A merchant service provider is vital for facilitating seamless payment transactions for businesses. Choosing the best merchant services is crucial for mid- to large-sized businesses looking to optimize their payment processing efficiency and business operations.

In this article, I evaluate the top free merchant account providers based on their affordability, scalability and performance, support and service, security and compliance, and ease of use and integrations. All of my picks have no minimum monthly fees and offer competitive rates.

Based on my evaluation, the best merchant services are:

SPONSORED

Software Spotlight: PaymentCloud

Flexible payment processing for any business

- 98% of applications are approved for a merchant account

- Wide range of payment options – including no-cost (surcharging)

- Month-to-month contract

- No setup, application, or annual fees

Visit PaymentCloud

Best merchant services comparison

Providers

Our score (out of 5)

Processing fee structure

Quick integrations

Customer Support

Adyen

4.38

- No monthly fee

- Interchange-plus

- Surcharging

Good

24/7

Helcim

4.30

- No monthly fee

- Interchange-plus

- Surcharging

- Automated volume discounts

Limited

Monday – Friday: 7am – 5pm MT

Saturdays: 9am – 5pm MT

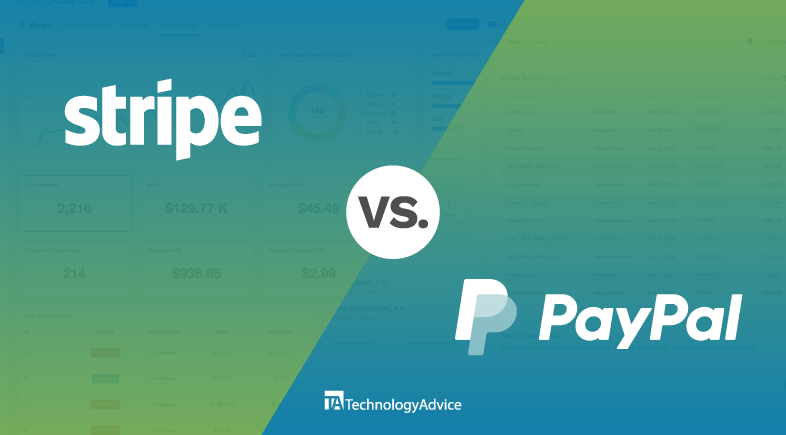

Stripe

4.25

- No monthly fee

- Flat rate

- Interchange-plus (custom for large-volume businesses)

Extensive

24/7

Stax

4.19

- Subscription-based pricing

- Surcharging

Limited

24/7

Square

4.14

- No monthly fee

- Flat rate

Good

Monday – Friday: 6am – 6pm PST

CDG Commerce

4.13

- Flat rate

- Interchange-plus

- Subscription-based pricing

Good

24/7

PaymentCloud

4.12

- Flat rate

Good

24/7

Adyen: Best overall merchant service

Overall Reviewer Score

4.38/5

Pricing and contract

3.75/5

Scalability and Performance

4.75/5

Support and Service

4.17/5

Security and Compliance

5/5

Ease of Use and Integrations

4.06/5

Pros

- Interchange fee without percentage markup

- Global reach

- Multi-currency and local payment method support

- Direct processor

Cons

- Monthly minimum sales requirement

- May require more technical know-how

- Limited support for small businesses

Why I chose Adyen

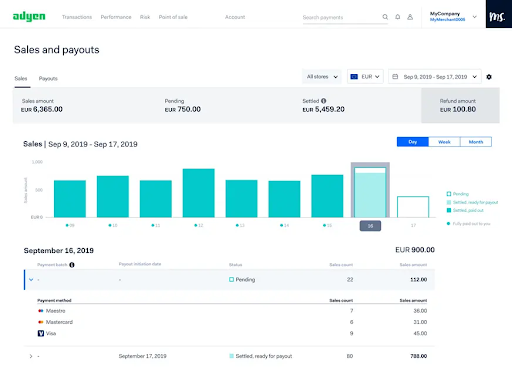

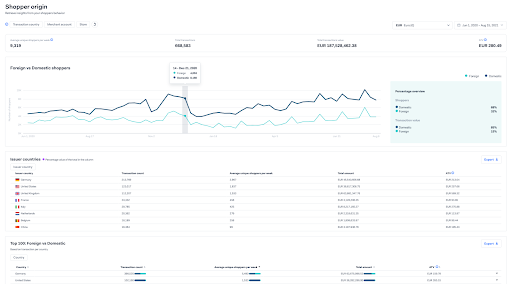

For mid- to large-sized businesses, Adyen stands out as the best overall merchant service provider due to its enterprise-grade global infrastructure, direct acquiring capabilities, and unified omnichannel experience. Unlike many competitors that rely on third-party acquirers, Adyen processes payments directly, which helps reduce transaction failures and improve settlement speeds.

