- January 7, 2025: Andrea Herrera evaluated three additional providers and included nine of the best ones instead of seven. She also updated the user review scores, checked the accuracy of the information for each provided, and made updates as needed.

Choosing the best credit card processing for nonprofits can make a significant impact on fundraising efforts and donor satisfaction. This involves balancing cost-effectiveness, user-friendly features, and specialized tools tailored to the unique needs of nonprofits.

In this guide, we looked at the best nonprofit payment processing solutions and evaluated them based on pricing, features, support and reliability, user experience, and user reviews.

Based on our evaluation, here are the best nonprofit credit card processors for 2025:

- Stripe: Best for technical flexibility and customization

- PayPal: Best for global reach and donor familiarity

- Givebutter: Best for free nonprofit platform

- Helcim: Best for transparent low-cost processing

- Square: Best for in-person donation and sales

- iATS: Best for integrated nonprofit solutions

- Bloomerang: Best for donor retention and relationship management

- Donorbox: Best for flexibility of donation options

- Snowball Fundraising: Best for simple online fundraising

Best nonprofit payment processing providers compared

Providers

Our score (out of 5)

Monthly fee starts at

Nonprofit processing rate

Deposit speed

Stripe

4.36

$0

- 2.2% + $0.30 for businesses with 501(c)(3) status

Same-day to 2 business days

PayPal

4.35

$0

- 1.99% + $0.49 for businesses with 501(c)(3) status

Same-day to 2 business days

Givebutter

4.28

$0

- 2.9% + $0.30 for cards and digital wallets* (donors have the option to cover this fee if Add tips is enabled)

- 1.9% + $0.30 for ACH payments

- Additional platform fee if tips are disabled: 1%-5%

3-5 business days

Helcim

4.24

$0

- Interchange + 8% for online transactions

- Interchange + 18% for in-person transactions

- Visa and Mastercard Charity Interchange Rates apply for MCC 83981

1-2 business days

Square

4.23

$0

- 2.6% + $0.10 for in-person transactions

- 2.9% + $0.30 for online transactions

- 3.5% + $0.15 for keyed-in transactions

Same-day to 2 business days

iATS

4.22

Not disclosed

- 2.49% to 3.2%

1-2 business days

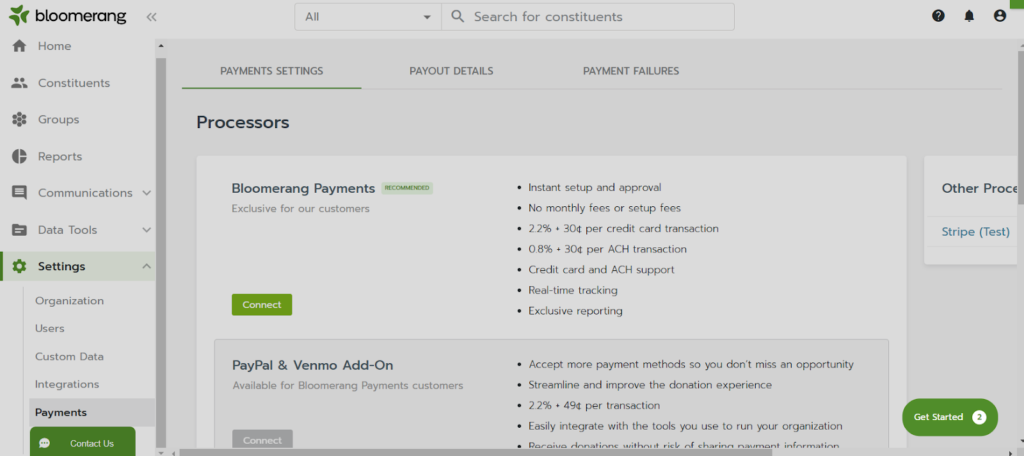

Bloomerang

4.01

$0

- 3.2% + $0.30 for all card transactions

- 1% + $0.30 for ACH transactions

2 business days

Donorbox

3.97

$0

- 2.2% + $0.30 (Stripe)

- 1.99% + $0.49 (PayPal)

- Platform fee: 1.75%-2.95%

1-3 business days

Snowball

3.86

$0

- 2.9% + $0.30 per transaction

2 business days

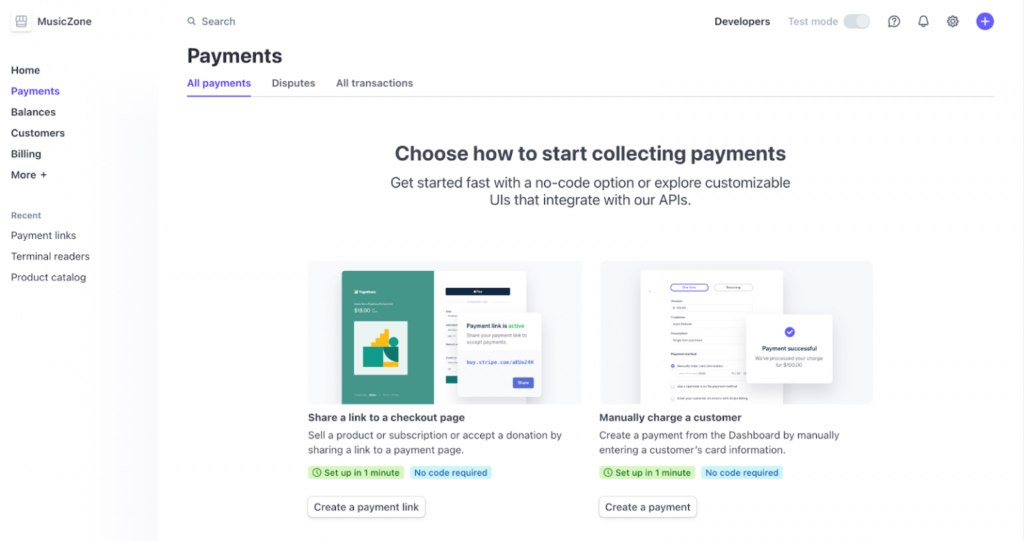

Stripe: Best for technical flexibility and customization

Overall Score

4.36/5

Pricing

4.5/5

Features

4.06/5

Support and reliability

4.38/5

User experience

4.38/5

User scores

4.47/5

Pros

- Discounted processing rate for nonprofits

- Robust developer tools and API

- 24/7 customer support

Cons

- No dedicated fundraising tools

- Requires 80% of donations to be processed on Stripe

- Nonprofit rate only applies to 501(c)(3) businesses

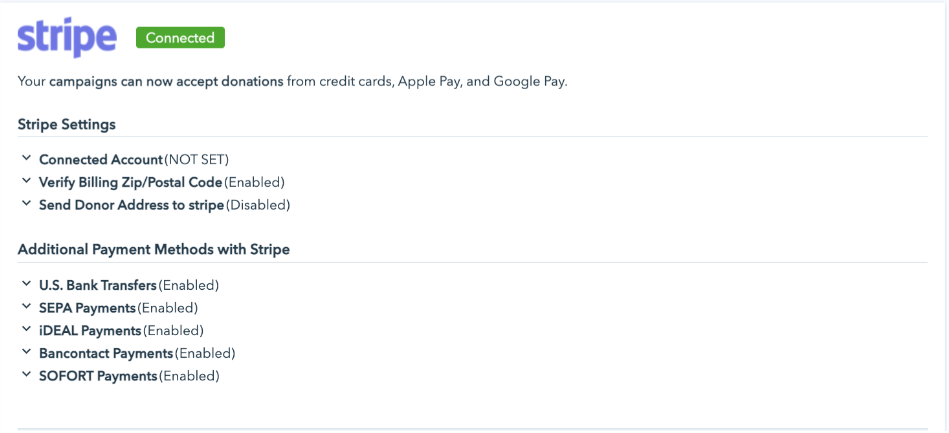

Why Stripe is good for nonprofits

I recommend Stripe for nonprofits primarily because of its discounted processing rate for 501(c)(3) organizations, which helps minimize costs, especially with its zero monthly fee. Its robust developer tools and API give you the technical flexibility and customization options unmatched by any provider on this list. This allows nonprofits to customize and integrate their payment solutions easily with their existing systems.

