Virtual terminals are merchant-facing platforms that allow businesses to manually enter payment information and complete transactions on the customer’s behalf. This is especially useful for businesses that have customers who prefer to transact over the phone, via email, or messaging apps. Most payment processors come with a virtual terminal platform, but some offer better value for money and standout features.

As there are no one-size-fits-all solutions, I evaluated the top payment processors to help you choose an option that best matches your current goals.

Based on my evaluation, the best virtual terminals are:

- Helcim: Best overall (best for minimizing fees)

- Payment Depot: Cheapest for mid-size volume transactions

- PaymentCloud: Best for high-risk businesses

- Stax: Cheapest, wholesale transaction fees for large businesses

- Square: Best for small and new businesses

- PayPal: Best for accepting online international payments

- CardX: Best for free credit card processing

Software Spotlight: PaymentCloud

Flexible payment processing for any business- 98% of applications are approved for a merchant account

- Wide range of payment options – including no-cost (surcharging)

- Month-to-month contract

- No setup, application, or annual fees

Visit PaymentCloud

Our score (out of 5)

Merchant account fee

Virtual terminal (VT) fee

VT-supported payment methods

VT-supported transactions

Helcim

4.59

$0

$0

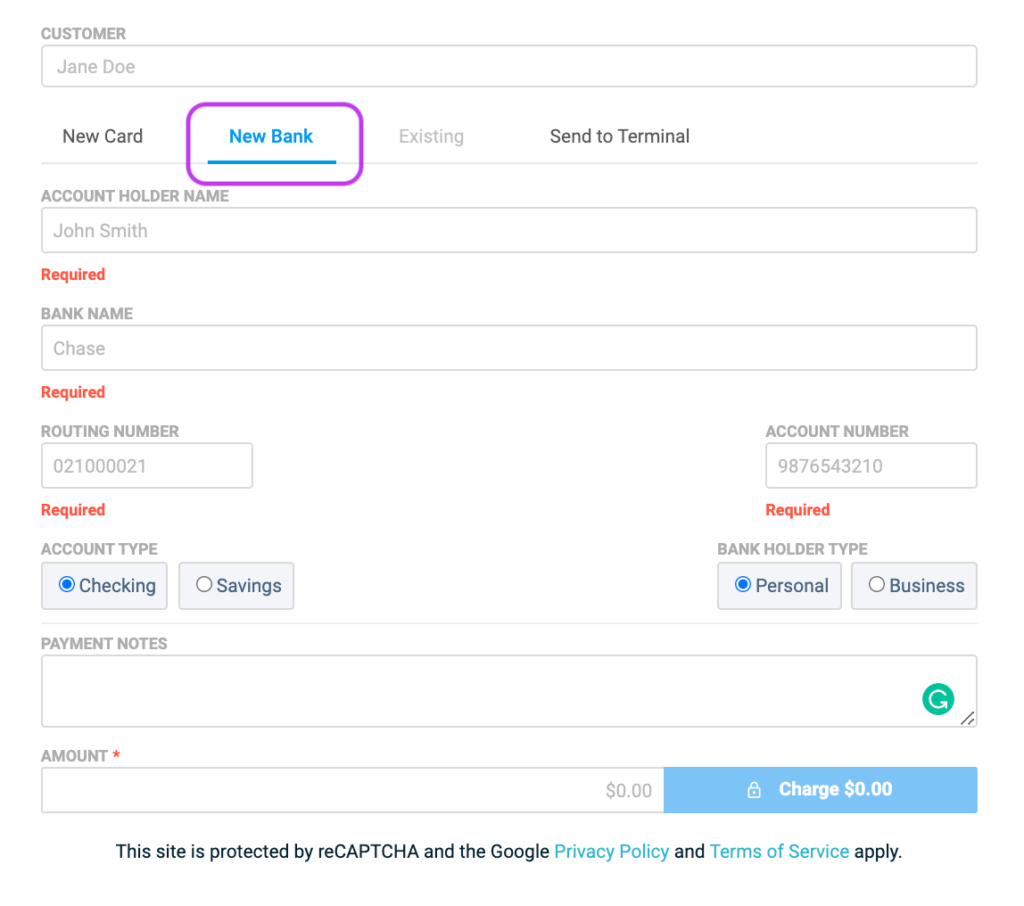

Card, ACH, surcharging

One-time, invoice, B2B, international payments

Payment Depot

4.46

$0

$0

Card, ACH, surcharging

One-time, invoice, B2B

PaymentCloud

4.43

$10–$45

$15–$45

Card, ACH, surcharging

One-time, invoice, B2B

Stax

4.42

$99–$199

$0

Card, ACH, surcharging

One-time, invoice, B2B

Square

4.33

$0–$165 (w/POS)

$0

Cash, card, ACH

One-time, invoice

PayPal

4.27

$0

$30

Credit and debit cards

One-time, invoice, international payments

CardX

4.25

$29–$199

$0

Credit and debit cards

One-time, invoice, B2B

Did you know?

Businesses can use virtual terminals without any additional hardware, so all you need is a computer or mobile device to log in to your merchant dashboard. However, card readers can be easily connected to process occasional in-person payments.

Consider the following questions as you go through my provider evaluations below:

- Can it work with your POS and other business systems?

- Is the software fee reasonable?

- Does it support transaction types and payment methods that your business needs?

- Does it support payment processing fit for your sales volume?