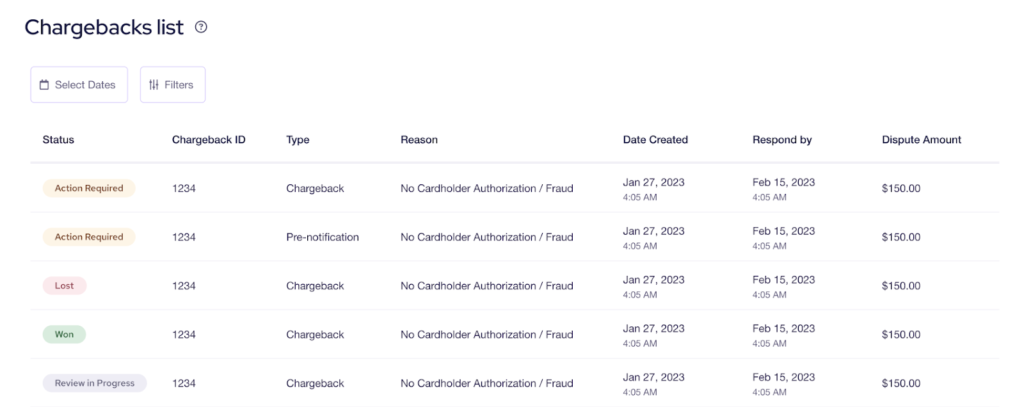

I also like Adyen’s AI-powered fraud detection tool, which helps minimize chargebacks. Its centralized payment management system streamlines operations by allowing businesses to manage multiple acquirers, currencies, and payment methods from a single platform, making it ideal for mid-to-large enterprises with international operations.

While Adyen requires a monthly minimum sales volume, its interchange-plus pricing combined with dynamic payment routing helps optimize costs and approval rates, making it a cost-effective choice for businesses with high average transaction values.