Stripe’s competitive nonprofit processing rate is another plus. The platform also offers 24/7 customer support, ensuring that any issues can be resolved promptly. Although it lacks dedicated fundraising tools, Stripe’s flexibility and powerful features make it a strong option for tech-savvy nonprofits seeking a tailored payment processing solution.

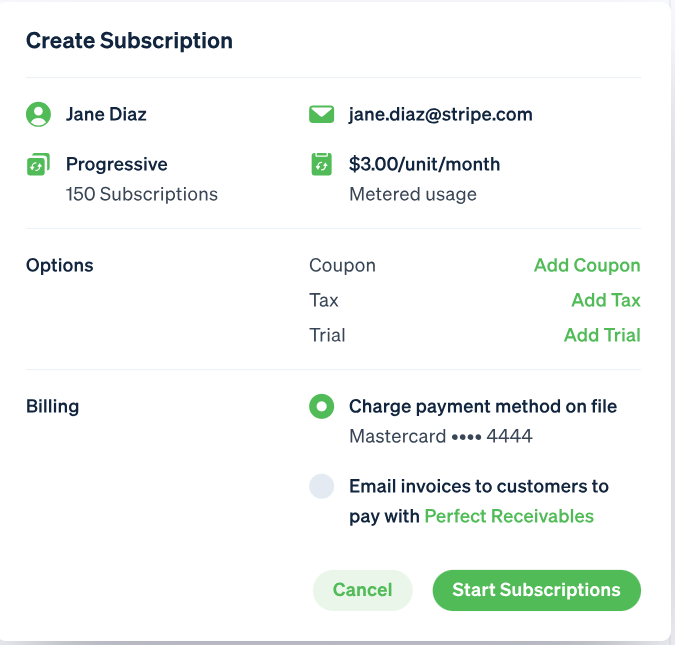

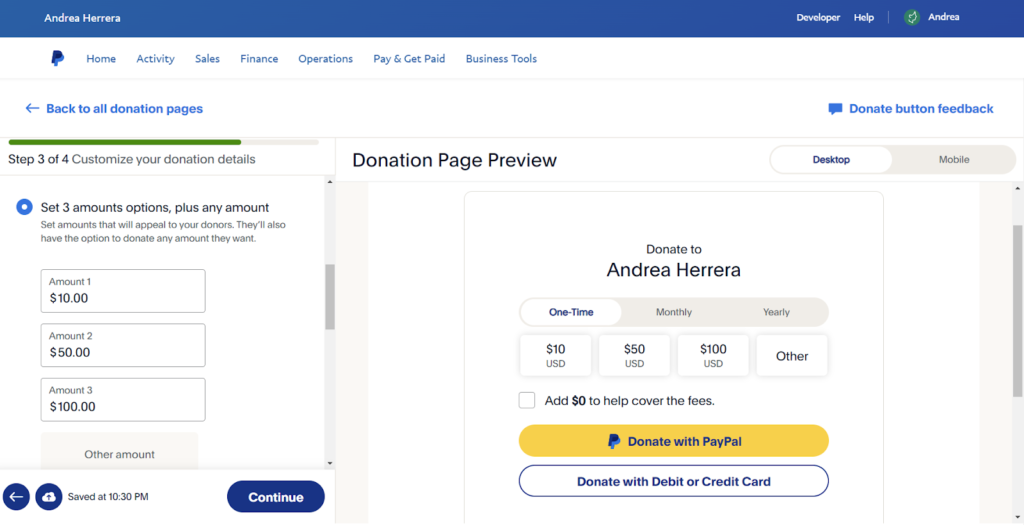

PayPal: Best for global reach and donor familiarity

Overall Score

4.35/5

Pricing

4.5/5

Features

4.22/5

Support and reliability

3.75/5

User experience

4.69/5

User scores

4.6/5

Pros

- Global reach

- Donor familiarity

- Discounted charity rates

Cons

- Account holds

- Limited fundraising tools

- High currency conversion fee

Why PayPal is good for nonprofits

PayPal is a strong choice for nonprofits due to its global reach and straightforward setup, making it especially useful for organizations with international donors. Unlike Square and other providers on this list, PayPal enables donations in multiple currencies with minimal effort, which I think is particularly helpful for global campaigns.

Like Stripe, it offers a competitive discounted transaction rate for 501(c)(3) organizations. Unlike Stripe, however, PayPal’s widespread recognition and trust among donors could lead to higher conversion rates for one-time contributions. Its donation button and compatibility with various fundraising platforms further enhance its appeal as a simple and reliable solution for nonprofits.

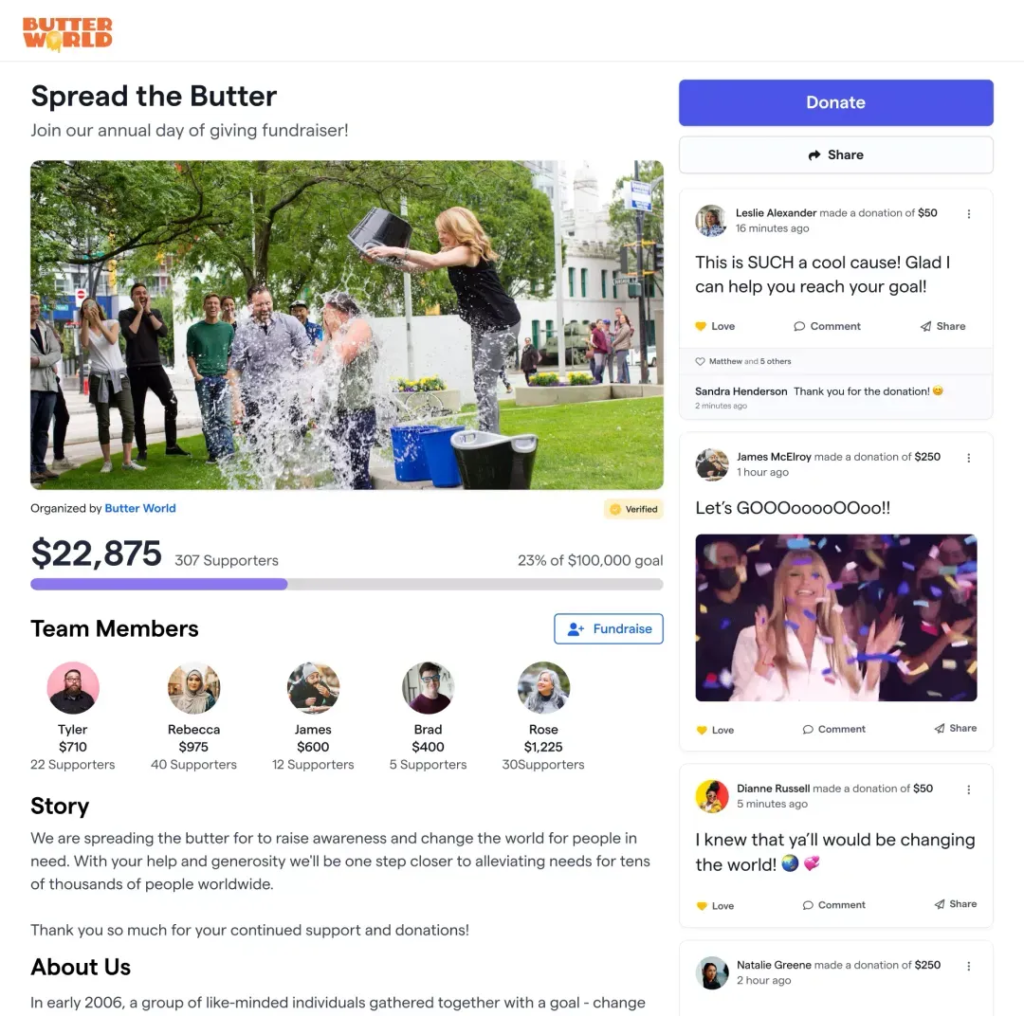

Givebutter: Best for free nonprofit platform

Overall Score

4.28/5

Pricing

4/5

Features

4.22/5

Support and reliability

4.06/5

User experience

4.38/5

User scores

4.77/5

Pros

- Multiple fundraising tools

- Free donor management system for tracking and engagement

- Zero platform fees if tips are enabled

Cons

- Dependence on donor tips

- Limited in-person fundraising tools

- Additional platform fee if tips are disabled

Why Givebutter is good for nonprofits

Givebutter is an excellent choice for nonprofits focused on maximizing donor engagement and transparency. Unlike PayPal or Stripe, which primarily offer standard payment processing, Givebutter combines crowdfunding, event ticketing, and peer-to-peer fundraising on a single platform. I like its modern, donor-friendly interface which encourages higher participation, especially for younger, tech-savvy audiences.

