Choosing the right credit card reader is essential for small businesses looking to streamline their payment processes and scale efficiently. The best credit card readers for small businesses combine advanced capabilities with portability, support a range of payment methods, offer robust security features, and have seamless integration with other business systems.

In this article, I evaluate the best credit card readers for small businesses based on their hardware features, payment processing, pricing, features, and user experience. I limited my review to standalone credit card readers—devices that do not require a separate smartphone or table to function.

Based on my evaluation, the best credit card readers for small businesses for 2025 are:

For this list, I specifically targeted smart terminals. These readers conveniently combine advanced capabilities with portability, making them ideal for small businesses that are ready to scale their business and looking for efficient, versatile, and user-friendly payment solutions.

Smart terminals or standalone terminals support a range of payment methods, offer robust security features, and often integrate seamlessly with other business systems like inventory management and ecommerce platforms. This evaluation focused on identifying the top smart terminals that provide the best balance of functionality, ease of use, and affordability for small businesses.

I took advantage of free trials and demos to get a first-hand user experience of available solutions.

Finally, I built an internal algorithm to rate over ten readers based on my evaluation of its hardware and payment features, cost, and user experience. Each category also includes my expert score, which contributes to its overall score.

Here’s a breakdown of how I evaluated each card reader:

Hardware features

I first considered the hardware features. I assessed the physical aspects of the credit card readers, such as multiple device setup, warranty, connectivity, battery life, screen quality, user interface, charging options, receipt printing capabilities, and overall durability. These factors determine the device’s usability, reliability, and adaptability to different business environments.

Payment processing

I evaluated the range of payment types accepted (swipe, dip, tap, QR), the transaction speed, the variety of processors supported, and the integration of ecommerce systems. Efficient and versatile payment processing is crucial for providing a smooth customer experience and managing sales data effectively.

Pricing

The overall cost of using the reader was also considered. I looked at the overall cost structure, including initial setup costs, hardware and software costs, and contract length. I prioritize solutions that offer flexible and transparent pricing models, with minimal upfront costs and no long-term commitments, making them suitable for budget-conscious small businesses.

Other features

I examined additional functionalities that enhance the utility of the smart terminals, such as offline mode capabilities, developer tools, security and PCI compliance, and system reliability. These features ensure the device can operate effectively under various conditions and maintain high-security standards.

User experience

I also looked at the ease of use, scalability, user reviews, and the application and onboarding process. A user-friendly interface, smooth onboarding experience, and positive user feedback are essential for ensuring that small businesses can quickly adopt and benefit from the technology.

February 10, 2025: Andrea Herrera added four more devices to be evaluated and increased the number of credit card readers featured in the article from five to eight. All the scores were updated based on the current information available.

The card readers I evaluated for this article are standalone devices, which means that they do not need to be paired with any other device. For simpler card readers that work by connecting it to your mobile phone, you may check our list of the best credit card readers for Android.

Best credit card readers comparison

Card Reader

Our score (out of 5)

Hardware Features

Price

Accepted Payment Types

4.67

- Receipt printer

- Barcode scanner

- Offline mode

- Wi-Fi, LTE

- Splash-proof

- 3.6” scratch- and fingerprint-resistant touchscreen

- PIN pad

- $279 or

- $13 per month for 36 months

- Swipe

- Dip

- Tap

- Clover gift cards

- Apple Pay, Google Pay

4.63

- Receipt printer

- Barcode scanner

- Offline mode

- Wi-Fi, LTE

- 6” touchscreen

- $649 or

- $40 per month for 36 months

- Swipe

- Dip

- Tap

- QR code

- Apple Pay, Google Pay, Samsung Pay

4.61

- Offline mode

- Wi-Fi

- Dual screen

- $799 or

- $39 per month for 24 months

- Swipe

- Dip

- Tap

- QR code

- Apple Pay, Google Pay, Samsung Pay, Cash App

4.49

- Receipt printer

- Offline mode

- Wi-Fi

- 5.5” touchscreen

- $299 or

- $27 per month for 12 months

- Swipe

- Dip

- Tap

- QR code

- Apple Pay, Google Pay, Samsung Pay, Cash App

4.32

- Offline mode

- Wi-Fi

- 7.5” touchscreen

- Restaurant grade

- Pay-as-you-go plan: Free

- Standard plan: $799.20

- Swipe

- Dip

- Tap

- QR code

- Apple Pay, Google Pay, Samsung Pay

4.24

- Receipt printer

- Wi-Fi

- 3” touchscreen

- $169

- Dip

- Tap

- Apple Pay, Google Pay

4.22

- Receipt printer

- Barcode scanner

- Wi-Fi, 3G/4G

- 9” touchscreen

- $199 or

- $239 (with built-in barcode scanner)