Helcim: Best for automatic volume discount

Overall Reviewer Score

4.30/5

Pricing and Contract

4.50/5

Scalability and Performance

4.00/5

Support and Service

4.17/5

Security and Compliance

5/5

Ease of Use and Integrations

3.75/5

Pros

- Interchange-plus pricing

- Automatic volume discounts

- Instant approval and quick set-up

Cons

- Limited integrations

- Limited customer support hours

- Limited hardware options

Why I chose Helcim

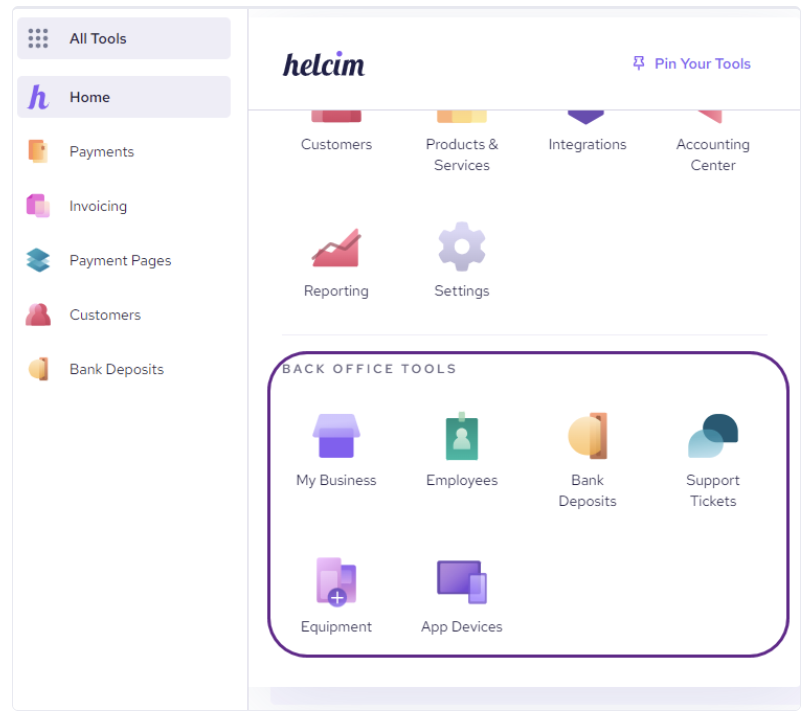

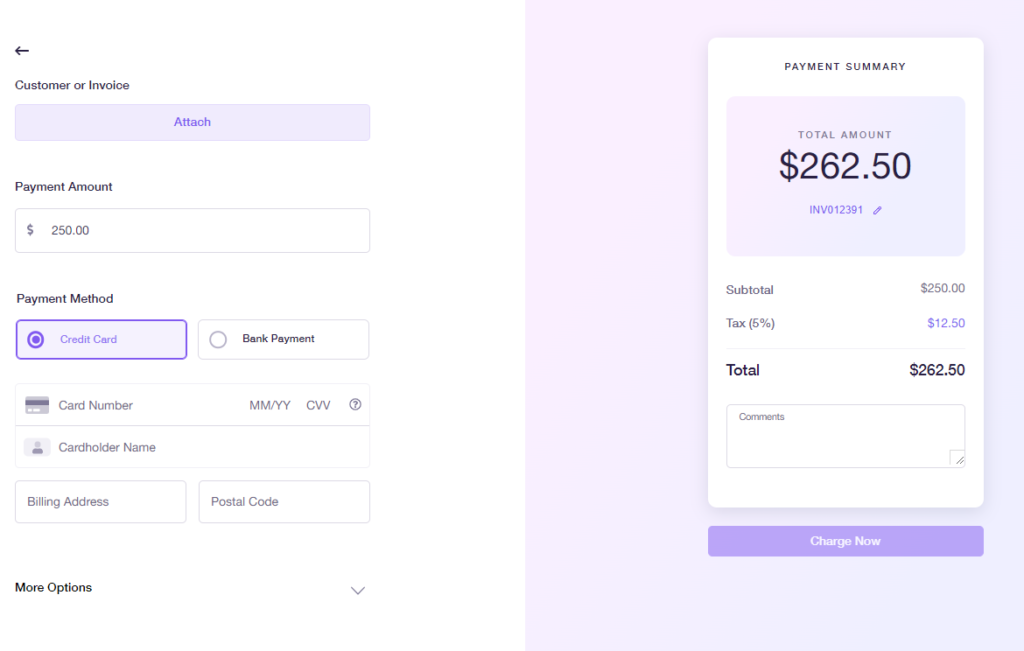

Helcim emerged as the best merchant service for automatic volume discounts, making it an excellent choice for growing businesses looking to reduce processing costs as they scale. It is the only provider in this guide that automatically lowers transaction fees as sales volume increases, eliminating the need for businesses to renegotiate better rates.

With its interchange-plus pricing and surcharging option, I recommend Helcim as the most cost-effective solution for mid-sized businesses. Its pricing structure ensures businesses can scale confidently without worrying about escalating fees, and companies that want to scale globally can do so without additional cross-border processing fees. Helcim also excels in security with fraud protection tools and end-to-end data encryption.

Although hardware options and customer support availability are somewhat limited, Helcim’s strong performance in scalability, security, and cost-effectiveness makes it the top choice for mid-market to large enterprises looking for a secure, versatile, and affordable merchant account provider.

Stripe: Best for custom solutions

Overall Reviewer Score

4.25/5

Pricing and Contract

3.25/5

Scalability and Performance

4.25/5

Support and Service

4.17/5

Security and Compliance

5/5

Ease of Use and Integrations

4.69/5

Pros

- Robust developer tools and powerful APIs

- Quick instant set-up

- 24/7 support

Cons

- Requires integration for in-person payment processing

- Additional fee for fraud protection tools

- Account freezes

Why I chose Stripe

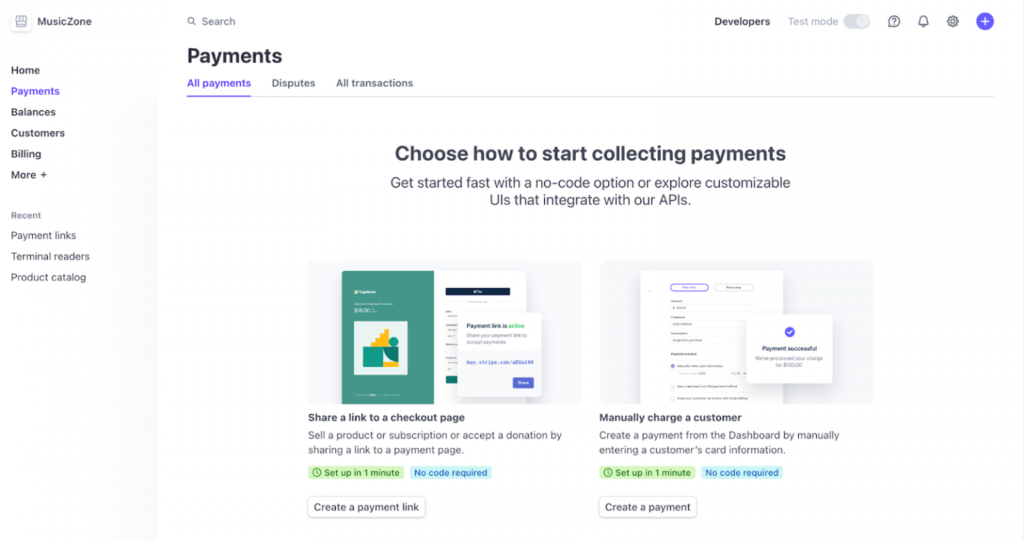

Stripe stands out as the best option for custom payment solutions due to its robust developer tools and powerful APIs. These tools allow businesses to create highly tailored payment processing systems, fitting unique needs and workflows seamlessly. The platform’s quick, instant setup ensures that businesses can start accepting payments with minimal delay, while its 24/7 support provides continuous assistance.

