Key takeaways

- Clover and Square are two of the most popular point-of-sale (POS) systems for businesses because they both offer reliable easy-to-use hardware solutions.

- Square is ideal for small businesses or startups needing an easy POS solution without upfront costs.

- Clover is ideal for more established businesses wanting the option to work with a different merchant services provider or payment processor.

A reliable and easy-to-use POS system is a must for any business. Square and Clover are two of the most popular options when it comes to the best POS systems because they both offer excellent hardware options, essential POS features, and tools for business growth.

When comparing Clover vs Square, it is important to look at their key differences to know which of the two is best for your business.

Square vs Clover: Key differences

|

|

|

| Monthly fee | Starts at $14.95 | Starts at $0 |

| Payment processing | Varies depending on payment processor | Flat rate |

| Online store | Ecommerce integrations only | Free (Square Online) |

| Merchant account | Through a separate merchant services provider | Included (aggregated merchant account) |

| Customer support | • 24/7 phone and email support • Clover Help: Online resource library |

• Mon to Fri phone support • 24/7 automated chat support |

| Visit Clover | Visit Square |

Clover: Best for established businesses

Pros

Cons

Our Rating: 4.05/5

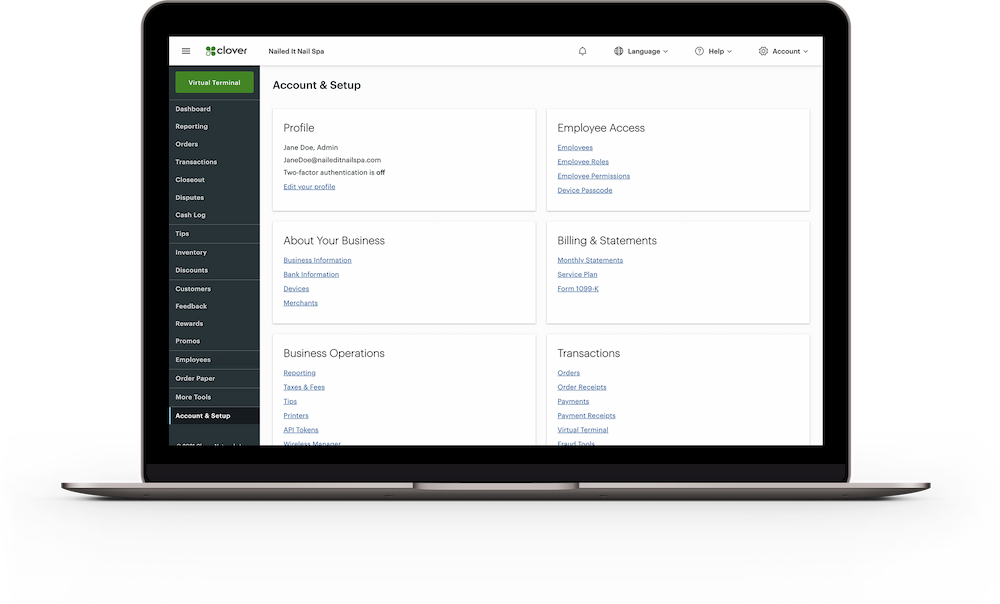