Givebutter also stands out with its “tips for platform” model, allowing nonprofits to avoid platform fees entirely if donors opt to cover them. This feature makes it more cost-effective than providers like PayPal, which charges fixed fees for transactions. For nonprofits prioritizing innovative and interactive fundraising campaigns, Givebutter provides a unique and effective solution.

Best for transparent low-cost processing

Overall Score

4.24/5

Pricing

4.5/5

Features

4.22/5

Support and reliability

3.75/5

User experience

4.69/5

User scores

4.07/5

Pros

- Discounted interchange rates for qualified charities

- Automatic volume discount

- Option for donors to cover processing fee

Cons

- No nonprofit platform discount

- Limited integrations

- No dedicated fundraising tools

Why Helcim is good for nonprofits

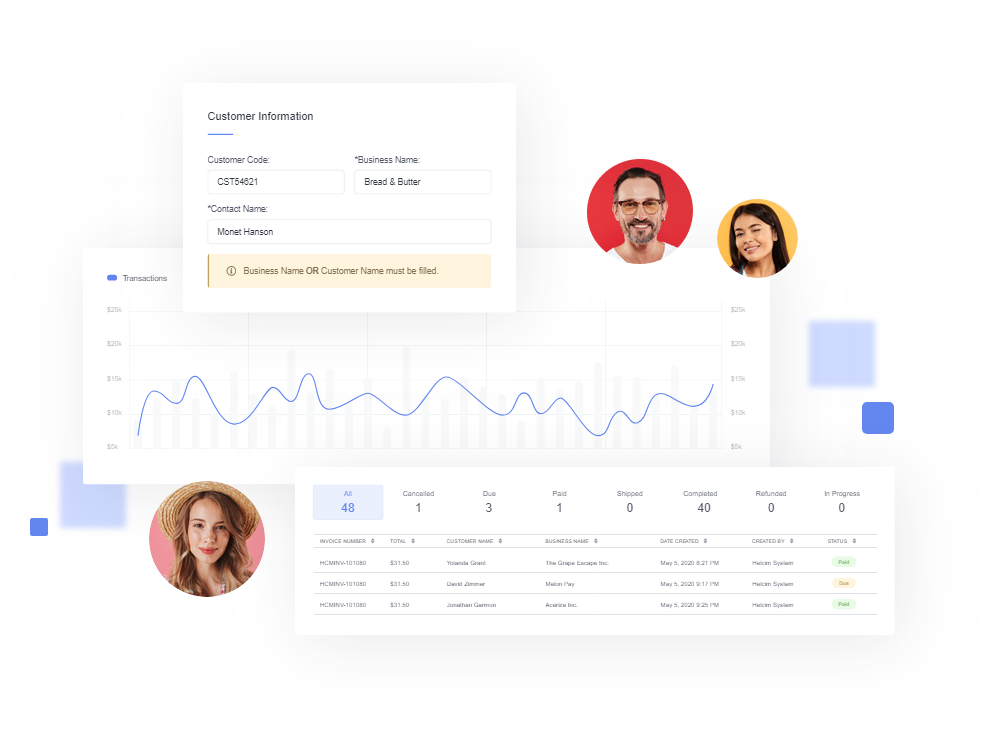

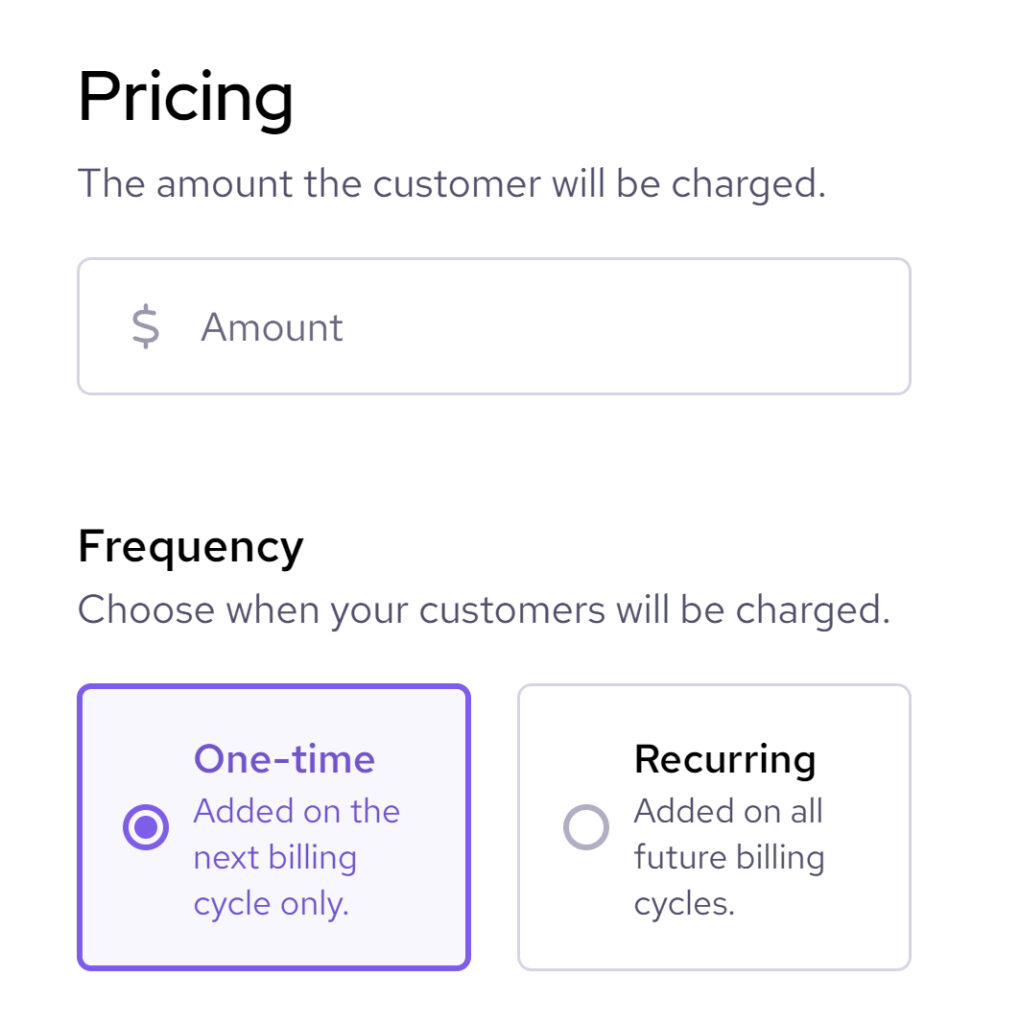

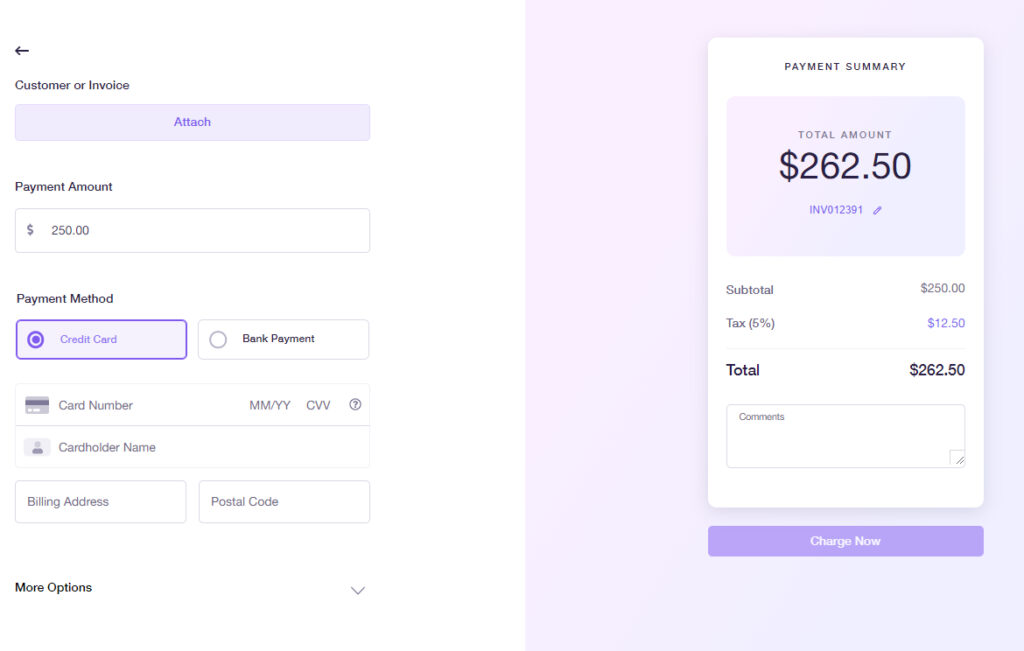

With zero monthly fees and interchange-plus pricing, Helcim stands out as one of the best payment processors for nonprofits. This pricing model ensures that nonprofit organizations benefit from lower Visa and Mastercard interchange fees if they qualify for the Merchant Category Code (MCC) 8398, designated for Charitable and Social Services Organizations. This can result in significant savings on transaction costs. However, regular interchange rates will apply to organizations not classified under MCC 8398.