Helcim: Best overall virtual terminal (best for minimizing fees)

Overall Score

4.59/5

Pricing

5/5

Features

4.5/5

Support & Reliability

4.69/5

User Experience

4.69/5

Average User Review Scores

4.07/5

Pros

- No add-on or monthly fees

- Automated volume discounts

- Offers free credit card processing via surcharging

Cons

- Charges extra for AMEX transactions

- Limited back-office integrations

- Application process not ideal for new businesses

Why I chose Helcim

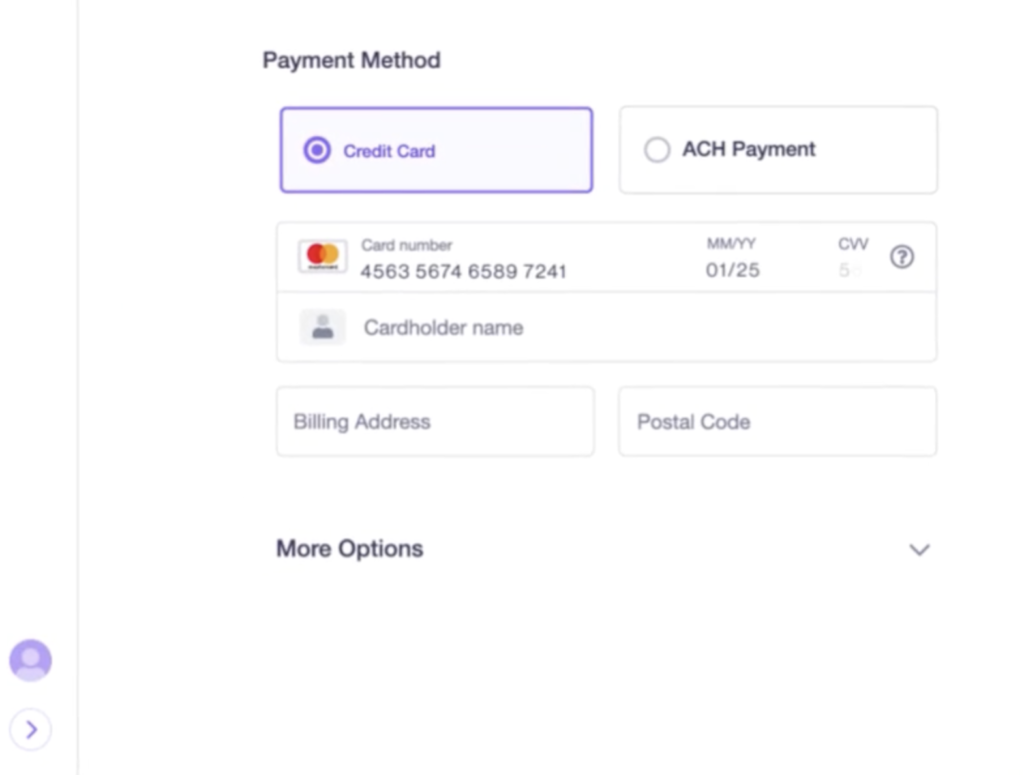

Helcim is a traditional merchant account services provider known for its free and automated payment processing features, including a virtual terminal. You can use the virtual terminal to accept one-time and recurring payments from an unpaid invoice or simply from pulling up a customer profile. It can process credit card, ACH, and EFT payments. Plus, Helcim has tools for free credit card processing that you can access any time, which pass along the processing fees to your customers.

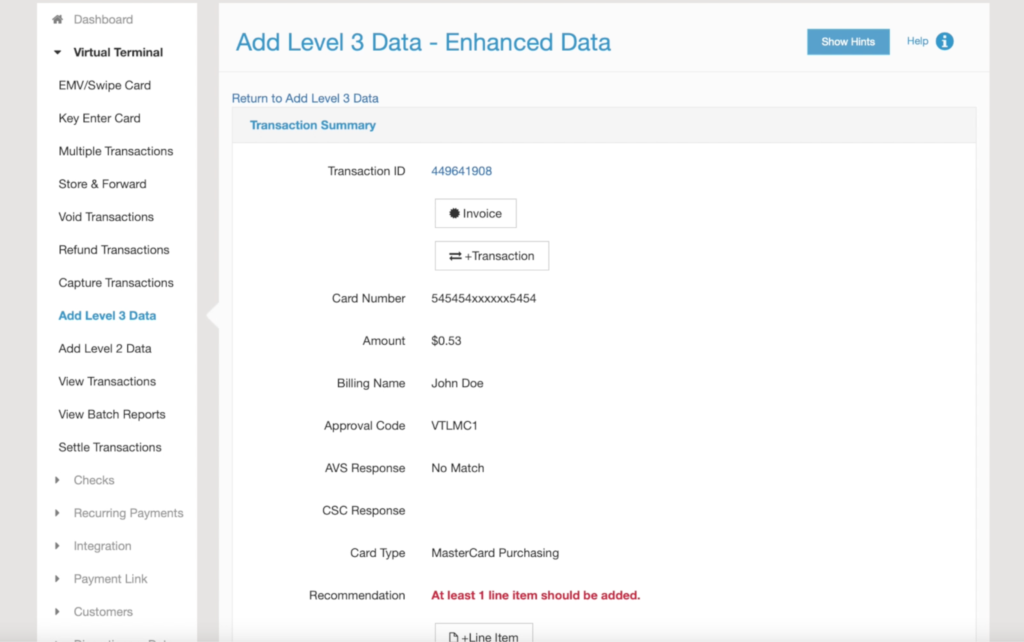

I chose Helcim for its strong cost optimization features. Aside from zero monthly fees and interchange plus rates, what makes Helcim stand out is its automatic volume discounts. In other words, your per-transaction fees will decrease automatically as your business scales and hits certain processing volumes. For B2B businesses, Helcim’s payment processing features automatically pull level 2 and 3 data so every qualified transaction can get discounted rates.