However, Stripe requires integration for in-person payments, which might not suit every business. Additional fees for fraud protection tools and potential account freezes are considerations to remember. Despite these drawbacks, Stripe’s flexibility and powerful customization capabilities make it an excellent choice for businesses seeking a custom payment processing solution tailored to their specific needs

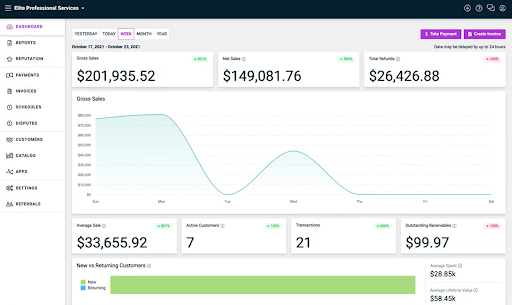

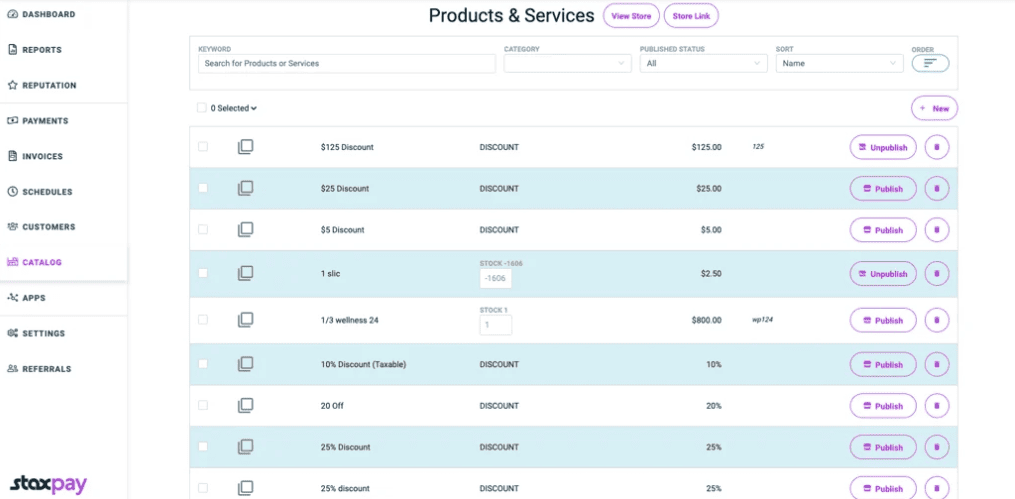

Stax: Best for subscription-based pricing

Overall Reviewer Score

4.19/5

Pricing and Contract

3/5

Scalability and Performance

4.75/5

Support and Service

3.75/5

Security and Compliance

5/5

Ease of Use and Integrations

4.38/5

Pros

- Subscription-based model

- No markup interchange-plus pricing

- Surcharging option

Cons

- Has a monthly fee

- Add-on fees for ACH processing

- Next-day funding costs extra

Why I chose Stax

Stax stands out as a top choice for high-volume businesses due to its subscription-based pricing model, which eliminates percentage-based markups in favor of a flat monthly fee. Unlike traditional merchant services that charge a percentage of each transaction, Stax provides wholesale interchange-plus pricing with no added markup, making it one of the most cost-effective options for businesses processing large transaction volumes.