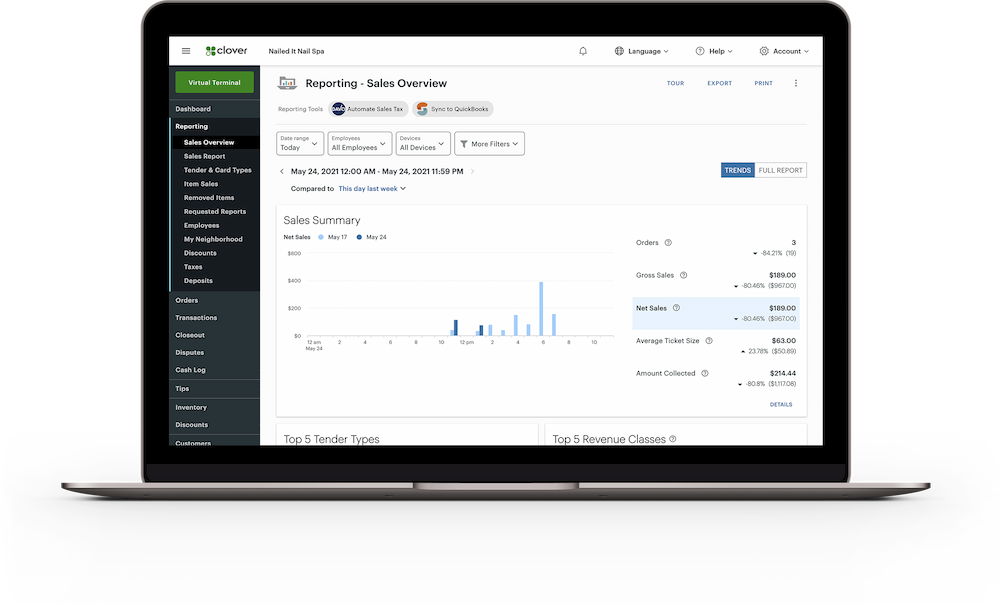

Clover is a provider of POS hardware and software for retail, restaurants, and service businesses. It offers a range of features aside from payment processing, such as inventory management, employee management, customer relationship management, and analytics. Clover is known for its sleek hardware, ease of use, and flexibility. It offers various hardware options from countertops to mobile devices.

Clover is owned by payment service provider Fiserv, which is also its default payment processor. However, businesses may also sign up with Clover through other merchant services providers that resell this POS system. This means a business may use Clover with a different payment processor, and potentially get lower payment processing rates.

With a user-friendly interface and easy-to-use hardware, Clover earned good ratings for user experience. Its management tools also help businesses as they grow, and customer support is available 24/7 through phone or email.

Square: Best for small businesses and startups

Pros

Cons

Our Rating: 4.03/5

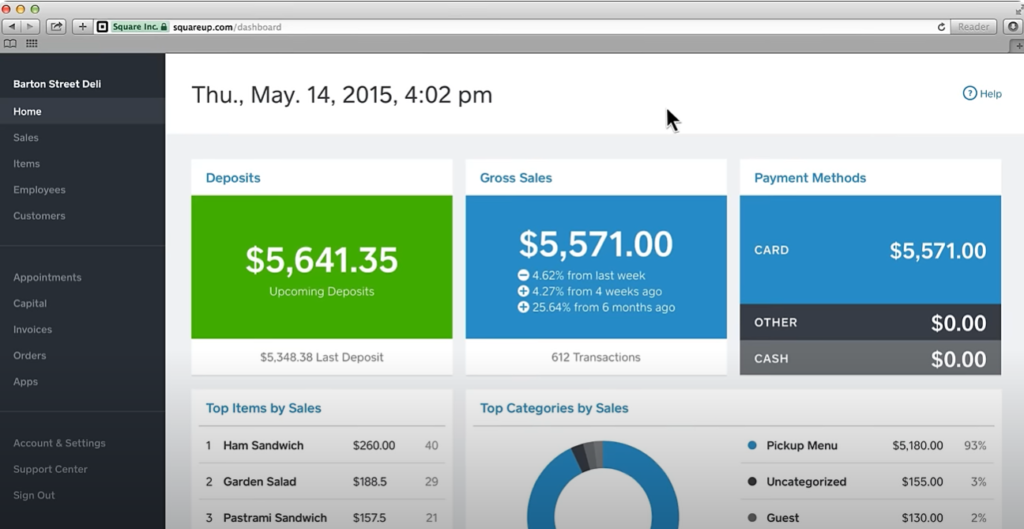

Square is a provider of an all-in-one POS system ideal for startups, independent sellers, and small businesses because of its ease of use, affordability, and accessibility. It offers various POS and payment processing plans, with the lowest option requiring no upfront costs for businesses to start accepting payments.

Businesses using Square may accept cards, mobile wallets, ACH, and buy now, pay later (BNPL) payments across multiple channels. However, unlike Clover, Square POS only works with Square Payments as its payment processor, and high-risk businesses are not supported.

Aside from POS systems and payment processing, Square also offers various other services such as Square Online Store (ecommerce platform), Square for Restaurants (restaurant management software), Square Banking (checking and savings accounts, credit cards, and small business loans), and Cash App (mobile peer-to-peer payment service).

Read more: Types of POS Systems

Clover vs Square: A detailed comparison

|

|

|

| Merchant account | Through a separate merchant services provider | With included aggregated merchant account |

| Monthly fee | Starts at $14.95 | Starts at $0 |

| Online store | Ecommerce integrations only | Free (Square Online) |

| Payment processing fee | • Card-present: 2.3% to 2.6% + 10 cents • Online: 3.5% + 10 cents • Keyed-in: 3.5% + 10 cents • Invoices: 3.5% + 10 cents |

• Card-present: 2.6% + 10 cents • Online: 2.9% + 30 cents • Keyed-in: 3.5% + 15 cents • Invoices: 3.3% + 30 cents |

| Hardware options | • Tap to Pay on iPhone • Standalone terminal starts at $499 (Clover Flex) |

• Comes with free magstripe reader • Tap to Pay on iPhone and Android • Standalone terminal starts at $299 (Square Terminal) |

| Customer support | • 24/7 phone and email support • Clover Help: Online resource library |

• Mon to Fri phone support • 24/7 automated chat support |

| Visit Clover | Visit Square |

Pricing

When it comes to pricing, Square wins over Clover. Square typically offers straightforward pricing structures with no monthly fees and transparent transaction rates. Businesses using Square can expect to pay a flat rate for each transaction, which is 2.6% + 10 cents for in-person transactions and 2.9% + 30 cents for online transactions. Additionally, Square provides its POS software for free and even provides a free magstripe reader, although businesses may incur charges for add-on features or integrations.

On the other hand, Clover’s pricing structure may vary depending on the specific hardware and software options chosen and where it is purchased. Clover offers a range of POS hardware devices, each with its own upfront cost, including countertop terminals, mobile readers, and handheld devices.

Additionally, Clover charges a monthly subscription fee for the use of its POS software. The lowest plan has a monthly fee of $14.95, and its transaction rates vary, with fees of around 2.6% + 10 cents for in-person transactions and 2.9% + 30 cents for online transactions. However, keep in mind that Square’s basic POS plan does not include other add-ons, such as email marketing, text marketing, and loyalty programs, which are all included in the lowest-priced Clover plan.

While Square may be more suitable for businesses seeking a simple and transparent pricing model with no monthly fees, Clover’s offering may appeal to those in need of more advanced features and customization options, albeit with potentially higher upfront costs and ongoing subscription fees.

Hardware

You can’t go wrong with your POS hardware if you’re choosing between Square and Clover. Both offer a wide range of device options for businesses of various sizes and types. Signing up with Square gets you a free magstripe reader, and if you don’t want to spend on a reader for contactless payments, you may use a compatible iPhone or Android phone, and use it as your contactless card reader.

| Square Magstripe Reader | Square Contactless and Chip Reader | Square Stand | Square Terminal | Square Register |

|

|

|

|

|

| 1st one: Free Additional reader: $10 |

1st generation: $49 2nd generation: $59 |

$149 or $14 per month for 12 months | $299 or $37 per month for 12 months | $799 or $39 per month for 24 months |

Clover, on the other hand, does not provide any free devices but its devices will process payments and update sales and inventory even when in offline mode—Square devices only have offline payment processing. Using your mobile phone as a card reader is also possible with Clover. However, it only has Tap to Pay for iPhone; it is currently not available for Android mobile phones.