This makes Helcim the ideal solution for fast-growing small and mid-size businesses in industries like retail, professional services, automotive, healthcare, education, and wholesale.

Related: B2B payments guide

Payment Depot: Cheapest for mid-size volume transactions

Overall Score

4.46/5

Pricing

5/5

Features

4.25/5

Support & Reliability

4.38/5

User Experience

4.06/5

Average User Review Scores

4.63/5

Pros

- No monthly fees

- Custom interchange-plus rates

- Multiple virtual terminal integrations

Cons

- Only for U.S.-based businesses

- Lacks option for same-day funding

- ACH payment processing is an add-on

Why I chose Payment Depot

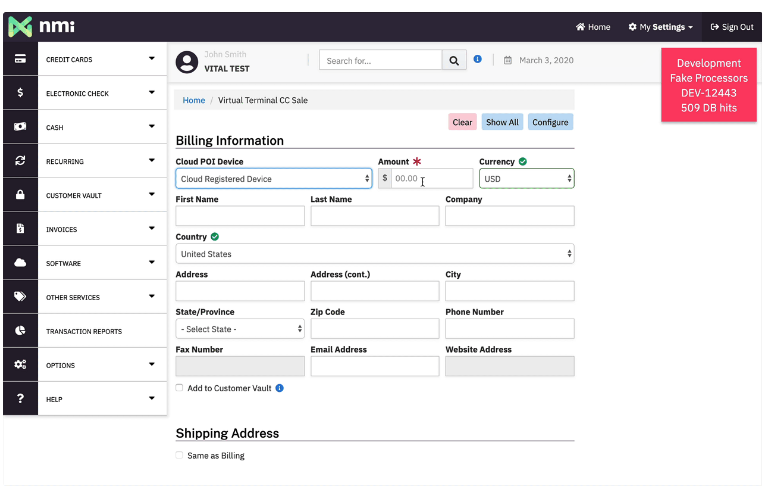

Payment Depot supports a variety of virtual terminal platforms from popular payment gateway integrations such as NMI, Authorize.net and PayTrace. There are no additional monthly fees, as Payment Depot’s custom pricing already includes every payment service that a business opts into, including a virtual terminal.

Until recently, Payment Depot operated under a similar subscription model (wholesale transaction rate + monthly fee) used by its parent company, Stax. It has since remodeled to custom interchange plus pricing. This makes Payment Depot more affordable and attractive to mid-size businesses that have yet to reach volume levels that can maximize savings with a monthly fee and wholesale rates.

PaymentCloud: Best for high-risk businesses

Overall Score

4.43/5

Pricing

3.75/5

Features

4/5

Support & Reliability

4.69/5

User Experience

5/5

Average User Review Scores

4.7/5

Pros

- Works with high-risk businesses

- Flexible fee structure

- Payment gateway agnostic

Cons

- Monthly account fee

- Add-on monthly cost for virtual terminals

- Lacks same-day funding option

Why I chose PaymentCloud

PaymentCloud is a traditional merchant services provider that supports all types of payment processing methods. While it caters to nearly all business types, PaymentCloud is particularly known for its expertise in working with high-risk businesses, which no other provider in our list can do. Virtual terminals are in-demand among these business types because most of these companies accept mail-order/telephone-order (MOTO) payments.

I especially like PaymentCloud’s attention to detail when handling accounts for high-risk merchants. It works with clients right from the application to provide the highest chance of being approved for a merchant account. I also like PaymentCloud’s flexibility as it can customize its rates based on what a potential client is familiar with and adapt the customer’s current payment gateway platform avoiding business downtime.