- $269 (with printer dock)

- Swipe

- Dip

- Tap

- QR code

- Apple Pay, Google Pay, Samsung Pay

- PayPal and Venmo

4.22

- Receipt printer

- Wi-Fi

- 5.5” touchscreen

- $329 or

- $30 for 12 months

- Swipe

- Dip

- Tap

- QR code

- Apple Pay, Google Pay, Samsung Pay

Clover Compact: Best overall credit card reader

Overall Score

4.67/5

Hardware features

4.44/5

Payment processing

5/5

Pricing and costs

4.5/5

Features

5/5

User experience

4.88/5

Pros

- Built-in printer

- Splash- and scratch-proof screen

- Has a tactile PIN pad

Cons

- Smaller screen size

- No full POS function (i.e., inventory management, menu management)

Why I chose Clover Compact

Clover Compact came out as the best overall standalone credit card reader because it balances powerful features, durability, and ease of use. I like that it offers excellent hardware features while providing reliable payment processing and a good user experience.

It is the only device on this list that has a built-in tactile PIN pad. Although its screen is smaller than other readers, it is splash- and scratch-proof, and while it lacks full POS functions like inventory management, its all-in-one design with a built-in printer still outperforms smaller, more limited readers.

Unlike the Clover Flex, which is more mobile-focused, the Compact is a sturdier countertop option—ideal for businesses that need a dedicated payment station without taking up too much space. It also supports multiple payment methods, making it a great fit for various industries. After reviewing multiple card readers, I found that Clover Compact strikes the best balance between functionality, durability, and ease of use.

Clover Flex: Best credit card reader with full POS function

Overall Score

4.63/5

Hardware features

4.86/5

Payment processing

4.69/5

Pricing and costs

4/5

Features

4.69/5

User experience

4.92/5

Pros

- Built-in printer, scanner, camera

- All-in-one device with inventory, employee management, reports

- 4G and Wi-Fi connectivity

- Can work with different payment processors

Cons

- Higher upfront cost

- Higher processing fees

Why I chose Clover Flex

Clover Flex stood out as the best credit card reader with a full POS function because it offers more than just payment processing—it provides a complete POS experience in a handheld device. I like that it includes a built-in receipt printer, barcode scanner, and inventory management tools, making it far more capable than simpler readers like Clover Compact, SumUp Solo, or Zettle Terminal.

Unlike Square Terminal, which is more countertop-focused, Clover Flex offers 4G and Wi-Fi connectivity, allowing businesses to accept payments anywhere. The offline mode is also a big plus, ensuring smooth transactions even during internet disruptions.

While it comes at a higher cost than basic card readers, I found that the robust feature set and seamless integration with larger POS systems make it a smart investment for growing businesses that need an all-in-one mobile payment solution.

Square Register: Best for businesses needing a dual-screen countertop POS

Overall Score

4.61/5

Hardware features

5/5

Payment processing

4.38/5

Pricing and costs

3.75/5

Features

5/5

User experience

4.92/5

Pros

- Dual screen setup

- Fully integrated POS system

- 24/7 phone support

Cons

- Higher upfront cost

- No built-in printer or scanner

Why I chose Square Register

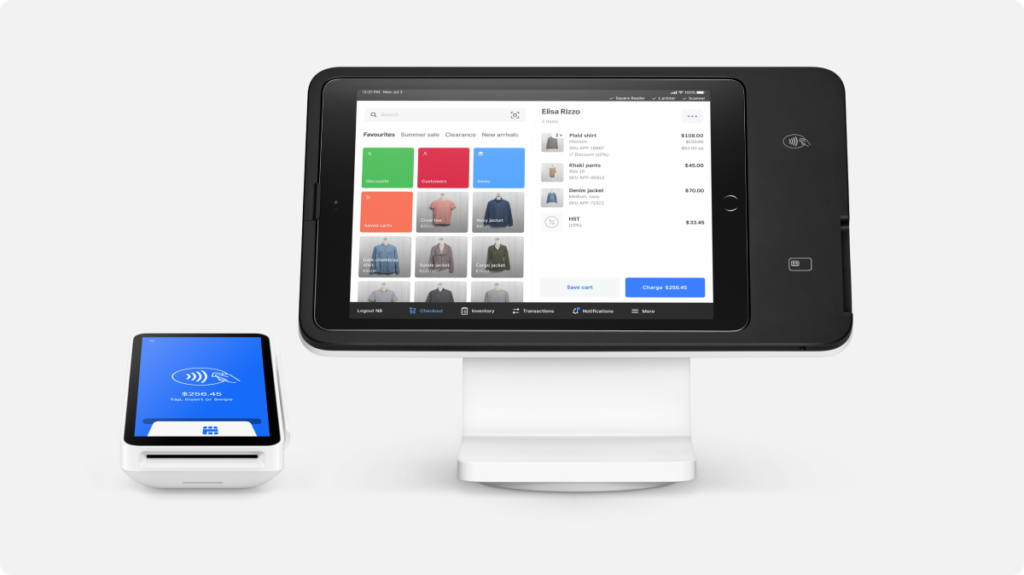

Square Register is the only credit card reader on this list with a dual-screen design, making it the best choice for businesses that want a dedicated countertop POS with seamless customer interaction. I like that it provides a professional, all-in-one solution without requiring extra hardware or software subscriptions. Unlike the Clover Flex, which also has full POS functionality and a single screen, Square Register allows customers to review transactions and complete payments independently, speeding up the checkout process.

Compared to Square Terminal, which is more compact and portable, Square Register is better suited for businesses with multiple staff handling transactions at a fixed counter. It offers a fully integrated POS experience with inventory, reporting, and employee management tools—all without monthly software fees. While Clover devices provide similar functionality, they may come with varying pricing structures and may have recurring fees, whereas Square provides a more straightforward, all-in-one system with transparent pricing, no monthly software costs, and no long-term contracts.

For businesses that want a modern, user-friendly, and cost-effective dual-screen POS, Square Register is the best option available.

Square Terminal: Best for new businesses

Overall Score

4.49/5

Hardware features

4.58/5

Payment processing

4.06/5

Pricing and costs

4.5/5

Features

4.38/5

User experience

4.92/5

Pros

- Seamless ecosystem integration

- Built-in receipt printer

- Inventory management

Cons

- No built-in barcode scanner

- No 4G support

Why I chose Square Terminal

Square Terminal stands out for its compact design and comprehensive user-friendly ecosystem. It is cost-effective with its low device cost and zero monthly fees, making it the best credit card reader for new businesses. Its all-in-one design includes a built-in receipt printer and robust inventory management capabilities, making it more affordable than full-fledged POS systems like the Square Register and easy for businesses to get started without additional equipment.

I like that it works effortlessly with other Square hardware and software, allowing businesses to scale up easily as they grow. Plus, with transparent pricing and no monthly software fees, it’s an excellent choice for businesses that need a reliable, cost-effective payment solution without hidden costs.

Toast Go: Best for restaurants

Overall Score

4.32/5

Hardware features

4.58/5

Payment processing

4.38/5

Pricing and costs

3/5

Features

4.69/5

User experience

4.95/5

Pros

- Restaurant-grade (spill-proof, drop-proof, dust-proof)

- Offline mode

- Pay-as-you-go plan with zero monthly fee and free device

Cons

- No built-in receipt printer

- No built-in barcode scanner

Why I chose Toast Go

Toast Go stands out as the best handheld POS for restaurants because of its restaurant-specific design and deep integration with a full restaurant management system. Its durability, long battery life, and offline mode make it a reliable choice for fast-paced food service environments.

I find it especially suitable for businesses needing a handheld POS with tableside ordering. While Square and Clover offer restaurant-focused POS plans, Toast Go 2 is built specifically for restaurant operations. Unlike general-purpose mobile POS devices, it’s spill-proof, dust-proof, and drop-proof—essential for high-volume restaurants where accidents are common.

Its fully integrated system, which includes a kitchen display system, online ordering, team management, and inventory tracking, helps streamline operations better than most standalone payment devices. Plus, the pay-as-you-go plan with no upfront hardware cost makes it a budget-friendly option for restaurants looking for flexibility without a major investment.

SumUp Solo: Cheapest standalone credit card reader

Overall Score

4.24/5

Hardware features

4.31/5

Payment processing

4.38/5

Pricing and costs

4/5

Features

3.75/5

User experience

4.77/5

Pros

- Compact, lightweight, and highly portable

- Free unlimited data witha built-in SIM card

- Comes with a free SumUp Business Account

Cons

- Limited POS features

- Limited third-party integrations

Why I chose SumUp Solo

SumUp Solo is the best option for businesses that need a simple, ultra-portable card reader without monthly fees. I like that it offers a sleek, modern design with an intuitive touchscreen, making it one of the easiest card readers to use. Unlike more complex systems like Clover and Square, SumUp Solo focuses purely on payment acceptance, making it ideal for small businesses, mobile vendors, and solo entrepreneurs who don’t need a full POS system.

Compared to other readers on this list, SumUp Solo is the most lightweight and compact, making it a great choice for businesses constantly on the move. While the main unit lacks a built-in receipt printer, purchasing the combined dick and printer still makes it cheaper than other readers on this list. It also lacks advanced inventory tools but its affordability and pay-as-you-go pricing model make it a great entry-level option for those who want a no-frills, cost-effective way to accept card payments.

PayPal Zettle Terminal: Best for PayPal and Venmo payments

Overall Score

4.22/5

Hardware features

4.86/5

Payment processing

4.38/5

Pricing and costs

4/5

Features

3.44/5

User experience

4.43/5

Pros

- Low processing fees

- Pre-loaded SIM card at no cost

- Accepts PayPal and Venmo payments

Cons

- No magstripe reader

- No offline mode

Why I chose PayPal Zettle

The PayPal Zettle Terminal works seamlessly with PayPal and Venmo transactions, making it an excellent choice for businesses already utilizing these platforms. Its low processing fees and the inclusion of a pre-loaded SIM card at no extra cost enhance its value. Although Clover Flex processes PayPal and Venmo payments, it requires a higher Clover paid subscription.

The terminal’s built-in barcode scanner and optional charging dock with a built-in receipt printer provide essential functionality for retail environments. Among the card readers on this list, the PayPal Zettle Terminal has the lowest flat-rate processing fees. I think this combination of affordability, ease of use, and specialized payment acceptance makes the Zettle Terminal particularly advantageous for businesses looking to streamline their payment processing with PayPal and Venmo.

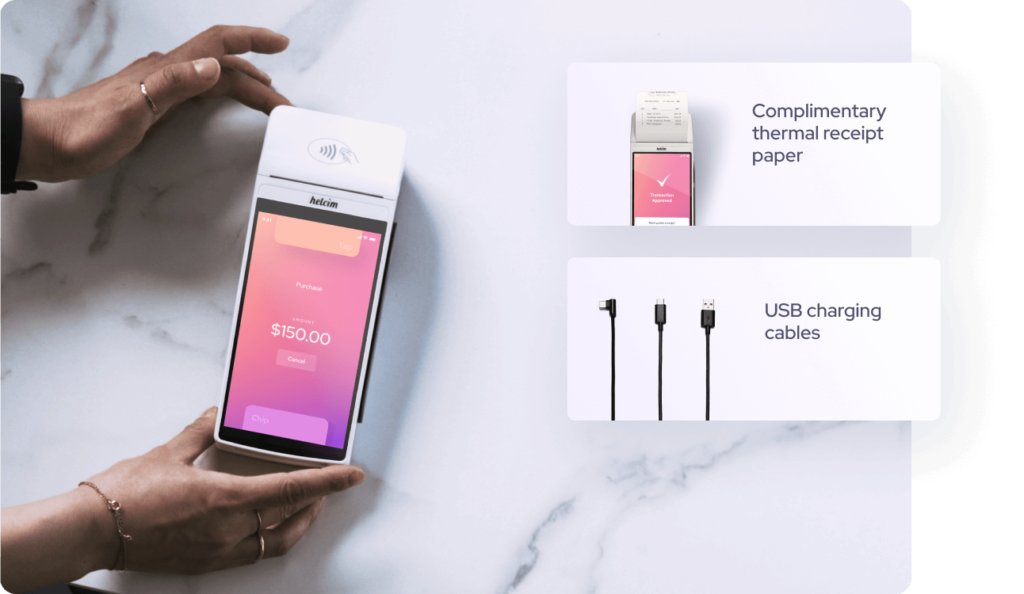

Helcim Smart Terminal: Best for interchange-plus pricing

Overall Score

4.22/5

Hardware features

4.86/5

Payment processing

4.06/5

Pricing and costs

4.5/5

Features

3.13/5

User experience

4.55/5

Pros

- Interchange-plus pricing

- Built-in receipt printer

- Automatic volume discounts

- Surcharging option

Cons

- Limited other hardware options

- No offline mode

Why I chose Helcim Smart Terminal

The Helcim Smart Terminal is the only card reader on this list that offers a transparent interchange-plus pricing model, which offers small businesses a clear and competitive fee structure. It is also included in our list of the best mobile credit card processing solutions and the cheapest credit card processing providers.

Its built-in receipt printer and automatic volume discounts provide added value, particularly for growing businesses. It also has a surcharging option which allows merchants to pass processing fees to customers, reducing costs.

Additionally, Helcim’s terminal supports inventory tracking and employee log-ins, enhancing operational efficiency. The competitive pricing, combined with zero monthly fees and surcharging options, makes this credit card reader among the most cost-effective for small businesses.

What is a credit card reader?

A credit card reader is a device that enables businesses to accept payments from customers via credit and debit cards. These readers can be standalone units or part of a larger POS system. They read the card’s information through a magnetic stripe, EMV chip, or contactless technology (NFC) to process transactions securely. Credit card readers are essential for modern businesses as they facilitate quick and secure payment processing.

How do credit card readers work?

Credit card readers work by capturing and transmitting card information to a payment processor. When a card is swiped, dipped, or tapped, the reader retrieves the card’s data (magnetic stripe, chip, or NFC signal). This data is encrypted and sent to the payment processor, which verifies the card details and checks for available funds. Once approved, the transaction is completed, and funds are transferred to the merchant’s account. This process happens in seconds, ensuring fast and secure payments.

Types of credit card readers

Credit card readers come in various forms to meet different business needs. These types include magstripe readers, EMV chip readers, NFC (contactless) readers, and smart terminals, each offering distinct features and security levels to cater to diverse payment processing requirements.

- Magstripe readers: Basic devices that read the magnetic stripe on the back of cards, offering straightforward but less secure transactions.

- EMV chip readers: Devices that read the embedded chip in cards, providing enhanced security against fraud.

- NFC (contactless) readers: Readers that accept contactless payments from cards or mobile wallets, enabling fast and convenient transactions.

- Smart terminals: Advanced, multifunctional devices that support magstripe, chip, and contactless payments, often integrated with POS systems.

Simple credit card readers, like ones that just perform the functions listed above, typically require integration with a different device (computer, tablet, or mobile device) where the POS app is installed. These simpler readers are in contrast to all the smart terminals discussed above – our recommended options are all standalone terminals and do not require any other integration to accept card payments.

Frequently asked questions (FAQs)

The best card reader for a small business depends on specific needs, such as budget, payment types, and business environment. For growing and scaling businesses, my evaluation shows that Clover Flex is the best credit card reader.

A simple card reader costs anywhere from $0 to $100, while a standalone card reader costs anywhere from $200 to $800. Some payment solutions providers may also have card readers for monthly rent.

Yes, you can use your phone as a card reader. Newer options like Tap to Pay on iPhone and Android allow you to accept contactless payments directly through your phone without any additional hardware.