricing structures which Clover has little oversight. While this is an advantage, I would only recommend it for businesses that already have a preferred payment processing service or are already familiar with how merchant accounts work to get the best rates.

Learn more: How does credit card processing work?

Shopify POS: Best for online businesses looking to sell in-person

Overall Score

4.11/5

Pricing

4.06/5

POS Hardware

4/5

POS Software features

4/5

Support, reliability, ease of use

4.5/5

User Review Scores

4/5

Pros

- Leading ecommerce platform

- Omnichannel features

- Accelerated checkout option (Shop Pay)

Cons

- High transaction rates when not using an ecommerce plan

- Limited offline capabilities

- Poor rating for Android POS software

Why I chose Shopify POS

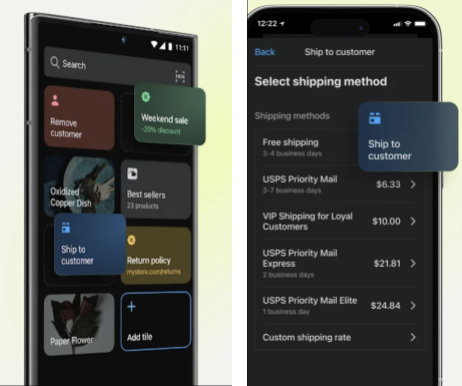

Shopify is a leading ecommerce platform for online businesses. It also offers POS software for users who intend to expand to in-person sales. Shopify’s omnichannel sales capability is popular among online retailers who participate in arts and crafts shows and regularly set up pop-up shops to widen their customer base. Like Square, Shopify POS comes with a built-in payment processor and mobile POS software that’s compatible with Android and iOS devices.

I chose Shopify for its outstanding omnichannel POS and ecommerce platform with strong inventory, order fulfillment, and payment processing capabilities. I like how Shopify’s POS plans give users the flexibility to choose, depending on the level of their in-person selling needs. This makes Shopify’s mobile POS service a great choice for expanding businesses’ customer bases with in-person sales.

While it rivals Square’s POS services in many ways, Shopify does not have the industry-specific software that Square offers. Transaction rates are also significantly higher if you opt for the POS plan without Shopify ecommerce.

Related: Best Square alternatives

Loyverse: Best for small quick-service restaurants

Overall Score

4.07/5

Pricing

4.06/5

POS Hardware

4.25/5

POS Software features

3.75/5

Support, reliability, ease of use

3.5/5

User Review Scores

4.8/5

Pros

- Forever-free POS software

- Flexible hardware and payment processing options

- Highly-rated POS software

Cons

- Integration capabilities for a fee

- Live support only for paid plans

- Separate sign-up with payment processor

Why I chose Loyverse

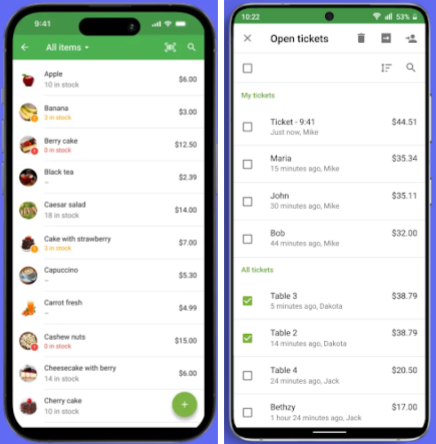

Loyverse is a mobile POS software for restaurants and food-based retailers. It’s compatible with Worldpay, SumUp, and Zettle so users enjoy hardware and payment processing flexibility similar to Clover. Though not as expansive in terms of features, the basic POS software is free and comes with a built-in kitchen display system ideal for small quick-service restaurants. Upgrades such as advanced inventory, employee management, and integrations are also available for a fee.

Loyverse made our list because of its affordability and the near-perfect reviews that real-life users gave the software. Overall, I like Loyverse’s scalability which allows businesses to keep their ongoing cost low and only grow as they decide that they need more advanced features. Some restaurants may not require the robust features of Toast and should not have to pay for tools that small establishments do not need. Small and new restaurants (and even food retailers) can start with free industry-specific POS software with an option to upgrade its inventory tools for a small monthly fee.

But while hardware and payment processing is flexible, Loyverse offers very limited support to businesses so it’s not a one-stop-shop solution like Square. There is a list of recommended partners on Loyverse’s website but you will have to sign up for a merchant account and purchase the hardware separately.

PayPal Zettle: Best for freelancers and occasional sales

Overall Score

4.02/5

Pricing

4.38/5

POS Hardware

4.5/5

POS Software features

3.75/5

Support, reliability, ease of use

4.25/5

User Review Scores

3.2/5

Pros

- Free POS software and merchant account

- Offers one of the lowest flat-rate transaction fees

- First mobile card reader available at a discount

Cons

- Lacks industry-specific POS features

- Limited integrations and upgrades

- Low user review ratings

Why I chose PayPal Zettle

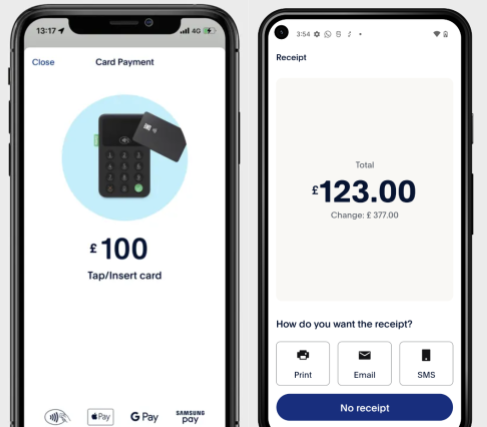

PayPal Zettle is PayPal’s POS software that replaced PayPal Here. The mobile POS software is free, compatible with both iOS and Android mobile devices, and comes with PayPal as a built-in payment processor. PayPal accepts all credit and debit card payments, including cards issued from other countries, and has one of the lowest in-person flat-rate transaction fees in the market

While it lacks industry-specific POS features, around 400 million consumers currently have a personal PayPal account. Therefore, being able to offer customers with the option to pay via PayPal gives businesses an edge over other person-to-person sellers. Freelancers and those that only sell occasionally such as to tourists, at farmers markets, and at art and craft shows can use PayPal Zettle so customers can pay their in-person purchases using their PayPal wallets.

That said, PayPal Zettle’s POS software is basic and could definitely benefit from some upgrades as most real-life users are saying in their reviews. If you need some industry-specific tools when selling on the go, consider Square.

Benefits of mobile POS

Of the many POS system types, the mobile POS offers flexibility to both online and brick-and-mortar businesses.

Selling on the go

Not all businesses are online or tied to a brick-and-mortar shop. Some are freelancers, occasional sellers, and ecommerce merchants selling in-person to introduce their products who require a more portable/mobile POS system to reach more customers.

Faster checkouts for in-store customers

Brick-and-mortar shops can add a mobile POS as an extension of their checkout counters. This helps reduce customer wait times by accepting orders and payments tableside (for restaurants), curbside (for pickups), and anywhere around the store (for retailers).

Save with in-person transaction fees

In-person transaction fees are less expensive than when selling online or taking payments over the phone. With a mobile POS system, users who sell remotely can accept payments in person and enjoy cheaper transaction fees.

Added security on mobile smart devices.

Aside from your POS software and payment processor’s built-in security features, customers who pay with their smartphone are protected by additional biometric tools such as fingerprint and facial recognition.

Learn more: What is a POS system?

Choosing the best mobile POS solution for your business

The best mobile point-of-sale solutions should match your business requirements and available budget. It should also take into account the overall value-for-money of each provider.

Every mobile POS software should have the following key features:

- Inventory management tools: For adding and tracking inventory inventory to your catalog

- Integrated or third-party payment processing: For fast, reliable, and secure payment processing.

- Range of mobile POS hardware options: Affordable mobile hardware solutions compatible with your Android or iOS smartphone or tablet.

- Free downloadable POS software: From the Apple App Store or Google Play store though some like Toast with advanced features are only available from the provider’s site.

- Customer relationship management tools: Helps create customer profiles that can save contact and payment information as well as purchase history.

- Integration and scalability: For connecting the mobile setup to a larger POS system that lets businesses upgrade to more advanced software plans.

- Real-time reporting: For providing a summary of sales and other related metrics whenever needed.

Related articles:

Square ticks most of the boxes that small businesses and startups need, such as a free merchant account, out-of-the-box software and hardware, industry-specific POS software, and an easy-to-use platform. It offers the most value out of a free POS plan, making it the best if you need a quick way to get your business off the ground.

For growing businesses, a versatile and scalable POS system is key. Shopify offers the best mobile POS for ecommerce merchants looking to expand their customer base via in-person sales. Clover’s compatibility with several payment processors makes it possible for businesses to upgrade their POS software and hardware seamlessly.

Meanwhile, PayPal Zettle offers the widest range of payment methods, including the ability for businesses to accept in-person payments from a customer’s PayPal account. Freelancers and seasonal sellers tend to benefit more from PayPal Zettle’s range of inventory and invoicing tools.

Learn more: How to use a POS system