Stax: Cheapest, wholesale transaction fees for large businesses

Overall Score

4.42/5

Pricing

4.69/5

Features

4.5/5

Support & Reliability

4.69/5

User Experience

4.38/5

Average User Review Scores

3.83/5

Pros

- Wholesale transaction fees

- No long-term contract

- Text2pay feature

Cons

- High monthly fees

- Lacks same-day funding option

- ACH payment processing is an add-on

Why I chose Stax

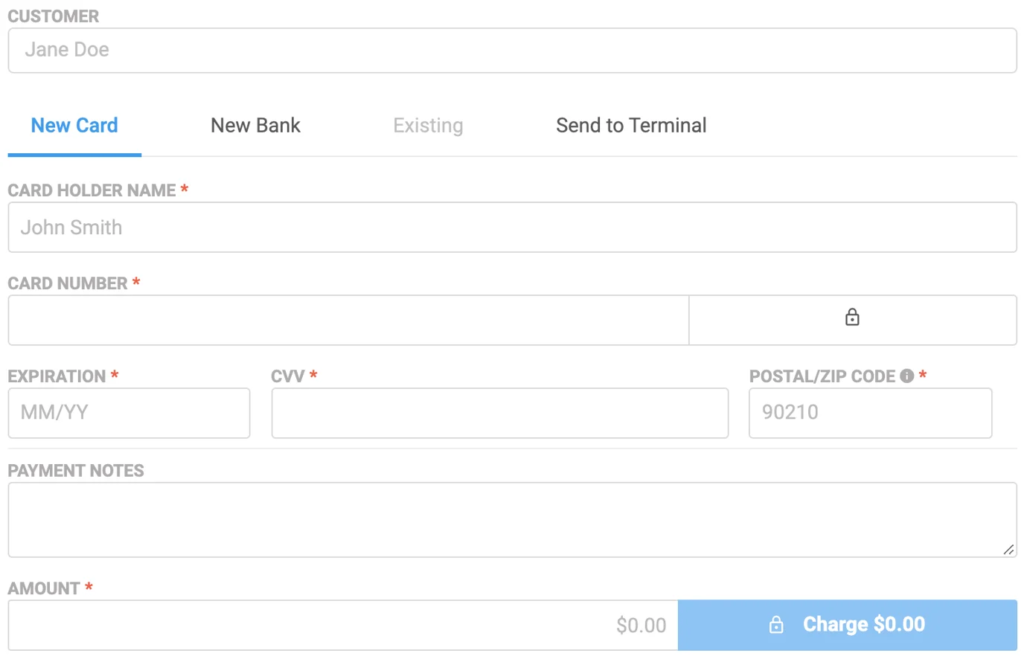

Stax is a popular merchant services provider, offering wholesale interchange rates ideal for high-volume businesses. Its virtual terminal is built into Stax Pay, allowing businesses to accept card and bank payments, set recurring transactions, send invoices, payment links, and even SMS to collect payments.

What’s also great about Stax is that it offers a range of products that can easily keep up with fast-growing businesses and large, enterprise-level companies. For example, Stax Bill offers advanced billing and recurring payment services for businesses that run subscriptions. There’s also Stax Connect for software vendors that want to integrate an end-to-end payment processing service to their software platforms (SaaS).