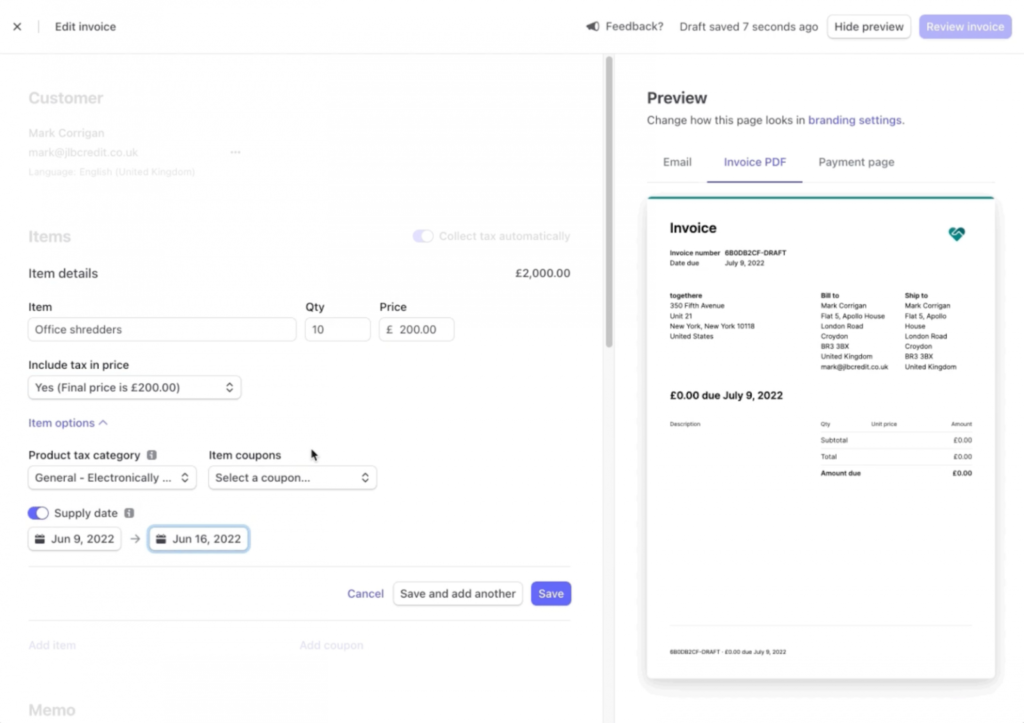

I like how Stax offers transparent pricing structure with no long-term contract because it gives businesses flexibility without being locked into restrictive agreements. Additionally, Stax supports omnichannel payments, allowing businesses to accept transactions in-person, online, and via invoicing.

While Stax does have a monthly fee and add-on costs for ACH processing and next-day funding, its overall savings on transaction fees make it an excellent choice for businesses looking to minimize payment processing costs while maintaining predictable expenses.