| Clover Go | Clover Flex | Clover Mini | Station Solo | Station Duo |

|

|

|

|

|

| $49 | $599 or $35 per month for 36 months | $799 or $45 per month for 36 months | $1,699 or $125 per month for 36 months | $1,799 or $135 per month for 36 months |

Features and integrations

|

|

|

| Online ordering |  |

|

| Online store | Third-party integration |  |

| Customer relationship management |  |

|

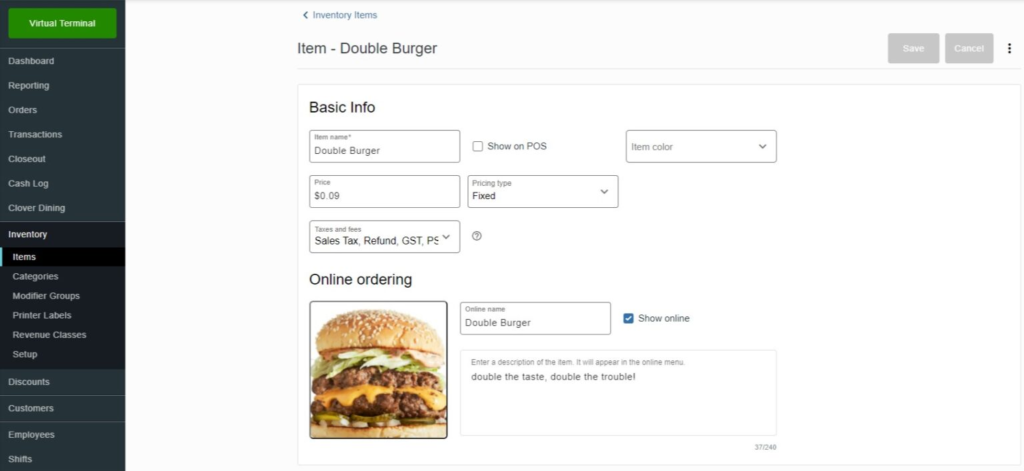

| Inventory management |  |

|

| Invoicing |  |

|

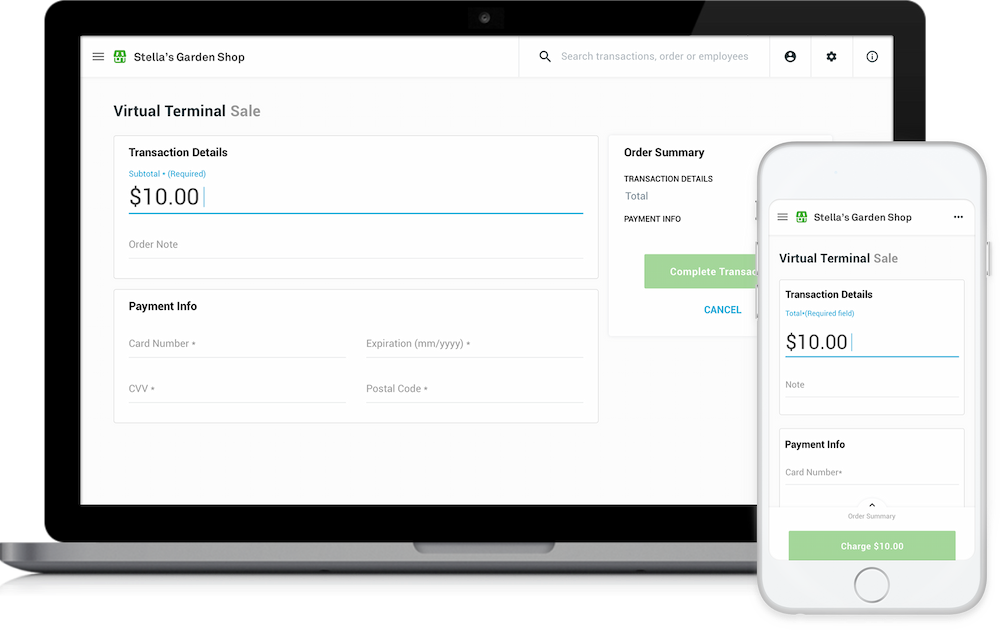

| Virtual terminal |  |

|

| Loyalty program |  |

With additional monthly fee |

| Scheduling | Via Clover apps; with additional monthly fee |

|

| Email and text marketing |  |

With additional monthly fee |

| Team management and payroll |  |

With additional monthly fee |

| Visit Clover | Visit Square |

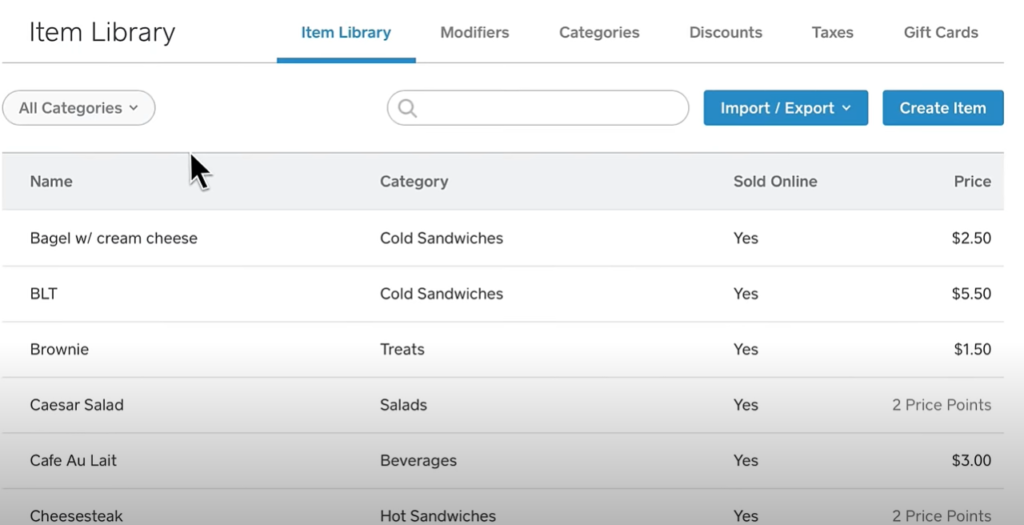

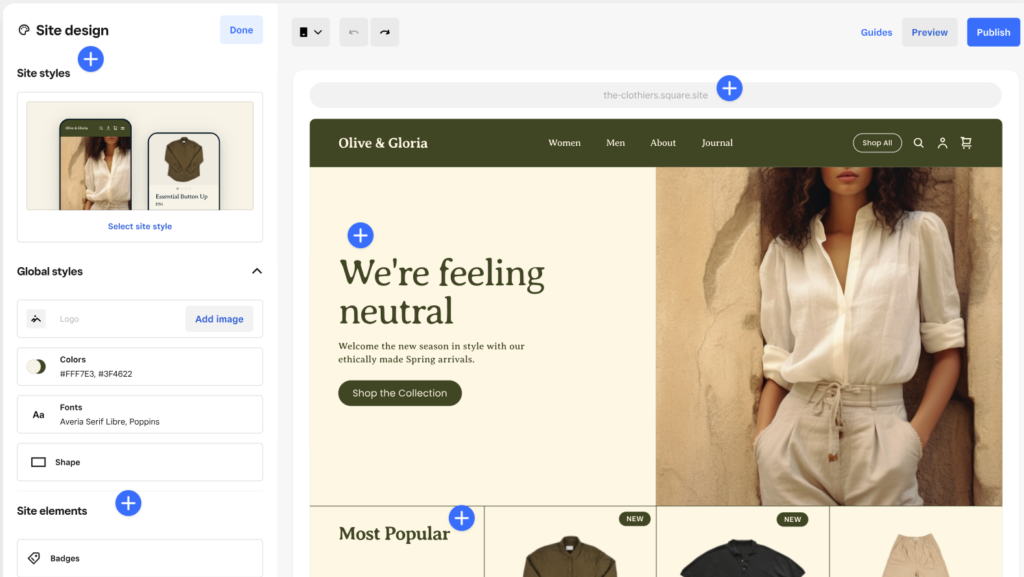

Clover and Square are on equal footing when it comes to their features. Both offer good tools for order management, inventory management, customer relationship management, and reporting and analytics. If you have a restaurant or food-based business, you can create an online ordering page with both Square and Clover. However, if you would like to create an ecommerce website, Square offers a free website builder, while Clover only has ecommerce integrations.

Additionally, all Square plans come with a free native appointment and scheduling tool, while Clover offers apps that require a monthly subscription. While both Square and Clover provide options for extending the functionality of their POS systems through third-party apps, Clover boasts a larger and more diverse app marketplace. This extensive selection of apps allows businesses using Clover to further customize their POS experience and integrate additional tools and services seamlessly.

In contrast, Square’s app selection, although robust, may be more limited in comparison. Therefore, businesses seeking a wide range of app integrations to augment their POS capabilities may find Clover’s marketplace to be more comprehensive and accommodating to their requirements.

Read more: Guide for POS Data Analysis

Ease of use

Deciding between Clover or Square for ease of use depends on your business preferences, the level of customization needed, and your willingness to invest time in learning the system. Square and Clover both prioritize simplicity, but they approach it in slightly different ways.

Square is often praised for its extremely intuitive interface, making it effortless for businesses to set up and start processing payments quickly. Its user-friendly design requires minimal training, which is particularly beneficial for small businesses and entrepreneurs who may not have extensive technical knowledge. With Square, businesses can easily navigate through the POS system, manage inventory, and access basic reporting tools without feeling overwhelmed by complex features.

Clover also offers a user-friendly experience but tends to provide more customization options and advanced features, which can slightly increase the learning curve for some users. While Clover’s interface is still intuitive, businesses may need a bit more time to explore its full range of functionalities and tailor the system to their specific needs.

However, once businesses become familiar with Clover’s features, they can take advantage of its flexibility and customization capabilities to optimize their operations. Additionally, Clover’s extensive hardware options cater to different business setups, offering versatility but potentially requiring more consideration during the initial setup phase.

Customer support and user reviews

Clover wins over Square for customer support with its 24/7 phone and email support. Square, on the other hand, only offers 24/7 customer support for higher-priced plans. For customers on the free Square plan, support is available on Mondays to Fridays, from 9 a.m. to 5 p.m.

When it comes to user reviews, Square has consistently received higher ratings than Clover on user review sites like G2, Capterra, and SoftwareAdvice. Square POS reviews focus on its affordability, ease of use, sleek hardware, and straightforward pricing, while Clover POS reviews mention its simple and easy-to-configure hardware devices.

Square vs Clover: Which is best?

The choice between Square or Clover depends on several factors, including your business size, industry, preferences, and specific needs. If you’re a small business or startup seeking simplicity and affordability, Square could be the ideal choice. With its straightforward pricing model, free POS software, and online store builder, Square offers a convenient solution with minimal upfront costs. Additionally, Square’s extensive hardware options, including free card readers, cater to startups and small businesses with varying needs.

Alternatively, if you’re an established business looking for advanced features, customization options, and flexibility in payment processing, Clover might be the better fit. Offering sleek design, versatile hardware choices, and comprehensive management tools, Clover supports businesses that require robust POS capabilities. Moreover, Clover’s compatibility with various merchant accounts and extensive app marketplace provide businesses with the freedom to tailor their POS experience to suit their unique requirements.

Ultimately, whether you prioritize simplicity and affordability with Square or flexibility and advanced functionality with Clover, both options offer reliable POS solutions to streamline your business operations and drive growth.