Learn more: Cheapest credit card processing companies

Square: Best for new and small businesses

Overall Score

4.33/5

Pricing

4.06/5

Features

4.5/5

Support & Reliability

4.06/5

User Experience

4.38/5

Average User Review Scores

4.67/5

Pros

- Free POS software

- No monthly fees for payment processing

- Waived chargeback fees

Cons

- Not the cheapest transaction fees

- Invoicing customization for a fee

- Account stability issues

Why I chose Square

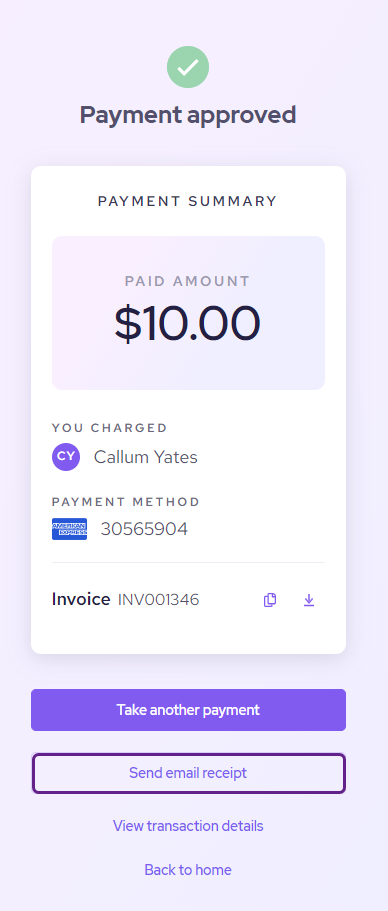

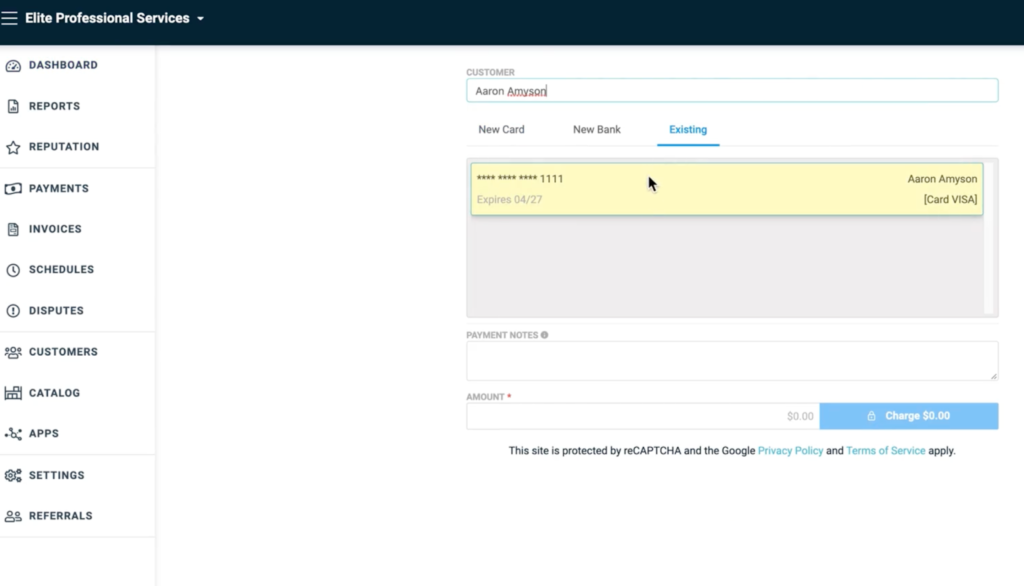

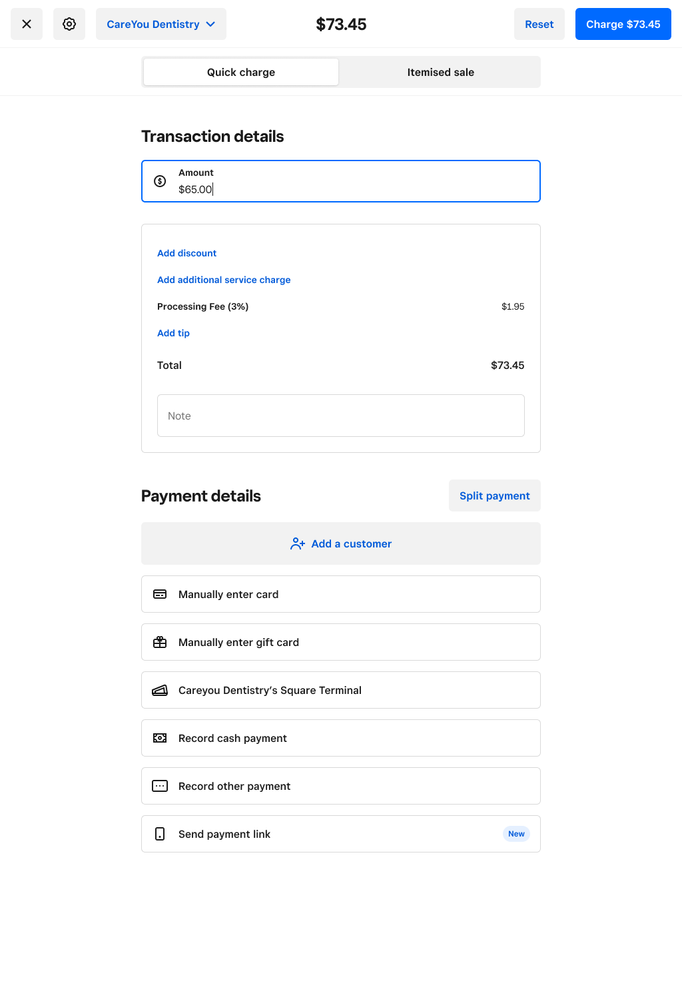

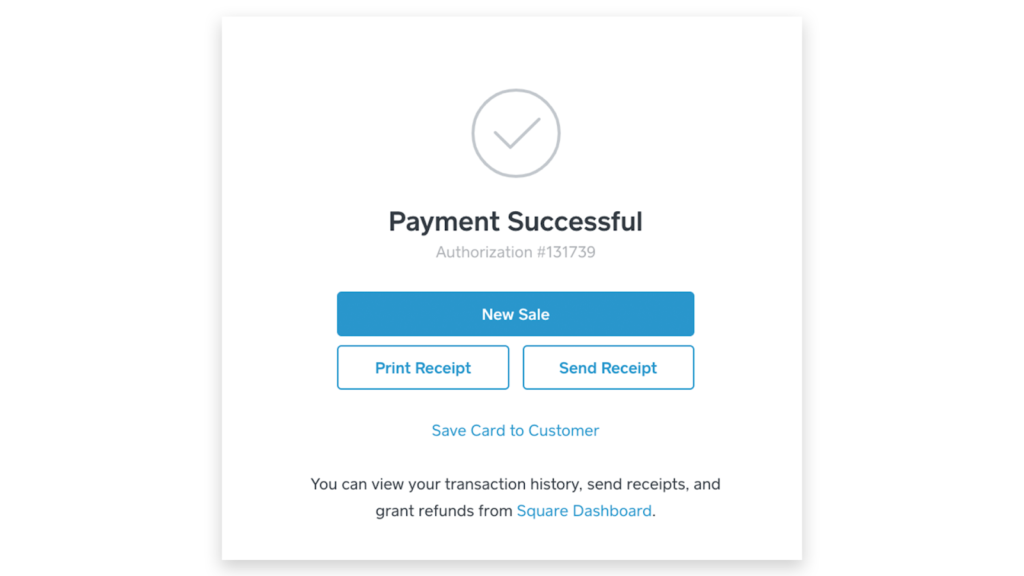

Square is the ideal all-in-one business solution for new businesses. There are no monthly fees for using its payment processing service, which comes built into Square’s suite of POS software. Square’s virtual terminal is also free with every merchant account and can just as easily handle all the payment methods supported by the other providers on our list. You can use it to manually enter card information, record a cash or check payment, and send a payment link. But what makes Square stand out from the rest is its overall small and new business friendly features.

Unlike Helcim, Payment Depot, PaymentCloud, or Stax, there is no application process to go through with Square, making it ideal for startups that don’t have a payment processing history. I particularly like how Square offers an all-in-one business solution of POS, hardware, ecommerce, and payments processing with the most feature-rich free account you’ll ever find in the market today. And while flat rate fees are not as cost-effective as interchange plus rates, this pricing structure is simple to manage particularly for new merchants. Square even offers proprietary business management tools, most of which you can get for free.

For larger businesses, Square now has an enterprise solution which allows you to create customized POS and payment processing platforms that will work with your current business set up. You can also qualify for custom rates if you process more than $250,000 in annual sales. However, note that you can only process ACH payments on Square’s virtual terminal if the transaction goes through an invoice. And while you can accept credit card payments from other countries, you will only be able to hold funds in your local currency.