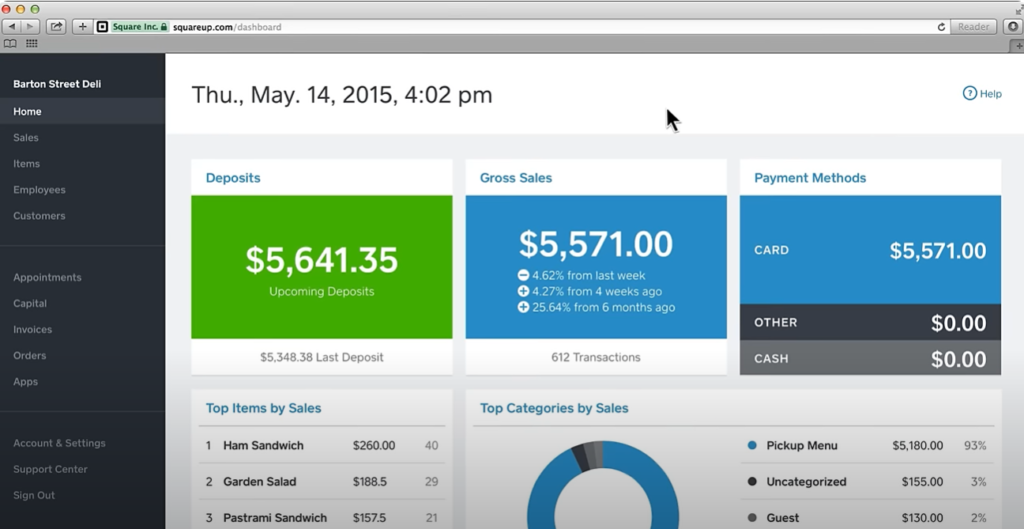

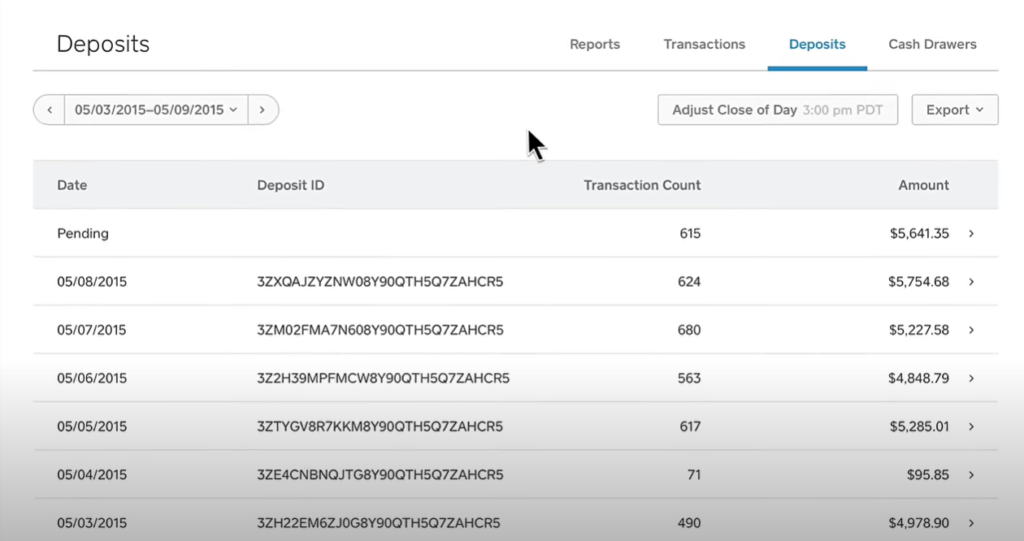

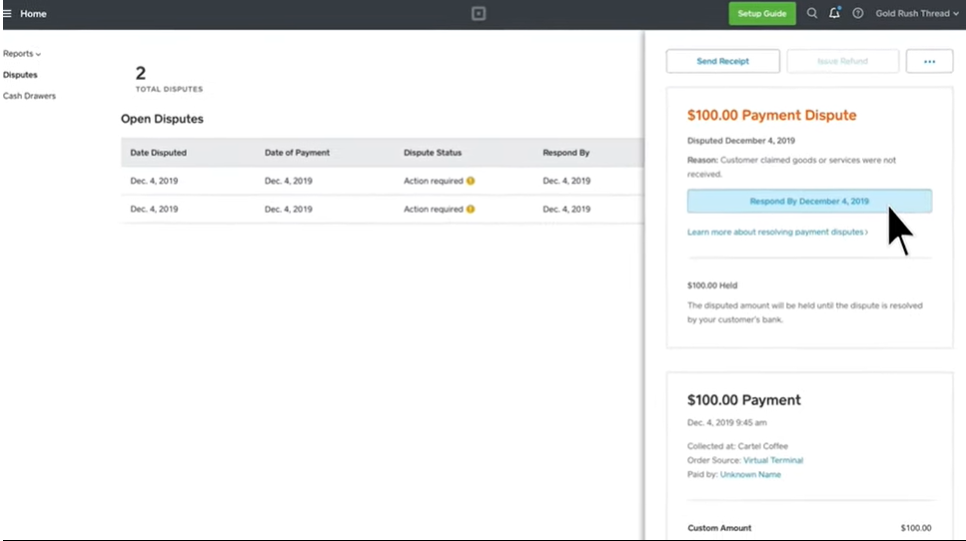

Square: Best out-of-the-box solution

Overall Reviewer Score

4.14/5

Pricing and contract

3.75/5

Scalability and Performance

3.75/5

Support and Service

3.75/5

Security and Compliance

5/5

Ease of Use and Integrations

4.69/5

Pros

- Seamless omnichannel payment solutions

- User-friendly intuitive interface

- Offers a full POS system

- Custom rates for businesses processing over $250,000 monthly

Cons

- Limited customer support hours

- Has a processing limit for the free plan

- Flat-rate fees only

Why I chose Square

Square stood out for its seamless omnichannel payment solutions, offering an integrated system that works effortlessly across in-store, online, and mobile platforms. This comprehensive ecosystem allows businesses to manage all payment processes in one place, enhancing efficiency and customer experience. Additionally, Square’s out-of-the-box solution and user-friendly interface ensure that both tech-savvy and less experienced users can navigate the system with ease.

Although it has limitations like flat-rate fees, which are very expensive for large-volume transactions, and restricted customer support hours, you will find Square’s robust POS system and intuitive design make it an excellent choice for businesses seeking versatile and reliable payment solutions.

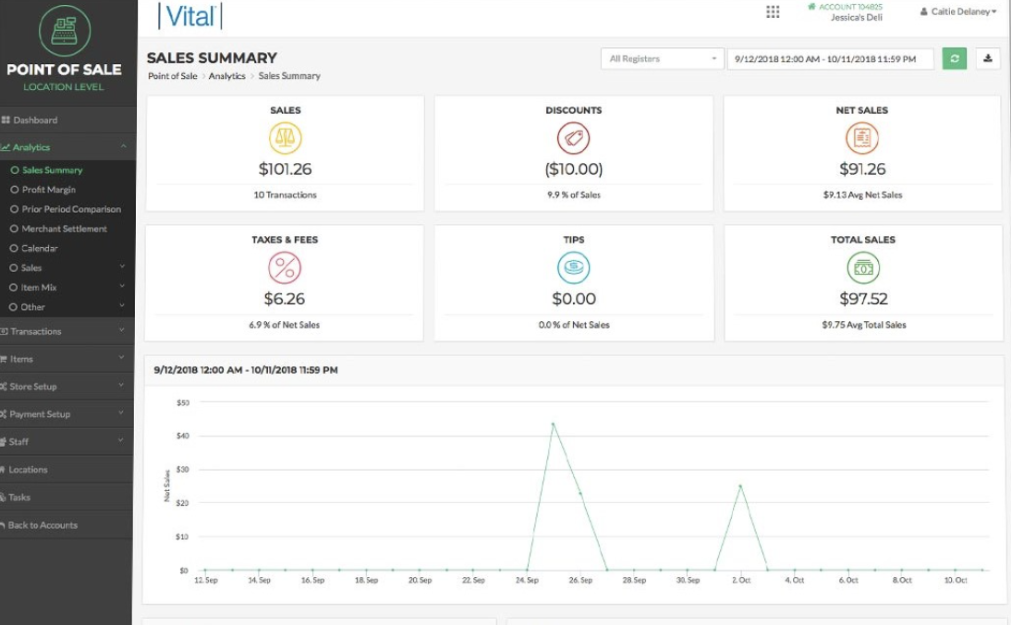

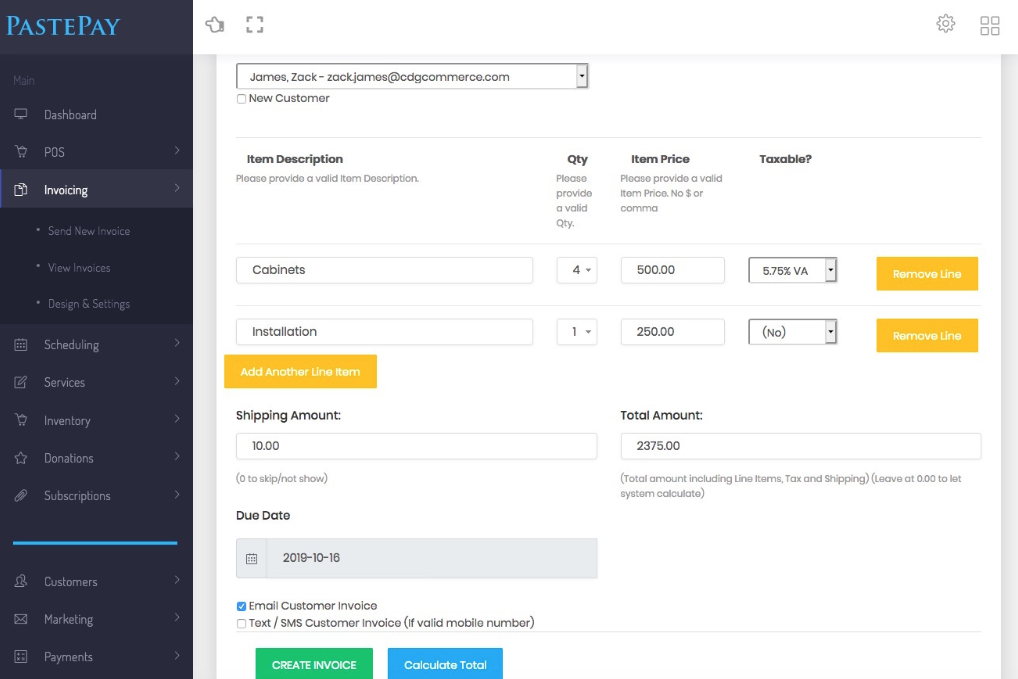

CDG Commerce: Best for growing businesses

Overall Reviewer Score

4.13/5

Pricing and contract

4.00/5

Scalability and Performance

4.75/5

Support and Service

2.92/5

Security and Compliance

5.00/5

Ease of Use and Integrations

3.75/5

Pros

- Offers flat-rate, interchange, and wholesale membership pricing

- Choice of payment gateway for interchange and subscription plans

- 24/7 customer support

Cons

- Additional fee for certain services, depending on plan

- For US-based merchants only

- Does not offer an all-in-one payment solution

Why I chose CDG Commerce

I like CDG Commerce for growing businesses because it offers three different pricing structures, which allows merchants to choose one that best fits their business size and processing volume.

Its flat-rate plan is good for new and small businesses that want predictable pricing without worrying about fluctuating interchange rates. Its interchange plan provides transparent pricing and cost savings for mid-sized businesses with growing transaction volumes. For large enterprise businesses, its wholesale membership plan offers wholesale interchange rates for a monthly subscription fee, making it the most-cost-effective option for businesses processing high volumes.

CDG Commerce also stands out with 24/7 customer support and the flexibility to choose a payment gateway for its interchange-plus and subscription plans. However, businesses should note that certain services may incur additional fees depending on the plan and that CDG Commerce is only available to U.S.-based merchants. Additionally, it does not provide an all-in-one payment solution, requiring separate integrations for some payment types.

PaymentCloud: Best for high-risk merchants

Overall Reviewer Score

4.12/5

Pricing and contract

3.50/5

Scalability and Performance

4.25/5

Support and Service

3.75/5

Security and Compliance

5.00/5

Ease of Use and Integrations

4.06/5

Pros

- Specializes in high-risk merchants

- Flexible pricing plans

- No long-term contracts

Cons

- No publicly disclosed pricing

- Other services have add-on fees

- May require rolling reserve

Why I chose PaymentCloud

PaymentCloud offers something unique among the merchant service providers on this list–it specializes in high-risk merchants. This makes it a go-to provider for companies in industries with elevated risk levels such as adult, CBD, tech support, and travel. Many standard payment processors shy away from these sectors but PaymentCloud has tailored its services to accommodate the unique needs of these businesses., offering customizable pricing and flexible solutions.

Its robust fraud protection tools, including chargeback management and fraud prevention measures, help mitigate risks that high-risk businesses face. This gives businesses peace of mind knowing their transactions are secure.

While it’s less suitable for new low-risk businesses because of its lengthier approval process, PaymentCloud’s ability to handle the challenges of high-risk industries, along with its flexible pricing plans and no long-term contracts, make it an excellent choice for businesses that need specialized payment solutions.

Benefits of merchant services

Merchant services provide businesses with tools to process payments efficiently and securely. These services enhance operational capabilities, boost customer satisfaction, and support business growth. Here are some key benefits:

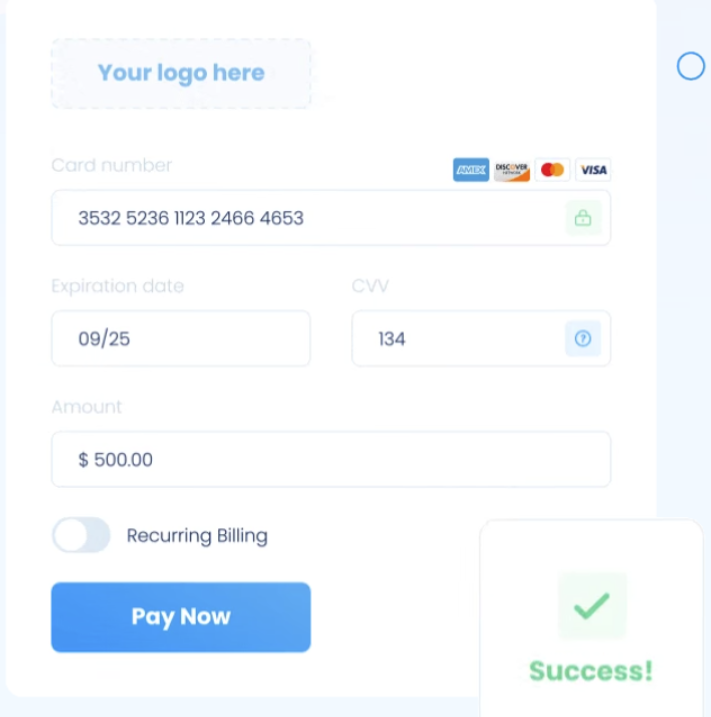

- Accept various payment methods, including credit and debit cards.

- Enhance customer convenience and satisfaction.

- Secure transaction processing to reduce fraud risk.

- Detailed transaction reporting for better financial management.

- Tools for invoicing, recurring billing, and customer management.

- Streamline business operations and improve cash flow.

- Support business growth and scalability.

How to choose the best merchant account provider

Selecting the best merchant account provider for your business involves careful consideration of several factors to ensure the provider meets your specific needs. To help you make the right choice, follow the step-by-step guide below:

- Identify your business needs: Determine what features and services are essential for your business, such as in-person payments, online transactions, recurring billing, or mobile payment options.

- Compare pricing structures: Evaluate the cost-effectiveness of different providers by comparing processing fees, setup fees, monthly fees, and any hidden charges. Look for providers with transparent pricing models, such as interchange-plus pricing.

- Check for scalability: Ensure the provider can support your business as it grows, with the ability to handle increased transaction volumes and offer advanced features.

- Evaluate security and compliance: Prioritize providers that offer robust security measures, including PCI compliance, end-to-end encryption, and fraud protection tools to safeguard your transactions.

- Assess customer support: Consider the quality and availability of customer support. Look for providers that offer 24/7 support, dedicated account managers, and comprehensive onboarding assistance.

- Examine integration capabilities: Ensure the provider can seamlessly integrate with your existing business systems, such as POS systems, accounting software, and e-commerce platforms.

- Read user reviews: Look for feedback from other businesses similar to yours to gauge real-world performance and customer satisfaction.

Which is the best merchant service provider?

The best merchant service provider depends on specific business needs, such as transaction volume, required features, and payment methods. In my evaluation, Adyen stands out as the best overall merchant account provider for mid-to-large enterprises because of its global reach, direct processing capabilities, and interchange-plus pricing.

With a comprehensive, scalable solution, Adyen offers the flexibility and reliability needed for businesses operating across multiple markets and processing large transaction volumes. Its ability to handle complex payment flows and reduce transaction failures makes it a top choice for enterprises.