Key takeaways

A reliable and easy-to-use POS system is a must for any business. Square and Clover are two of the most popular options because they both offer excellent hardware options, essential POS features, and tools for business growth.

When comparing Clover vs Square, look at their key differences to determine which is best for your business.

Clover vs. Square: Key features

Monthly fee

Starts at $14.95

Starts at $0

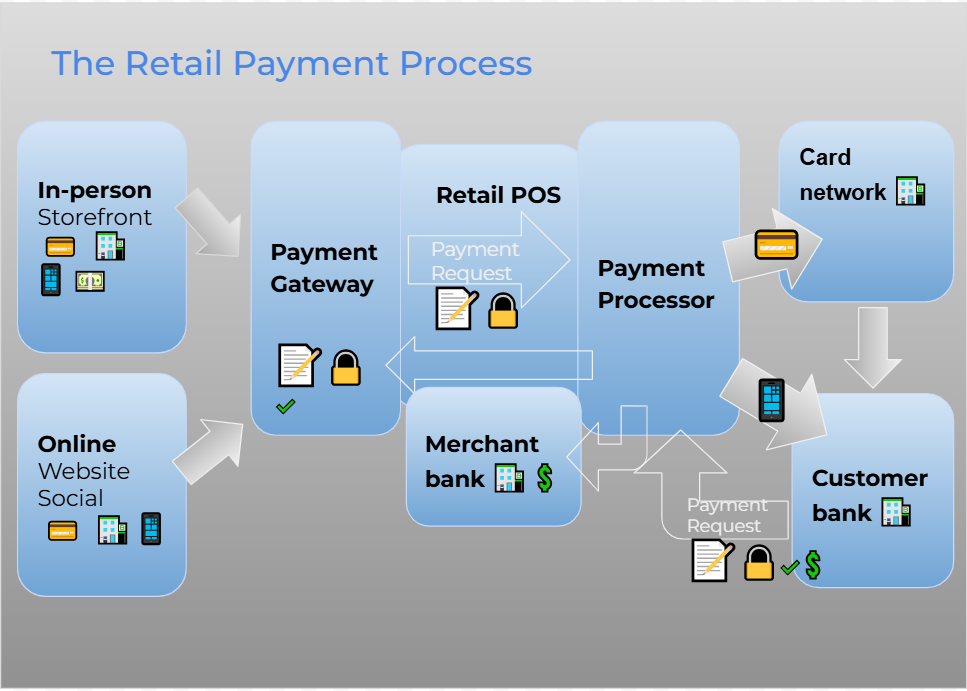

Payment processing

Varies depending on payment processor

Flat rate

Online store

E-commerce integrations only

Free (Square Online)

Merchant account

Through a separate merchant services provider

Included (aggregated merchant account)

Customer support

- 24/7 phone and email support

- Clover Help: Online resource library

- Mon to Fri phone support

- 24/7 automated chat support

Expert Tip

Although Clover and Square are two of the most popular POS systems for businesses, they may not be the best option for you. Check other providers in our list of the best POS hardware for businesses.

Clover: Advantages & disadvantages

Advantages of Clover POS

|

Disadvantages of Clover POS

|

Square: Advantages & disadvantages

Advantages of Square POS

|

Disadvantages of Square POS

|

Expert Tip

Looking for a restaurant POS system? Both Square and Clover are included in our list of the best restaurant POS systems.

Benefits of Clover

Clover is a popular POS solution designed for retail, restaurant, and service-based businesses. It offers payment processing with low flat-rate fees and an extensive suite of business management tools. Clover also comes with 24/7 customer support, and a flexible hardware lineup that includes countertop stations and mobile devices.

Merchant processing

Clover’s POS system supports diverse payment types, including credit and debit cards, contactless payments, gift cards, and mobile wallets. This provides businesses with flexibility in how they accept payments. It can also accept PayPal and Venmo QR code payments.