Learn more: Best mobile credit card processors

PayPal: Best for accepting online international payments

Overall Score

4.27/5

Pricing

3.75/5

Features

4.25/5

Support & Reliability

3.75/5

User Experience

5/5

Average User Review Scores

4.6/5

Pros

- Free merchant account

- Fast set up and no long term contract

- Supports multi fiat and crypto currencies

- Free instant access to funds via PayPal balance

Cons

- Monthly fee for virtual terminal

- Does not support ACH payments on virtual terminal

- Access to recurring billing features w/fee

- Not covered by PayPal Seller Protection policy

Why I chose PayPal

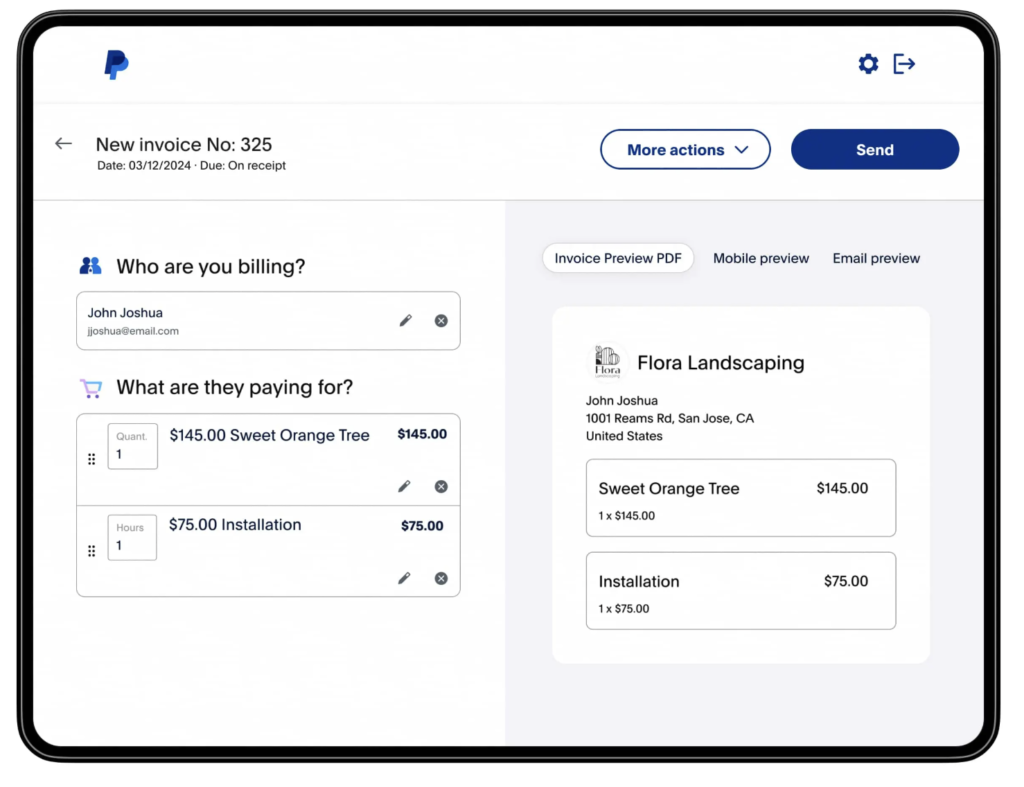

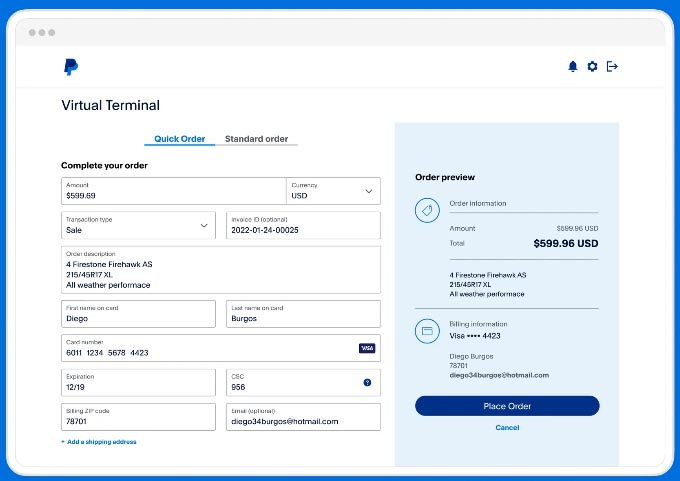

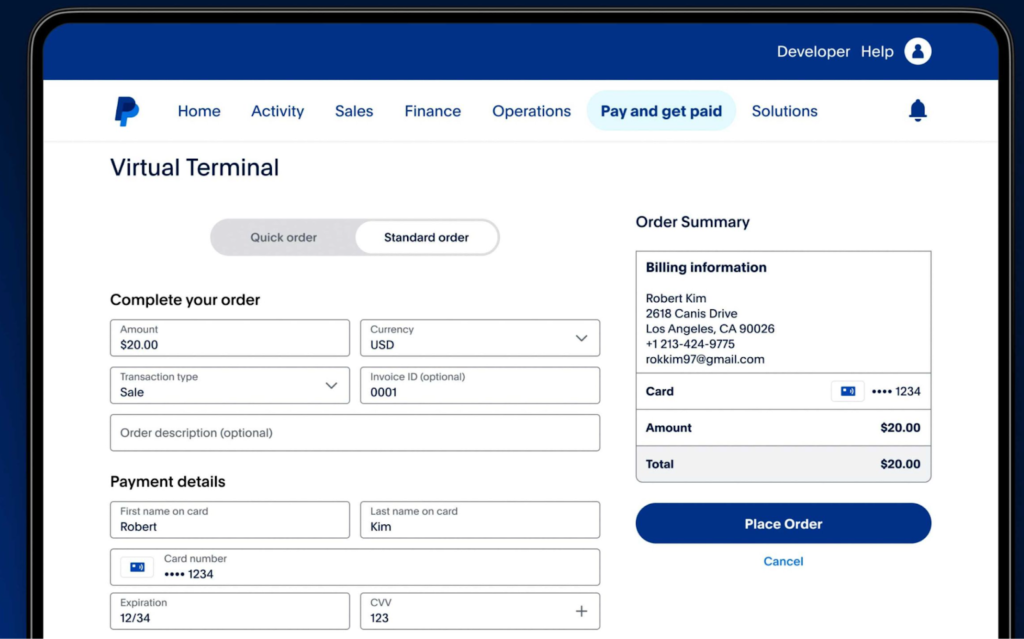

PayPal is the pioneer of mobile payment platforms and the most trusted brand with over 400 million active users around the globe to date. Like Square, the merchant account is easy to set up and free to use with no long term contracts. And while it can’t match Square’s versatile POS software options, PayPal stands out among my list of providers for its ability to handle 100+ currencies, making it the best mobile payment solution for businesses that accept international payments.