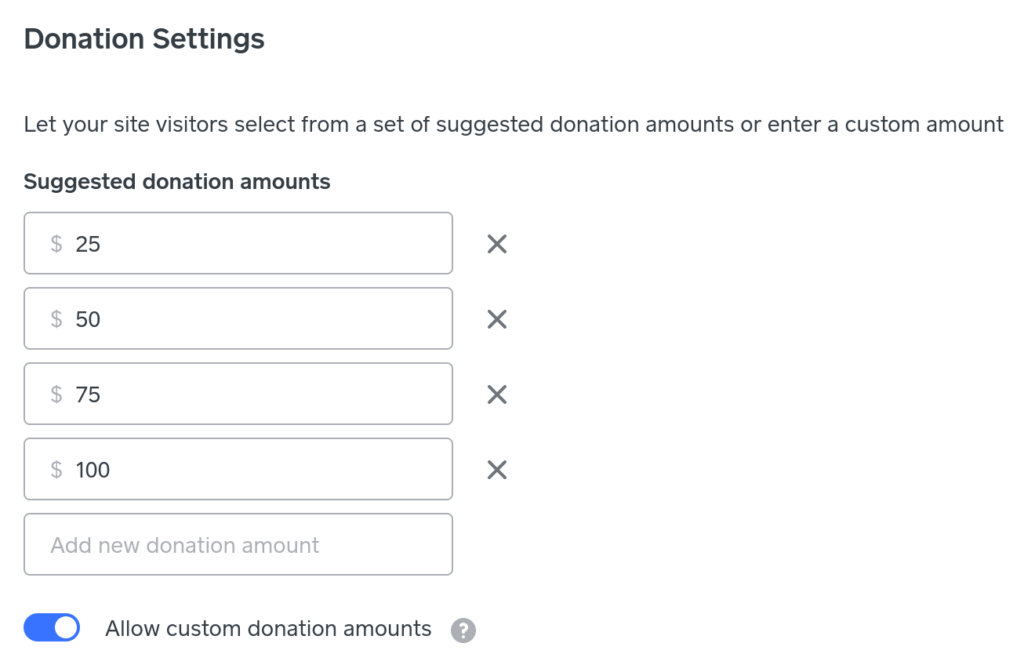

Helcim offers automatic volume discounts, further reducing costs for high-volume transactions. Its adaptable tools, like the CRM system for managing donor information, surcharging to pass processing fees onto donors, and subscription management for recurring donations, are valuable for nonprofits. Despite lacking specific nonprofit discounts and dedicated fundraising tools, Helcim’s cost-effective and versatile features make it a top choice for nonprofits.

Square: Best for in-person donations and sales

Overall Score

4.23/5

Pricing

4/5

Features

4.06/5

Support and reliability

4.06/5

User experience

4.38/5

User scores

4.67/5

Pros

- Flexible hardware options

- Omnichannel capabilities

- Easy set-up

Cons

- No nonprofit discounts

- Limited dedicated fundraising tools

- Limited customer support

Why Square is good for nonprofits

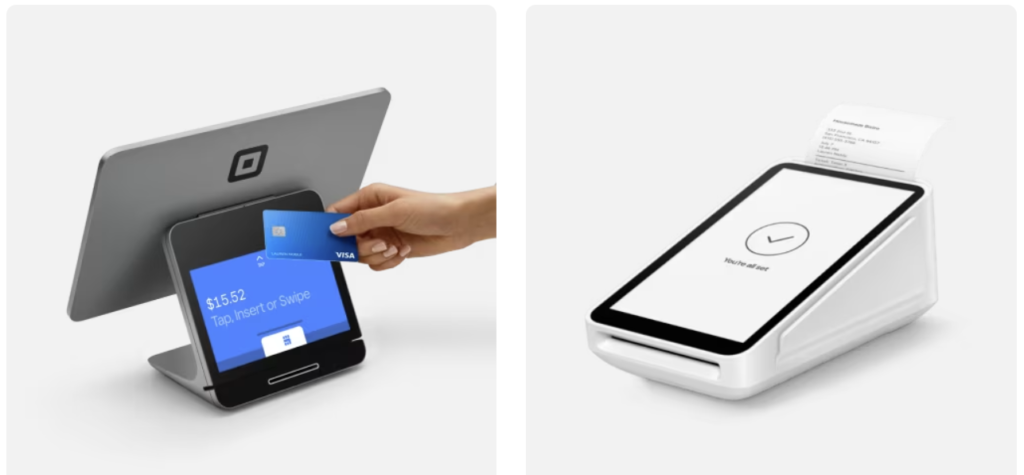

Square is a great choice for nonprofits, especially those focusing on in-person donations and sales. Its flexible hardware options, such as contactless chip readers and POS systems make it easy to accept payments at events or in physical locations. I find Square to be an excellent no-upfront-cost option for new and small businesses and this benefit applies equally to nonprofits.

The platform also offers robust reporting tools, providing valuable insights into donations and sales. Its omnichannel capabilities support both in-person and online transactions, which gives nonprofits the flexibility they need to manage their funds effectively. Compared to other providers like PayPal or Stripe, Square’s easy setup and user-friendly interface make it an ideal choice for nonprofits looking for a simple yet comprehensive payment solution.

iATS: Best for integrated nonprofit solutions

Overall Score

4.23/5

Pricing

4/5

Features

4.06/5

Support and reliability

4.06/5

User experience

4.38/5

User scores

4.67/5

Pros

- Specialized nonprofit focus

- Integrated solutions

- Dedicated support

Cons

- For nonprofits only

- Limited customization

- Fees are not disclosed

Why iATS is good for nonprofits

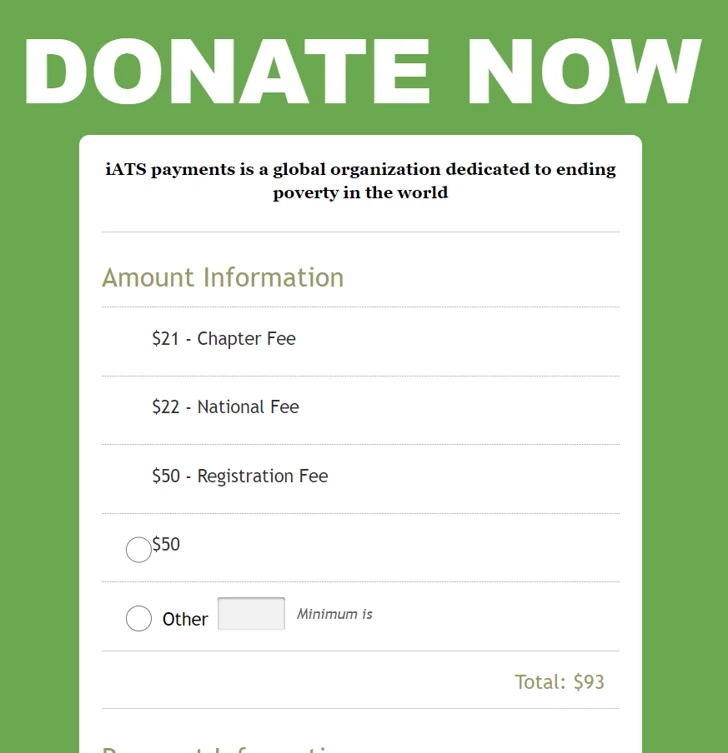

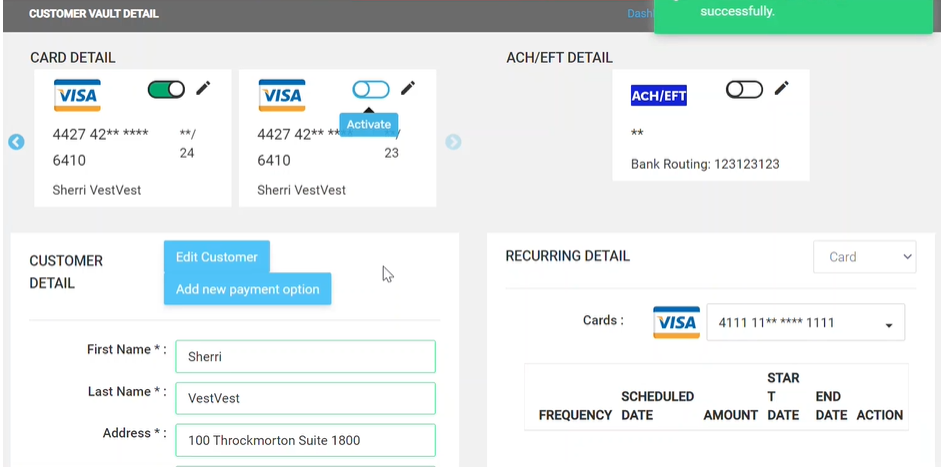

iATS is a suitable option for nonprofits due to its specialized focus on charitable organizations. Its integration with leading nonprofit management tools, like Salesforce’s Nonprofit Success Pack, simplifies data management and reduces administrative effort. I find this particularly valuable compared to more general solutions like PayPal or Stripe. iATS also offers customizable donor communication tools, which help nonprofits build stronger relationships with their supporters, setting it apart from platforms with a broader focus.

Recurring donation support is a key feature of iATS and this helps nonprofits establish predictable revenue streams for sustainability. I also appreciate how iATS combines this functionality with knowledgeable, nonprofit-specific customer support, making it more tailored to your needs than solutions like Square, which is better suited for general fundraising or event-driven donations. For organizations seeking a payment processor designed specifically for their unique challenges, iATS offers an excellent balance of functionality and security.

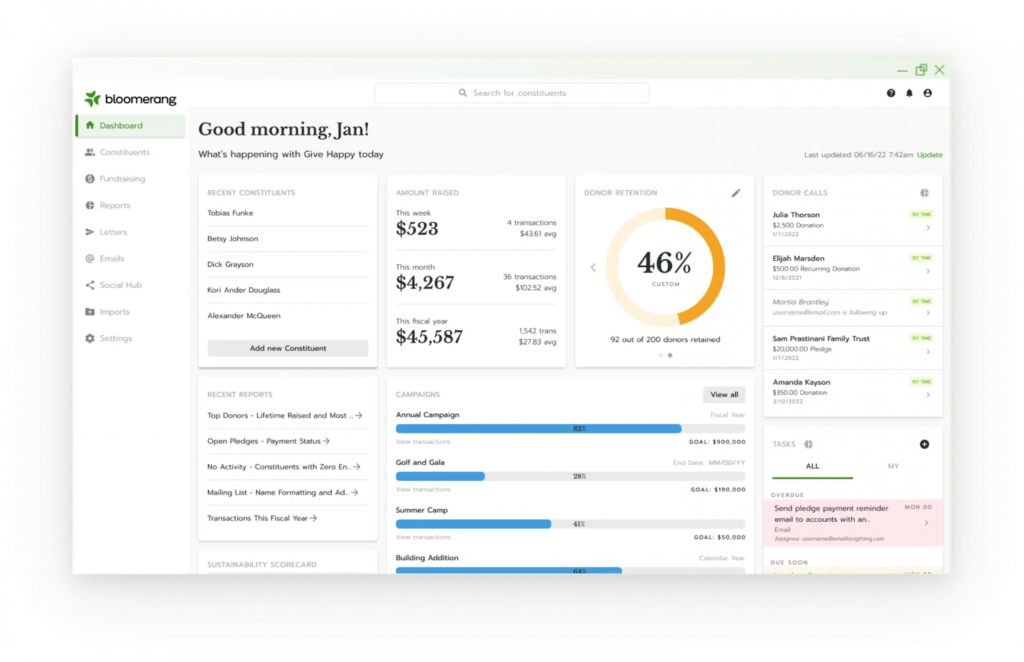

Bloomerang: Best for donor retention and relationship management

Overall Score

4.01/5

Pricing

3/5

Features

4.53/5

Support and reliability

4.06/5

User experience

3.75/5

User scores

4.7/5

Pros

- Donor engagement tools

- Integrated email marketing

- Unlimited fully customizable donation pages

Cons

- Higher monthly costs

- Limited integrations

- Limited event management tools

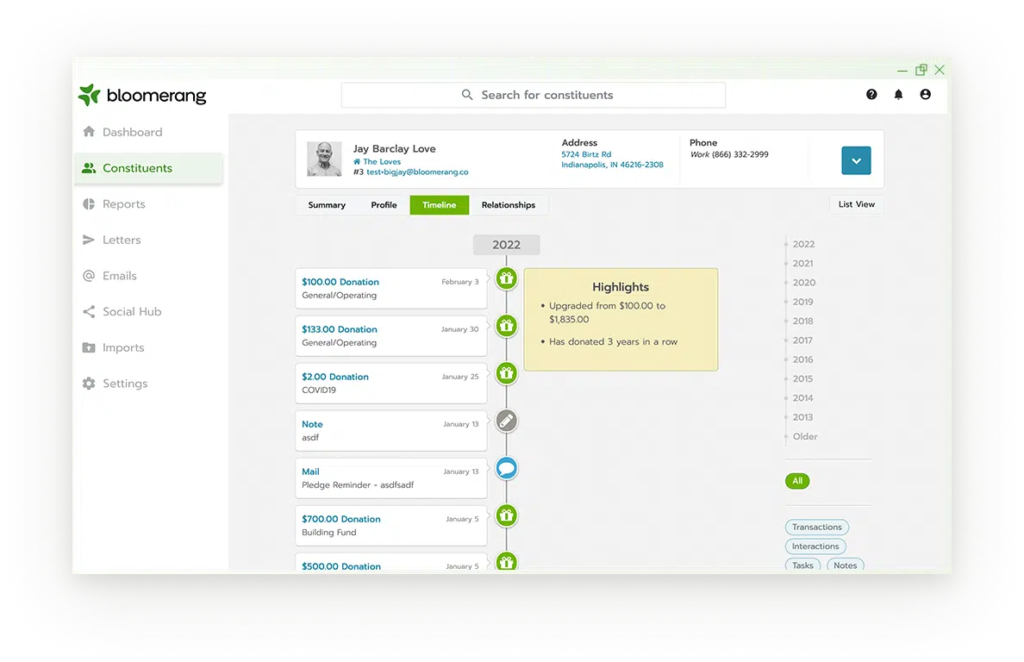

Why Bloomerang is good for nonprofits

Bloomerang is a good choice for nonprofits focused on improving donor retention and relationship-building. It is specifically designed to help nonprofits foster long-term donor engagement with tools such as its donor retention dashboard and communication timeline. I find its ability to track donor interactions and recommend best times to re-engage a standout feature compared to general CRM platforms like Salesforce or QuickBooks.

The platform also offers easy-to-use donor profiles and automated reporting that simplify managing data for small and mid-sized organizations. While it lacks some advanced features like in-depth event management or peer-to-peer fundraising, Bloomerang excels in its core focus on retention, making it particularly beneficial for nonprofits looking to maximize recurring donations and long-term support.

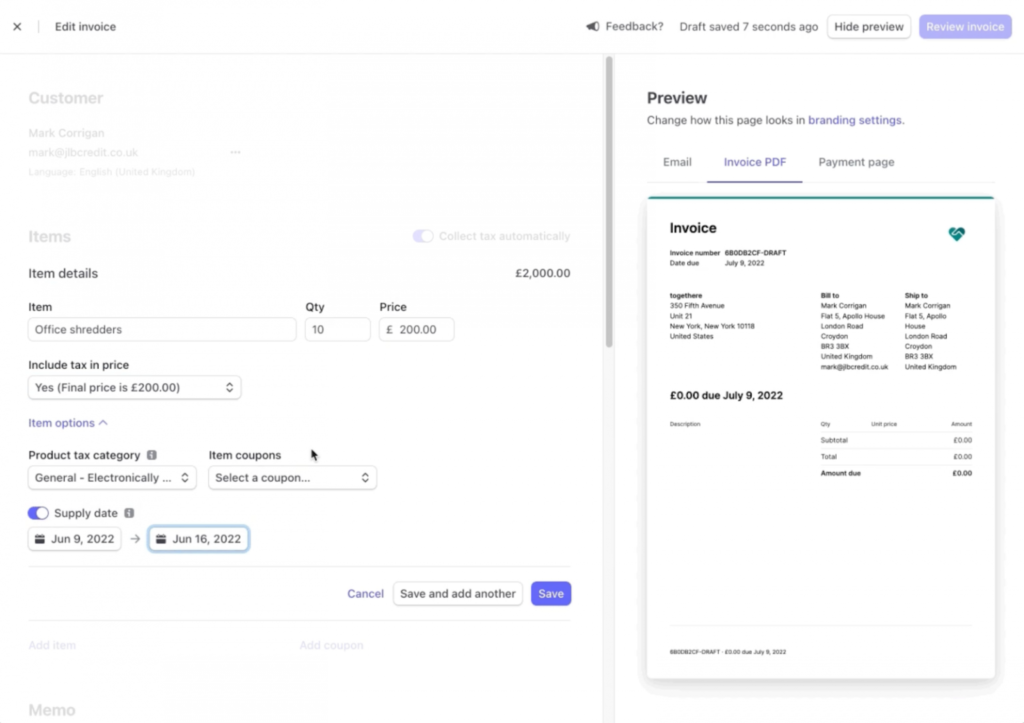

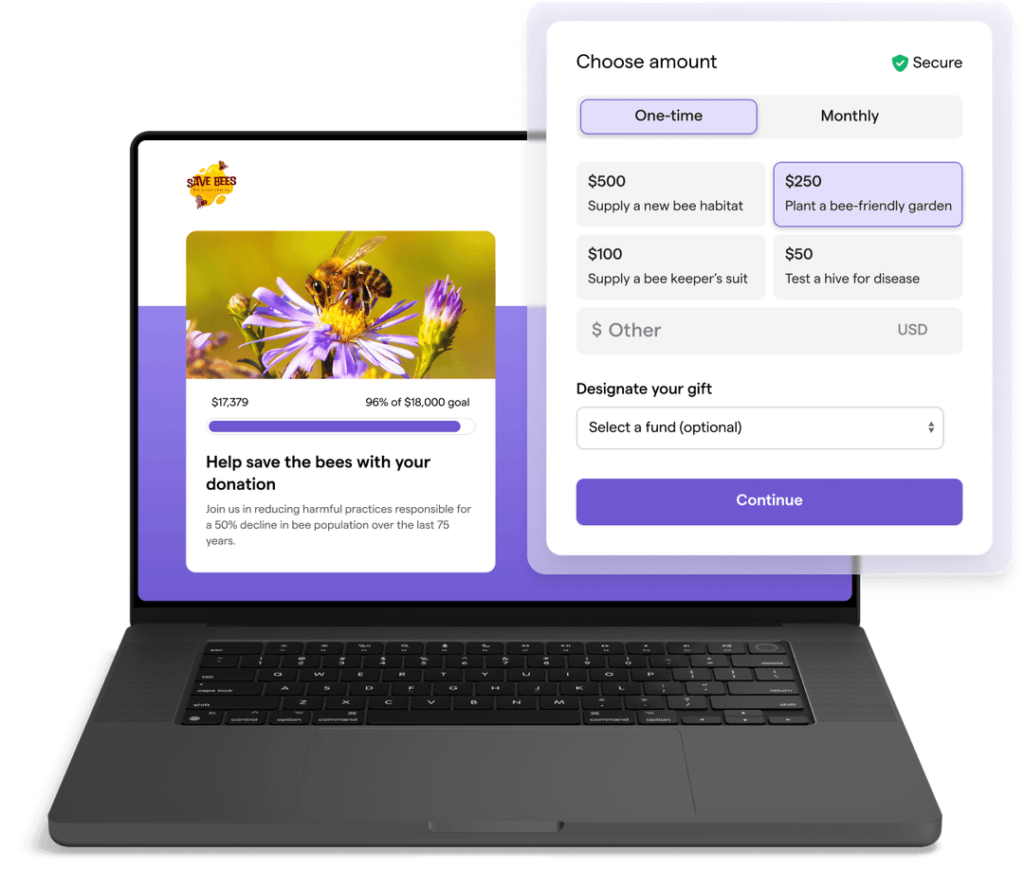

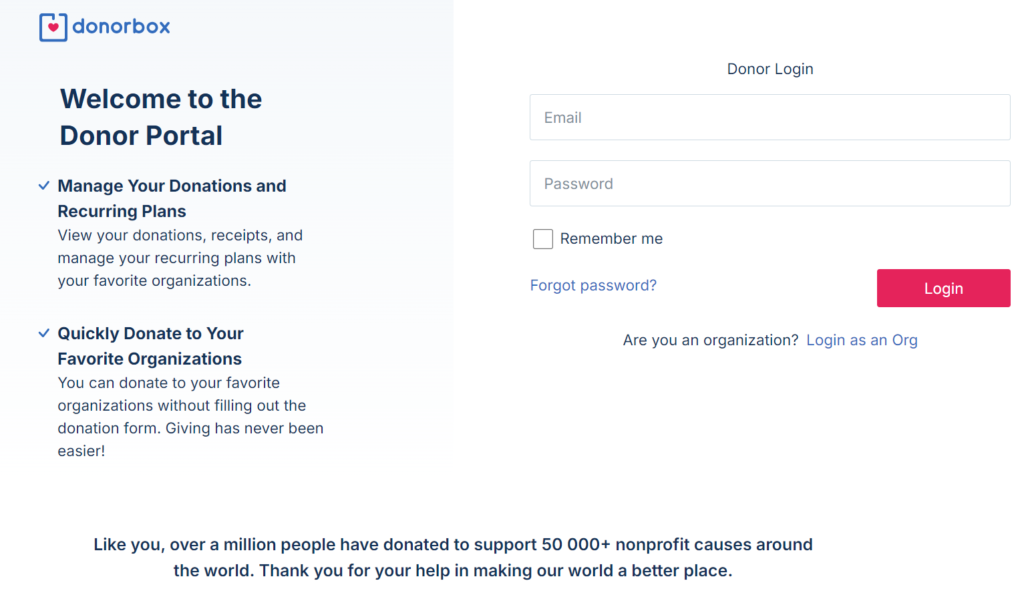

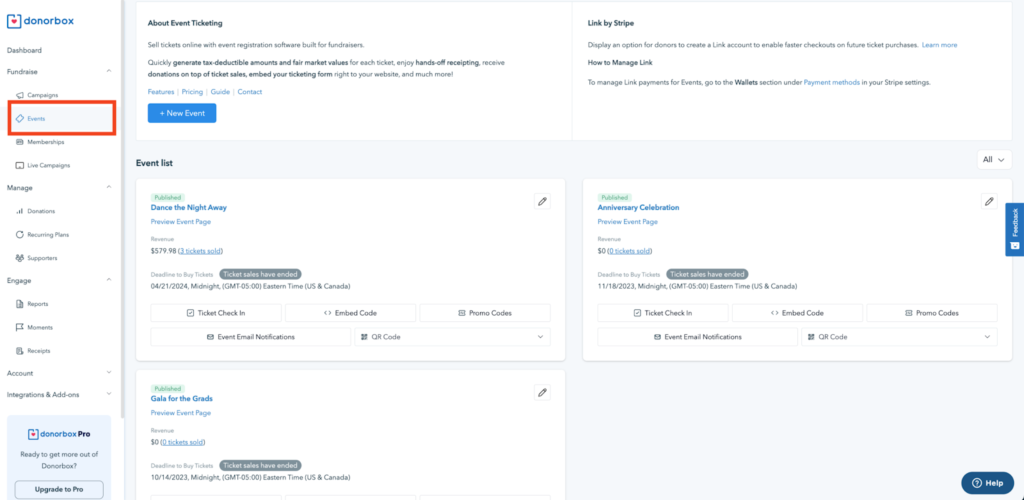

Donorbox: Best for donor management

Overall Score

3.97/5

Pricing

4.5/5

Features

3.75/5

Support and reliability

2.81/5

User experience

4.06/5

User scores

4.73/5

Pros

- Uses both Stripe and PayPal for payment processing

- Donor control over donation frequency

- Accepts stock or crypto donations

Cons

- Has an additional platform fee

- Pricing can be confusing

- Can be expensive

Why Donorbox is good for nonprofits

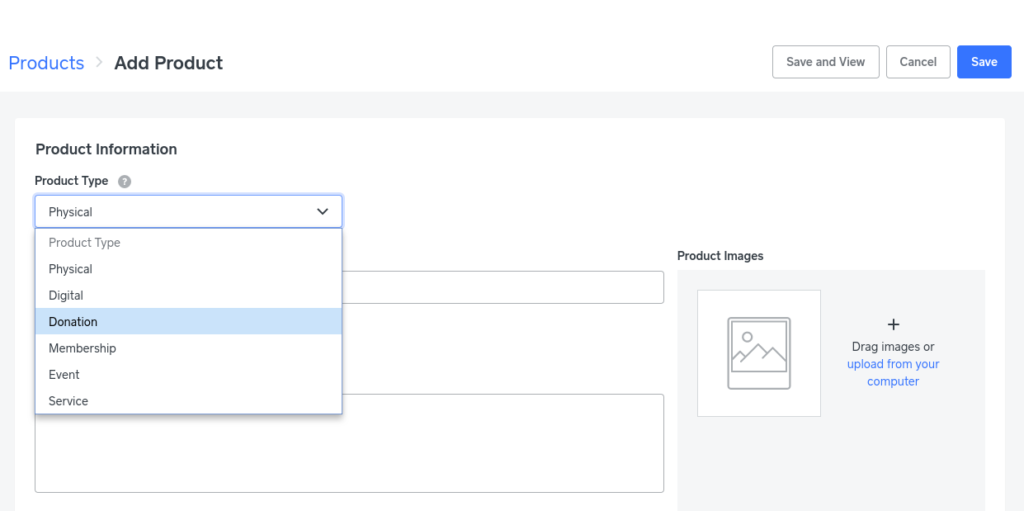

Donorbox is ideal for small nonprofits looking for flexibility in payment processing. It uses both Stripe and PayPal/Venmo, which gives you better control over operating costs—a feature I find advantageous compared to single-platform-focused providers like Square. Its donor management tool also gives more control to its donors. I like that donors can easily log in and manage their settings and payment methods independently. This helps provide a smooth and user-friendly experience and reduces administrative workload for nonprofits.

Another thing I like about Donorbox is its feature-rich free plan, which is an edge over other nonprofit-focused providers on this list like iATS or Givebutter. Additionally, its ability to accept crypto and stock donations through higher-tier plans is unique among the providers on this list. This is ideal for nonprofits looking to diversify their funding sources.

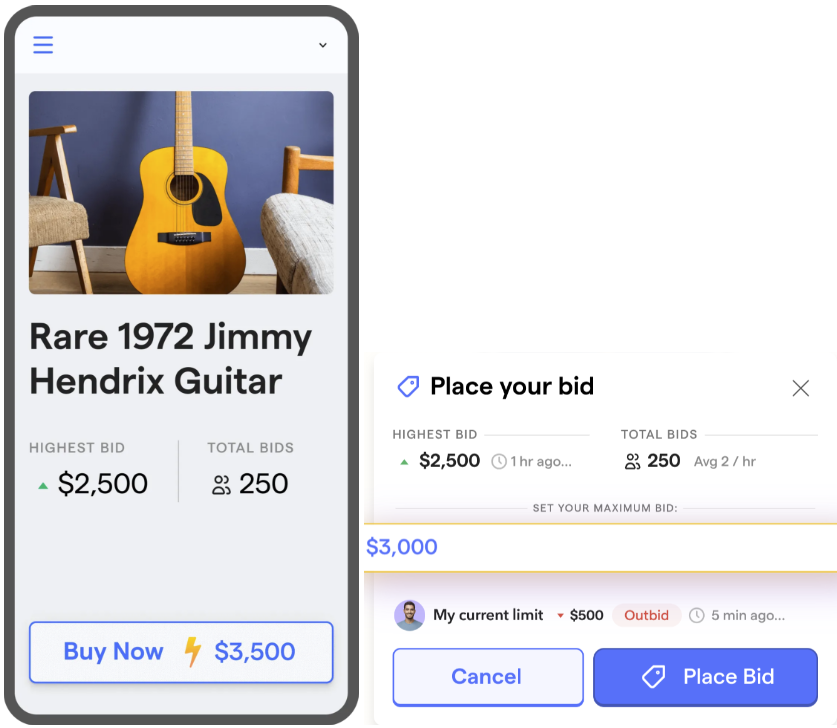

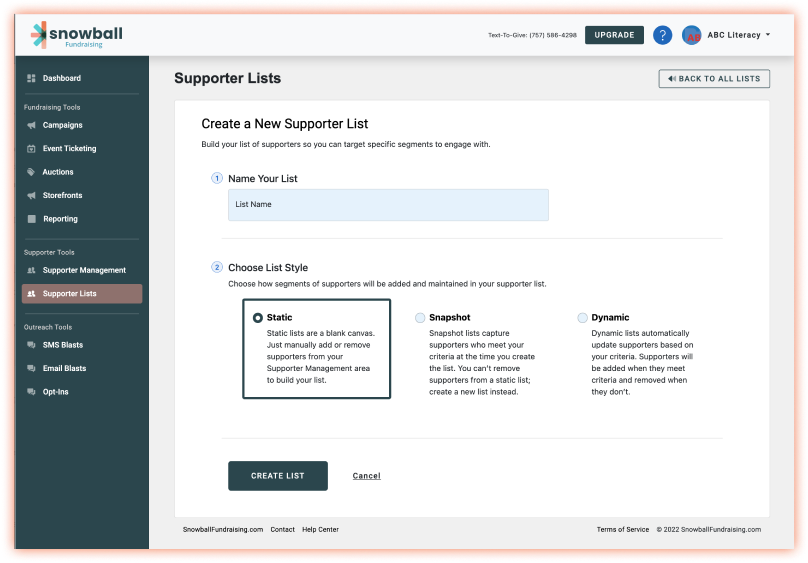

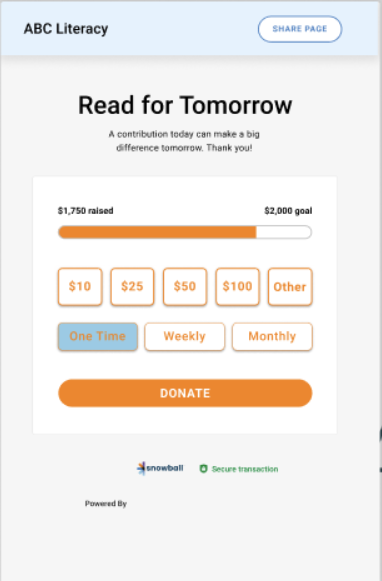

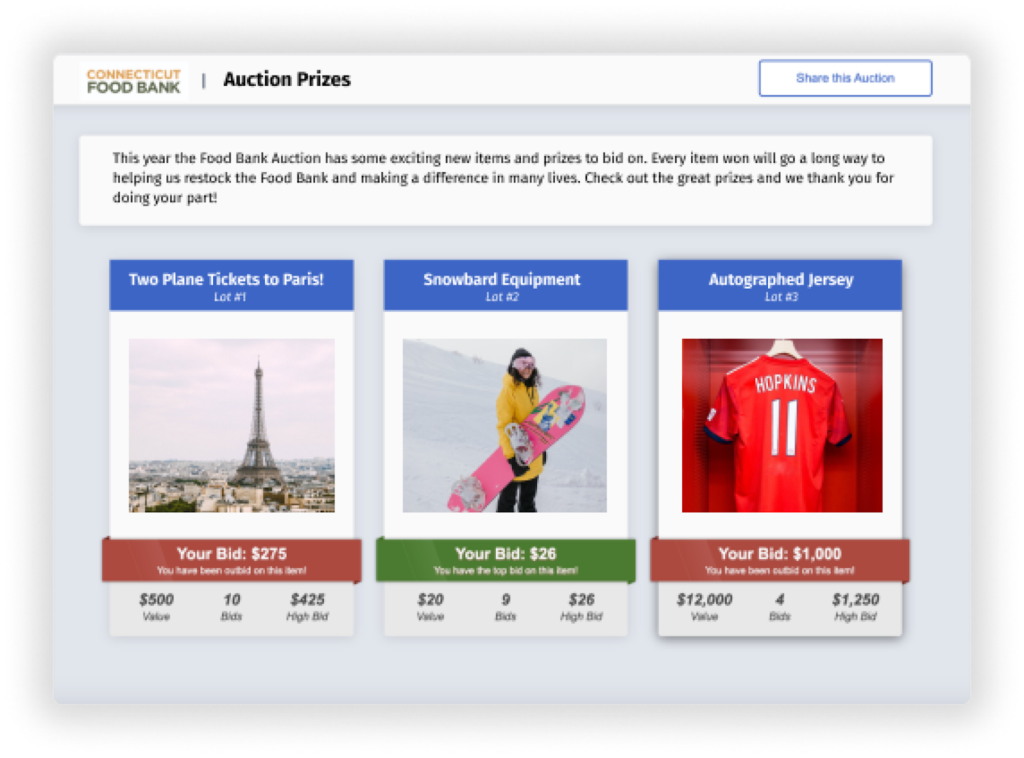

Snowball Fundraising: Best for simple online fundraising

Overall Score

3.86/5

Pricing

3.5/5

Features

4.06/5

Support and reliability

3.44/5

User experience

3.75/5

User scores

4.53/5

Pros

- Robust event fundraising tools

- Affordable pricing

- Mobile giving features

Cons

- Limited customization options

- Higher-priced paid plans

- Limited payment methods

Why Snowball Fundraising is good for nonprofits

Snowball Fundraising is a suitable choice for small to mid-sized nonprofits looking for a cost-effective and user-friendly fundraising solution. Its text-to-donate feature stands out, allowing nonprofits to easily engage mobile donors—something not all platforms on this list emphasize. I find its mobile-first approach particularly appealing for nonprofits focused on connecting with tech-savvy supporters or running on-the-go campaigns.

The platform’s tools for event fundraising, including silent auctions and ticketing, make it a versatile choice for nonprofits that host in-person or hybrid events. Compared to more advanced systems like Bloomerang, Snowball’s simpler interface and lower pricing tiers are ideal for organizations just starting out or those with limited resources. While it lacks advanced CRM capabilities, its focus on accessibility and straightforward features makes it a practical solution for growing nonprofits.

What are nonprofit businesses?

Nonprofits exist to serve public or mutual benefits rather than to generate profits for owners. It is important to be categorized correctly as a nonprofit business because of several advantages it offers:

- Tax exemptions: Nonprofits, especially those with 501(c)(3) status, often qualify for federal and state tax exemptions.

- Eligibility for grants and donations: Only recognized nonprofits can receive certain grants and donations.

- Public trust: Official status enhances credibility and attracts more supporters.

- Discounted rates: Many service providers, including payment processors, offer discounted rates to nonprofits.

Nonprofit status, particularly 501(c)(3), and the Merchant Category Code (MCC) 8398 affect payment processing:

- Discounted processing rates: Nonprofits often receive lower rates, reducing transaction costs. Stripe, PayPal, and Donorbox all offer lower processing rates for 501(c)(3) businesses, while Helcim passes on lower interchange rates for businesses with MCC 8398.

- Waived fees: Set-up and monthly fees may be waived.

- Favorable terms: More flexible contract terms are often available when negotiating custom plans and rates, like with iATS.

Which is the best nonprofit payment processing provider?

Selecting the best processing provider for your nonprofit hinges on specific needs and operational goals.

Helcim is best for its transparent interchange-plus pricing and donor management tools, ideal for organizations prioritizing clear financial oversight. Givebutter is perfect for nonprofits needing a free or low-cost platform, providing customizable donation pages, event ticketing, and peer-to-peer fundraising.

Stripe is best for nonprofits requiring global accessibility and robust API integration, while PayPal offers a user-friendly interface and access to its extensive donor base. Square is a go-to solution for in-person donations, thanks to its flexible hardware and omnichannel capabilities. IATS excels at nonprofit-specific integrations and donor management, and Donorbox is best for small nonprofits with flexibility in payment processing and unique features like crypto donations.

Lastly, Bloomerang is best for donor retention with its engagement scoring and communication tools, and Snowball Fundraising stands out for its text-to-give campaigns and simplified fundraising tools.

Frequently asked questions

The best payment system for nonprofits depends on your needs. Platforms like Donorbox offer flexibility and unique features like crypto donations, while PayPal and Stripe are great for their global reach and robust tools. Helcim provides transparent low-cost processing, and Givebutter is excellent for its free nonprofit platform. Bloomerang is best for donor retention, and Snowball Fundraising shines with text-to-give campaigns. Each system has strengths, so choose one that aligns with your organization’s goals.

Yes, nonprofits typically pay credit card processing fees, although some platforms offer discounted rates. For example, PayPal and Stripe offer reduced fees for registered 501(c)(3) organizations. Additionally, the best nonprofit credit card processing platforms allow donors to cover these fees, potentially reducing costs for the nonprofit.

Yes, Square charges a fee for nonprofits, typically at the same rate as for-profit businesses. This includes a standard transaction fee for in-person, online, and keyed-in transactions.