Clover is owned by Fiserv, and can work with any processor that operate on the Fiserv network. This flexibility allows businesses to select a provider that offers lower rates, providing more control over transaction fees and overall costs.

Lower transaction fees

Since Clover can work with various payment processors, businesses can compare rates and choose an option that minimizes transaction fees. With Fiserv as its default processor, Clover often provides competitive rates, but companies opting for alternative merchant service providers may negotiate even lower fees. This adaptability can lead to significant savings, especially for high-volume businesses.

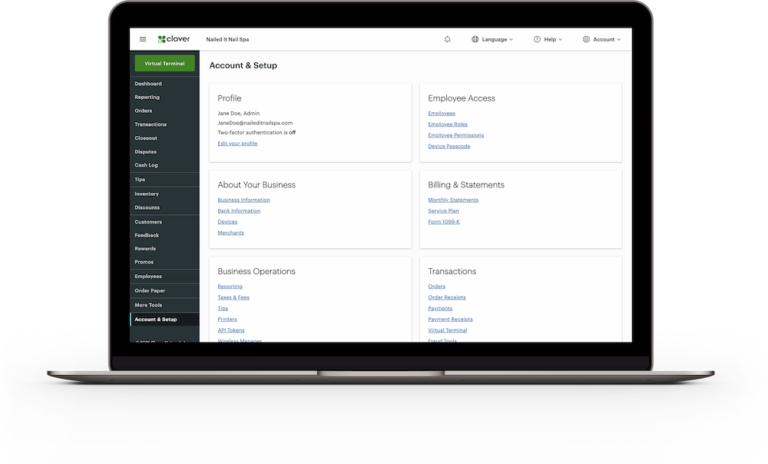

Robust business management tools

Clover’s POS system goes beyond payments by offering robust business management tools. Features include inventory tracking, sales analytics, customer management, and employee scheduling, which help businesses streamline operations. Clover’s CRM features enable companies to capture customer data, manage loyalty programs, and tailor marketing efforts, helping to improve customer retention and engagement.

Learn more about POS data analytics.

Dedicated customer support

Clover provides 24/7 customer support via phone and email, ensuring businesses can access assistance whenever they need it. This round-the-clock availability is valuable for companies with irregular hours or high-traffic periods, as it minimizes downtime in case of technical issues. Clover’s dedicated support helps businesses resolve issues quickly, maintaining a positive experience for both merchants and customers.

Durable, modern hardware

Clover is known for its sleek, modern hardware, which are available in a variety of configurations, from countertop stations to mobile handheld devices. Clover’s devices are built with durability in mind and are easy for staff to operate, making them a good fit for busy retail and restaurant environments.

Benefits of Square

Square is a provider of an all-in-one POS system ideal for startups, independent sellers, and small businesses because of its ease of use, affordability, and accessibility. It offers various POS and payment processing plans, with the lowest option requiring no upfront costs for businesses to start accepting payments.

Integrated system

Square simplifies payment processing by combining a merchant account and payment processor into one platform, eliminating the need for a third-party account. This integrated system supports multiple payment methods, including credit and debit cards, contactless payments, and mobile wallets. Square’s quick setup and transparent pricing make it especially appealing to small businesses that want an all-in-one, hassle-free payment processing experience.

Simple pricing

One of Square’s standout benefits is its straightforward, transparent pricing model. Square charges a flat rate per transaction without monthly fees for its basic plan, making it easy for businesses to predict costs and budget accurately. This structure is beneficial for businesses with low or variable transaction volumes, as it removes the uncertainty often associated with tiered pricing or hidden fees.

Affordable, user-friendly POS hardware

Square offers a range of affordable, easy-to-use hardware options to suit various business needs. From the free magstripe reader included with every account to the sleek Square Terminal and Square Register, businesses can select hardware that fits their budget and operational requirements. Square’s hardware is designed to integrate seamlessly with its POS software, enabling smooth transactions and enhancing the overall customer experience.

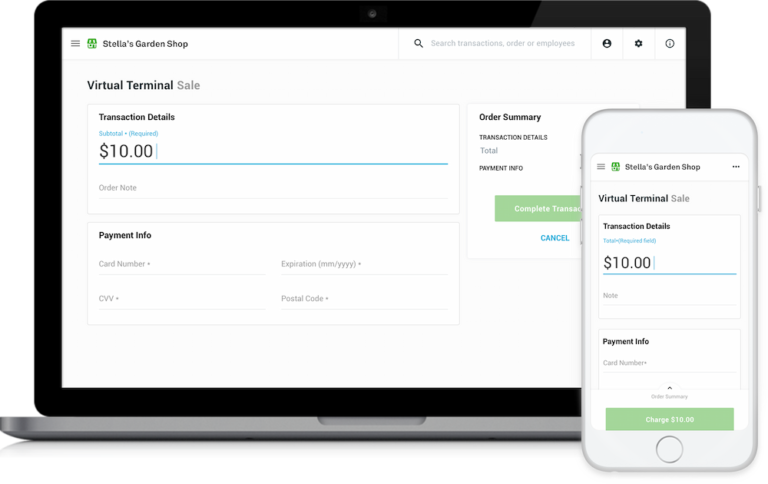

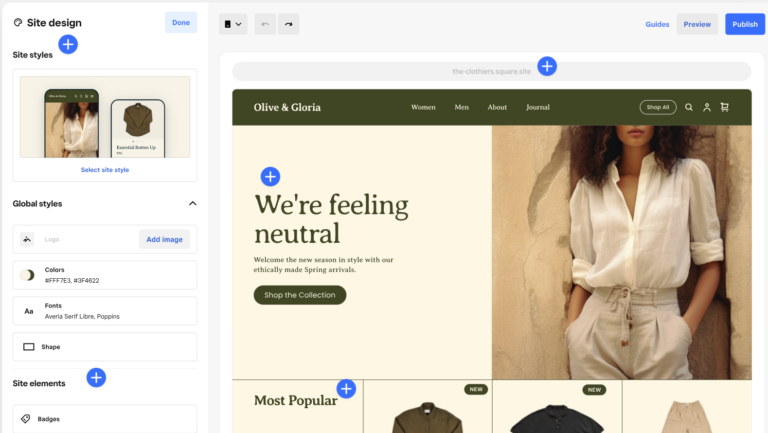

E-commerce support

Square’s POS system includes e-commerce tools that allow businesses to create an online store with ease. The free online store option helps businesses establish an online presence without additional costs. Square’s omnichannel capabilities enable businesses to manage in-store and online orders from one platform, streamlining inventory and sales tracking.

Management tools

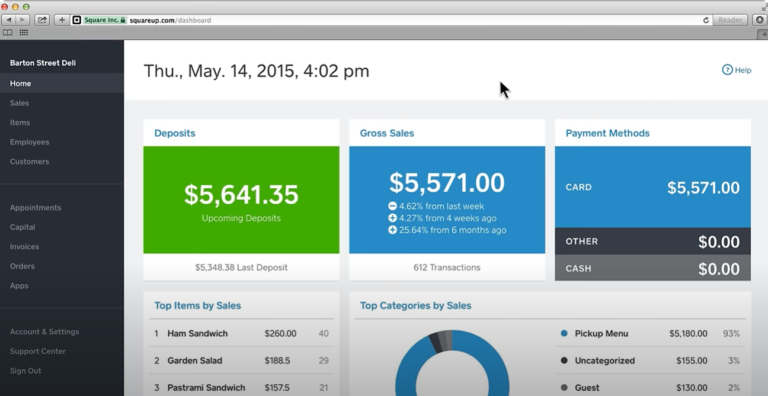

Square provides a suite of management tools to help businesses oversee various aspects of their operations. Its inventory management, sales analytics, employee tracking, and customer relationship management features are all accessible through Square’s dashboard. These tools empower businesses to monitor performance, optimize stock levels, track employee hours, and engage customers through loyalty programs, making Square a well-rounded solution for business growth and efficiency.

Extended customer service

Square offers customer support through various channels, including email, live chat, and phone support, available during extended business hours. Additionally, Square’s online Support Center and Community Forum provide resources like FAQs, how-to guides, and peer advice for users seeking self-service solutions. While phone support isn’t 24/7, Square’s resources are comprehensive, making it easy for businesses to find answers to common questions and troubleshoot independently when necessary.

Square vs. Clover for small business case studies

Selecting the right payment processing tools is crucial for small businesses aiming to enhance operations and customer satisfaction. This section highlights real-world examples of how businesses use Square vs Clover to streamline processes, improve customer experiences, and drive growth, showcasing the unique benefits each platform offers across various industries.

Square real-world examples

- Plants & Spaces: Zilah Drahn transformed her passion for plants into a thriving business, Plants & Spaces, leveraging Square tools like Square Stand, Inventory Management, and Payroll to streamline operations from retail to tax reporting. Square has enabled Drahn to manage her multifaceted business efficiently, providing a seamless payment experience, accurate inventory tracking, and clear financial insights. With the addition of retail, Drahn has expanded her customer base while setting standards that attract serious clients and strengthen her business’s foundation.

- Crêpes Bonaparte: This food truck business uses Square Kiosk to cut labor costs and improve order accuracy across its locations, allowing customers to place and customize orders directly, even in high-noise settings. The integration with Square’s Kitchen Display System and inventory tools helps staff manage orders efficiently and keep customers informed about menu availability. This streamlined setup enhances both customer experience and operational efficiency.

- Station RBNY: This community-focused surf and skate shop in Rockaway Beach, New York, uses Square’s ecosystem to streamline business operations. Owner Nigel Louis relies on Square for managing cash flow, payroll, and vendor payments, which allows him to focus on building connections with his customers. Square Loans and Square Banking tools have also provided financial stability, enabling Station RBNY to thrive while keeping operations simple and efficient.

Clover real-world examples

- Out the Dough: This cookie dough shop in Concord, California, leveraged Clover Online Ordering to handle a major increase in demand after a feature on Good Morning America. With Clover’s built-in, commission-free online ordering, the company quickly adapted to the surge in sales, offering customers convenient curbside pickup and flexible ordering options. Since adopting Clover, online sales have remained a steady 15% of their revenue, demonstrating Clover’s pivotal role in Out the Dough’s ongoing growth and customer satisfaction.

- Transylvania Moving Company: This moving and storage business in Beverly, Massachusetts, needed a reliable way to accept large payments on the go, even in remote areas. Clover Go’s mobile app and card reader provided the flexibility to accept payments on any mobile device, with or without Wi-Fi, allowing the team to focus on moving rather than payment logistics. With quick setup, dependable connectivity, and transparent fees, Clover Go became an essential tool for Transylvania Moving Company, supporting seamless payment processing across New England and empowering the business to grow.

- Broken Spoke Boutique: This company owned by Phil and Whitney Mayhew in Valentine, Nebraska, faced challenges managing inventory between their physical store and e-commerce platform. Clover’s integration with the store’s existing WooCommerce site allowed seamless inventory syncing, significantly reducing manual updates and errors. This efficiency not only ensured accurate inventory counts but also facilitated the boutique’s growth, letting it compete with trendy retailers across the country. With Clover, the store can now manage all inventory from a single dashboard while offering diverse payment options, enhancing the customer experience, and supporting the expansion of their unique product offerings.

Clover vs. Square: Which one is right for your business?

The choice between Clover vs. Square POS depends on several factors, including your business size, industry, preferences, and specific needs. If you’re a small business or startup seeking simplicity and affordability, Square could be the ideal choice. With its straightforward pricing model, free POS software, and online store builder, Square offers a convenient solution with minimal upfront costs. Additionally, Square’s extensive hardware options, including free card readers, cater to startups and small businesses with varying needs.

Alternatively, if you’re an established business looking for advanced features, customization options, and flexibility in payment processing, Clover might be the better fit. Offering sleek design, versatile hardware choices, and comprehensive management tools, Clover supports businesses that require robust POS capabilities. Moreover, Clover’s compatibility with various merchant accounts and extensive app marketplace allow businesses to tailor their POS experience to suit their unique requirements.

Ultimately, whether you prioritize simplicity and affordability with Square or flexibility and advanced functionality with Clover, both options offer reliable POS solutions to streamline your business operations and drive growth.

Here’s a more detailed comparison of Clover vs. Square:

Merchant account

Through a separate merchant services provider

With included aggregated merchant account

Monthly fee

Starts at $14.95

Starts at $0

Online store

E-commerce integrations only

Free (Square Online)

Payment processing fee

- Card-present: 2.3% to 2.6% + 10 cents

- Online: 3.5% + 10 cents

- Keyed-in: 3.5% + 10 cents

- Invoices: 3.5% + 10 cents

- Card-present: 2.6% + 10 cents

- Online: 2.9% + 30 cents

- Keyed-in: 3.5% + 15 cents

- Invoices: 3.3% + 30 cents

Hardware options

- Tap to Pay on iPhone

- Standalone terminal starts at $499 (Clover Flex)

- Comes with free magstripe reader

- Tap to Pay on iPhone and Android

- Standalone terminal starts at $299 (Square Terminal)

Customer support

- 24/7 phone and email support

- Clover Help: online resource library

- Mon to Fri phone support

- 24/7 automated chat support

Square vs. Clover fees

When it comes to pricing and fees, Square wins over Clover. Square typically offers straightforward pricing structures with no monthly fees and transparent transaction rates. Businesses using Square can expect to pay a flat rate for each transaction, which is 2.6% + 10 cents for in-person transactions and 2.9% + 30 cents for online transactions. Additionally, Square provides its POS software for free and even provides a free magstripe reader, although businesses may incur charges for add-on features or integrations.

On the other hand, Clover’s pricing structure may vary depending on the specific hardware and software options chosen as well as where it is purchased. Clover offers a range of POS hardware devices, each with its own upfront cost, which can include countertop terminals, mobile readers, and handheld devices.

Additionally, Clover charges a monthly subscription fee for the use of its POS software. The lowest plan has a monthly fee of $14.95 and its transaction rates vary, with fees around 2.6% + 10 cents for in-person transactions and 2.9% + 30 cents for online transactions. However, keep in mind that Square’s basic POS plan does not include other add-ons such as email marketing, text marketing, and loyalty programs, which are all included in the lowest-priced Clover plan.

While Square may be more suitable for businesses seeking a simple and transparent pricing model with no monthly fees, Clover’s offering may appeal to those in need of more advanced features and customization options, albeit with potentially higher upfront costs and ongoing subscription fees.

Evaluate your budget

Before choosing between Clover vs Square, it’s essential to assess your budget. Square’s pay-as-you-go model is advantageous for businesses with limited cash flow or those just starting, as it eliminates upfront costs.

In contrast, Clover may involve higher initial hardware investments and ongoing fees, which can impact cash flow. Consider how much you’re willing to spend on transaction fees, equipment, and potential software add-ons.

If you need to start accepting payments without any upfront costs, Square is definitely the way to go. If you are an established business that already has a merchant account, Clover may be a more suitable option.

Consider your business needs

Your specific business needs play a significant role in selecting the right POS system. Square is particularly well-suited for small businesses, mobile vendors, and e-commerce retailers looking for an all-in-one solution with minimal setup requirements. Its user-friendly interface and comprehensive online features make it ideal for businesses that prioritize simplicity.

Conversely, Clover offers more customization options and advanced features that cater to businesses with more complex needs, such as inventory management and employee scheduling. Assessing your operational requirements, industry, and growth plans will help you choose the system that best supports your business’s future success.