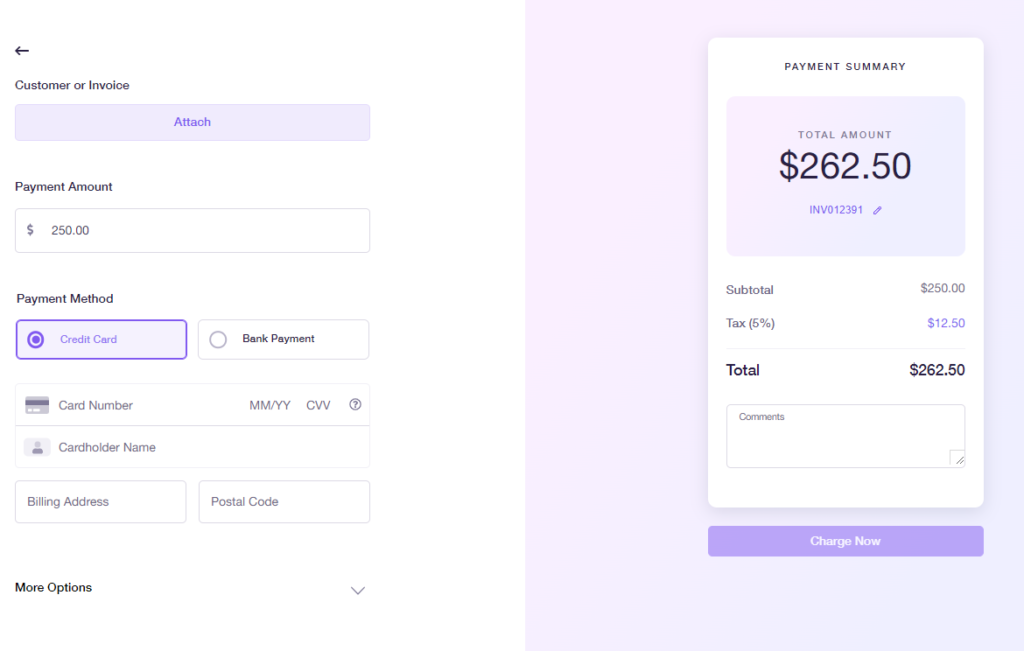

As a virtual terminal I particularly like PayPal because of how easy it is to use. While I can say the same for other contenders like Helcim, Square, and CardX which I all tried, PayPal’s layout and interface is simply more user-friendly. Whether you are preparing a quick manual order, pulling an outstanding invoice, or creating an invoice within the virtual terminal itself, all you need to do is choose a different option from the choices in the dropdown boxes. Plus, you also get instant access to your funds from your PayPal balance.

A few caveats if you choose PayPal though: First, its virtual terminal can only process credit and debit card payments unless you use PayPal enterprise to upgrade the service with developer tools. Second, unlike Square and Helcim, PayPal charges a monthly fee to use the virtual terminal platform. Third, manual payments processed on the customer’s behalf are not covered by PayPal’s seller protection policy so make sure to have solid chargeback protection protocols in place to protect you from fraudulent claims.

Related: Best online payment processors

CardX: Best for free credit card processing

Overall Score

4.25/5

Pricing

4.69/5

Features

4/5

Support & Reliability

4.69/5

User Experience

4.38/5

Average User Review Scores

3.5/5

Pros

- Automated surcharging

- Built-in invoicing and virtual terminal

- Exclusive Mastercard partner

Cons

- Charges a monthly fee

- Some limitations on invoicing tools

- Lacks same-day funding

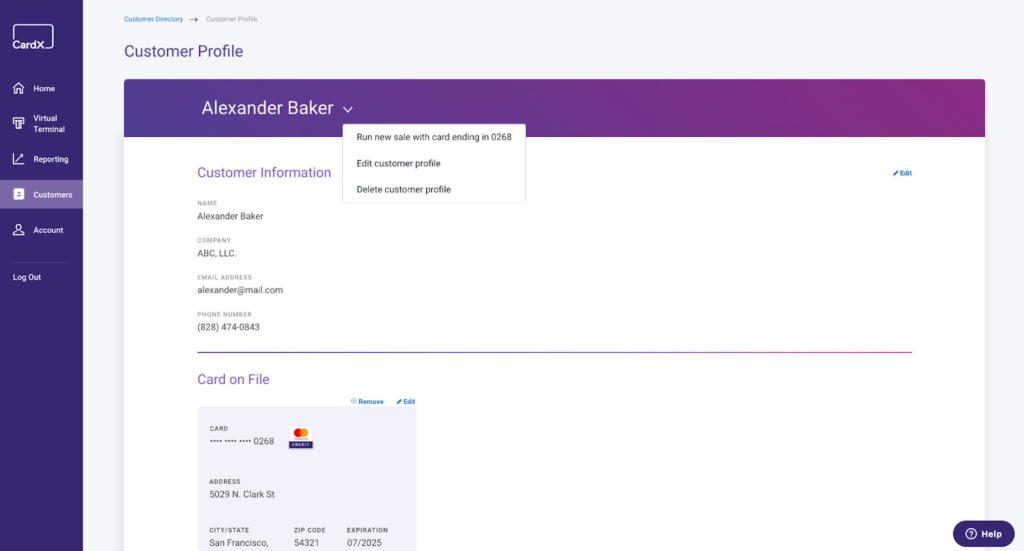

Why I chose CardX

CardX is the leading expert in credit card surcharging services and is the exclusive surcharging partner for Mastercard. It comes with built-in invoicing and a virtual terminal feature that users can access at no extra cost. CardX also provides businesses with the necessary surcharging signage and staff training to assist with start-up.

I chose CardX primarily for its credit card surcharging service. While other merchant account service providers in this list, like Helcim and PaymentCloud, also offer this feature, it’s hard to ignore CardX’s expertise. This makes CardX an overall more reliable solution for businesses where credit card surcharging is a key consideration.

However, like PayPal, CardX only supports credit and debit card payments, which is partly why the two land at the tail end of this buyers’ guide. CardX also charges a monthly merchant account fee which may be a deal breaker for those looking to minimize their monthly operating expenses, but keep in mind that the surcharging means there are no transaction fees to be paid unless your customer uses a debit card. CardX also does not charge extra for its subscription/recurring billing tools which will cost you an additional $10 per month with PayPal.

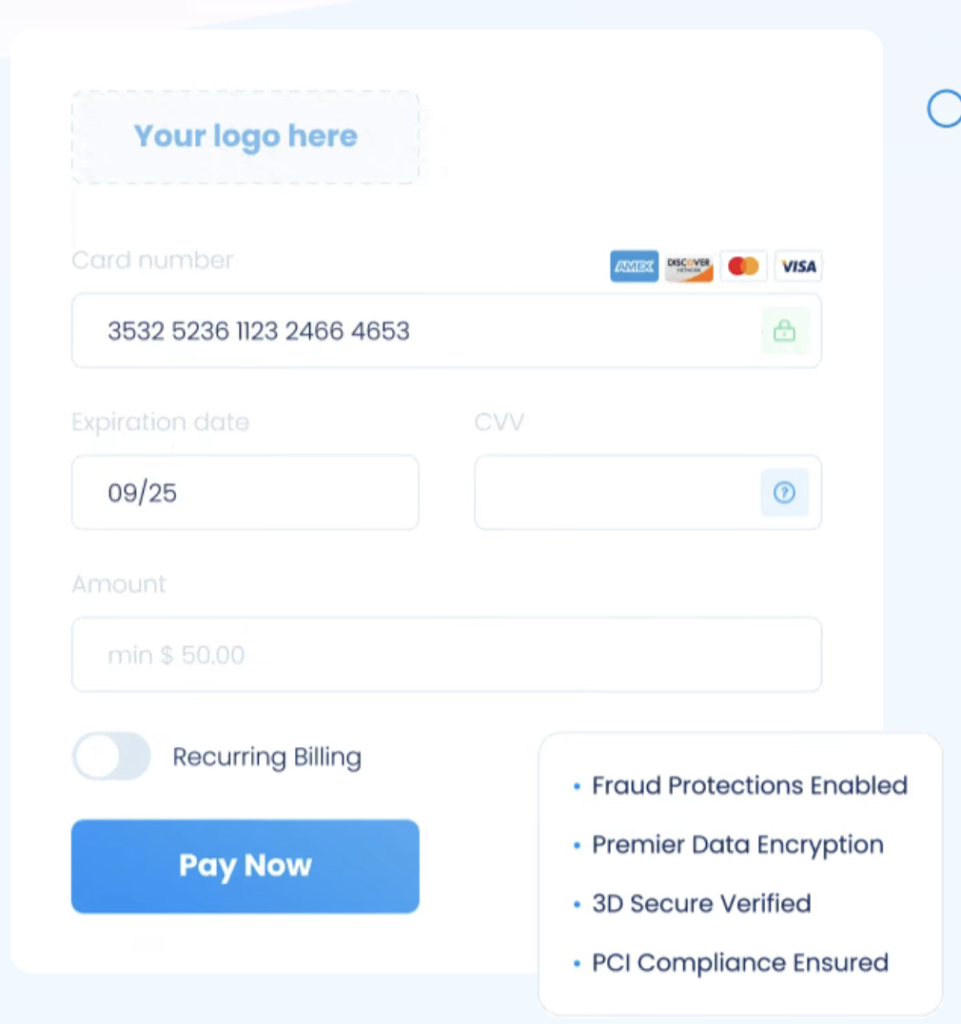

Finding the right virtual terminal for your business

Virtual terminals allow you to manually enter payment information on the customer’s behalf, as well as create shareable payment links to add on websites, social media posts, or send to customers via email and instant messaging platforms.

But while not all virtual credit card processing terminals are the same, there are key features you should look for when narrowing your list for the best option: